One Big Thing

Cardiac imaging AI clinched an FDA clearance with a clear reimbursement path, while browser‑based advanced visualization crossed the regulatory chasm — signaling a shift from point AI apps to platform + payment models in imaging.

Marketstrat POV — Strategy to-dos

- Anchor AI to codes and capital cycles. Prioritize use cases with explicit payment (e.g., CCTA plaque) or demonstrable DRG/throughput impact; bundle into enterprise platform deals to reduce integration friction.

- Exploit the cloud‑platform moment — but hedge with edge. Sirona’s 510(k) shows cloud can be diagnostic‑grade; still, latency/PHI concerns keep on‑prem inference relevant. Offer hybrid architectures and pre‑wired governance artifacts (validation plans, model cards).

- Prepare payer dossiers early. Leverage peer‑reviewed outcomes and local validation against evolving plan policies and Joint Commission/CHAI guidance to accelerate coverage and enterprise approval.

Key Takeaways

- CCTA plaque AI goes “in‑house.” Circle CVI’s cvi42 | Plaque won FDA 510(k). Because CCTA plaque analysis already has a national payment (~$950 via 0625T; Category I code effective 2026), hospitals can now capture economics on‑prem rather than outsourcing. Expect fast adoption at cardiac CT sites.

- Cloud-native imaging turns clinical. Sirona Advanced Imaging Suite gained 510(k), adding PET/CT (SUV quant, fusion, MIP/MPR) with instant cloud rollout — no per‑site installs. This validates a unified, browser‑based diagnostic workspace strategy.

- Imaging agents advance neurology. FDA accepted Lantheus’ NDA for MK‑6240 tau PET (AD), underscoring molecular imaging’s role alongside device‑side AI.

- Evidence pipeline: X‑ray + clinical data for body composition. Truveta’s peer‑reviewed model (Radiology Advances) showed strong correlations, enabling opportunistic screening from ubiquitous CXR.

- Macro: Imaging demand resilient; policy push‑pull. GE HealthCare raised FY25 EPS guidance on solid Q3 orders; in parallel, Harrison.ai petitioned FDA to streamline repeat clears for AI CAD/CADt, while Joint Commission/CHAI guidance formalized governance expectations.

Quick-Glance Table

| Date | Headline | Our Take |

| Oct 29 | FDA clears Circle CVI cvi42 | Plaque (AI plaque analysis) for CCTA | Brings reimbursable, on‑prem analysis into the CT lab; economics favor internalization. |

| Oct 30 | FDA 510(k) for Sirona Advanced Imaging Suite (PET/CT) | Cloud-native advanced visualization enters regulated care; reduces upgrade friction; platform play. |

| Oct 28 | FDA accepts Lantheus NDA for MK‑6240 (tau PET) | Neuro PET broadens precision dx in AD; complements device‑side AI triage. |

| Oct 29 | Truveta: X‑ray + EHR model estimates body composition | Low‑cost CXR route to metabolic risk stratification at scale; supports opportunistic screening. |

| Oct 27 | Philips: cath lab integration auto‑syncs pre‑op CT with C‑arm (toward CT‑guided PCI) | Workflow fusion tightens imaging–therapy loop; potential time savings and radiation reduction. |

| Oct 29 | GE HealthCare Q3: EPS beat; guidance raised | Imaging orders up; AI/advanced viz cited as growth drivers; tariffs still a margin headwind. |

| Oct 29 | Harrison.ai files FDA petition to streamline CAD/CADt pathways | If adopted, could lower lifecycle cost of iterative AI updates while preserving oversight. |

| Oct 24 | YorLabs intracardiac ultrasound imaging wins 510(k) | Workflow/cost innovation in ICE; not AI radiology but adjacent to imaging digitization. |

| Sep–Oct context | Joint Commission + CHAI release AI governance guidance | Hospitals will need local validation and monitoring — a prerequisite for enterprise AI at scale. |

