One Big Thing

CTA‑native stroke AI moved from pilot to frontline this week—two FDA wins in neurovascular workflow (CTA LVO triage and automated aortic measurements) compress minutes to thrombectomy and hard‑wire CFO‑friendly ROI levers.

Key Takeaways

- Two FDA clearances point squarely at neurovascular throughput: Qure.ai’s CTA LVO triage (qER‑CTA) and Nurea’s “zero‑click” PRAEVAorta 2. Minutes saved → better EVT eligibility and fewer transfers.

- Hologic goes private (up to $18.3B): expect breast imaging acceleration (DBT upgrades, CADx, service bundles) under a PE playbook.

- Gadolinium dose looks ripe for re‑write: Subtle Medical × Bayer POC suggests ~50% GBCA reduction with maintained diagnostic utility—patient‑safety and cost tailwinds.

- Payment rails matter: UHC/Cigna coverage for AI coronary‑plaque analysis puts CCTA AI on a reimbursed path; expect copycats.

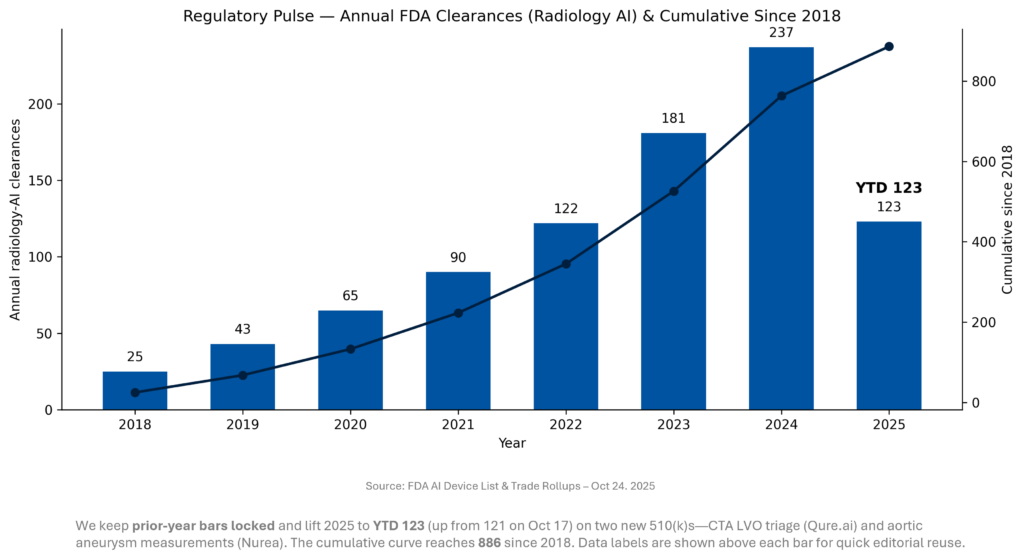

- Reg pulse: Radiology‑AI FDA clearances now 123 YTD (121 through Oct 17 +2 this week); cumulative since 2018 rises to 886.

Quick-Glance Table

| Date | Headline | Our take |

| Oct 22 | Qure.ai qER‑CTA 510(k) for CTA‑based LVO alerts (ICA/M1). | CTA‑native triage cuts minutes before EVT; pairs with stroke‑hub messaging for faster decisions. |

| Oct 22 | Nurea PRAEVAorta 2 510(k) (automated aortic diameters/volume). | “Zero‑click” vascular measurements standardize surveillance, reduce variability, and de‑friction follow‑up clinics. |

| Oct 22 | Hologic take‑private (Blackstone/TPG, up to $18.3B; $79/sh incl. CVR). | Private ownership should accelerate breast imaging & diagnostics bets; watch DBT AI and service bundles. |

| Oct 21 | Subtle Medical × Bayer: POC shows ~50% lower GBCA with similar diagnostic quality. | Safety + cost + throughput: a credible wedge for AI in core MRI protocols; multi‑center validation next. |

| Oct 21 | UHC/Cigna approve AI plaque analysis for CCTA indications. | Catalyzes CT cardiology upgrades and AI adoption; get coding workflows (0623T–0626T) crisp. |

| Oct 20 | GE HealthCare co‑develops AI‑driven hospital command‑center software (CareIntellect). | Moves ops from reactive dashboards to prescriptive actions; recurring SaaS on top of imaging base. |

| Oct 18–24 | Foundation‑model plumbing: MONAI NIM microservices (MAISI, VISTA‑3D) gain traction. | Synthetic 3D CT + segmentation microservices shorten AI deployment cycles in imaging stacks. |

| Week | Lunit scale: national framework in France; >1M mammos/yr across ~200 U.S. sites. | Procurement‑led breast AI is real; vendor‑agnostic orchestration becomes a must‑have. |

