Individual License: $4,950 | Team and Enterprise License Options Available

A Markintel(™) Horizon Report

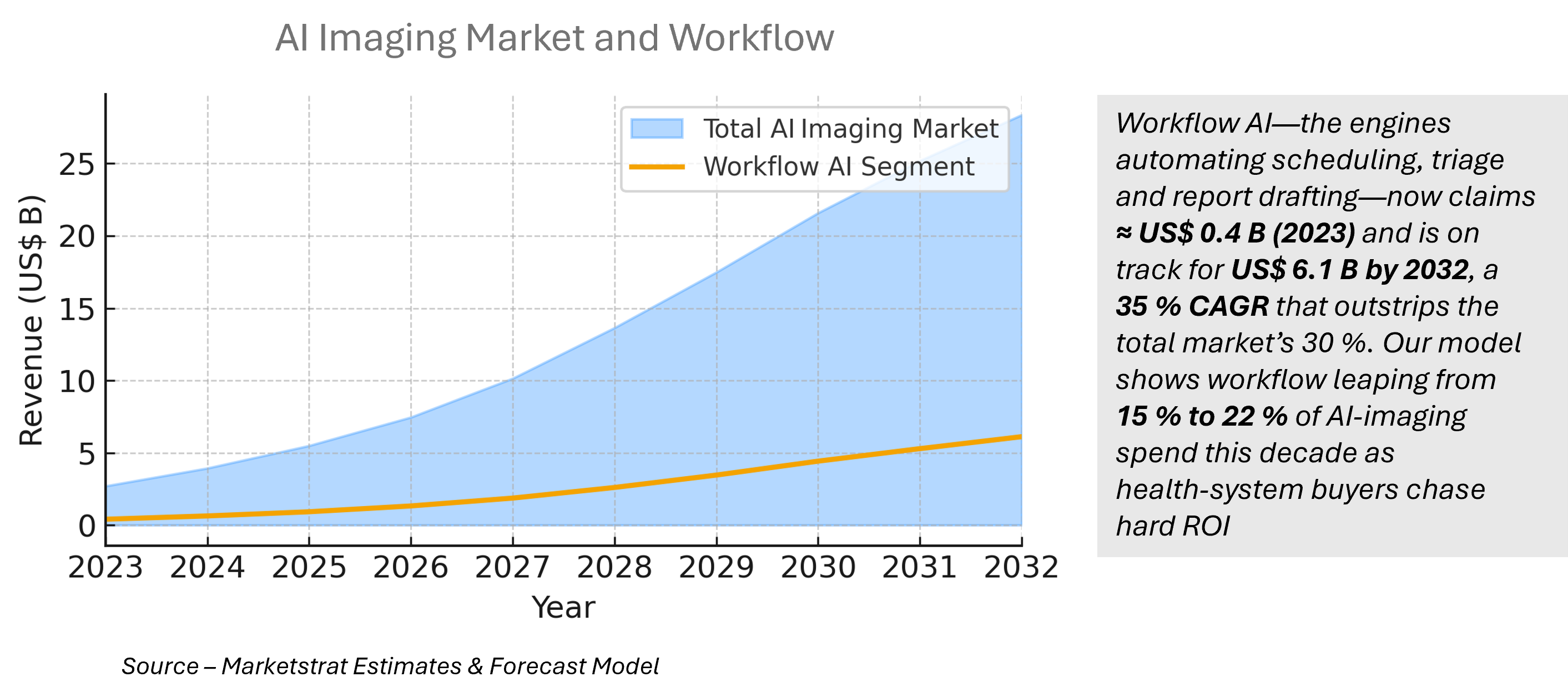

Diagnose the next decade of imaging growth—today. Marketstrat’s two‑volume study quantifies the US $2.7 B AI‑imaging market and charts its ascent to US $28.4 B by 2032. Seven proprietary frameworks—M³, TEM, ARC, GTM Growth‑Maturity, Platform‑Leverage, Ecosystem Collaboration, and Solution Adoption & Growth—convert thousands of datapoints into executive strategy. Whether you build, invest in, or purchase AI solutions, this report moves you from insights → action in one step.

Why This Study Matters

Radiology faces a triple squeeze: rising scan volumes, stagnant radiologist head‑count, and fast‑evolving reimbursement that now rewards computer‑assisted detection, triage, and quantification. AI is no longer experimental; it is operational. Capital allocation is shifting, yet market signals remain noisy—valuations, attach‑rate assumptions, and regulatory pace vary sharply by geography and modality. Marketstrat’s World Market for AI in Medical Imaging 2025‑2032 cuts through that noise and offers a single, evidence‑weighted source of truth.

Table of Contents – Volume One – Market Analysis & Forecasts

The integration of artificial intelligence (AI) into the realm of medical imaging has shifted from an experimental curiosity to a mainstream imperative. This transition is driven by an intersection of factors:

Within this ecosystem, Marketstrat sees AI solutions tackling a multi-faceted set of challenges—ranging from improved diagnostic accuracy and early detection of pathologies to greater efficiency in managing large volumes of scans. The market’s double-digit CAGR forecasts reflect both genuine optimism about AI’s potential and early but tangible clinical successes, particularly in oncology, neurology, and cardiovascular imaging.

Accelerating but uneven

Marketstrat’s analysis shows a near-30 % global CAGR, with the market growing from US $ 2.7 B in 2023 to US $ 28.4 B by 2032. Growth is led by:

Bottom line: Capital availability, regulatory clarity, and enterprise IT readiness explain the regional growth deltas. Vendors that can align commercial models to these realities will capture disproportionate share as the market approaches the US $ 28.4 B mark by 2032.

The AI‑imaging arena is a classic “David‑plus‑Goliath” battlefield. Incumbent modality OEMs—GE HealthCare, Siemens Healthineers, Philips and Canon—are embedding native algorithms into existing scanners and platform stores, leveraging installed bases and service contracts. Pure‑play specialists such as Aidoc, Viz.ai, Annalise.ai and Lunit compete on algorithm depth, evidence volume and cloud‑first deployment, often securing first‑mover reimbursement codes and best‑of‑breed mindshare. A growing cadre of Chinese players—United Imaging, Deepwise, Keya—push price‑performance envelopes and benefit from provincial subsidy programs.

The competitive gap is no longer purely technical; it is commercial. Distribution reach, regulatory cadence and platform stickiness increasingly trump standalone sensitivity metrics. M&A momentum is accelerating: larger OEMs are acquiring niche algorithm firms to plug modality and clinical gaps, while cloud hyperscalers invest in foundation‑model infrastructure. Over the forecast period, we expect platform consolidation to push the market toward three to four ecosystem hubs, with attach‑rate economics favoring vendors that bundle AI with service, cloud storage and analytics dashboards.

