One Big Thing

Trust is becoming the moat in imaging AI—RSNA Ventures’ tie‑up with RadAI and platform plays like Hyperfine’s PULSE show that workflow‑embedded, evidence‑anchored intelligence is eclipsing stand‑alone algorithms.

Key Takeaways

- Workflow > algorithm: RSNA Ventures × RadAI hard‑wires a century of peer‑reviewed radiology knowledge into reporting—shifting advantage from “best model” to trusted, in‑workflow guidance. Expect faster adoption and stickier enterprise deals.

- Total‑body PET/CT steps into precision oncology: GE HealthCare and Erasmus MC will evaluate a 128‑cm axial FOV system aimed at ultra‑low dose, faster scans and theranostics workflows—evidence reports show management changes from dual‑tracer protocols.

- Robot wars escalate: Medtronic starts a U.S. Hugo IDE in gynecology while Intuitive adds AI navigation + tomosynthesis to Ion—raising the bar on imaging‑guided interventions.

- Regulatory tailwinds: UK MHRA–US FDA pact sets up international reliance routes by 2027 for faster UK access to AI devices, while several new 510(k)s landed this week (AR spine, CT‑MAC).

- Platformization of AI: Google’s Gemini Enterprise and DiMe’s playbook aim to govern and scale “agentic” AI across healthcare stacks—an adoption accelerator for imaging‑adjacent workflows.

Quick-Glance Table

| Date | Headline | Our Take |

| Oct 7 | RSNA Ventures partners with RadAI | Trust + workflow is the new moat; expect copycat society–vendor alliances and pressure on pure‑algorithm shops. |

| Oct 7–10 | GE HC & Erasmus: next‑gen total‑body PET/CT | Positions GE to shape EU protocol standards for multi‑time‑point, theranostics‑ready oncology imaging. |

| Oct 9 | Medtronic begins U.S. Hugo GYN IDE | Most credible large‑cap challenge to Intuitive in years; watch pricing and evidence. |

| Oct 8 | Intuitive Ion adds AI nav + tomosynthesis | Tackles CT‑to‑body divergence; raises diagnostic yield in lung biopsies without cone‑beam CT. |

| Oct 8 | MHRA–FDA AI collaboration | Reliance routes could cut UK launch lag for AI/ML devices from 2027; plan submissions with that horizon. |

| Oct 8 | AR SyncAR Spine wins 510(k) | XR + AI inch into intra‑op imaging guidance; early but notable efficiency signal. |

| Oct 8 | Bunkerhill MAC CT algorithm cleared | Expands opportunistic cardiology risk detection from routine chest CTs—good reimbursement pathway story. |

| Oct 6–10 | DiMe + Google launch AI implementation playbook; Google unveils Gemini Enterprise | Governance and connectors reduce deployment friction; vendors should align to these playbooks. |

| Oct 6 | Oath Surgical $24M Series A | AI‑powered ASC model targets cost curve; early proof of value‑based surgical ops. |

| Oct 7 | MediView XR raises $24M | AR guidance gains OEM validation (GE led round); watch for image‑guided oncology use cases. |

