One Big Thing

AI’s center‑stage moment: clinical evidence, billion‑dollar funding rounds and the EU AI Act all converged this week—turning regulatory prowess into the new competitive moat for imaging‑AI vendors.

Key Takeaways

- Clinical proof > curve‑fitting. Studies on prostate MRI, amyloidosis echo and generative radiology reporting moved ROI discussions from AUCs to 40 % efficiency gains and 21‑day pathway cuts.

- Money chases workflow, not widgets. 62 % of H1 digital‑health capital—and 9 of 11 mega‑deals—targeted workflow or data‑infrastructure AI, commanding an 83 % valuation premium.

- EU AI Act is live. “High‑risk” imaging AI now requires hospital co‑accountability; vendors must ship “compliance‑in‑a‑box” or face stalled deals.

- Platform land‑grab. Samsung’s Xealth buy proves Big Tech wants the data‑layer—forcing point‑solution apps toward ecosystem toll‑roads.

- Feature vs. Platform shake‑out. The week’s evidence suggests single‑feature startups will consolidate into PACS/EMR majors; platform players attract national pilots (e.g., NHS prostate AI).

Quick-Glance Table

| Date | Headline | Our Take |

|---|---|---|

| 9 Jul | Ultromics AI flags cardiac amyloidosis, AUC 0.93 | Screening/flagging category will scale fastest—low‑risk, huge value |

| 10 Jul | Samsung buys Xealth | Wearables + Rx‑apps = data gatekeeper; OEMs risk disintermediation |

| 8 Jul | FDA final cybersecurity guidance | “Secure‑by‑design” now 510(k) table‑stakes for imaging‑AI |

| 2 Jul | Philips SmartSpeed Precise cleared | Dual‑AI MRI uplift could free ~US$550 k/3 T magnet/yr |

| 11 Jul | Medibank covers pharmacogenomics | Payer push signals wider precision‑medicine reimbursement coming |

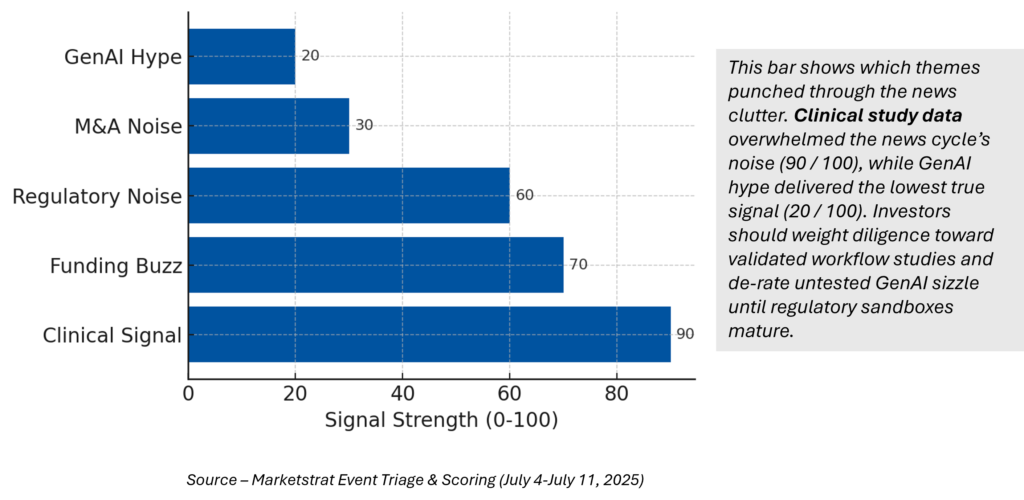

Signal-to-Noise Heatbar

Signal Pulse Heatmap

Deeper Dives

Regulatory

- EU AI Act “high‑risk” obligations now live → hospitals become liable deployers

- FDA pre‑approves change‑control plan (Moon Surgical) → faster iterative AI updates

- UK MHRA Airlock invites Phase 2 AI‑device sandboxes

Funding

- H1 VC: US$ 6.4 B; 62 % to AI; average AI deal US$ 34 M

- Kardium pulls US$ 250 M in one of 2025’s largest med‑tech rounds (PFA)