Companies analyzed and profiled in this report

4D Medical Ltd.; Accuray Inc.; Adiposs SA; Advanced Micro Devices (AMD); Agfa HealthCare; Aidoc; AIQ Solutions; Airdoc; Annalise.ai; Align X-ray Insights; Artrya; Astute Imaging; Avicenna.ai; AZmed; Baidu; Bayer Radiology; BioMind; Blackford Analysis Ltd.; Bracco Imaging S.p.A.; Brainlab AG; Brainomix Ltd.; BrightHeart.ai; Butterfly Network, Inc. (NYSE: BFLY); CancerCenter.ai; Canon Medical Systems; Carestream; Caristo Diagnostics; CARPL.ai; CathWorks; Cellmatiq GmbH; Cerebra AI; Clarius Mobile Health; Cleerly; Combinostics Oy; ContextFlow GmbH; CoreTechs Labs; CureMetrix; deepc GmbH; DeepHealth (RadNet); DeepMind (Google); DeepSight Technology; DeepTek.ai; DEEPNOID INC; Deepwise; Diagnocat; Digital Diagnostics Inc; EchoNous; Elucid BioImaging; Enlitic; Envisionit Deep AI; Exo Inc; Ferrum Health; Fujifilm; GE Healthcare; Gleamer; Guerbet SA; Heartflow, Inc.; HeartFocus; Heuron; Hologic Inc; Huawei; Huiyihuiying (HY Medical); Hyperfine; icometrix; ImageBiopsy; Imagen Technologies; Incepto Medical SAS; Infervision; JLK Inc; Koios Medical; Konica Minolta; LPIXEL; Lantheus Holdings; Lunit Inc.; Mediaire GmbH; Median Technologies; Medtronic PLC; Merative L.P.; Microsoft; Mindray Ltd; MSKai; Nanox Imaging Ltd.; Nico-Lab B.V.; NIRAMAI; NVIDIA; Olea Medical; Oracle; Oxipit; Perimeter Medical Imaging; Perspectum; Philips Healthcare; Pro Medicus, Ltd.; Qure.AI; Quibim; Radiobiotics; Rad AI; RapidAI; Samsung Healthcare; ScreenPoint Medical; Segami Corporation; Shenzhen Keya Medical Technology Co., Ltd; Shukun Technology / Careverse; Siemens Healthineers; Sirona Medical; Smart Soft Healthcare (CoLumbo); Spectral AI; Stryker Corp; Subtle Medical; Synapsica; Tata Elxsi; Tempus AI; Tencent Holdings; Therapixel; Ultromics; United Imaging; Us2.ai; Vara AI; Vista AI; Viz.ai; VoxelCloud; VUNO; Zimmer Biomet.

Oncology is the fastest‑professionalizing segment in AI‑driven medical imaging, growing from US $ 0.6 B in 2023 to an expected US $ 7.7 B by 2032 (32.7 % CAGR). Growth is propelled by three forces:

North America retains >45 % of global profit through 2032 on the back of NTAP and Category‑I CPT momentum, while APAC overtakes Europe on volume by 2028 amid China’s Class‑II lung‑screening mandate.

Strategic moves now: align product roadmaps with the CPT calendar (breast AI 2026, CT‑FFR lung 2026), publish ≥10 peer‑reviewed real‑world studies, bundle oncology modules into enterprise AI suites, and tier SaaS pricing by GDP‑per‑capita to defend mature‑market ASPs while scaling emerging regions. Players executing on these levers are positioned to own the next inflection point in oncology‑imaging AI.

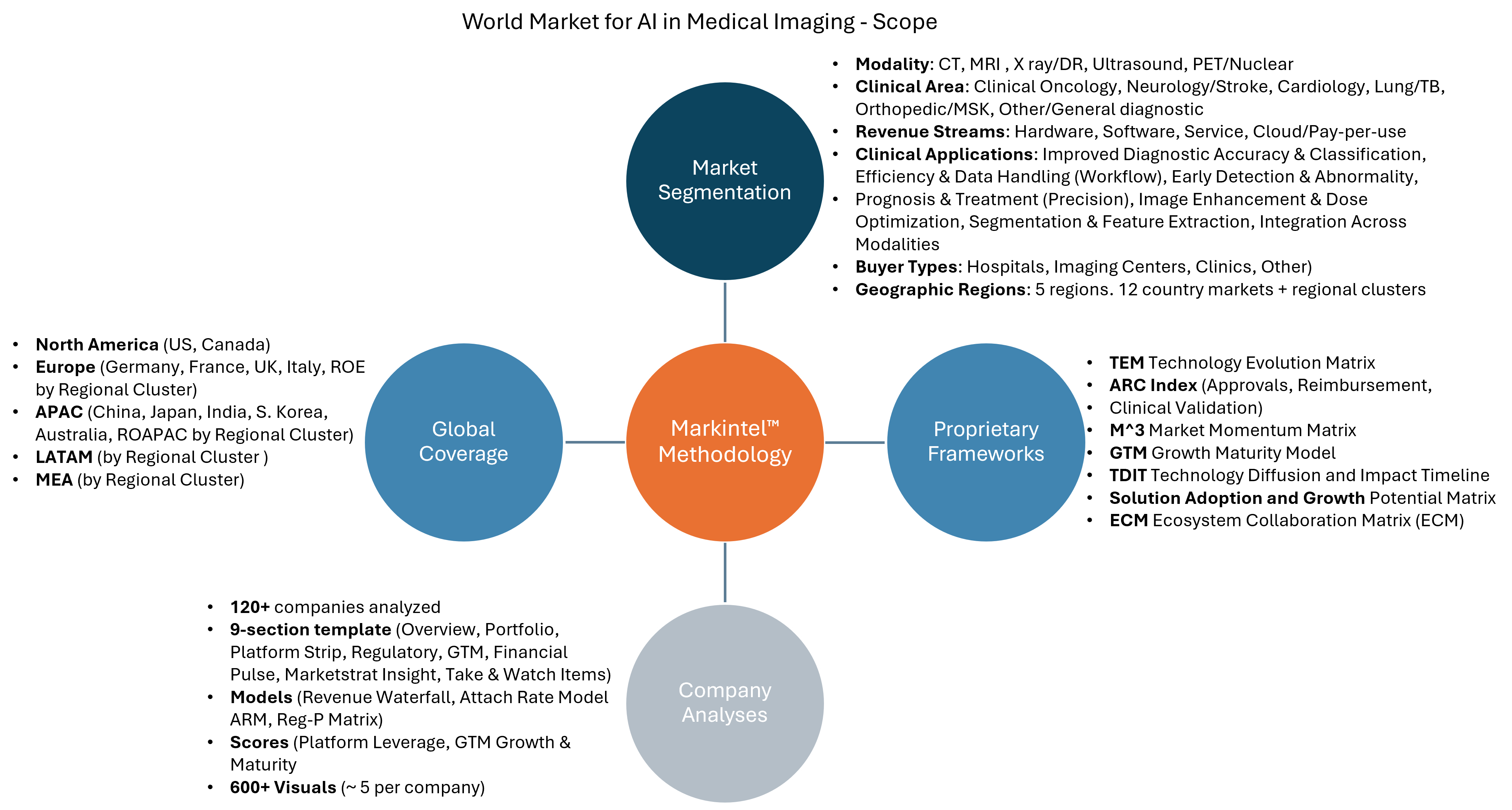

Marketstrat’s World Market for AI in Medical Imaging 2025‑2032 goes several layers deep. Our dual‑lens methodology reconciles top‑down market sizing with bottom‑up attach‑rate and ASP calculations, all stress‑tested against licensed expert interview transcripts. Seven proprietary frameworks—M³, TEM, ARC, GTM Growth‑Maturity, Platform‑Leverage, Ecosystem Collaboration and Solution Adoption & Growth—translate raw data into decision tools that flag not just where the money is, but how fast it can be captured and at what risk.