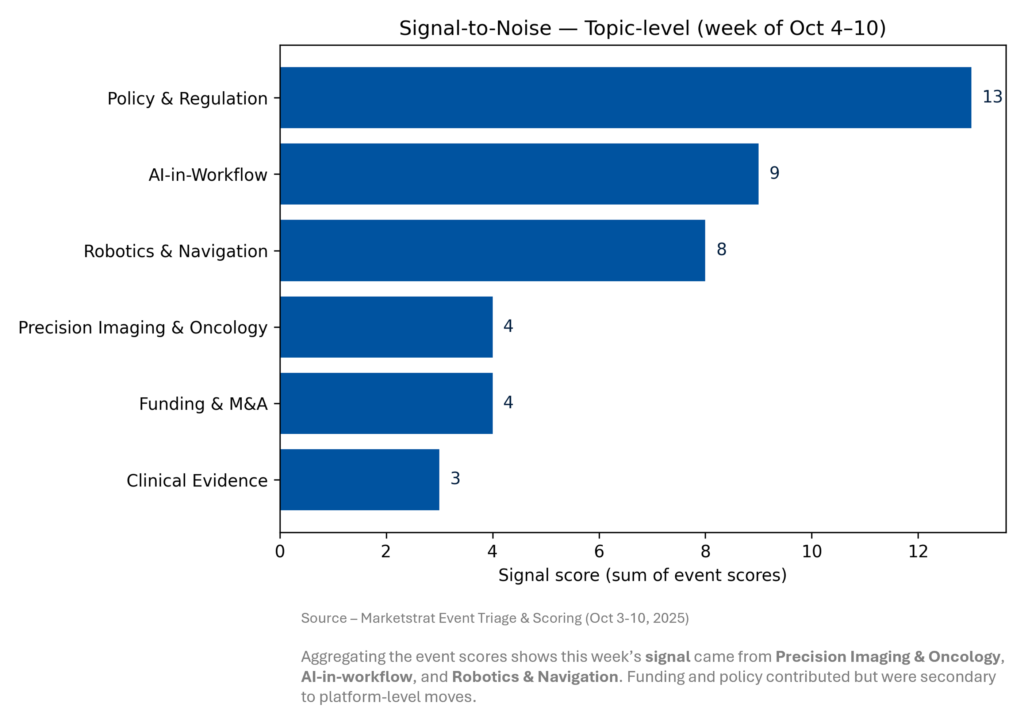

Signal-to-Noise by Topic – Oct 3-10, 2025

The balance of signal indicates where to allocate attention (and BD resources): enterprise workflow partnerships, oncology imaging platforms (PET/CT, MRI), and robotic procedures enhanced by imaging AI. Expect these themes to dominate RSNA and HLTH narratives through Q4.

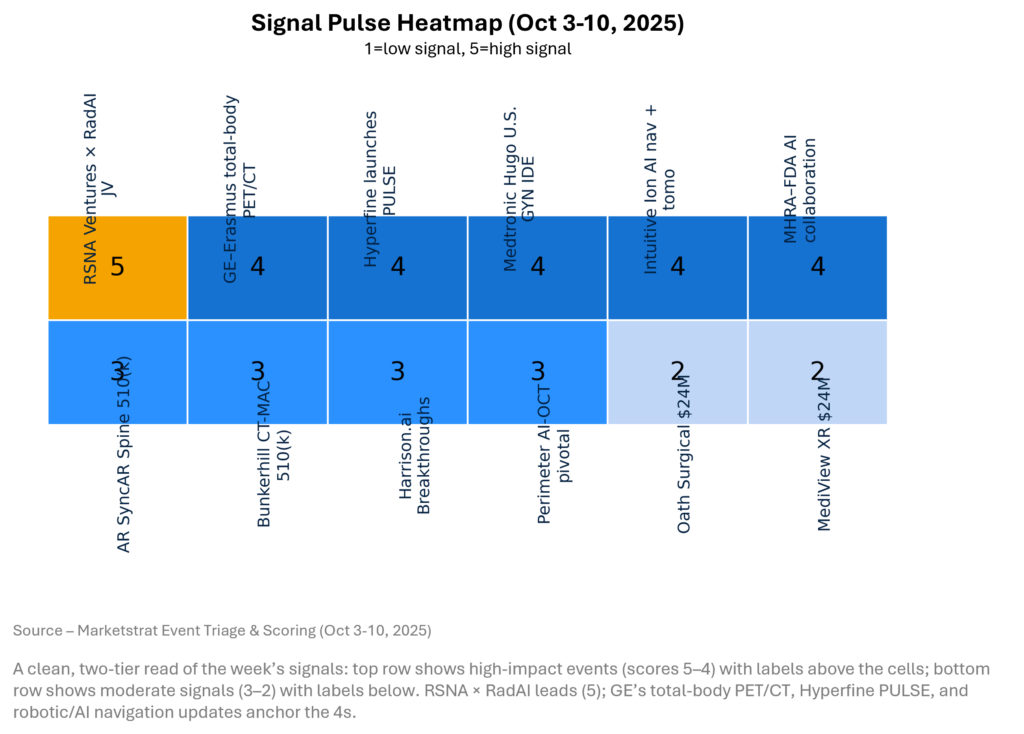

Signal Pulse Heatmap – Oct 3-10, 2025

Signals clustered in workflow‑embedded AI, precision oncology imaging, and robotics. Regulatory and policy news (MHRA–FDA) boosted confidence in multi‑market launches. Funding rounds concentrated on AR guidance and AI‑run surgical operations—adjacent to imaging yet reinforcing the same theme: trusted, integrated platforms are pulling ahead.

