ONE BIG THING

AI in imaging is shifting from algorithms to infrastructure: RadNet’s CIMAR acquisition and its deepened GE HealthCare alliance put cloud PACS and OEM channels at the center of next-generation AI screening and workflow.

MARKETSTRAT POV – STRATEGY TO-DOs

- Treat cloud PACS and OEM attach as strategic assets, not plumbing. The RadNet–CIMAR–GE triangle shows that owning the rails plus attach rights can lock in AI distribution for a decade. Vendors and health systems that ignore this will find their AI options constrained by others’ platform choices.

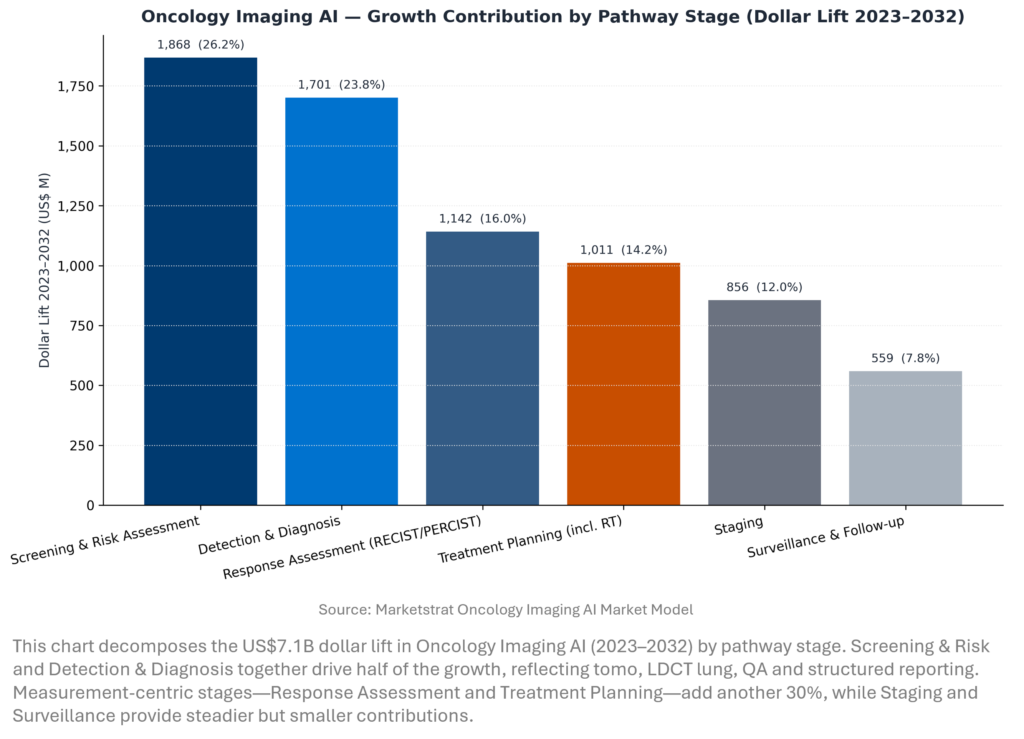

- Package oncology imaging AI by pathway bundles, not point apps. Use Screening + Detection + QA + Structured Reporting as the entry-level offer, then upsell into Staging, Response and RT planning once governance and tumor-board workflows are in place. This aligns with where the 2023–32 dollar lift actually sits.

- Build TPLC and monitoring into the commercial story now. With FDA and RSNA both converging on post-deployment monitoring, vendors should turn “trust infrastructure” into a differentiator—dashboards, drift detection, bias tracking—not a compliance afterthought. Buyers will increasingly treat this as table stakes for enterprise-scale AI deployments.

KEY TAKEAWAYS

- Platforms > point solutions. RadNet is buying the UK’s imaging “rails” (CIMAR) and plugging DeepHealth AI into GE scanners, signaling that control of cloud PACS and OEM attach will decide AI share, not stand-alone algorithms.