The result is a single source of truth for OEM strategists, pure‑play AI vendors, investors and hospital procurement teams who need to quantify TAM, benchmark competitors and de‑risk capital allocation. If your growth plan depends on accurate attach‑rate assumptions, reimbursement scenarios or vendor evidence scoring, this is the report that turns market noise into actionable signal.

Seven proprietary strategy lenses—M³ Matrix, TEM Map, ARC Index, GTM Growth‑Maturity Quadrant, Platform‑Leverage Strip, Ecosystem Collaboration, and Solution Adoption & Growth Matrix—translate complex datasets into board‑ready visuals. Volume 1 delivers the macro picture and forecasts; Volume 2 profiles 120 vendors with side‑by‑side heat‑maps, attach‑rate models, and forward scenarios. Use the insights to benchmark competitors, stress‑test investment theses, or de‑risk purchasing decisions.

| Forecast Period | 2024–2032 |

| Market Size | From $2.7B (2023) to $28.4B (2032) at 29.9% CAGR |

| Pages | ~890 pages (including 750+ visuals & 160 data tables) |

| Companies Profiled | 120+ (OEMs, AI specialists, tech titans) |

| Release Date | Aug 2025 |

| Geographies Covered | N. America, Europe, Asia-Pacific, LATAM, MEA.

North America (US, Canada) | Europe (Germany, France, UK, Italy, Spain, ROE) | APAC (China, Japan, India, S. Korea, Australia, ROAPAC) | LATAM | MEA |