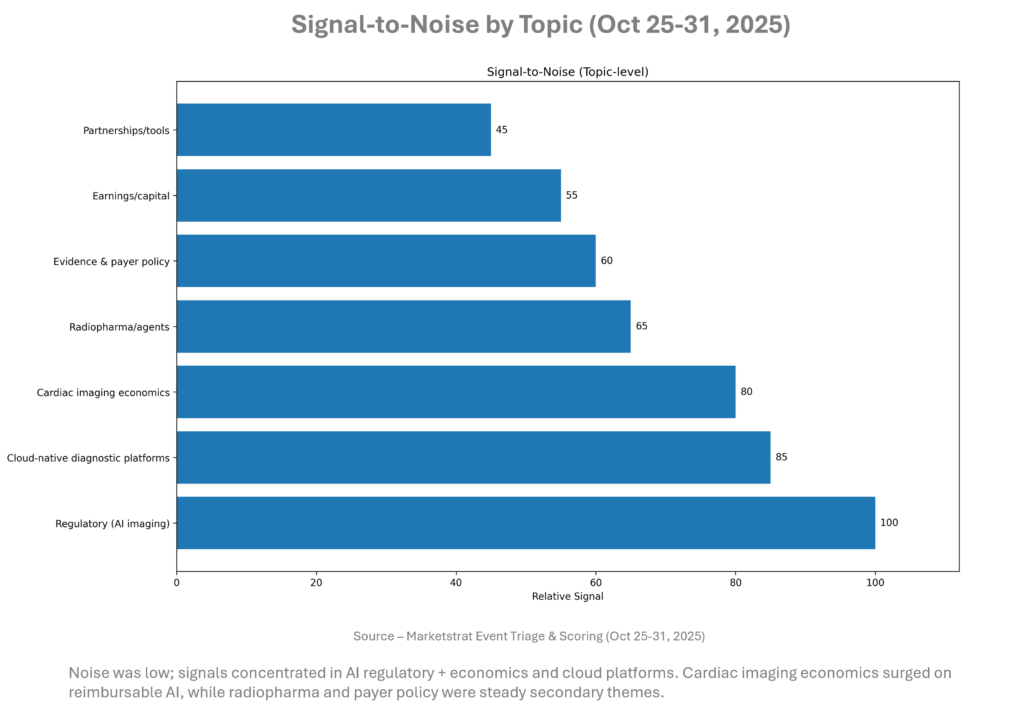

Signal-to-Noise by Topic – Oct 25-31, 2025

The mix favors commercially actionable items: code‑tethered AI and platform deployment. This will shape RSNA messaging toward ROI, latency, and governance rather than model novelty. Keep attention on payer bulletins and state‑level AI policies that can either accelerate or chill adoption at IDNs.

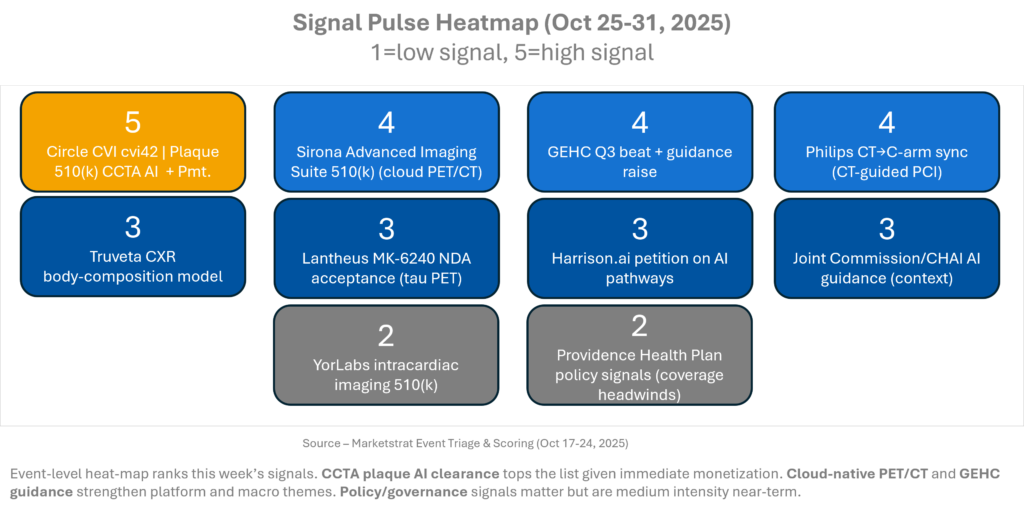

Signal Pulse Heatmap – Oct 25-31, 2025

Two patterns stand out: (1) Revenue‑attached AI (CCTA plaque) outperforms “nice‑to‑have” tools; (2) Cloud delivery is moving from viewer to diagnostic workbench, compressing upgrade cycles. Governance and payer positions will shape deployment velocity but are unlikely to derail hospital pilots already chasing throughput and quality metrics.