- Capital still flows to robotics. Cornerstone’s $200M raise and new clearances (Stereotaxis GenesisX, Zydus “Andy”) show surgical robotics remains a funding magnet even as VC for medtech overall softens.

- Precision oncology tightens Dx–Rx links. Promega’s MSI companion diagnostic for Keytruda/Lenvima and Grail’s Galleri PMA push reinforce diagnostics as gatekeepers for high-cost oncology drugs.

- Legacy medtech is restructuring for AI. Olympus’ 2,000-person restructuring and Siemens AG’s decision to relinquish control of Siemens Healthineers both aim to free capital for digital, AI and imaging growth.

- Radiology AI approvals plateau, scrutiny rises. No new clearances moved the 2025 YTD tally off 124; buyers are now pushing harder on real-world evidence, governance, and post-deployment monitoring rather than raw device counts.

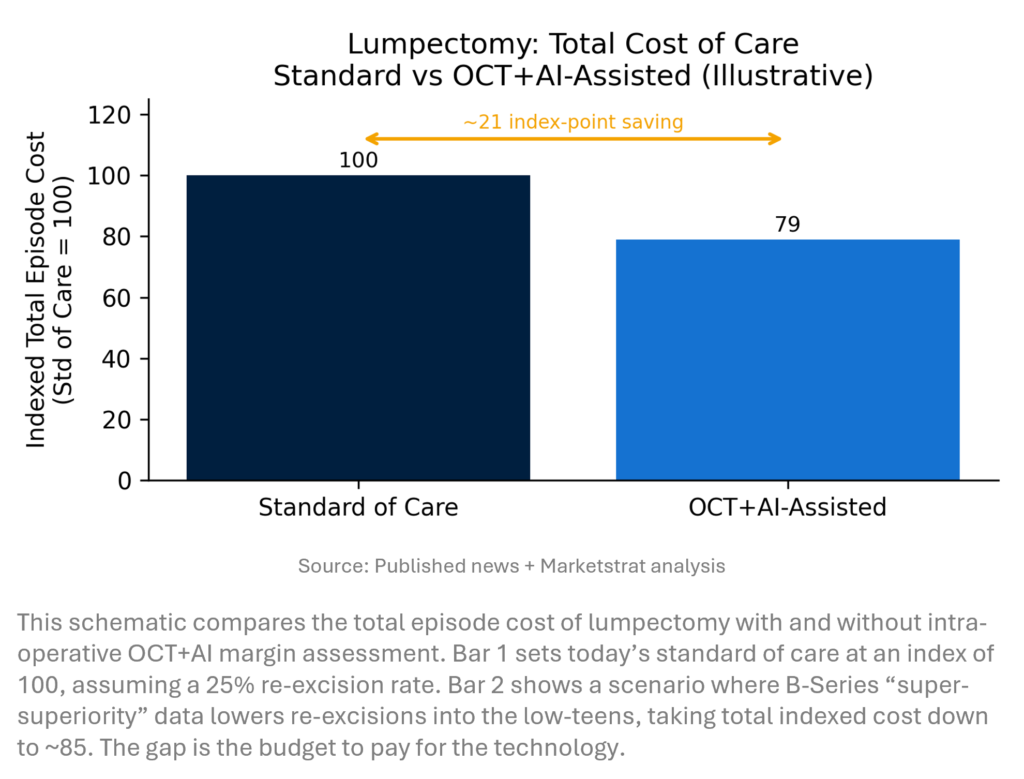

INNOVATION HOOK – LUMPECTOMY COST CURVE

When “Super-Superiority” Pays for Itself Perimeter’s B-Series OCT+AI platform aims to cut re-excision rates in breast-conserving surgery, moving from 20–30% historical re-operations toward low-teens or better. The economic lever is simple: every avoided second surgery saves a full OR episode (surgeon, anesthesia, pathology, recovery). Even a 10–15-point absolute reduction in re-excisions can offset the device and per-case fees, particularly in high-volume breast programs. The right story for CFOs is not “fancier imaging,” it is lower total episode cost and better experience.

