One Big Thing

Remote scanning and cloud‑native reading moved from pilots to platform economics this week—turning imaging AI from “nice algorithm” into measurable uptime and revenue.

Marketstrat POV — Strategy To-dos

- Platform beats point solution. Buyers are choosing cloud + workflow + QA + remote ops platforms. Vendors should own uptime (protocols, safety, monitoring) and not just pixels.

- Distribution is destiny. Moves like EyePACS show that owning the channel (PCP, tele‑oph networks) accelerates adoption more than marginal AUC gains.

- Evidence shifts post‑market. PCCPs mean value accrues to vendors with robust monitoring, drift detection, and real‑world performance management—not just first 510(k).

Key Takeaways

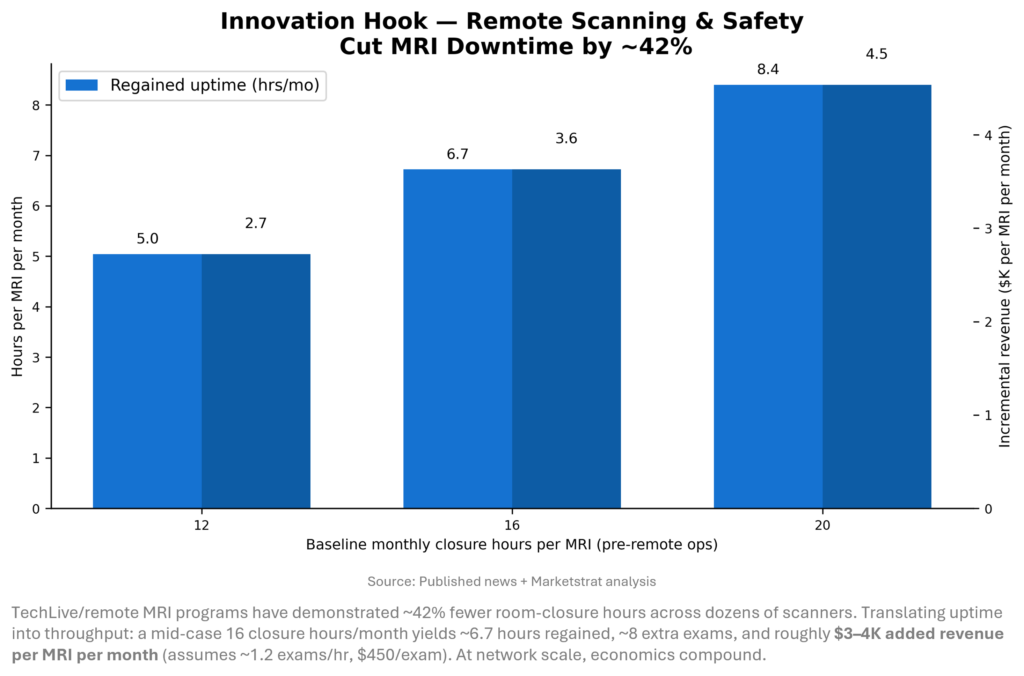

- Ops AI hits the console. RadNet’s acquisition of Alpha RT consolidates remote MRI operations at scale; its TechLive program previously cut MRI room closure hours ~42%, converting AI+remote into capacity and dollars.

- Cloud PET/CT arrives. Sirona’s FDA 510(k) adds PET/CT (SUV quant, fusion/MIP/MPR) to a cloud-native suite—evidence that diagnostic reading stacks are shifting cloud‑first.

- Primary care imaging goes oculomics. Optain bought EyePACS, marrying AI retinal imaging with a massive PCP tele‑oph network—distribution, not algorithms, may be the moat.

- Capital still favors GenAI in care ops. Hippocratic AI’s $126M round (≈$3.5B valuation) underlines investor appetite for safe, high‑ROI agent workflows that will spill into imaging front/back‑ends.

- Macro: Imaging majors steady amid tariffs. Siemens Healthineers signaled €200M FY25 tariff headwind (doubling to ~€400M FY26) even as Imaging grew; Philips posted Q3 growth with AI launches cushioning tariffs. Expect pricing and software mix to matter more.