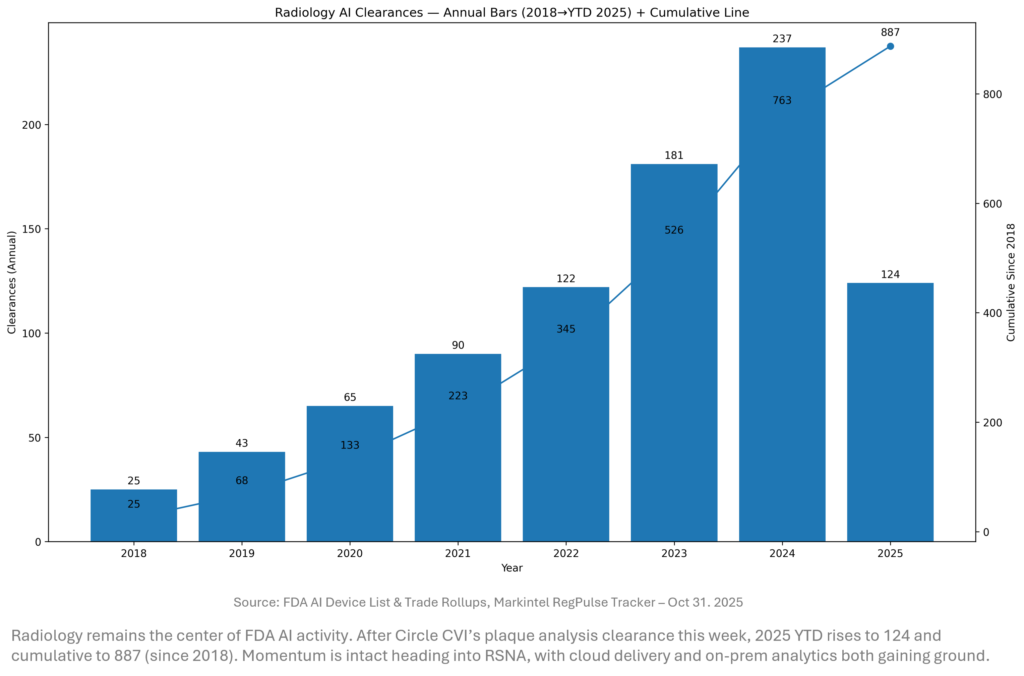

Regulatory Pulse

Clearances continue to cluster around CT and cardiovascular use cases, but the platform trend is unmistakable — cloud viewers are clearing feature packs while quant tools attach to reimbursable pathways. We expect a Q4 mini‑surge as vendors time submissions before RSNA launches. Watch for CADt updates if FDA responds to petitions seeking lighter‑weight change protocols.

Deeper Dives

Regulatory Approvals & Clearances

- Circle CVI’s cvi42 | Plaque — FDA 510(k) (Oct 29). AI‑enabled on‑prem quantification of total/calcified/non‑calcified plaque on CCTA; leverages existing national payment and Category I in 2026. Why it matters: Converts AI into a billable workflow; empowers in‑lab risk stratification.

- Sirona Advanced Imaging Suite — FDA 510(k) (Oct 30). Adds PET/CT advanced viz to a cloud‑native suite; browser delivery eliminates per‑site upgrades. Why it matters: Accelerates feature velocity and shrinks IT burden; foreshadows unified reporting + AI orchestration.

- YorLabs Intracardiac Imaging — FDA 510(k) (Oct 24). Zero‑CapEx ICE platform with single‑operator control. Why it matters: Lower entry cost for EP labs; adjacent to imaging digitization trend.

- Lantheus MK‑6240 tau PET — NDA accepted (Oct 28). Fast Track; PDUFA Aug 2026. Why it matters: Strengthens neuro‑imaging pipeline; complements device‑side AI for patient selection.

Commentary: FDA actions this week underscore two winning patterns: (i) AI linked to payment (CCTA plaque) and (ii) cloud‑delivered diagnostic workspaces (Sirona). Expect others to follow with bundled AI + workflow clearances.

M&A, Funding & Partnerships

- Platform + cloud momentum: Multiple sources flagged cloud‑native adoption and GPU constraints shaping deployment timelines; 4DMedical cited site and scan growth. Why it matters: Capacity/latency constraints will influence where inference runs (edge vs cloud).

- Payer & governance signals: Providence Health Plan maintained conservative AI coverage positions; Joint Commission/CHAI guidance sets validation expectations. Why it matters: Governance readiness is now a sales prerequisite.

Digital Health & AI

- Truveta’s X‑composition (Radiology Advances). Combining chest radiographs with basic clinical variables achieved strong correlations for body composition, enabling opportunistic screening without CT/MR. Why it matters: Lowers cost/threshold for metabolic risk programs using existing CXR workflows.