COMPANY SPOTLIGHT – SIEMENS HEALTHINEERS: FROM CAPTIVE ASSET TO PURE-PLAY MEDTECH

Siemens AG has finally pulled the trigger on a long-anticipated move: it will transfer 30% of Siemens Healthineers shares to Siemens AG shareholders via a direct spin-off, cutting its stake from ~67% to roughly 37% and deconsolidating Healthineers from the Siemens group. This is framed as part of Siemens’ pivot toward industrial software, automation, and AI, while Healthineers steps into the market as a more autonomous medtech champion spanning imaging, diagnostics, and Varian-powered oncology.

For Healthineers, the long-term impact is significant. Reduced parental control should give management more freedom to use its balance sheet—whether to deepen its oncology and imaging AI stack, pursue targeted M&A, or reshape partnerships—without competing against Siemens’ industrial priorities. For investors, this creates a clearer pure-play medtech equity story; for hospital customers, the near-term product roadmap won’t change overnight, but a more agile Healthineers could accelerate innovation cycles in MR, CT, RT planning, and AI-enabled workflows. The strategic risk is execution: Healthineers must prove it can deliver growth and capital discipline without the Siemens “safety net,” while defending share against GE HealthCare, Philips, and fast-moving Chinese entrants.

MARKET LENS – ONCOLOGY IMAGING AI GROWTH CONTRIBUTION BY PATHWAY STAGE

The mix tells a clear story. Early dollars sit in Screening and Detection, where AI improves throughput and consistency in tomo and LDCT programs. But the long-run value shifts toward measurement: RECIST/PERCIST response analytics, PET-based dosimetry and RT auto-contouring. Staging and Surveillance grow more modestly but are cloud-friendly and marketplace-driven. Commercially, the winning strategy is to bundle stages—Screening + Detection + QA + Reporting first, then ladder into Staging/Response/RT as governance and budgets mature.