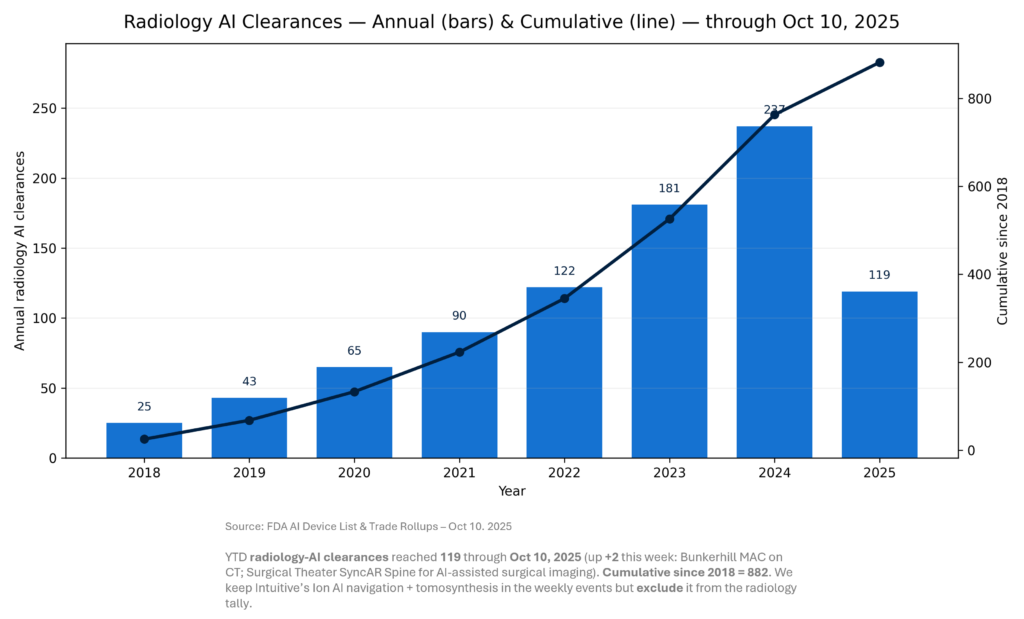

Regulatory Pulse

Regulatory momentum remains steady. Bunkerhill’s incidental MAC on chest CT illustrates the pull of opportunistic risk detection, while SyncAR’s AI‑guided AR visualization shows imaging AI’s spread into the OR. For the Pulse tracker, we count radiology‑coded SaMD—hence Ion’s AI nav + tomo upgrade (robotic bronchoscopy) is not added to the radiology line, though it’s clinically important. Expect late‑Q4 filings to lean into workflow value and reimbursement narratives as vendors seek measurable ROI.

Deeper Dives

Regulatory

Multiple imaging‑adjacent 510(k)s landed: AR‑guided SyncAR Spine and Bunkerhill’s CT‑based MAC detection. The MHRA–FDA collaboration adds reliance routes from 2027, likely trimming UK launch lag for cleared AI/ML devices. Harrison.ai picked up three FDA Breakthroughs (one with NTAP path), signaling regulators’ appetite for high‑impact imaging AI.

Regulators are rewarding tools that shorten time‑to‑diagnosis or tie tightly to outcomes (triage, navigation, opportunistic risk). The transatlantic alignment lowers multi‑market friction if firms pre‑wire submissions to shared evidence and real‑world monitoring expectations. Net: plan UK entries in parallel with U.S. filings from 2026, and prioritize claims with operational metrics (yield, turnaround time) to de‑risk reimbursement.

