Individual License: $4,950 | Team and Enterprise License Options Available

Key Takeaways

Download Table of Contents

World Market for Oncology Imaging AI – Markintel™ Horizon Report (2023–2032)

This Horizon report is Marketstrat’s dedicated deep dive on how AI is reshaping oncology imaging pathways globally—from breast and lung screening to complex CT/MRI staging, PET-based theranostics, and RT planning. The analysis quantifies the global market for Oncology Imaging AI from 2023 through 2032, then layers in a full competitive and GTM lens tailored to vendors, providers, and investors.

The report measures all imaging-centric AI software and AI‑linked revenue deployed across the oncology pathway (screening, detection, staging, treatment planning, response, and surveillance) across five core modalities—CT, X‑ray/DR (incl. DBT), MRI, PET/Nuclear, and Ultrasound—and a full buyer set spanning cancer centers, IDNs/AMCs, community providers, and teleradiology networks.

Beyond sizing, the study is structured as a practical playbook. Each major stakeholder cluster—AI software vendors, imaging OEMs, RT/TPS players, AI platforms & cloud orchestrators, provider/telerad networks, and imaging‑pharma/CROs—is analyzed through Markintel’s proprietary strategy frameworks, with explicit recommendations on attach‑rate expansion, packaging, evidence building, and partnership models. The goal is not just to explain the market, but to help decision makers sequence investments, shape offers, and defend margins in a fast‑moving but noisy category.