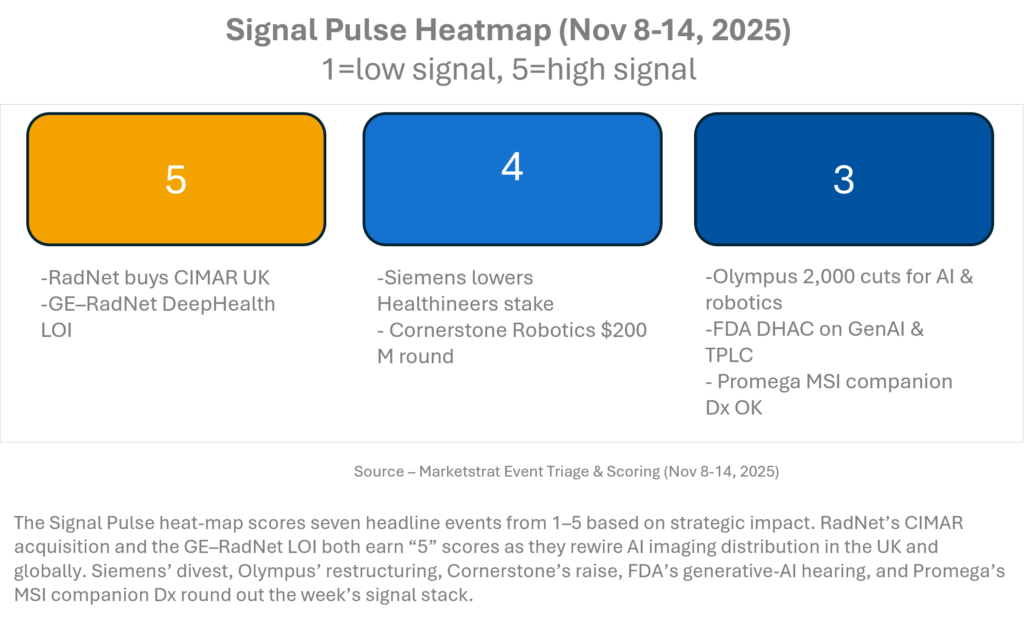

SIGNAL PULSE HEATMAP – NOV 8-14, 2025

This week’s signal is concentrated in platform and capital moves. RadNet’s dual strike—buying CIMAR and deepening its GE partnership—defines the new AI imaging playbook: own the cloud rails, then pipe your algorithms through OEM channels. Siemens AG’s exit from control of Healthineers and Olympus’ restructuring both free capital for imaging and AI bets. Cornerstone’s $200M round underscores continued conviction in robotics, while the FDA’s generative-AI hearing flags coming oversight for all “agentic” tools in radiology.

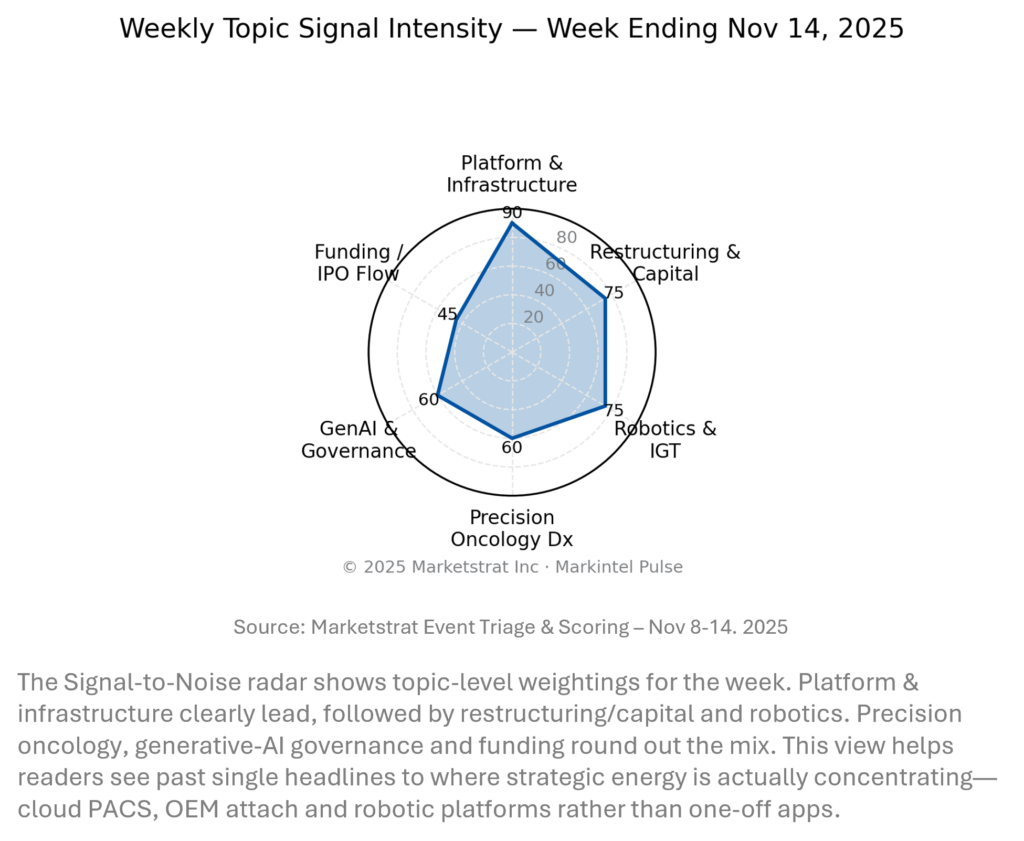

SIGNAL-TO-NOISE RADAR BY TOPIC – NOV 8-14, 2025

When we aggregate this week’s news by theme, platform and infrastructure stories dominate. RadNet’s cloud PACS moves, OEM attach strategies, and RSNA-bound PACS/AI platforms are the clearest medium-term growth drivers. Corporate restructurings (Siemens, Olympus) and robotics remain next-tier signals. Precision oncology (Promega, Grail) and regulatory work on generative AI provide strong but narrower threads. Funding is still there—but increasingly concentrated in a few high-signal plays rather than broad early-stage bets.