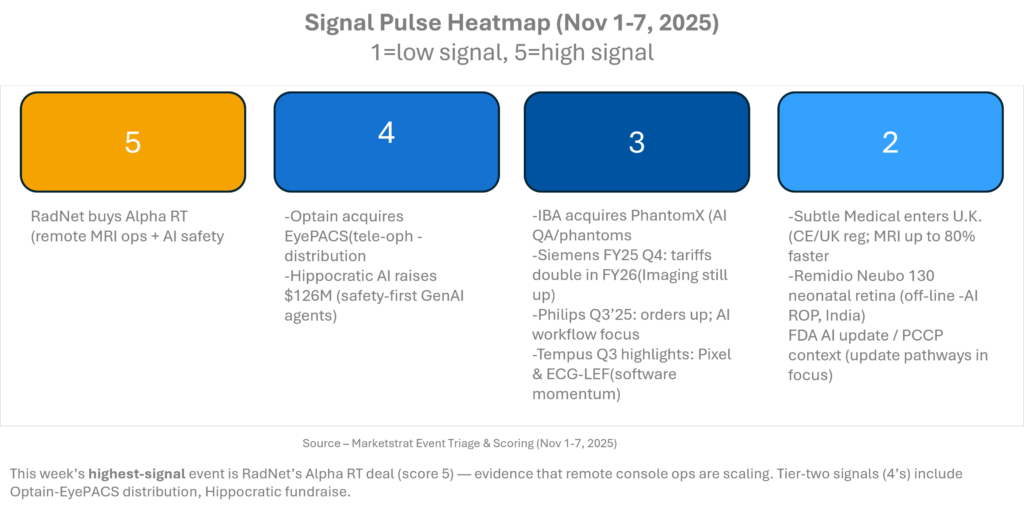

Signal Pulse Heatmap – Nov 1-7, 2025

The pattern is clear: platform + distribution beats point algorithms. Purchasers are rewarding offerings that bundle AI with workflow, safety, QA, and cloud‑first deployment. Regulatory cadence remains healthy, but the week’s strongest adoption signals came from operating‑model moves (remote scanning, primary‑care oculomics distribution). Expect RSNA to emphasize platformization and operational ROI over novelty algorithms.