Funding & M&A

ZimVie shareholders approved a go‑private sale; Owens & Minor carved out a low‑margin unit to refocus on home‑based care economics. On the innovation edge, Oath Surgical ($24M) and MediView XR ($24M) drew capital to AI‑run surgical centers and AR‑guided interventions.

Capital is bifurcating: portfolio rationalization at scale, and targeted bets on workflow‑native tech where ROI is legible. Expect deal‑making to favor assets that bolt into incumbent stacks (PACS/RIS/EHR/OR) and demonstrate throughput or cost avoidance—particularly in high‑volume oncology, pulmonary, and ortho lines.

Digital Health / AI Platforms

Google launched Gemini Enterprise (governed multi‑agent AI), while DiMe released a practical AI implementation playbook. Together they shrink rollout friction—central policy, connectors (DICOM/HL7/FHIR), and audit trails. Health systems also scaled GenAI evidence lookup (UpToDate Expert AI).

The platform layer is maturing: governance, consent‑indexed access and packaged adapters will determine who scales fastest. Imaging vendors that lean into these rails—think Blackford‑style orchestration, PACS plug‑ins, and EHR side‑panels—will convert pilots into enterprise‑wide deployments, turning AI from a point solution to shared infrastructure.

Clinical Research

Perimeter’s AI‑OCT cut re‑excision rates in breast‑conserving surgery (p=0.005), and Clairity teed up multiple RSNA abstracts on mammography‑based 5‑year risk—evidence that decision support is moving the needle on outcomes, not just accuracy.

Evidence is tilting toward real‑world benefit: fewer re‑ops, calibrated risk models, and time savings. Tie your claims to patient‑relevant endpoints and economics (e.g., avoided re‑surgery cost) to unlock payer support—mindful that CMS denial rates remain high without outcome proof.

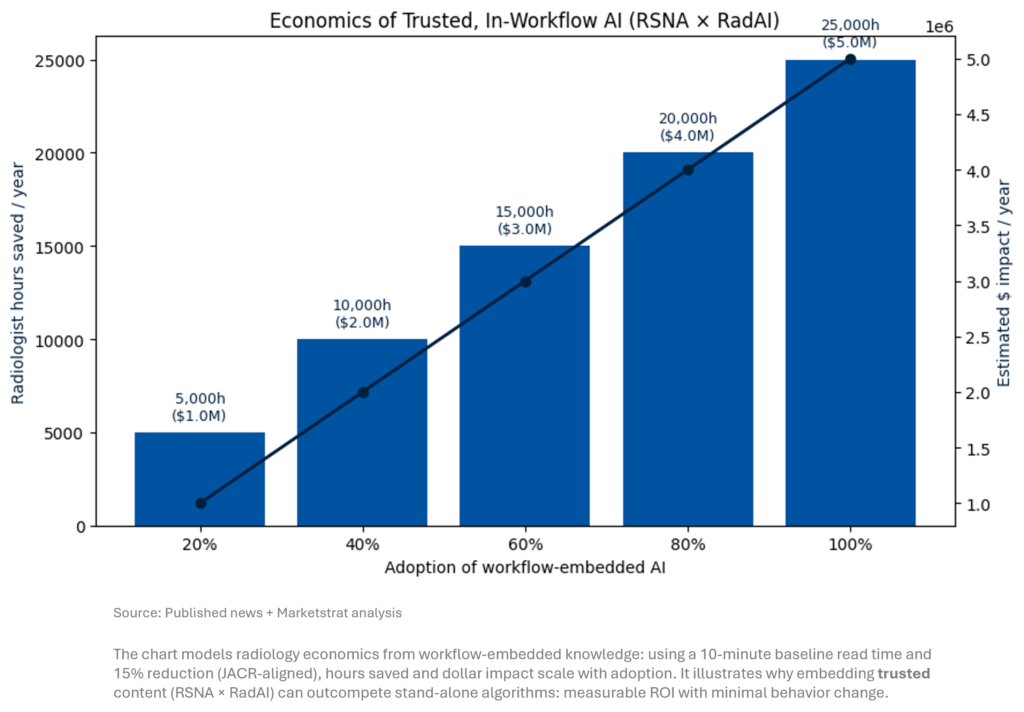

Innovation Hook — The New AI Moat: Workflow‑Embedded Knowledge (RSNA Ventures × RadAI)

What changed: RSNA will surface a century of peer‑reviewed content inside RadAI Reporting—turning AI from a “black box” into a trusted conduit to vetted guidance. Using JACR efficiency data (~15% time reduction with AI‑generated drafts), a 1M‑study system saves ~25k radiologist hours/year (≈$5M at $200/hr) at 100% adoption; even 40% adoption nets ≈$2M.