REGULATORY PULSE

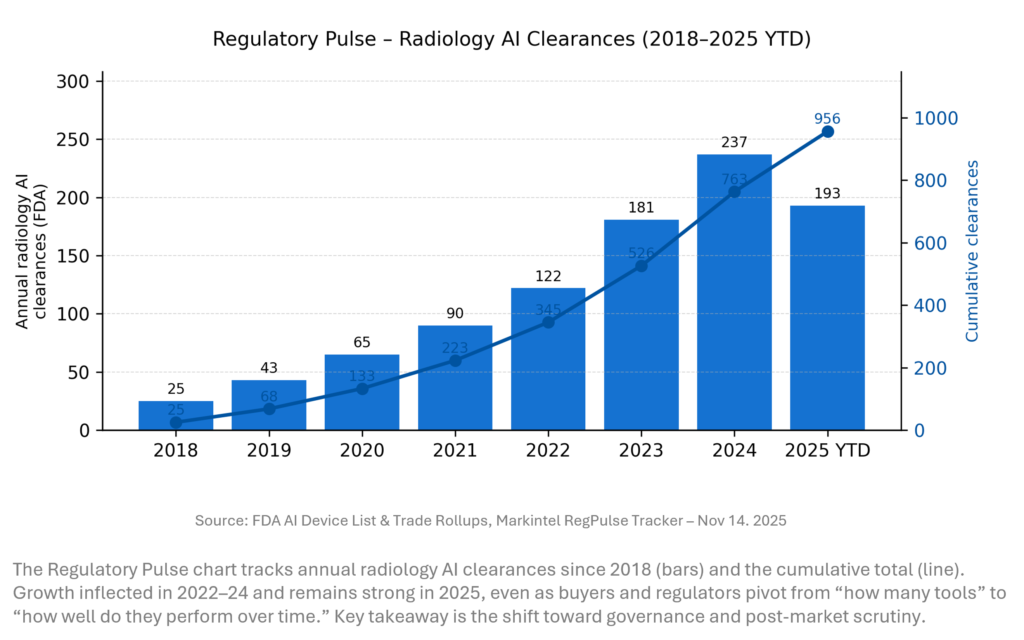

Radiology AI continues to be the workhorse of medical AI regulation. From 2018 to 2024, annual FDA clearances grew nearly ten-fold, pushing the cumulative total to 763 by end-2024 and 956 by mid-November 2025. The FDA’s Digital Health Advisory Committee meeting on generative AI and TPLC is a clear signal: future radiology AI approvals will face tougher expectations on monitoring, evidence and lifecycle management.

Methodology: Radiology AI counts are derived from the FDA AI-Enabled Medical Device List, cross-checked against JAMA 2025 and MedTech Dive analyses. As of July 10, 2025, the list includes ~1,200 AI/ML devices, of which ~956 (≈77%) are radiology. Year-by-year radiology counts from 2018 onward are reconstructed by applying this specialty share to the FDA’s annual AI clearance totals; they match independent specialty-level snapshots (e.g., 531 radiology devices in 2023, 723 in mid-2024) to within a few device

DEEPER DIVES

Regulatory

The FDA’s Digital Health Advisory Committee session on generative AI for mental health quietly sets precedent for all generative tools in medicine. The three pillars—risk-based classification, Total Product Lifecycle monitoring, and explicit human-in-the-loop expectations—will apply directly to radiology reporting copilots and foundation-model-based imaging platforms. Short-term, the device count may slow; medium-term, vendors with strong TPLC monitoring and audit trails will gain a structural advantage over lightweight point solutions.

Funding / IPO

Medtech VC funding slowed to $3B in Q3 (vs. $4.6B in Q2), but dollars are concentrating in fewer, larger rounds with AI or robotics angles. Cornerstone Robotics’ $200M raise and QT Imaging’s 339% revenue growth illustrate this “barbell” dynamic: capital is available for high-conviction platforms, while earlier-stage imaging startups face a tougher road. Public markets remain selective, rewarding credible growth stories like Billion-To-One’s IPO but punishing over-promised AI narratives.