Digital Health

- Samsung + Xealth sets new bar for consumer‑to‑clinical integration

- Medibank to pay for PGx testing → payer push into precision meds

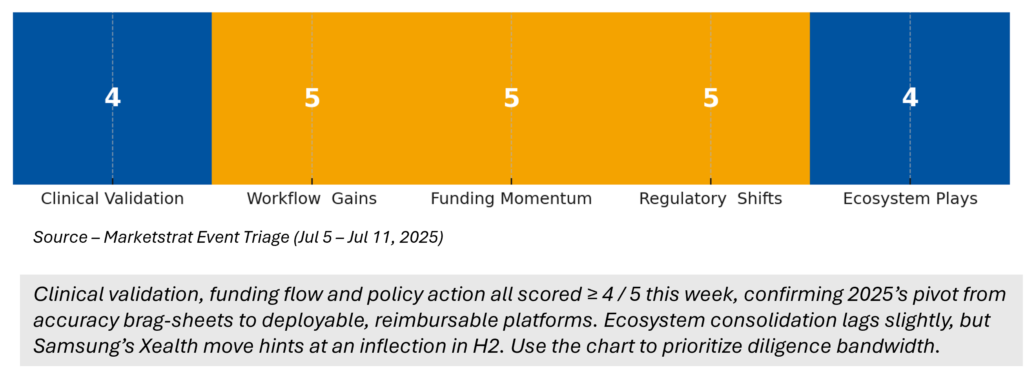

Regulatory Pulse (annual FDA imaging‑AI clearances)

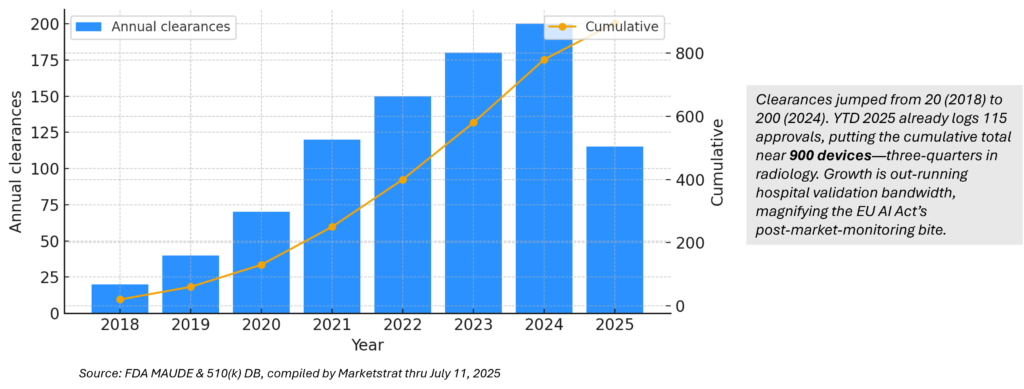

Innovation Hook – Northwestern’s In-house GenAI Reporter

Northwestern’s generative AI reporter drafted 95 %‑complete X‑ray reads, boosting throughput 15‑40 % across 24 k exams—with zero accuracy loss. Every radiology service line now has a blueprint for ‘centaur’ reading.