| Custom Region Breakouts | Available upon request (add-on) |

SECTION 1 – EXECUTIVE SUMMARY. 40

Why This Market Matters — the 25-second Read. 40

Global Growth at a Glance. 40

Five Strategy Headlines to Internalize. 41

Where Growth Concentrates – Modality & Clinical Slices. 41

Regional Pulse – Inflection Points & Watchouts. 42

Competitive Heat ‑ the Five Moves to Track. 42

Three-year KPI Outlook (2024 → 2027). 43

Six Board-level Actions for the Next 12 Months. 43

Methodology Summary. 43

SECTION 2 – RESEARCH METHODOLOGY. 44

About the Report. 44

Scope & Segmentation. 44

Marketstrat’s “Insights → Action” Approach. 44

Dual-Lens Architecture. 45

Top-Down Market Funnel 45

Bottom‑up Attach Rate Flow.. 46

Evidence Confidence – Density vs Reliability. 47

Framework Stack – Turning Insight into Action. 48

Quality Assurance Loop. 48

Limitations & Mitigations. 48

Company Briefs Methodology (Vol Two). 48

SECTION 3 – STRATEGIC MARKET ANALYSIS & FRAMEWORKS. 49

Why Read This Chapter?. 49

Outlook (2025–2030). 49

Recommendations by Stakeholder Type. 49

Section Introduction. 50

Global Market & Procedure Volumes: Contextual Overview.. 50

Imaging Procedure Volumes. 51

Core Reference — Annual Procedure Volumes. 52

Market Drivers and Restraints. 52

Top Market Drivers (Ranked). 53

Top Market Restraints (Ranked). 53

World Market Forecast by Region (2023-2032). 54

Regional Growth Pattern. 54

Strategic Implications for Vendors. 54

Markintel M^3 Matrix (Market Momentum Matrix). 55

Portfolio Recommendations. 55

Market Size vs. 2024-32 CAGR. 56

Market Momentum by Modality. 57

Market Momentum by Clinical Segment. 57

Market Phases. 57

Market Sensitivity — Tariffs & FX (2024-26). 58

Markintel Technology Evolution Matrix (TEM). 58

TEM by Geographic Region. 58

TEM by Imaging Modality. 59

TEM by Clinical Application. 59

Markintel TEM Scoring Framework – Methodology Snapshot. 60

Markintel TEM by Region (2025) – Numeric Scorecard. 61

Markintel TDIT (Technology Diffusion and Impact Timeline). 61

TDIT Stage Definitions & Horizon. 62

TDIT Quantitative Impact Tags. 63

Key Inflection Drivers. 63

Potential Roadblocks. 63

Marketstrat Actionable Insights. 63

Markintel Solution Adoption & Growth Matrix – Worldwide. 64

Immediate Strategic Recommendations. 64

Quantification Guide. 65

Illustrative Segment Scores. 65

Quadrant Explanations & Global AI Solution Examples. 65

Marktintel ARC Index (Approvals, Reimbursement, Clinical Validation). 66

Markintel ARC Index by Use Case. 66

Rationale for ARC Index Score by Use Case. 67

Markintel ARC Index Score by Clinical Area. 67

Oncology and Sub-Areas. 67

Neurology and Sub-Areas. 67

Cardiology and Sub-Areas. 68

Respiratory/Pulmonary and Sub-Areas. 68

Orthopedics and Sub-Areas. 68

Regulatory and Compliance Trends. 68

FDA Approvals: Key Details. 68

Global Regulatory Landscape. 69

Potential Shifts. 69

FDA Clearances & Emerging Regulatory Landscapes. 69

Regulatory & Reimbursement Snapshot – Update to Apr 2025. 69

FDA Imaging-AI Clearances Heatmap, 2018 – 2025 YTD.. 70

Reimbursement Timeline Snapshot. 70

FDA Clearances by Modality (cumulative Apr 2025). 71

Reimbursement Timeline Detail 71

Markintel GTM Growth Maturity Matrix – World Market. 72

Competitive Dataset – World Market for AI Imaging. 72

Key Takeaways. 74

Growth & Maturity Highlights (selected). 74

Competitive Landscape and Clusters. 74

SECTION 4 – WORLD MARKET ANALYSIS & FORECAST. 76

Section Overview.. 76

Why Read This Chapter?. 76

Marketstrat Thesis. 76

Regional Growth Picture. 76

World Market Forecast by Region (2023-2032, $ Mill). 77

Strategic Takeaways. 77

Big-5 Regions CAGR Waterfall 78

World Market Analysis by Clinical Area. 79

Clinical Area Summary. 79

Global Forecast by Clinical Area (2023-2032, USD Mill). 79

What the Numbers Mean for Strategists. 79

Caveats & watch-points. 80

Clinical Area Definitions. 80

Oncology Imaging AI Market Worldwide. 82

Market Forecast by Region – Oncology Imaging AI (2023-2032, USD Mill). 82

Oncology Imaging AI: From Niche App to Enterprise Platform.. 82

Regional Growth Snapshot (2023 → 2032). 82

Strategic Implications for Vendors. 83

Market Momentum & Outlook. 83

Markintel GTM Growth Maturity Framework – Oncology AI Worldwide. 83

Competitive Dataset – Oncology AI Imaging. 84

Competitive Context – Oncology AI 84

Strategic Takeaways – Oncology AI 85

Growth & Maturity Highlights (All Vendors). 85

Fast-Mover M&A Targets (Oncology AI). 86

Regulatory Velocity – New FDA Clearances Oncology Imaging AI 86

Modality-Reach Heatmap – Oncology Imaging AI 2024. 87

Procedure Volumes. 87

AI Applications & Adoption Trajectories. 87

Cardiology Imaging AI Market Worldwide. 89

Market Forecast by Region (2023-2032, USD Mill). 89

Cardiology AI – Why Adoption is Breaking Out. 89

Regional Growth Snapshot. 89

Strategic Implications. 89

Markintel GTM Growth Maturity Framework – Cardiology Imaging AI Worldwide. 90

Competitive Dataset – Cardiology AI-Imaging. 90

Competitive Context – Cardiology AI 91

Strategic Takeaways. 92

Growth & Maturity Highlights – Cardiology Imaging AI 92

M&A Watch — Fast-Moving Rising Stars. 93

Regulatory Velocity – New Cardiology AI Imaging Clearances (Mar 2024 to June 2025). 93

Modality-Reach Heatmap – Cardiology AI 2024. 94

Procedure Volumes. 94

AI Applications & Adoption. 94

Future Directions. 94

Neurology Imaging AI Market Worldwide. 96

Market Forecast by Region (2023-2032, USD Mill). 96

Why Adoption is Moving Beyond Stroke Triage. 96

Regional Growth Snapshot. 96

Strategic Implications. 96

Markintel GTM Growth Maturity Framework – Neurology Imaging AI Worldwide. 97

Competitive Dataset – Neurology AI-Imaging. 97

Competitive Context — Neurology AI 98

Strategic Takeaways. 98

Growth and Maturity Highlights – Neurology AI Imaging. 99

Fast-Mover M&A Watch-List — Neurology AI 99

Regulatory Velocity – New Neuro-AI Clearances – Neurology AI Imaging (Mar ’24 – Jun ’25). 100

Modality Reach Heat-Map – Neurology AI 2024. 100

Procedure Volumes – Neurology Imaging AI 101

AI Use-Cases. 101

Market Evolution. 101

Respiratory Imaging AI Market Worldwide. 102

Market Forecasts by Region (2023 – 2032, USD Mill). 102

What Ignited the 2024 Breakout. 102

Regional Growth Snapshot. 102

Strategic Implications. 102

Markintel GTM Growth Maturity Framework – Respiratory Imaging AI – World. 103

Competitive Dataset – Respiratory AI Imaging. 103

Competitive Context — Respiratory AI 104

Strategic Takeaways. 104

Growth and Maturity Highlights. 105

Fast-Mover M&A Watchlist. 105

Regulatory Velocity – New Respiratory-AI Clearances (Mar ’24 – Jun ’25). 106

Modality Reach Heat-Map – Respiratory Imaging AI Worldwide – 2024. 106

Orthopedic/MSK Imaging AI Market Worldwide. 107

Market Forecasts by Region (2023 – 2032, USD Mill). 107

What is Driving Acceleration. 107

Regional Growth Snapshot. 107

Strategic Implications. 108

Markintel GTM Growth Maturity Framework – Orthopedic/MSK Imaging AI – World. 108

Competitive Dataset – Orthopedic Imaging AI 108

Competitive Context — MSK (Orthopedic) AI 109

Strategic Takeaways. 110

Growth and Maturity Highlights. 110

Fast-Mover M&A Watchlist. 110

Procedure Volumes. 110

AI Adoption & Key Applications. 111

Regulatory Velocity – Orthopedic (MSK) Imaging AI Worldwide – (Mar ’24 – Jun ’25). 111