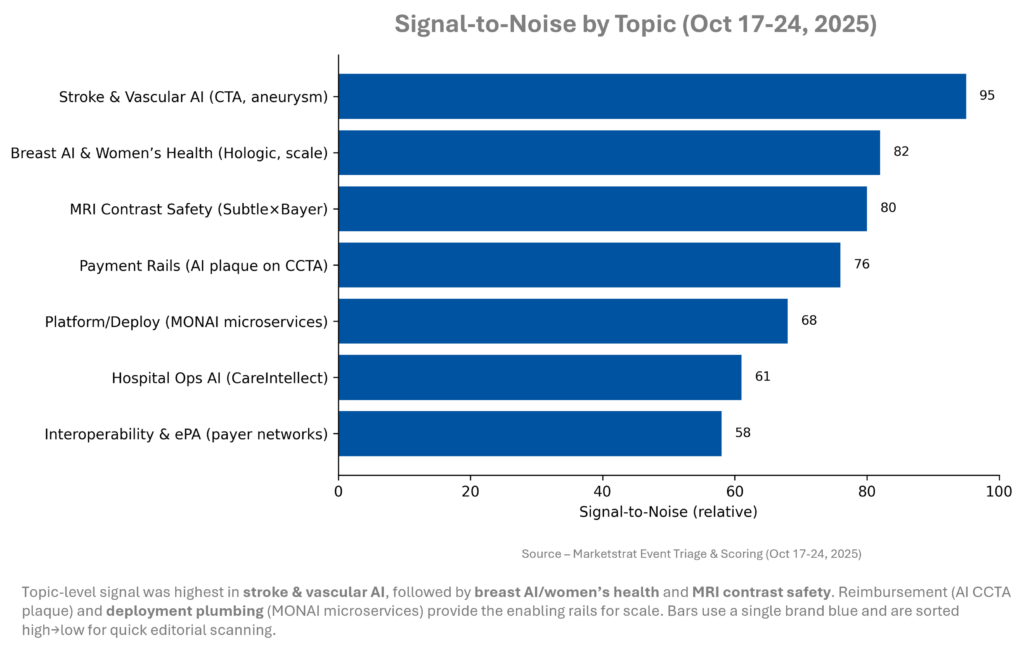

Signal-to-Noise by Topic – Oct 17-24, 2025

Clear, clinical time/quality effects (stroke CTA, vascular measurements, gadolinium‑sparing MRI) dominated. Financial payoff clarity (CCTA AI coverage) pushed payment up the list. Platform talk was quieter but important—microservices and orchestration shrink validation and IT effort, the friction that often stalls hospital‑wide rollouts.