M&A

RadNet’s acquisition of CIMAR UK is the standout deal: by owning the UK’s vendor-neutral cloud imaging backbone and integrating DeepHealth AI, RadNet effectively becomes an infrastructure player, not just an imaging provider. Laborie’s purchase of Organon’s Jada postpartum hemorrhage device shows continued appetite for clinically proven, fast-growing devices. Looking ahead, we expect more “rails + apps” combinations—PACS, VNA and workflow platforms snapping up AI or analytics assets to deepen their moat.

Digital Health / AI

GE HealthCare and RadNet’s expanded LOI epitomizes the OEM-plus-platform model: DeepHealth’s breast, thyroid and remote-scanning AI becomes native on GE mammography and ultrasound systems. Inbrain’s Azure-powered BCI collaboration and Neuralink’s patient controlling a camera by thought highlight neurotech’s convergence with big tech AI. At RSNA, expect generative AI reporting, post-deployment monitoring dashboards, and opportunistic screening platforms (e.g., Coreline AVIEW) to dominate the conversation, shifting focus from single-modality detection to enterprise workflows.

Clinical Research

MMI’s REMIND trial—using the Symani microsurgical robot to reroute cervical lymphatics in Alzheimer’s patients—is the clearest example of “medtech meets neurology” risk-taking. If the approach improves neurotoxin clearance and slows decline, it could open a new class of device-drug combination pathways. In parallel, NHS lung screening data showing 76% of cancers caught at Stage 1–2 in AI-enabled programs vs. 29% historically underlines how AI screening can materially shift stage-of-diagnosis curves and survival economics.

Product Launches

Avicenna.AI’s AVI platform and other workflow-centric launches address the real blocker to AI expansion: integration, not algorithms. AVI positions itself as the neutral orchestrator that plugs multiple AI tools into a single PACS/RIS interface without extra workstations—a selling point for IT and radiology alike. On the device side, SS Innovations’ tele-surgery console and Stereotaxis’ more install-friendly GenesisX extend robotics into smaller ORs and remote sites, pushing robotics from flagship centers into broader networks.

QUICK-GLANCE TABLE

| Date | Headline | Our Take |

| Nov 11 | RadNet acquires CIMAR UK; expands GE HealthCare partnership | RadNet now owns both the UK cloud imaging rails and a global OEM channel, creating a formidable “walled garden” for AI screening and reporting. |

| Nov 13 | Siemens AG to give up majority stake in Siemens Healthineers | Healthineers becomes a near-pure-play medtech, likely more aggressive in imaging, AI, and Varian-driven oncology deals. |

| Nov 12 | FDA DHAC focuses on generative AI for mental health | The FDA is quietly setting the template for generative AI oversight that radiology and imaging AI will have to live within 2026+. |

| Nov 10 | SS Innovations performs remote coronary bypass via tele-robotics | Tele-robotic surgery moves from demo to real cardiac case, opening a new competitive front in surgical robotics and networked care. |

| Nov 12 | Perimeter Medical and QT Imaging post triple-digit revenue growth | “New MedTech” imaging plays show strong top-line growth but depend on capital markets to fund commercialization to 2026 inflection points. |

About Marketstrat

Marketstrat® is a market intelligence and GTM enablement firm committed to empowering clients in data-driven industries. Under the Markintel™ brand, it delivers robust market intelligence, while GrowthEngine solutions offer specialized GTM advisory and app-based tools—together fueling growth, innovation, and competitive advantage. For more information, visit www.marketstrat.com.

Marketstrat® is a registered trademark and Markintel™ is a pending trademark of Marketstrat.

Check out free Research and Insights and Analysis of Industry Events

Check out our collection of Markintel Horizon and Markintel Pulse research.

Check out details on our reports, World Market for AI in Medical Imaging and other Pulse Reports in the Imaging space.