- Harrison.ai citizen petition (Oct 29). Proposed “partially exempt” path for pre‑cleared CAD/CADt to speed iterative updates. Why it matters: Could cut lifecycle cost for AI vendors and shorten hospital upgrade cycles — if adopted.

Clinical Research & Trials

- Breast AI risk & interval cancer research (Oct 28–29). New studies highlighted risk models and invasive cancer detection improvements. Why it matters: Reinforces breast imaging AI as a scale market today; aligns with our Market Lens.

Company Updates & Earnings Highlights

- GE HealthCare Q3: Revenue $5.14B; EPS $1.07; raised FY EPS range to $4.51–$4.63. Imaging grew despite tariff drag. Why it matters: Imaging demand is resilient; validates AI/advanced viz investment theses.

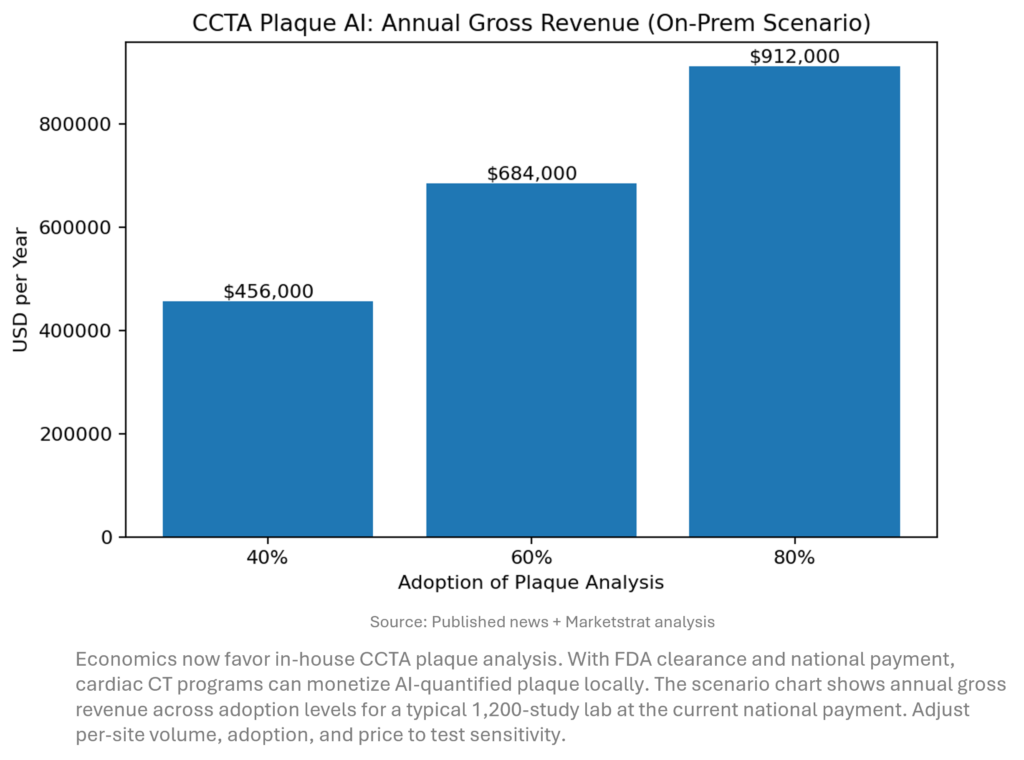

Innovation Hook — CCTA Plaque AI becomes a service line, not an add‑on

What changed: FDA cleared cvi42 | Plaque, and plaque quantification has national payment (~$950 per study; Category I code set for 2026). Bringing analysis on‑prem shifts value from third‑party services to the site of care. For a 1,200‑study/year CT lab, 60% adoption ≈ $684k/yr gross; even at a $200k software + support budget, payback < 5 months (scenario).

This is the template many imaging AIs have lacked: regulatory clearance + quantitative output + defined payment. Circle CVI’s on‑prem deployment keeps PHI inside radiology, shortens turn‑around, and allows practices to retain reimbursement. The next battleground: integration time and reading workflow. Expect enterprise platforms (reporting, PACS, RIS) to prioritize CCTA workflows and analytics dashboards as cardiology service lines chase throughput and risk‑stratification quality.