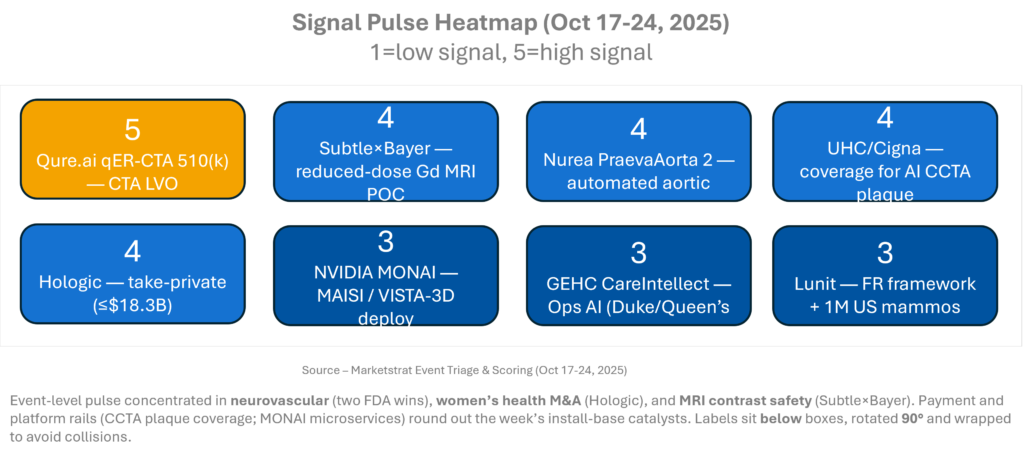

Signal Pulse Heatmap – Oct 17-24, 2025

Signals skew practical: clearances that shave minutes or standardize measurements; coverage that pays for AI where clinical benefits are crisp; and platform plumbing that makes deployment repeatable. Together, they shift buyers from pilots to enterprise standardization—particularly across stroke, breast, and cardiac CT pathways—while PE pushes women’s health toward faster product cycles.

Regulatory Pulse

Pace remains brisk and radiology keeps leading AI device clearances. The week’s additions skew to neurovascular and cardiovascular workflows—areas with clear time‑to‑treatment impacts and reproducibility value. Expect YTD to keep drifting upward as RSNA approaches and vendors finalize 510(k)s queued for Q4 disclosure.

Deeper Dives

Regulatory

Two 510(k)s matter this week: qER‑CTA for LVO on CTA (adult ICA/M1) with automated alerts, and PRAEVAorta 2 for “zero‑click” aortic measurements. Both target high‑stakes decisions (EVT candidates; aneurysm surveillance) and reduce manual friction that slows care. Watch for prospective KPI reporting (door‑to‑notification, PPV, EVT rates).

Funding/M&A

Hologic’s take‑private (up to $18.3B) sets a high bar for strategic velocity in women’s health. Expect aggressive DBT upgrade cycles, CADx bundling, and service‑heavy offers; competitors will counter with platform partnerships and reader‑workflow proof.

Digital Health & AI

Coverage for AI plaque analysis on CCTA (UHC/Cigna) creates a practical GTM path: align order sets and prior‑auth to criteria; code with 0623T–0626T. Platform plumbing advanced as MONAI microservices (MAISI/VISTA‑3D) gained traction, reducing deployment friction for 3D CT and segmentation stacks.

Clinical Research

Subtle×Bayer POC indicates MRI enhanced by AI could halve GBCA dose while maintaining diagnostic quality; follow‑on trials will decide formulary and throughput impacts. Early signals favor value‑based protocols with radiologist oversight and QA tied to organ‑specific reads.

Product/Platform

GE HealthCare advanced its CareIntellect hospital command‑center software with Duke and The Queen’s—prescriptive ops layered over imaging fleets; radiology will feel this in bed and staffing decisions that cut idle time and accelerate scans.

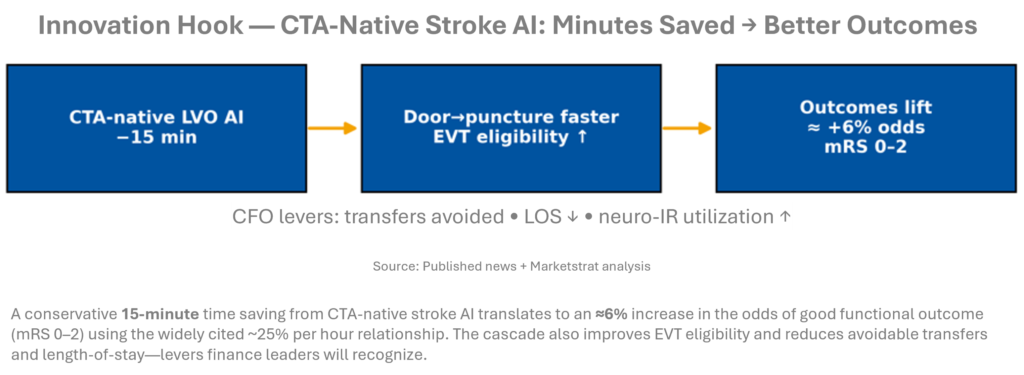

Innovation Hook — CTA‑Native Stroke AI: Minutes Saved → Better Outcomes

Two neurovascular clearances give operational footing to stroke AI where it matters—CTA. Evidence lines up: real‑world programs report 10–40 minutes saved from door‑to‑notification/door‑to‑puncture; each hour saved lifts odds of independence by ~25%. Our cascade adopts 15 minutes to stay conservative. Business impact shows up in fewer secondary transfers, faster bed turnover, and neuro‑IR throughput. Expect enterprise RFPs to prefer multi‑site, CTA‑first bundles over point apps.