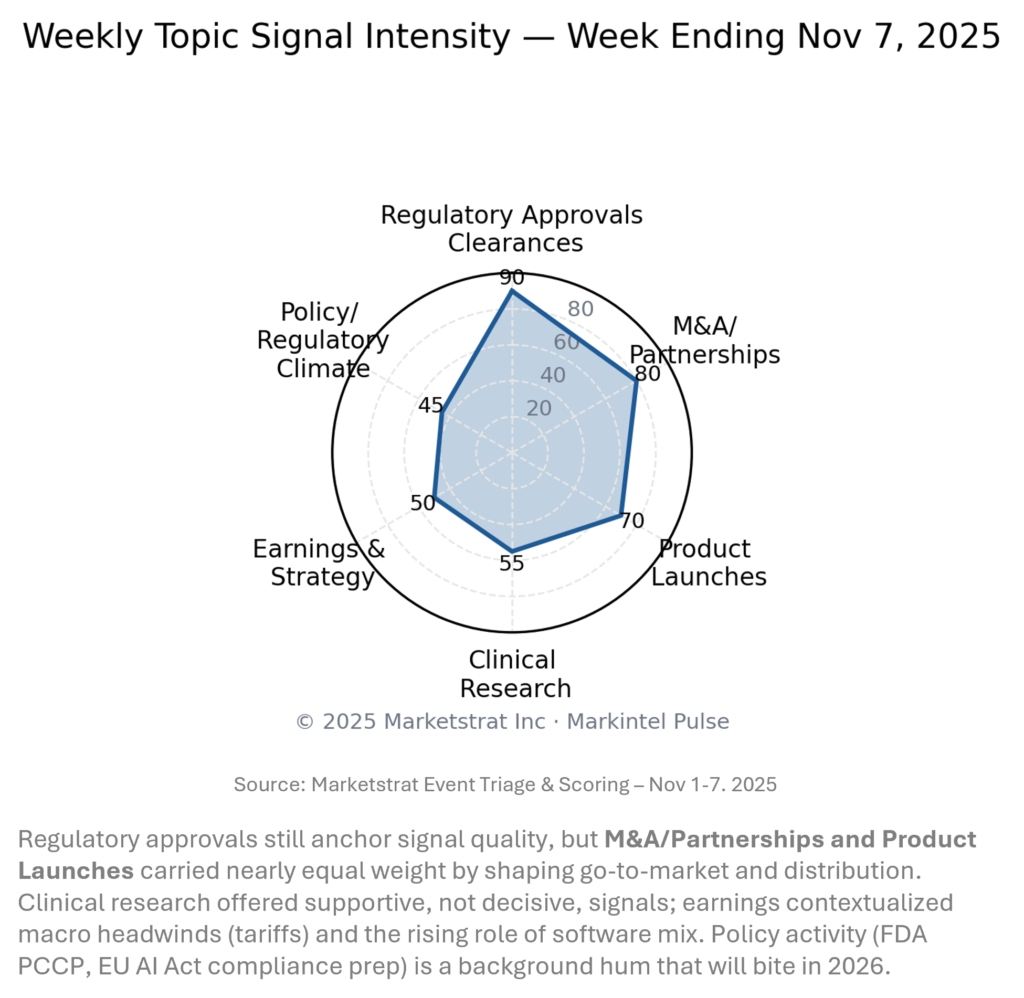

Signal-to-Noise by Topic – Nov 1-7, 2025

Buyers tell us outcomes trump novelty. This week’s mix suggests capital and customers prioritize deployable AI—solutions that ship with remote ops, QA, and distribution. Regulatory friction is dropping thanks to PCCP playbooks, but commercialization now depends on integration across cloud, service, and quality. Vendors without a distribution wedge or ops story will struggle to sustain SNR at RSNA.

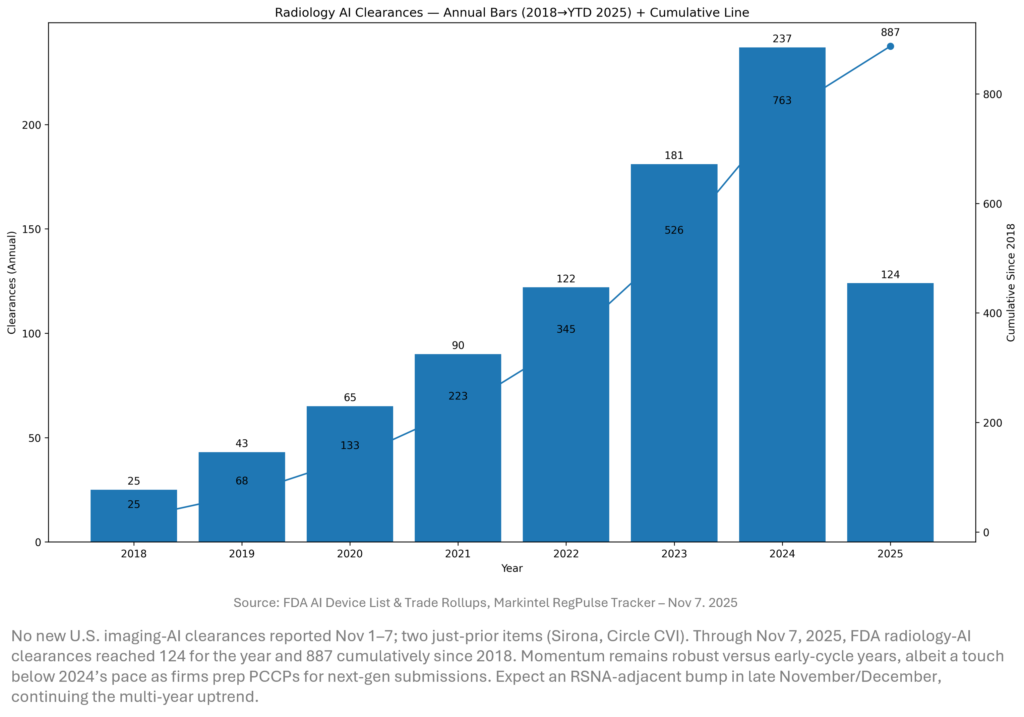

Regulatory Pulse

The market has transitioned from “firsts” to portfolio refresh—with many vendors lining up PCCPs to legally iterate models post‑clearance. That likely shifts emphasis to post‑market evidence, updates, and QA. Buyers should interrogate vendors on PCCP scope (data, retraining cadence, monitoring). Vendors should expand change protocols and validation pipelines now to win 2026 upgrade cycles.

Quick-Glance Table

| Date | Headline | Our take |

| Nov 6 | Optain acquires EyePACS to expand AI retinal screening in primary care | Distribution power play: combines AI with a national tele‑oph network; accelerates oculomics in PCPs and screening programs. |

| Nov 5 | RadNet buys Alpha RT (remote MRI ops) | Consolidation of remote scanning + safety monitoring into DeepHealth’s TechLive; converts staffing volatility into uptime and throughput. |

| Nov 5 | Siemens Healthineers Q4 FY25: tariffs to double impact in FY26 | Imaging up; tariff headwinds rising. Software, service lines, and cloud adjacencies gain strategic weight. |

| Nov 4 | Philips Q3 2025 beats; AI tools, tariff mitigation highlighted | Momentum in order intake; AI‑powered workflows help defend margins. |