This partnership reframes AI advantage around credibility and frictionless integration. When clinical knowledge is curated, current, and surfaced at the reporting moment, adoption moves from pilots to production. The economics compound: modest per‑study time deltas scale across high volumes, while trust reduces resistance and re‑work. Expect vendor–society deals to proliferate, forcing algorithm‑centric firms toward content alliances, acquisitions, or embedding within broader platforms.

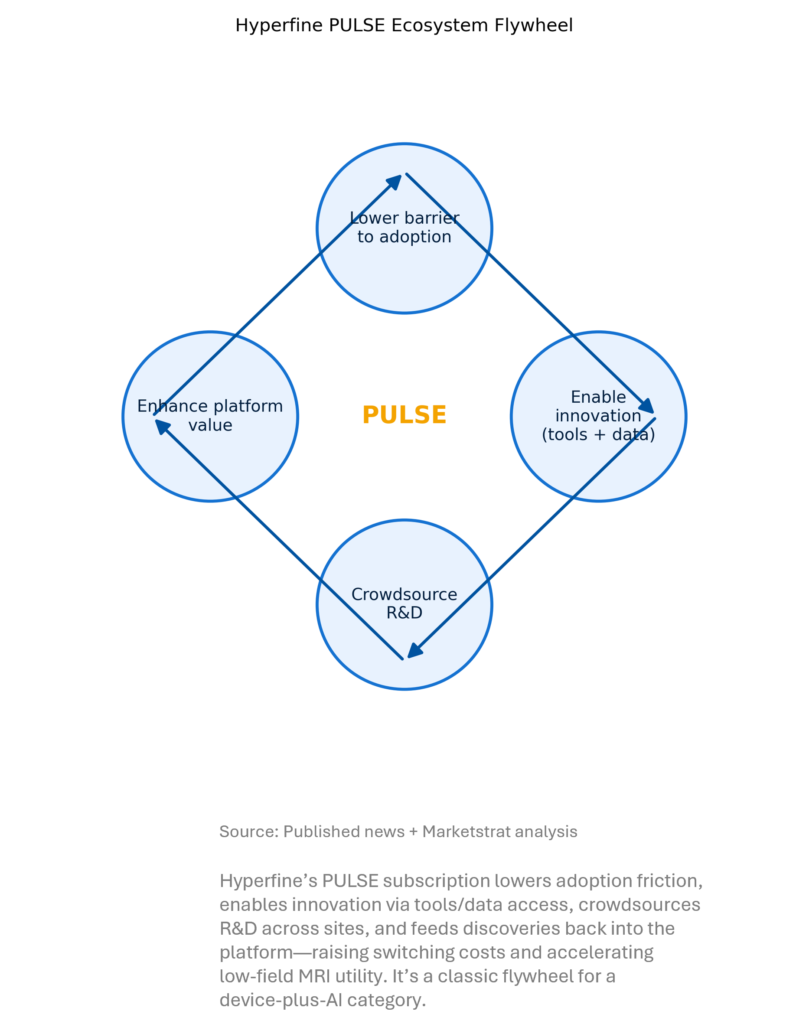

Hyperfine PULSE Ecosystem Flywheel

A hardware‑to‑platform pivot builds a defensible moat via network effects. For small‑cap device players, this is an efficient way to expand indications, publish faster, and pre‑empt scale advantages of larger OEMs. Watch for developer access and curated IP sharing as the next acceleration steps.