Use Cases. 111

AI Solutions. 111

Modality Reach Heat-Map – Orthopedic (MSK) AI 112

Other Clinical Areas Imaging AI Market Worldwide. 113

Market Forecasts by Region (2023 – 2032, USD Mill). 113

Segment Overview & Characteristics. 113

Regional Snapshot. 114

Strategic Takeaways. 114

Revenue Breakdown — “Other” Clinical Areas Worldwide (2024). 114

Sub-Areas, Use Cases, Vendors. 114

Reimbursement Readiness Heatmap. 115

Depth vs Breadth Snapshot. 115

Regulatory Velocity – Other Clinical Areas Imaging AI (Mar ’24 – Jun ’25). 116

Strategic Takeaways. 117

M&A Watchlist. 117

World Market Analysis by Imaging Modality. 118

Modality Outlook: Where AI Value Pools Shift Through 2032. 118

Highlights. 118

Global Forecast by Modality (2023-2032, USD Mill). 118

Market Math & Diffusion Pattern. 118

Strategic Takeaways for Vendors. 118

Modality Definitions. 119

CT Modality Imaging AI Market Worldwide. 120

Market Forecast by Region – CT Imaging AI (2023 – 2032, USD Mill). 120

Regional mix in 2032. 120

Adoption Accelerators. 120

Strategic implications for vendors. 120

Markintel GTM Growth and Maturity Matrix – CT Imaging AI – World. 121

Competitive Dataset – CT AI-Imaging. 121

Growth and Maturity Highlights – CT AI-Imaging Companies. 122

Competitive Context – CT modality AI 123

Strategic Takeaways for 2024-2027. 123

M&A Watchlist – Global CT AI 124

Regulatory Velocity – CT-Specific Clearances. 124

Attach-Rate by Region (CT only, 2024). 125

Revenue Split (Factory vs Retrofit) by Region – CT. 126

Procedure Volumes & Applications. 126

MRI Modality Imaging AI Market Worldwide. 128

Market Forecast by Region – MRI Imaging AI (2023 – 2032, USD Mill). 128

Regional Mix in 2032. 128

Adoption Accelerators. 128

Strategic Implications. 128

Markintel GTM Growth and Maturity Matrix – MRI Imaging AI – World. 129

Competitive Dataset – MRI AI-Imaging. 129

Growth and Maturity Highlights – MRI AI-Imaging Companies. 130

Competitive Context – MRI AI Modality. 131

Strategic Takeaways for 2024 – 2027. 131

M&A Watchlist – Global MRI AI 132

Regulatory Velocity (MRI-AI Clearances). 132

Attach-Rate by Region – MRI 133

Factory vs Retrofit Revenue Split (MRI, 2024). 133

Procedure Volumes & Applications. 134

X-ray Modality Imaging AI Market Worldwide. 135

Market Forecast by Region – X-ray Imaging AI (2023-2032, USD Mill). 135

Regional Split – 2032. 135

Adoption Accelerators. 135

Strategic implications. 135

Markintel GTM Growth and Maturity Matrix – X-ray Imaging AI – World. 136

Competitive Dataset. 136

Growth and Maturity Highlights – X-ray AI-Imaging Companies. 137

Competitive Context — X-ray Modality AI 138

Strategic Takeaways 2024-27. 139

M&A Watchlist – Global X-ray-AI 139

Regulatory Velocity – X-ray AI 139

Attach-Rate by Region (X-ray, 2024). 140

Factory vs Retrofit Revenue Split (X-ray, 2024). 141

Market & Procedure Volumes. 141

Ultrasound Modality Imaging AI Market Worldwide. 142

Market Forecast by Region – Ultrasound Imaging AI (2023-2032, USD Mill). 142

Regional Split – 2032. 142

Adoption Accelerators. 142

Strategic Market Implications. 142

Markintel GTM Growth and Maturity Matrix – Ultrasound AI – World. 143

Competitive Dataset – FY-2024 Ultrasound AI-Imaging (Worldwide). 143

Growth & Maturity Highlights – Ultrasound AI 144

Competitive Context – Ultrasound AI 145

Strategic Takeaways 2024-2027. 145

AI M&A Watchlist – Global Ultrasound. 145

Regulatory Velocity – Ultrasound AI (Mar-23 → Mar-24). 146

Attach-Rate by Region (Ultrasound). 146

Factory vs Retrofit Revenue Split (Ultrasound). 147

Market & Procedure Volumes. 147

Nuclear/PET Modality Imaging AI Market Worldwide. 148

Market Forecast by Region (2023-2032, USD Mill). 148

Regional Split – 2032. 148

Adoption Accelerators. 148

Strategic Market Implications. 148

Markintel GTM Growth and Maturity Matrix – Nuclear/PET imaging AI – World. 149

Competitive Dataset – Nuclear/PET AI-Imaging. 149

Growth & Maturity Highlights – Nuclear / PET AI 150

Competitive Context – Nuclear/PET AI 150

Strategic Takeaways. 151

M&A Watchlist – Nuclear/PET Imaging. 151

Market & Procedure Volumes. 151

World Market Analysis by Revenue Stream.. 152

Forecast by Revenue Stream (2023-2032, USD Mill). 152

Revenue-Stream Dynamics. 152

Regional Color. 153

Strategic Takeaways. 153

Revenue Stream Segments. 153

World Market Analysis by Clinical Application. 155

Forecast by Clinical Application (2023-2032, USD Mill). 155

Functional Value Pools. 155

Regional Color. 156

Strategic Takeaways. 156

Use-Case/Workflow Segmentation. 156

AI Clinical Solutions. 157

World Market Analysis by End-Use Organization. 159

Forecast by End-Use Organization (2023-2032, $US Mill). 159

Buyer Mix Shift. 159

Regional Color. 160

Strategic Implications. 160

End-Use Org Definitions. 160

World Market Analysis by AI Technology. 162

Forecast by AI Technology (2023-2032, $US Mill). 162

Technology Mix. 162

Regional Color. 163

Strategic Takeaways. 163

AI Technology Definitions and Applications. 163

Deep Learning. 163

Computer Vision (Classical). 164

Machine Learning (Traditional). 165

Natural Language Processing (NLP). 165

Robotics. 166

Expert Systems. 167

Summary Comparison of AI Technologies. 168

Key Takeaways. 168

SECTION 5 – REGIONAL MARKET ANALYSIS & FORECAST. 169

What’s in This Section?. 169

Why Read This Section?. 169

Market Summary. 170

Market Size & Drivers. 170

Latest Trends. 170

Strategic Outlook. 170

Competitive Environment. 170

New Focus Areas. 170

North American Market Estimates & Forecasts (2023-2032). 171

AI Imaging Market by Country – North America. 171

What’s Driving the Numbers. 171

Implications. 171

Markintel GTM Growth and Maturity Matrix – North America. 172

Competitive Dataset – North America. 172

Competitive Context — North America AI-Imaging 2024. 173

Strategic Takeaways. 173

Growth & Maturity Highlights – North America. 174

M&A Watchlist — North America Rising Stars. 175

Regulatory Velocity – North America. 175

Source: Marketstrat Analysis of Public Data. 175

OEM AI Attach-Rate by Modality. 175

Source: Marketstrat Analysis. 176

Attach Rate Trends – North America. 176

Factory vs Retrofit – North America. 177

Market Summary – United States. 178

Key Market Dynamics. 178

Strategic Takeaways. 178

Top 3 Recommendations. 178

Market Overview – United States. 179

Demographics & Epidemiology. 179

Macro‑economics & Health Spending. 179

Imaging Volume & Installed Base. 179

Regulatory & Reimbursement Snapshot. 179

Healthcare Delivery & Practice Patterns. 180

AI Market Dynamics (Imaging). 180

Competitive Landscape. 180

Takeaways for Vendors. 180

US Market by Clinical Area. 181

Forecast by Clinical Area (2023-2032, USD Mill). 181