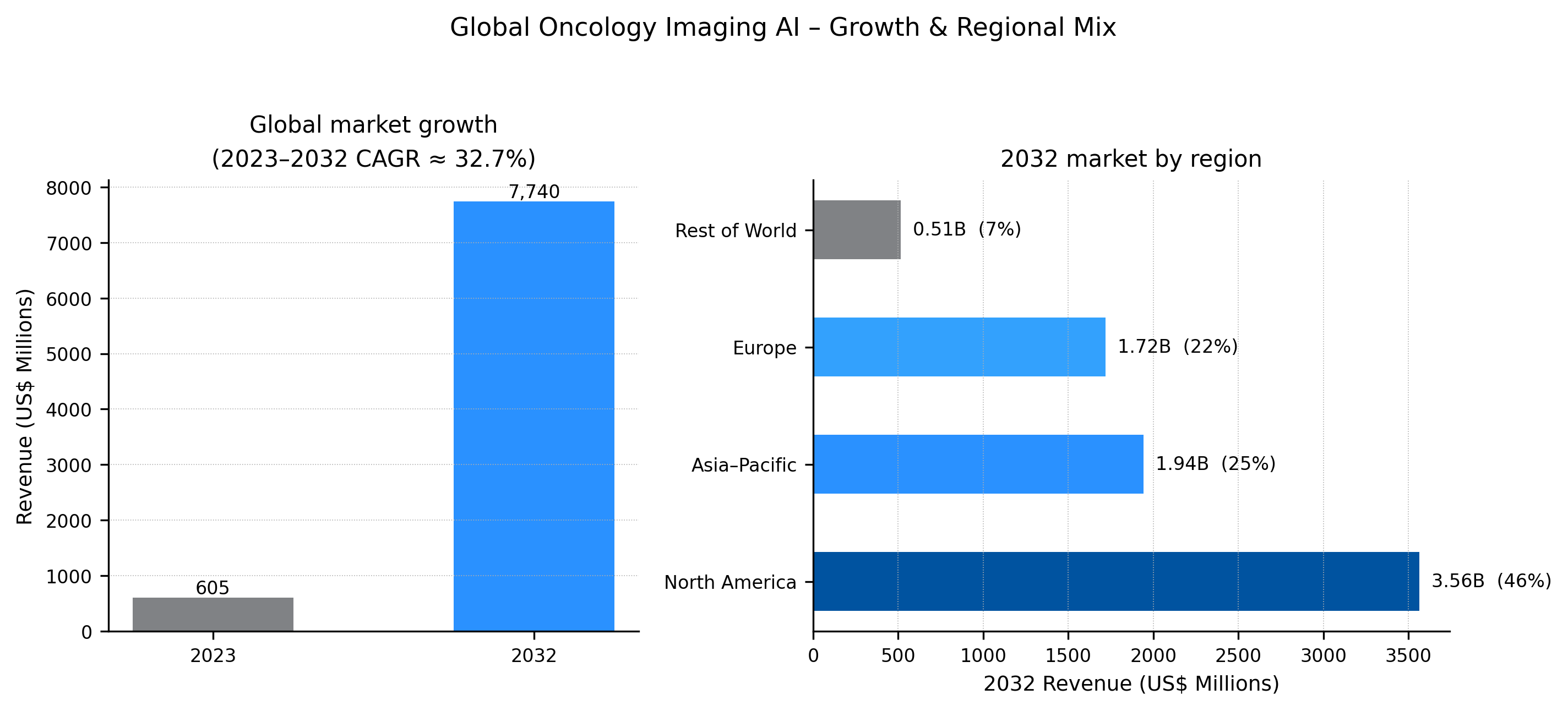

Oncology Imaging AI has moved from experimental pilots to a fast‑scaling market. The report sizes a global opportunity that expands more than 10x between 2023 and 2032, with a compound annual growth rate in the low‑30s. North America remains the largest revenue pool over the horizon, but Asia–Pacific is the fastest‑growing region, overtaking Europe on momentum as national breast and lung programs, domestic OEMs, and cloud‑first deployments ramp. Europe stays a strong second engine, with adoption paced by MDR, HTA, and national screening strategies.

Most spend concentrates in CT, X‑ray/DBT and MRI oncology workflows, with PET/Nuclear and Ultrasound forming smaller but high‑value niches tied to theranostics, quantification, and interventional oncology. The mix of value pools also shifts along the pathway: Detection & Diagnosis remains foundational, but more spend migrates toward screening, treatment planning, and response assessment, where lesion‑level segmentation, dosimetry, and structured reporting are becoming mandatory for modern cancer programs.

The report quantifies Oncology Imaging AI across regions and countries, modalities, tumor sites, clinical applications, pathway stages, revenue streams, and end‑use settings (cancer centers, IDNs/AMCs, community providers, teleradiology). Detailed numbers are reserved for report buyers; the public snapshot is directional by design.

What’s Covered

Global market sizing & forecast (2023–2032) – total Oncology Imaging AI market today and through 2032, with growth outlook, scenario commentary and key inflection points along the decade.

Granular segmentation of value pools – analysis by modality, tumor site, clinical application, pathway stage, revenue stream and end-use setting (cancer centers, IDNs/AMCs, community hospitals, imaging centers, teleradiology), aligned with the broader Markintel™ AI-in-Imaging taxonomy.

Regional & country perspectives – detailed views for North America, Europe, Asia-Pacific, Latin America and Middle East & Africa, including commentary on leading and fast-growth countries, screening initiatives, and local regulatory/reimbursement dynamics.

Clinical & technology trends across the oncology pathway – how AI is being deployed from breast and lung screening through CT/MR staging, RT planning, PET theranostics and longitudinal response assessment, with use-case mapping to Screening, Diagnosis, Staging, Planning, Response and Surveillance stages.

Regulatory, reimbursement and evidence landscape (ARC) – assessment of Approvals, Reimbursement and Clinical validation by key use case (e.g., DBT AI, CT-lung, adaptive RT, PET response, radiomics), including where Oncology Imaging AI is deployment-ready vs where it remains pilot-only.

Competitive landscape by cluster – analysis of six major competitive clusters (AI Software, Imaging OEMs, RT/TPS vendors, AI Platforms & Cloud, Providers & Teleradiology, Imaging-Pharma/CRO & Trials), with GTM Growth–Maturity positioning and qualitative company spotlights.

GTM & packaging strategies – Markintel Upgrade & Package Ladders for each cluster (Foundation / Advanced / Elite), recommended commercial and pricing rules, channel and partnership strategies, and implications for attach-rate expansion and suite-based selling.

Strategic implications & scenarios – cross-cutting insights on where Oncology Imaging AI is likely to become “workflow-critical infrastructure,” how APAC’s faster growth changes global competition, and what boards, product leaders and investors should prioritize over the next 3–5 years.

The report ranks and explains growth drivers and structural restraints, helping leaders separate hype from durable momentum.

Primary growth drivers

Key restraints

The report articulates strategic implications for each driver/restraint pair—for example, how to design attach‑ready bundles in high‑volume screening programs, or how to prioritize RWE and ARC improvements where reimbursement is not yet explicit.

Marketstrat organizes Oncology Imaging AI into a cluster-based competitive architecture, making it easier to see where different types of vendors sit and how they interact:

Within each cluster, the report provides:

Together, the cluster architecture and frameworks help readers answer concrete questions:

5C Network; Accuray; Aidoc; AIQ Solutions; Bracco; Brainlab; Canon Medical; CARPL.ai; deepc (deepcOS); DocPanel; Elekta; Everlight Radiology; Ferrum Health; Fujifilm Healthcare; GE HealthCare; Guerbet; Hologic; Incepto; Koios Medical; Lantheus / EXINI (aPROMISE / PYLARIFY AI); Limbus AI; Lunit; Median Technologies; MIM Software; Mirada Medical; MVision AI; Nuance Precision Imaging Network (PIN); Philips Healthcare; Quibim;

QView Medical; RadNet / DeepHealth; RaySearch Laboratories; Riverain Technologies; Samsung Healthcare; ScreenPoint Medical (Transpara); Siemens Healthineers; Teleradiology Solutions; Tempus (Arterys); Therapixel (MammoScreen); Unilabs / Telemedicine Clinic (TMC); United Imaging; Vara; vRad.