| Nov 3 | Hippocratic AI raises $126M at ~$3.5B | GenAI agents funding remains hot; radiology ops (scheduling, intake, post‑read) will benefit indirectly. |

| Nov 3 | IBA buys PhantomX (AI QA for dosimetry) | QA/validation stack is becoming strategic as AI permeates oncology imaging/radiation. |

| Oct 31 | Elucid launches PlaqueIQ (CT carotid plaque) | Risk‑stratification tools continue to shift from research to clinical workflows; stroke prevention economics are the wedge. |

| Oct 30 | Sirona FDA 510(k) for Advanced Imaging Suite adds PET/CT | Cloud‑first reading with quantitative PET/CT widens the “platformization” of imaging software. |

| Oct 30 | Foundation Medicine + Manifold to power FoundationInsights AI | Oncology AI data platforms are converging on biopharma use‑cases first—provider rollout slated 2026. |

| Oct 30 | Fresenius at ASN Kidney Week: AI + HDF outcomes | Kidney AI remains a frontier; not pure imaging but sets precedent for safety + ops models portable to imaging departments. |

| Oct 29 | Qure.ai CE mark: pediatric TB (0–5 yrs) | Expands chest X‑ray AI to the hardest‑to‑reach group; relevant for global TB screening programs and OEM partnerships. |

| Nov 5 | Brainomix joins AHA Innovators’ Network | U.S. channel cred for stroke AI; aids payer and system adoption. |

| Nov 5 | Tempus Q3: highlights Pixel & ECG‑LEF clearances | AI imaging increasingly bundled with cardiology diagnostics; hardware‑agnostic readouts matter. |

Deeper Dives

Regulatory Approvals & Clearances

- Sirona 510(k) adds PET/CT to cloud suite (Oct 30). SUV quant, fusion/MIP/MPR enable fully cloud‑native PET/CT reading. Why it matters: unlocks distributed reading and subspecialty access; strengthens cloud RIS/PACS competition.

- Tempus: two 510(k)s cited in Q3 (Sept; highlighted in Nov 5 results). Pixel upgrade (T1/T2 inline maps) and ECG‑LEF software add to cardiology stack. Implication: hardware‑agnostic, raw‑data processing expands addressable fleet.

- Qure.ai CE mark (pediatric TB) (Oct 29). Extends X‑ray AI to 0–5 years. Implication: expands global health deployments; raises bar for validation in under‑represented cohorts.

M&A, Funding, Partnerships

- RadNet buys Alpha RT (Nov 5). Adds remote MRI ops to TechLive; internal data showed ~42% fewer room‑closure hours across 81 systems. Implication: network‑level ROI from ops + safety stack; likely to pressure hospital holdouts to adopt remote.

- Optain acquires EyePACS (Nov 6). Builds oculomics distribution into PCP. Implication: screening economics shift upstream; payer pilots likely.

- Hippocratic AI raises $126M at ~$3.5B (Nov 3). Implication: sustained capital for GenAI agents that will be embedded into imaging front office/back office.

- IBA buys PhantomX to embed AI QA in dosimetry (Nov 3). Implication: QA/validation becomes a competitive axis for imaging oncology stacks.

- Foundation Medicine + Manifold (Oct 30). AI‑enabled analytics for FoundationInsights; provider version slated 2026. Implication: oncology AI value migrates to multimodal data platforms.

Product Launches & Market Entries

- Elucid PlaqueIQ (Oct 31). CT‑based carotid plaque quantification and classification. Implication: translates plaque biology into risk‑based triage; likely payer interest in stroke prevention bundles.

- RSNA 2025 previews spotlight PCCT, stroke triage, dementia biomarkers (Nov 3–4). Implication: energy moves from point triage to precision biomarkers and spectral quantification.

Clinical Research & Trials (selected)

- Ambient AI documentation (JAMA Netw Open)—Sutter study shows improved experience and time-in-notes; mixed by sex/specialty (May; widely cited this week). Implication: strengthens case for AI scribes in radiology clinics and interventional suites.

Company Updates & Earnings

- Siemens Healthineers FY25 Q4 (Nov 5). Imaging grew; tariff headwind €200M in FY25, ~€400M expected FY26; raised dividend. Implication: software/service mix and U.S. pricing discipline in focus.

- Philips Q3 2025 (Nov 4). Sales +3%; AI tools launch cited; tariff mitigation ongoing. Implication: resilience through software and order pipeline; selective price.