U.S. AI-Imaging Outlook by Clinical Area (2023 → 2032). 181

Key Dynamics to Watch. 181

Implications for Vendors. 182

US Market by Imaging Modality. 182

Forecast by Modality (2023-2032, USD Mill). 182

U.S. Modality Outlook: Who Grows, Who Overtakes. 182

Key Takeaways. 183

US Market by Revenue Stream.. 183

Forecast by Revenue Stream (2023-2032, USD Mill). 183

U.S. Revenue Stream Shift: From Capital Boxes to Recurring Bytes. 183

What’s Driving the Mix Change. 183

Implications for Vendors. 184

US Market by Clinical Application. 184

Forecast by Clinical Application (2023-2032, USD Mill). 184

Outlook by Clinical Application. 184

Highlights. 185

Implications. 185

US Market by End-Use Organization. 185

Forecast by End-Use Organization (2023-2032, USD Mill). 185

Who Buys AI—and How That Mix Shifts Through 2032. 186

What’s Behind the Shift. 186

Strategic Implications for Vendors. 186

US Market by AI Technology. 187

Forecast by AI Technology (2023-2032, USD Mill). 187

Outlook by Core Technology (2023-2032). 187

Markintel Growth Maturity Matrix – US & Canada. 188

Competitive Dataset – United States. 188

Competitive Context — U.S./North America. 189

What to Watch Next. 189

Markintel Solution Adoption & Growth Matrix – US & Canada. 190

Scorecard — Solution Adoption & Growth Matrix (U.S. & Canada). 190

Strategic Implications for Stakeholders. 191

Markintel Ecosystem Collaboration Matrix – US & Canada. 191

Who to Partner with and How Deep?. 192

What Succeess Looks Like in Each Quadrant. 192

Stratregic Guidance. 192

GTM at a Glance – United States. 193

Channel & Pricing Matrix. 193

GTM Readiness Radar – US. 193

Customer Tier Potential – US. 194

GTM Timeline (2025–2028) – US. 194

Fast Strategic Cues (2025). 195

Regulatory x Funding Heatmap – US. 195

Adjacency-Opportunity Radar – US. 196

Whitespace Partner-Fit Matrix – US. 196

Market Summary: Canada. 197

Key Market Dynamics. 197

Strategic Takeaways. 197

Top 3 Recommendations. 197

Market Overview – Canada. 198

Demographics & Epidemiology. 198

Imaging Supply & Utilization. 198

Health System & Practice Patterns. 198

Regulatory & Reimbursement. 198

AI-Imaging Market Dynamics. 199

Competitive Snapshot. 199

Key Implications. 199

Canadian Market by Clinical Area. 200

Forecast by Clinical Area (2023-2032, USD Mill). 200

Outlook by Clinical Area. 200

Key Dynamics to Watch. 200

Implications for Vendors. 201

Canadian Market by Imaging Modality. 201

Forecast by Imaging Modality (2023-2032, USD Mill). 201

Outlook by Modality. 201

Key Dynamics to Watch (2025-27). 202

Implications for Vendors. 202

Canadian Market by Revenue Stream.. 203

Forecast by Revenue Stream (2023-2032, USD Mill). 203

What’s Driving Each Revenue Stream.. 203

Key Dynamics to Watch. 203

Implications for Vendors. 203

Canadian Market by Clinical Application. 204

Forecast by Clinical Application (2023-2032, USD Mill). 204

Outlook & Drivers by Application. 204

Key Market Dynamics to 2027. 205

Implications for Vendors and Providers. 205

Canadian Market by End-Use Organization. 205

Forecast by End-Use Organization (2023-2032, USD Mill). 205

Outlook 2025-2032. 206

Key Drivers by Segment. 206

Implications for Vendors. 206

Strategic Takeaways. 206

Canadian Market by AI Technology. 207

Forecast by AI Technology (2023-2032, USD Mill). 207

Highlights by Technology. 207

Key Dynamics to Watch (2025‑27). 208

Implications for Vendors & Providers. 208

GTM at a Glance – Canada. 209

GTM Readiness Radar – Canada. 209

Tiered Customer Landscape. 209

Channel & Pricing Matrix. 210

GTM Timeline (Canada). 210

Fast Cues for 2025 Stakeholders. 210

Market Overview & Analysis. 211

Market Snapshot. 211

Structural Demand Signals. 211

Regulatory & Funding Landscape (2024-2028). 211

Market Segmentation 2032 (value share). 211

Competitive Heat Map (2024-26). 212

Execution Playbook (2024-2027). 212

Action-Oriented Recommendations. 212

European Market Estimates and Forecasts by Country (2023-2032, USD Mill). 213

Five Forces Shaping Adoption. 213

Country Archetypes & What Sells. 213

Near‑term Adoption Runway (2024-27). 213

Strategic Implications. 214

Regulatory Velocity by Company – Europe. 214

Markintel Growth Maturity Matrix – Europe. 215

Landscape Snapshot. 215

Why the Quadrant Looks the Way it Does. 216

Key Competitive Dynamics. 216

Strategic Takeaways. 216

Bottom Line. 217

M&A Watchlist – Europe. 217

Competitive Dataset – Europe. 217

Growth & Maturity Highlights – Europe. 218

Markintel Ecosystem Collaboration Matrix (ECM) – Europe. 219

Quadrant Commentary & European Illustrations. 220

Action Checklist. 220

Markintel Solution Adoption & Growth Matrix – Europe. 221

Quadrant Deep Dive. 221

What Moves a Solution from One Box to the Next?. 222

Strategic Guidance. 222

AI Attach Rate – Europe. 223

OEM AI Attach Rate. 223

Attach Rate Trends – Europe. 223

AI Revenue Split – Factory vs Retrofit Attach — Europe. 224

GTM at a Glance – Europe. 224

Channel & Pricing Matrix (2025-2028). 224

GTM Readiness Radar — Europe. 225

Tiered Customer Landscape (2032 View). 226

GTM Timeline (2025 → 2028) – Europe. 226

Adjacency Opportunity Radar (2026+) – Europe. 227

Regulatory x Funding Heatmap – Europe. 227

AI Imaging Whitespace Matrix – Europe. 228

Fast Strategic Cues (2025 playbook). 228

Market Overview – Germany. 229

Macro & Epidemiology. 229

Health‑system & Funding Landscape. 229

Regulatory & Evidence Pathway. 229

Competitive Landscape. 229

Strategic Takeaways & Recommendations. 230

German Market by Clinical Area. 230

Forecast by Clinical Area (2023-2032, USD Mill). 230

Primary Growth Catalysts. 230

Strategic Messages for Stakeholders. 231

Key Takeaways. 231

German Market by Modality (2023-2032, USD Million). 231

Forecast by Modality (2023-2032, USD Mill). 231

Key Inflection by Modality. 232

What’s Driving Each Modality. 232

Strategic Implications. 232

German Market by Revenue Stream (2023-2032, USD Million). 233

Forecast by Revenue Stream (2023-2032, USD Mill). 233

Revenue Streams and Drivers. 233

Key Dynamics by Stream.. 233

Strategic Guidance. 234

German Market by Clinical Application (2023-2032, USD Million). 234

Forecast by Clinical Application (2023-2032, USD Mill). 234

What is Driving Each Bucket. 235

Strategic Messages. 235

Action Playbook. 235

German Market by End-Use Organization (2023-2032, USD Million). 236

Forecast by End-Use Organization (2023-2032, USD Mill). 236

Segments Review.. 236

Strategic Implications. 236

German Market by AI Technology (2023-2032, USD Million). 237

Forecast by AI Technology (2023-2032, USD Mill). 237

Germany – AI Imaging Market by Core Technology. 237

Why Deep Learning Keeps the Lion’s Share. 237