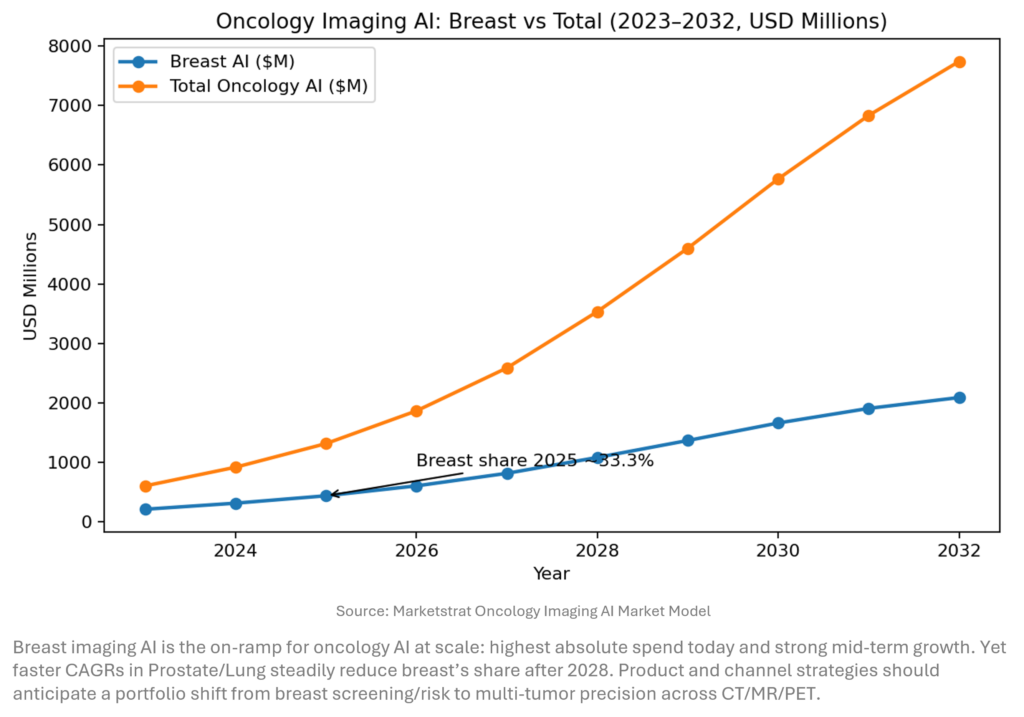

Market Lens – Total Imaging AI vs Neurology Imaging AI

What the data says: Breast AI grows from $211.6M (2023) to $2.09B (2032) (29% CAGR) while Total Oncology AI expands from $604.7M to $7.74B (32.7% CAGR). Breast remains the largest single tumor site through 2030, but Prostate/Lung growth overtakes in CAGR terms, shifting mix post‑2028. (Marketstrat model.)

Commercial focus in 2026–2029 will pivot from “AI for mammography” to whole‑oncology platforms that harmonize mammography, chest CT, prostate MRI, and PET quant into one workflow fabric. Reimbursement traction in CCTA and emerging theranostics (e.g., tau PET) will pull AI from detection to quantitative disease management, reinforcing enterprise buying over point solutions.

Company Spotlight

What happened. On Oct 30, Sirona Medical received FDA 510(k) clearance for its Advanced Imaging Suite, adding full PET/CT capabilities—SUV quantification, image fusion, MIP and MPR—to a 100% cloud‑native reading platform. Practically, this lets radiologists interpret PET/CT studies securely in a browser with no on‑prem hardware and get new features as soon as they’re deployed. This week’s Markintel Pulse Insights flags this as Sirona’s first Class II device clearance and underscores the workflow flexibility and lower IT overhead it enables.

Why it’s a changemaker. Sirona isn’t just shipping features; it’s shifting the architecture of enterprise imaging—unifying PACS, reporting, and AI in a cloud platform (RadOS™) so advanced visualization lives inside the workflow, not beside it. That matters for health systems scaling oncology and theranostics programs (where PET/CT is central), for distributed networks that need instant upgrades, and for IT teams trying to escape costly, brittle installs. The Deep Dive section this week calls out this “platformization” trend and the competitive pressure it places on legacy PACS and siloed AI apps; Sirona’s clearance is a tangible step toward that future.

About Marketstrat

Marketstrat® is a market intelligence and GTM enablement firm committed to empowering clients in data-driven industries. Under the Markintel™ brand, it delivers robust market intelligence, while GrowthEngine solutions offer specialized GTM advisory and app-based tools—together fueling growth, innovation, and competitive advantage. For more information, visit www.marketstrat.com.

Marketstrat® is a registered trademark and Markintel™ is a pending trademark of Marketstrat.

Check out free Research and Insights and Analysis of Industry Events

Check out our collection of Markintel Horizon and Markintel Pulse research.

Check out details on our reports, World Market for AI in Medical Imaging and other Pulse Reports in the Imaging space.