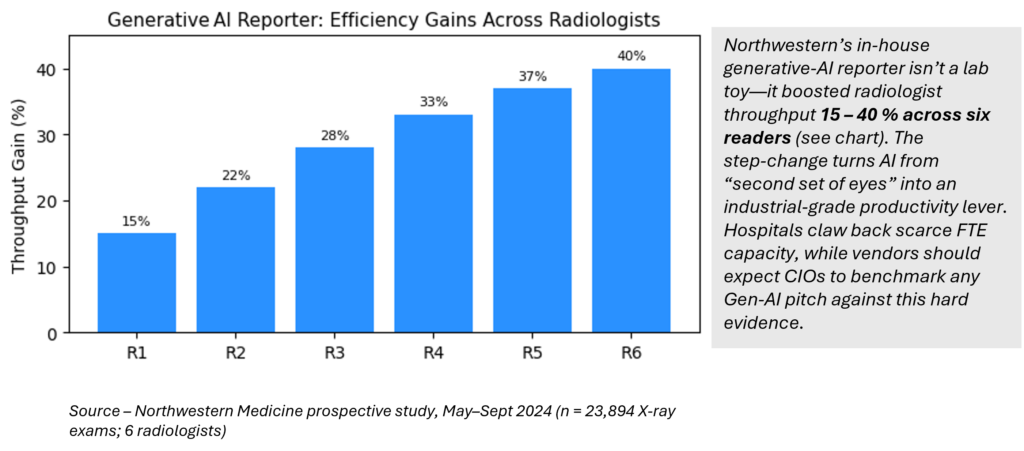

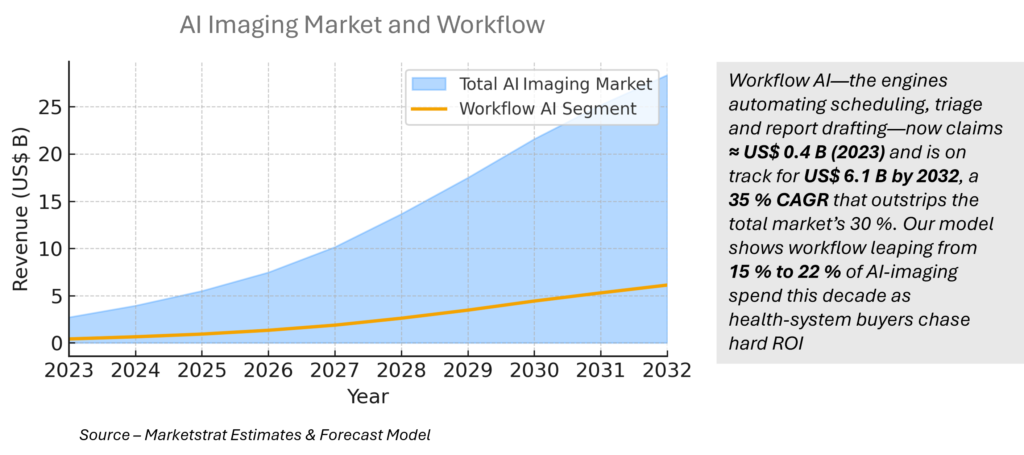

Market Lens – Workflow AI

Marketstrat POV

- Regulatory readiness is the new moat. Integrate “compliance‑as‑a‑service” into the product or risk 12‑month sales‑cycle blow‑outs.

- Workflow is king. Solutions proving 20 %+ throughput gains will out‑monetize diagnostic‑only tools, even at lower standalone accuracy.

- Consolidation window opens Q4. Cash‑burning feature vendors will seek PACS/EMR exits as EU compliance costs bite.

About Marketstrat™

Marketstrat™ is a market intelligence and GTM enablement firm committed to empowering clients in data-driven industries. Under the Markintel™ brand, it delivers robust market intelligence, while GrowthEngine™ solutions offer specialized GTM advisory and app-based tools—together fueling growth, innovation, and competitive advantage. For more information, visit www.marketstrat.com.

Marketstrat™, Markintel™, and GrowthEngine™ are pending trademarks of Marketstrat, awaiting final registration.

Check out free Research and Insights and Analysis of Industry Events

Check out our collection of Markintel Horizon and Markintel Pulse research.

Check out details on our upcoming report, World Market for AI in Medical Imaging

1. Why does this week’s Market Lens isolate “Workflow AI” instead of MRI?

Workflow automation now attracts 35 % CAGR—outpacing every clinical slice of imaging‑AI. We pivoted the lens to show where hospital ROI and investor capital are converging. :contentReference[oaicite:0]{index=0}

2. What exactly counts as “Workflow AI” in imaging?

Any tool that speeds scheduling, triage, protocoling, report drafting or data routing—e.g., work‑list prioritisers, generative report writers or zero‑click scan planning solutions. :contentReference[oaicite:1]{index=1}

3. How big is the Workflow AI slice today?

Roughly US$ 0.4 B in 2023 (≈15 % of total imaging‑AI spend) and tracking to US$ 6.1 B by 2032. :contentReference[oaicite:2]{index=2}

4. What drove the 40 % throughput gain in Northwestern’s study?

A home‑grown generative model that drafted 95 %‑complete X‑ray reports and flagged critical findings in real time, freeing radiologists for high‑value reads. :contentReference[oaicite:3]{index=3}

5. Does the EU AI Act slow Workflow AI adoption?

Yes—vendors must bundle “compliance‑as‑a‑service” toolkits because hospitals are now joint deployers under the Act. :contentReference[oaicite:4]{index=4}

6. Are Workflow AI vendors reimbursed?

Indirectly. Productivity wins shorten pay‑back periods without CPT codes, but CMS is piloting usage‑based add‑ons for triage and automated reporting tools. :contentReference[oaicite:5]{index=5}

7. Will GenAI compress imaging‑AI prices?

Expect 20‑25 % ASP erosion as accuracy converges; platform bundles and workflow fees can cushion the blow. :contentReference[oaicite:6]{index=6}

8. First step for a hospital starting its Workflow AI journey?

Pilot automated X‑ray report drafting; quantify cycle‑time gains, then reinvest saved FTE hours into validating the next wave of AI tools. :contentReference[oaicite:7]{index=7}