Break-out Growth Themes. 238

Strategic Playbook. 238

GTM at-a-Glance. 238

Channel x Pricing Matrix. 238

GTM Readiness Radar — Germany. 239

Tiered Customer Landscape. 239

GTM Timeline – Germany. 240

Fast Strategic Cues. 240

Market Summary: France. 241

Top‑line Snapshot – France. 241

Key Market Dynamics. 241

Strategic Takeaways. 241

Top 3 Recommendations. 242

French Market Speed scan – Market Analysis (2024‑2032). 242

French Market Estimates and Forecasts (2023-2032). 243

French Market by Clinical Area (2023-2032). 243

French Market by Modality (2023-2032). 244

French Market by Revenue Stream (2023-2032). 244

French Market by Clinical Application (2023-2032). 245

French Market by End-Use Organization (2023-2032). 245

French Market by AI Technology (2023-2032). 246

Quick Strategic Cues – France GTM… 246

GTM at a Glance – France. 247

Channel x Pricing Matrix. 247

GTM Readiness Radar — What Counts Most in France. 247

GTM Timeline (2024‑30) – France. 248

Spend Potential by Customer Tier – France. 248

Market Overview – United Kingdom.. 249

UK Market Speed Scan. 250

UK Market Estimates and Forecasts (2023-2032). 251

UK Market by Clinical Area (2023-2032). 251

UK Market by Modality (2023-2032). 251

UK Market by Revenue Stream (2023-2032). 252

UK Market by Clinical Application (2023-2032). 252

UK Market by End-Use Organization (2023-2032). 253

UK Market by AI Technology (2023-2032). 254

GTM at a Glance – UK. 254

Channel x Pricing Matrix. 254

GTM Readiness Radar – UK. 255

Fast Strategic Cues. 255

Tiered Customer Landscape. 256

GTM Timeline (2024‑29) – UK. 256

Market Overview & Summary: Italy. 257

What Makes Italy Unique in the EU Context. 258

Strategic Takeaways. 258

Italian Market Estimates & Forecasts (2023-2032). 258

Italian Market by Clinical Area (2023-2032). 258

Italian by Modality (2023-2032). 259

Italian Market by Revenue Stream (2023-2032). 259

Italian Market by Clinical Application (2023-2032). 260

Italian Market by End-Use Organization (2023-2032). 260

Italian Market by AI Technology (2023-2032). 261

GTM at a Glance – Italy. 261

Market Overview & Summary – Spain. 264

Strategic Takeaways. 264

Spanish Market Estimates and Forecasts (2023-2032). 265

Spanish Market by Clinical Area (2023-2032). 265

Spanish Market by Modality (2023-2032). 265

Spanish Market by Clinical Application (2023-2032). 266

Spanish Market by Revenue Stream (2023-2032). 266

Spanish Market by End-Use Organization (2023-2032). 267

Spanish Market by AI Technology (2023-2032). 267

GTM at a Glance – Spain. 268

GTM Readiness Radar – Spain. 268

Channel x Pricing Matrix. 268

Tiered Customer Landscape – Spain. 269

GTM Timeline – Spain. 269

Market Overview: Rest of Europe (ROE). 270

Strategic Takeaways. 270

Rest of European Market for AI in Medical Imaging (2023-2032). 271

Rest of European Market by Clinical Area (2023-2032). 271

Rest of European Market by Modality (2023-2032). 271

Rest of European Market by Revenue Stream (2023-2032). 272

Rest of European Market by Clinical Application (2023-2032). 272

Rest of European Market by End-Use Organization (2023-2032). 273

Rest of European Market by AI Technology (2023-2032). 273

GTM at a Glance – Rest of Europe (ROE). 274

GTM Readiness Radar – ROE. 274

Tiered Customer Landscape – ROE. 275

GTM Timeline – ROE. 275

Channel × Pricing Matrix. 275

Adjacency-Opportunity Matrix (2026-2030). 275

Country‑Cluster Framework & Strategic Playbook. 276

White-Space Partnership Matrix. 276

Regulatory Funding Heatmap (ROE Clusters). 277

Fast Strategic Cues. 277

Size, Trajectory & Strategic Importance. 278

Demand Drivers & Headwinds. 278

Competitive & Partnership Landscape. 278

Strategic Clustering & Go-to-Market Nuances. 279

Strategic Recommendations. 279

AI Imaging Market by Country – APAC. 279

Markintel GTM Growth and Maturity Matrix – APAC. 280

Competitive Data Set – APAC. 280

Numbers-in-Context – APAC. 282

Strategic Takeaways – APAC. 282

Growth & Maturity Highlights – APAC. 282

M&A Watchlist – APAC. 283

Regulatory Velocity – APAC. 283

OEM AI Attach Rate – APAC. 284

Attach‐Rate Trends – APAC. 285

GTM at a Glance – APAC. 286

GTM Readiness Radar – APAC. 286

Tiered Customer Landscape – APAC. 286

GTM Timeline – APAC. 287

Adjacency Opportunity Matrix – APAC. 287

Country-Cluster Framework – APAC. 287

White Space Partner Framework – APAC. 288

Regulatory Funding Heatmap – APAC. 289

Channel x Pricing Matrix – APAC. 289

Fast Strategic Cues – APAC. 289

China – Market Overview & Strategic Summary (2023‑2032). 290

Strategic Takeaways. 290

Chinese Market Forecasts (2023-2032). 291

Chinese Market by Clinical Area (2023-2032). 291

Chinese Market by Modality (2023-2032). 292

Chinese Market by Revenue Stream (2023-2032). 292

Chinese Market by Clinical Application (2023-2032). 293

Chinese Market by End-Use Organization (2023-2032). 294

Chinese Market by AI Technology (2023-2032). 294

Markintel Growth Maturity Matrix – China AI in Medical Imaging. 295

Executive Commentary. 296

Cross-Quadrant Insights & Tactical Guidance. 297

Priority Recommendations (next 18 months). 297

Competitive Dataset – China. 297

Markintel Ecosystem Collaboration Matrix – China. 298

Decoding the 2 × 2 and Turning it into Action. 299

Three Rules for Winning the Collaboration Game. 299

Quick‑hit Actions for BD teams (Next Two Quarters). 299

Markintel Solution Adoption and Growth Matrix – China. 300

Translating the Matrix into Action. 301

Execution Priorities by Function. 301

“First‑100-Days” Checklist. 302

Metrics that Matter. 302

Operating Roadmap Takeaway. 302

GTM at a Glance – China. 303

GTM Readiness Radar – China. 303

Tiered Customer Landscape – China. 303

GTM Timeline – China. 304

Adjacency-Opportunity Radar – China. 304

Regulatory Funding Heatmap – China. 305

Channel × Pricing Matrix – China. 305

White Space Partnership Matrix – China. 306

Market Overview & Strategic Summary: Japan. 307

Strategic Outlook. 307

Action Points. 307

Japanese Market Forecasts (2023-2032). 308

Japanese Market by Clinical Area (2023-2032). 308

Japanese Market by Modality (2023-2032). 308

Japanese Market by Revenue Stream (2023-2032). 309

Japanese Market by Clinical Application (2023-2032). 309

Japanese Market by End-Use Organization (2023-2032). 310

Japanese Market by AI Technology (2023-2032). 310

Markintel Solution Adoption & Growth Matrix – Japan. 311

Turning the Matrix into an Operating Road‑Map for Japan (2024‑28). 311

Markintel Ecosystem Collaboration Matrix – Japan. 312

Turning the Matrix into an Operating Roadmap. 313

Playbook Highlights by Quadrant. 313

Risk Checkpoints & Mitigations. 314

Go-to-Market (GTM) Playbook – Japan. 315