The list is cluster‑balanced—it includes AI software specialists, modality OEMs, RT/TPS vendors, platform players, provider/telerad networks, and imaging‑pharma/iCROs that feature in the oncology analysis.

The Oncology Imaging AI Horizon report is built on the same Markintel™ methodology, taxonomy, and QA rules used in Marketstrat’s global AI in Medical Imaging program, adapted specifically to oncology.

Scope & segmentation

Full country‑level model rolled up to five regions (North America, Europe, APAC, LATAM, MEA).

Segmentation by Modality, Tumor Site, Clinical Application, Pathway Stage, Revenue Stream, and End‑Use/Bayer Type, with oncology‑specific taxonomies (e.g., PSMA/SSTR PET, PIRADS prostate MRI, RT planning & contouring).

Dual‑lens architecture

Top‑down market funnel – anchors the oncology slice within the broader AI in medical imaging market, ensuring consistency with other Markintel Horizon reports.

Bottom‑up attach‑rate flow – models how oncology AI revenue actually accrues, via attach‑rates to modality fleets, oncology programs, RT/TPS workflows, and cloud/PPU services by country and segment.

Framework stack

The report leverages a stacked framework approach to translate numbers into action:

Markintel M³ – Market Momentum Matrix

Maps oncology sub‑segments (e.g., DBT suites, CT‑lung packs, PET response analytics, auto‑contouring libraries) into Prime Drivers, Emerging Gems, Stable Giants, and Niche/Declining, based on 2023–2032 revenue and CAGR.

Markintel ARC‑Index (Approvals, Reimbursement, Clinical Validation)

Scores key oncology use cases and attach segments on a composite ARC scale and links them explicitly to GTM packages and cluster recommendations.

Markintel GTM Growth–Maturity Matrix

Uses 0–100 Growth and Maturity scores to place companies into quadrants at the cluster level, with clear criteria and Evidence Confidence tags (Strong, Moderate, Emerging). Leaders are only recognized where evidence depth and reliability meet defined thresholds.

Upgrade & Package Ladders (Foundation → Advanced → Elite)

A proprietary GTM framework that organizes oncology AI capabilities into tiered packages with recommended commercial rules (e.g., minimum bundle configurations, pricing/discount logic, and when to unlock higher tiers). This addresses a common vendor problem: selling oncology AI as a bag of parts instead of coherent, value‑anchored offers.

Evidence Confidence and QA

The report documents an Evidence Confidence rating for company and segment placements based on density, recency, and independence of sources (regulatory filings, audited financials, multi‑center trials, RWE, documented programs). “Emerging” confidence is reserved for earlier‑stage vendors/use cases and is explicitly kept out of the Leader quadrants.

This report is designed for decision‑makers with P&L, product, or capital at stake in Oncology Imaging AI, including:

Vendors & OEMs

Healthcare providers & networks

Pharma, biotech & CROs

Clinical development and medical affairs teams using imaging AI for trial endpoints, response quantification, and theranostic programs.

Investors & boards

Private equity, growth equity, and strategic corporate investors assessing where Oncology Imaging AI is truly scalable—and which clusters and companies are best positioned to capture value over the next 3–5 years.

For all of these audiences, the core promise is consistent with Marketstrat’s Markintel philosophy: not just an accurate market model, but an Insights → Action roadmap—showing where oncology imaging AI is ready to scale, which segments and clusters matter most, and how to translate opportunity into disciplined, repeatable growth.

| Title | World Market for Oncology Imaging AI |

| Type | Markintel Horizon (Flagship, In-Depth) |

| Estimated Publication | December 2025 |

| Number of Pages | ~643 (141 Market Data Tables, 344 Figures – Charts, Strategic Frameworks, and Heatmaps) |

| Format | PDF (digital download, direct purchase) |

| Geographical Coverage |

|

| Market Segmentation |

|

| Key Topics Covered |

|

| Methodology | Markintel Horizon Research Program – Medical Imaging & AI |

| Price & Licensing | Individual ($4,950), Team ($5,450), Enterprise ($8,950) license options |

Driving healthcare innovation through actionable intelligence, strategic execution, and transformative solutions for global impact and growth.