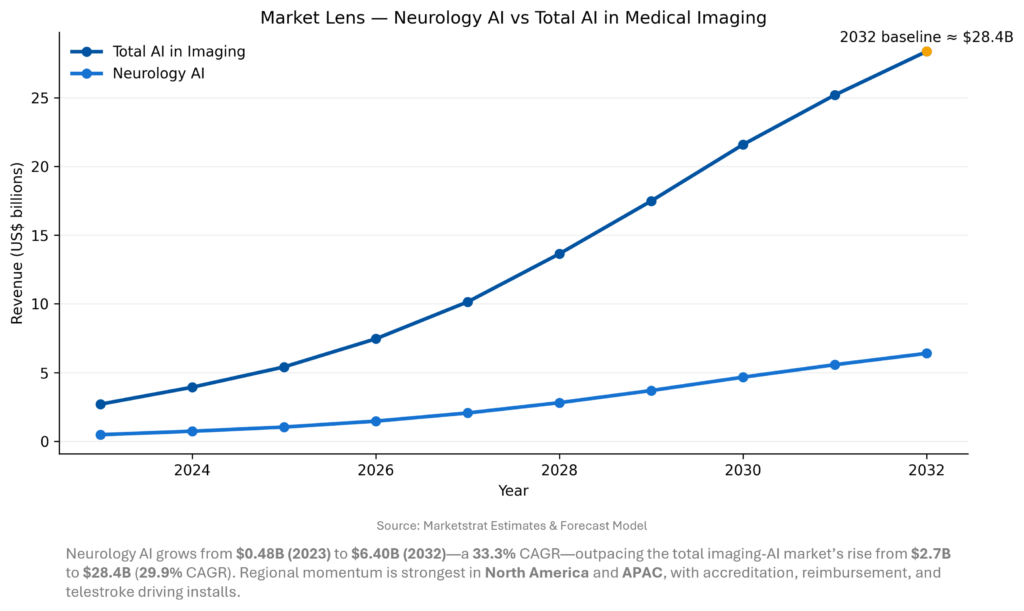

Market Lens – Total Imaging AI vs Neurology Imaging AI

Stroke triage was the on‑ramp; now neurology AI is a suite sell—NCCT/CTA plus perfusion, ICH quant, and MRI LVO follow‑up. Growth remains accreditation‑ and reimbursement‑led in the U.S., while Europe leans on MDR/ESO guidance and APAC on telestroke expansion. Expect price compression in basic triage and margin to migrate to perfusion analytics and neuro‑ICU trending.

Marketstrat POV — Strategy to-dos

- Buy the workflow, not the widget. Hospitals are awarding suite RFPs (CTA+CTP+MR+ICH), with orchestration, alerts, and PACS/VNA embedding as selection criteria equal to algorithm AUC.

- Prove dollars with minutes. For stroke, publish door‑to‑puncture deltas and EVT lift, then convert to LOS and transfer avoidance. Those metrics carry budget meetings.

- Price front door low; monetize depth. Expect triage to commoditize; hold margin in perfusion analytics, ICU trending, and cross‑modality neuro bundles.

About Marketstrat

Marketstrat® is a market intelligence and GTM enablement firm committed to empowering clients in data-driven industries. Under the Markintel™ brand, it delivers robust market intelligence, while GrowthEngine solutions offer specialized GTM advisory and app-based tools—together fueling growth, innovation, and competitive advantage. For more information, visit www.marketstrat.com.

Marketstrat® is a registered trademark and Markintel™ is a pending trademark of Marketstrat.

Check out free Research and Insights and Analysis of Industry Events

Check out our collection of Markintel Horizon and Markintel Pulse research.

Check out details on our reports, World Market for AI in Medical Imaging and other Pulse Reports in the Imaging space.