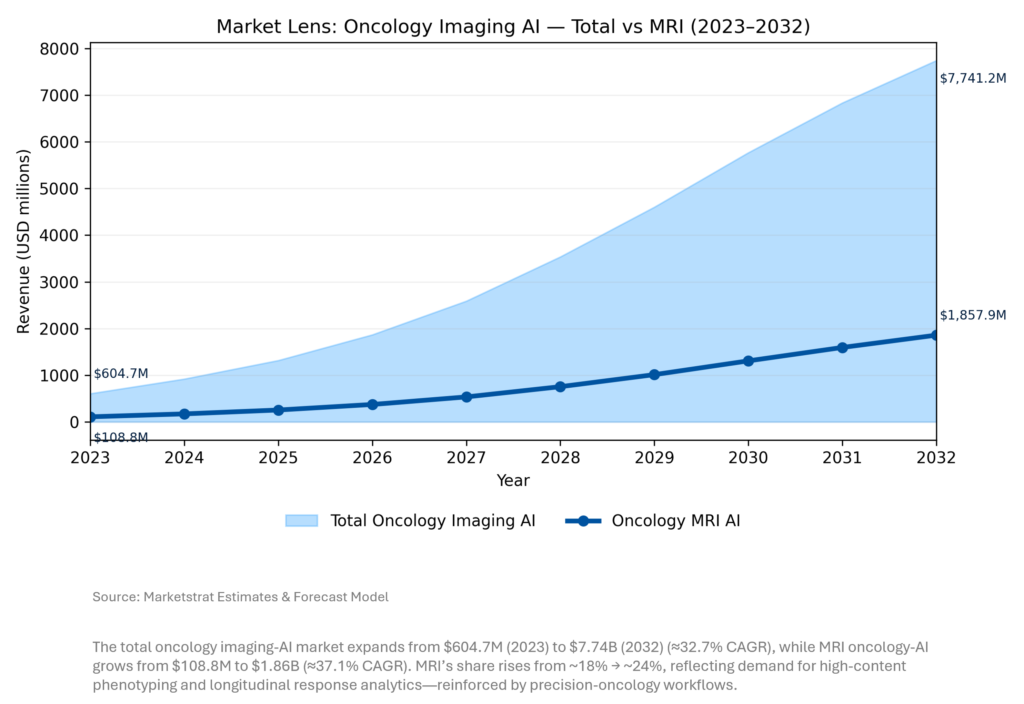

Market Lens – Oncology Imaging AI vs MRI Oncology Imaging AI

Oncology remains AI’s growth engine. From a $605M base in 2023 to $7.7B by 2032, spending shifts toward high‑information modalities. MRI outpaces the market (37.1% CAGR) as radiomics and longitudinal response modeling scale. In parallel, PET/CT is catalyzed by total‑body platforms and AI reconstruction, improving dose, throughput, and kinetic readouts (e.g., GE–Erasmus initiative). Expect oncology portfolios to converge radiopharmacy, reconstruction AI, and therapy‑selection analytics.

Marketstrat POV — Strategy to-dos

- Build or borrow trust. Tie your AI to peer‑reviewed knowledge and embed it where work happens. Partnerships with societies and large provider networks will compress sales cycles.

- Own the oncology stack. Pair imaging platforms (e.g., total‑body PET/CT) with radiopharmacy, reconstruction AI, and theranostics workflows to win share in precision oncology.

- Scale via governance rails. Align with emerging enterprise AI platforms (connectors, audit, consent tokens) to reduce integration friction and speed enterprise rollouts.

About Marketstrat

Marketstrat® is a market intelligence and GTM enablement firm committed to empowering clients in data-driven industries. Under the Markintel™ brand, it delivers robust market intelligence, while GrowthEngine solutions offer specialized GTM advisory and app-based tools—together fueling growth, innovation, and competitive advantage. For more information, visit www.marketstrat.com.

Marketstrat® is a registered trademark and Markintel™ is a pending trademark of Marketstrat.

Check out free Research and Insights and Analysis of Industry Events

Check out our collection of Markintel Horizon and Markintel Pulse research.

Check out details on our reports, World Market for AI in Medical Imaging and other Pulse Reports in the Imaging space.