GTM Readiness Radar – Japan. 315

Tiered Customer Landscape – Japan. 315

GTM Timeline – Japan. 316

Adjacency Opportunity Radar – Japan. 316

Regulatory Funding Heatmap – Japan. 317

Channel x Pricing Matrix – Japan. 317

White Space Partnership Matrix – Japan. 318

Fast Strategic Cues. 318

Market Overview & Analysis. 319

Executive Snapshot. 319

Market Mechanics. 319

Constraint Map. 319

Competitive Temperature (“5 P” quick lens). 320

Actionable Opportunities (2024-26 Window). 320

Go‑Forward Recommendations (by player type). 320

What Success Looks Like. 320

Indian Market Forecasts (2023-2032). 321

Indian Market by Clinical Area (2023-2032). 321

Indian Market by Modality (2023-2032). 321

Indian Market by Revenue Stream (2023-2032). 322

Indian Market by Clinical Application (2023-2032). 322

Indian Market by End-Use Organization (2023-2032). 323

Indian Market by AI Technology (2023-2032). 323

Markintel Solution Adoption & Growth Matrix – India. 324

Solution Classes and Action Cues. 324

Strategic Interpretation & Operating Roadmap. 325

One-Page Operating Checklist. 326

Markintel Ecosystem Collaboration Matrix – India. 326

Operating Roadmap: Leveraging India’s Collaboration Matrix. 327

Strategic Sequencing (2024‑27). 328

Execution Tips. 328

Key Metrics to Track. 328

Competitive Landscape – India. 328

Key Competitive Insights. 330

Operating Roadmap. 330

GTM at a Glance – India. 331

GTM Readiness Radar – India. 331

Tiered Customer Landscape – India. 331

GTM Timeline – India. 332

Adjacency-Opportunity Radar – India. 332

Regulatory x Funding Heatmap – India. 333

White-Space Partnership Matrix. 333

Channel × Pricing Matrix. 333

Fast Strategic Cues (Do‑This‑First). 333

Market Summary: South Korea. 334

Key Market Dynamics. 334

Strategic Takeaways. 334

Top 3 Recommendations. 335

South Korean Market Forecasts (2023-2032). 337

South Korean Market by Clinical Area (2023-2032). 337

South Korean Market by Modality (2023-2032). 337

South Korean Market by Revenue Stream (2023-2032). 338

South Korean Market by Clinical Application (2023-2032). 338

South Korean Market by End-Use Organization Type (2023-2032). 339

South Korean Market by AI Technology (2023-2032). 339

GTM at a Glance – South Korea. 340

Six-Pillar GTM Readiness Radar – South Korea. 340

Tiered Customer Landscape – South Korea. 340

Five-Step GTM Timeline – South Korea. 341

Adjacency-Opportunity Radar – South Korea. 341

Regulatory x Funding Heatmap – South Korea. 342

Whitespace Partnership Matrix – South Korea. 342

Channel × Pricing Matrix – Typical 2025 Deals. 342

Fast Strategic Cues. 343

Market Overview & Analysis. 344

Market Structure & Growth Drivers. 344

Segment Hotspots (Qualitative Sizing). 344

Competitive Landscape. 344

Strategic Implications & GTM Priorities. 345

Action-Oriented Recommendations (Next 12 Months). 345

Australian Market Forecasts (2023-2032). 346

Australian Market by Clinical Area (2023-2032). 346

Australian Market by Modality (2023-2032). 346

Australian Market by Revenue Stream (2023-2032). 347

Australian Market by Clinical Application (2023-2032). 348

Australian Market by End-Use Organization (2023-2032). 348

Australian Market by AI Technology (2023-2032). 349

GTM at a Glance – Australia. 350

GTM Readiness Radar – Australia. 350

GTM Timeline – Australia. 350

Adjacency-Opportunity Radar – Australia. 351

Regulatory x Funding Heatmap. 351

Market Overview & Analysis. 352

Regional Clusters. 352

Market Dynamics ― What’s Shaping Buying Decisions. 352

Actionable Recommendations. 353

Quick-Hit Opportunities by Cluster. 353

What Success Looks Like. 354

Rest of Asia-Pacific Market Forecasts (2023-2032). 354

Rest of Asia-Pacific (ROAPAC) Market by Clinical Area (2023-2032). 354

Rest of Asia-Pacific (ROAPAC) Market by Modality (2023-2032). 355

Rest of Asia-Pacific (ROAPAC) Market by Revenue Stream (2023-2032). 355

Rest of Asia-Pacific (ROAPAC) Market by Clinical Application (2023-2032). 356

Rest of Asia-Pacific (ROAPAC) Market by End-Use Organization (2023-2032). 356

Rest of Asia-Pacific (ROAPAC) Market by AI Technology (2023-2032). 357

GTM at a Glance – ROAPAC. 357

GTM Readiness Heatmap – ROAPAC Clusters. 357

Five-Step GTM Roll‑Out Timeline (2024‑2029) – Keyed to Clusters. 358

Market Overview & Analysis: Latin America (LATAM). 359

Market Summary. 359

Growth Driver Waterfall – LATAM… 359

Geo‑Economic Clusters (for GTM focus). 359

Segment Trends to 2032. 360

Regulatory Snapshot (big‑5). 360

Action-Oriented Recommendations. 360

LATAM Market Estimates and Forecasts. 361

LATAM Market by Clinical Area (2023-2032). 361

LATAM Market by Modality (2023-2032). 362

LATAM Market by Revenue Stream (2023-2032). 362

LATAM Market by Clinical Application (2023-2032). 363

LATAM Market by End-Use Organization (2023-2032). 364

LATAM Market by AI Technology (2023-2032). 364

Markintel Solution Adoption & Growth Matrix – LATAM… 365

Cross‑Quadrant Operating Roadmap (2024‑27). 367

Markintel Ecosystem Collaboration Matrix – LATAM… 367

Operating Roadmap (90‑Day Focus). 368

GTM at-a-Glance – LATAM… 369

GTM Readiness Radar – LATAM… 369

GTM Timeline – LATAM… 369

LATAM Country Clusters Summary. 370

Cluster-Priority Heatmap. 370

Regulatory Velocity & Reimbursement Pulse – LATAM… 370

OEM AI Attach Rate – LATAM… 371

GTM Maturity Highlights by Company – LATAM… 371

Market Overview & Analysis: Middle East & Africa (MEA). 372

LATAM Snapshot. 372

Logical Clusters & Why They Matter. 372

Key Growth Catalysts. 372

Structural Barriers & Mitigation. 372

Actionable Recommendations by Vendor Type. 373

Sequencing Roadmap. 373

Executive Takeaways. 373

Middle East & Africa (MEA) – Market Estimates and Forecasts. 374

MEA Market by Clinical Area (2023-2032). 374

MEA Market by Modality (2023-2032). 374

MEA Market by Revenue Stream (2023-2032). 375

MEA Market by Clinical Application (2023-2032). 375

MEA Market by End-Use Organization (2023-2032). 376

MEA Market by AI Technology (2023-2032). 376

Markintel Solution Adoption & Growth Matrix – MEA.. 377

Interpretation & Operating Roadmap. 377

Execution Checklist. 378

Markintel Ecosystem Collaboration Matrix – MEA.. 379

Partnership Playbook. 379

Operating Roadmap & Key Execution Metrics. 380

GTM at-a-Glance – Middle East & Africa (MEA). 380

GTM Readiness Radar – MEA.. 380

Country Cluster Heatmap – MEA.. 381

GTM Timeline – Pilot‑to‑Scale (2024-2029) – MEA.. 381

Adjacency-Opportunity Radar – MEA.. 382

GTM Maturity Highlights. 382

Regulatory Velocity – MEA.. 383

Attach Rate Trends – MEA.. 383

Driving healthcare innovation through actionable intelligence, strategic execution, and transformative solutions for global impact and growth.