Innovation Hook — Remote Scanning Turns Uptime into Cash (Δ & Economics)

Operations is the new frontier for imaging AI. Remote scanning + safety standardizes protocols, reduces staffing‑driven downtime, and unlocks latent capacity without capex. The measurable Δ is uptime: fewer closure hours directly yield more exams, lower patient waitlists, and higher revenue intensity per scanner. As tariffs and labor costs rise, workflow and utilization levers like these will likely out‑earn narrow triage algorithms—making “Ops AI” a board‑level priority for 2026 budgeting.

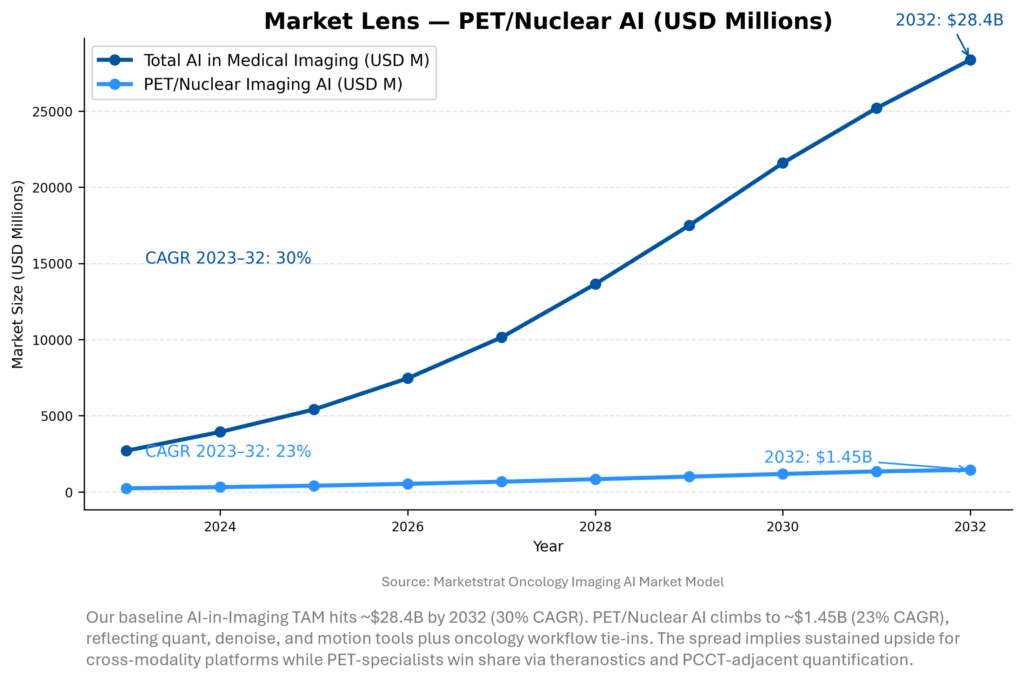

Market Lens

Two forces pull growth: (1) platform consolidation across modalities (cloud reading, orchestration, QA) and (2) oncology workflows that monetize PET/Nuclear precision. Expect budget rotation from pure detection to quantification, scheduling/remote ops, and integrated reporting. As theranostics expands and PET supply chains normalize, PET‑specific AI should accelerate inside enterprise platforms, not as stand‑alone SKUs.

Company Spotlight – RadNet

Why it matters (Marketstrat POV): RadNet’s acquisition of Alpha RT turns remote scanning from pilot to platform. By folding AI-enabled MRI safety monitoring, remote technologist coverage, centralized training, and dispatch into DeepHealth TechLive, RadNet converts staffing volatility into uptime and throughput. Our read: this is the clearest blueprint yet for Ops-AI—standardizing protocols, reducing room-closure hours (~42% across 81 MRIs in NY), and scaling expertise across mixed fleets. Expect copycat programs and rising buyer expectations for vendor-agnostic remote ops baked into imaging service contracts.

Changemaker traits: distribution scale (400+ centers), workflow-native AI, measurable ROI (capacity uplift), and a services bundle hospitals can deploy without capex shock. The next battleground: quality assurance at scale (post-market AI monitoring) and multi-modality command centers (MR/CT/US/PET).

About Marketstrat

Marketstrat® is a market intelligence and GTM enablement firm committed to empowering clients in data-driven industries. Under the Markintel™ brand, it delivers robust market intelligence, while GrowthEngine solutions offer specialized GTM advisory and app-based tools—together fueling growth, innovation, and competitive advantage. For more information, visit www.marketstrat.com.

Marketstrat® is a registered trademark and Markintel™ is a pending trademark of Marketstrat.

Check out free Research and Insights and Analysis of Industry Events

Check out our collection of Markintel Horizon and Markintel Pulse research.

Check out details on our reports, World Market for AI in Medical Imaging and other Pulse Reports in the Imaging space.