ONE BIG THING

Radiology AI crossed from point solutions to infrastructure this week—vision‑language model M&A, RSNA25 platform launches, and landmark AI mammography data signal that imaging AI is becoming a core operating layer, not an add‑on.

MARKETSTRAT POV – STRATEGY IMPLICATIONS

- Evidence bar for imaging AI is rising fast. ASSURE’s scale and the JAMA validation‑gap studies create a new benchmark: algorithms need prospective, multi‑site evidence linking to outcomes and equity, not just ROC curves. Health systems should embed AI into HTA processes and favor vendors ready to share real‑world performance dashboards.

- Platform gravity is real—and accelerating at RSNA25. Radiology Partners + Cognita, HOPPR’s Foundry, Synapse One, and Hyland–Tribun all point to a future where a handful of enterprise platforms control data, workflow, and AI orchestration. Smaller algorithm vendors must choose whether to become deeply integrated “apps” on these platforms or build defensible niches with proprietary data and outcomes.

- Imaging’s adjacencies are expanding into therapy and neuro‑interfaces. DeviceGuide, Cardiovalve, renal denervation and BCIs show AI migrating into procedural guidance and neuro‑prosthetics. Imaging OEMs and AI vendors should view these as growth markets requiring tighter partnerships with interventional cardiology, neurology and device makers—especially around 3D planning, intra‑procedural navigation, and longitudinal monitoring.

KEY TAKEAWAYS

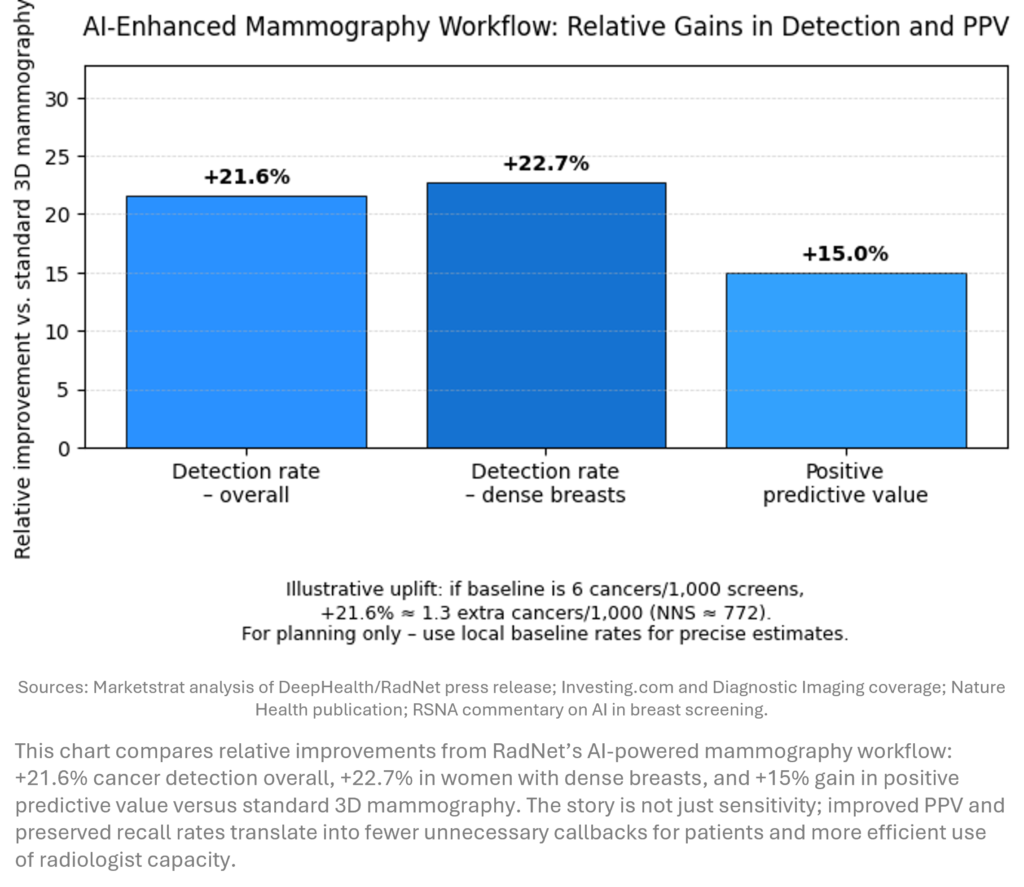

- AI mammography delivers step‑change outcomes. RadNet/DeepHealth’s ASSURE study (579k women) showed a 21.6% uplift in cancer detection and +15% PPV vs standard 3D mammography, with similar recall rates and consistent benefits in dense breasts and Black women.

- Vision‑language models (VLMs) move into production radiology. Radiology Partners’ Mosaic unit is acquiring Cognita Imaging for $80M, integrating VLMs that cut radiologist read times by up to 76% and quadruple error reduction in early testing—pointing toward AI‑drafted reports as a new baseline workflow.

- RSNA25 will be an infrastructure show. HOPPR’s AI Foundry, Fujifilm’s Synapse One enterprise imaging platform, and Hyland–Tribun’s digital pathology alliance will showcase cloud‑first data and workflow stacks that make multi‑modal AI deployable at scale, rather than tool‑by‑tool.

- Regulators and researchers are turning up the heat on AI validation. JAMA‑linked work and Radiology Business coverage show only ~29% of FDA‑cleared radiology AI devices have clinical testing at authorization; devices without validation are almost twice as likely to be recalled.

- Connected devices and data platforms extend AI’s footprint beyond imaging. Insulet’s Investor Day guidance for ~20% revenue CAGR through 2028, anchored by machine‑learning–driven Omnipod Discover and closed‑loop systems, underscores that algorithm‑rich device ecosystems are now the default expectation.

- IP friction in wearable sensing is escalating. A U.S. jury awarded Masimo $634M vs Apple over blood‑oxygen patents, while the ITC re‑examines redesigned Apple Watch imports—raising the stakes for medtech–big‑tech collaborations in regulated sensing.

INNOVATION HOOK — AI MAMMOGRAPHY TURNS EVIDENCE CORNER

What Happened

RadNet and DeepHealth reported ASSURE, the largest real‑world AI mammography study in U.S. history (579k women, 109 centers). An AI‑enhanced workflow combining DeepHealth’s FDA‑cleared CADe/x with an AI safeguard review delivered: +21.6% cancer detection, +22.7% in dense breasts, +15% PPV, and recall rates within ACR guidelines, with strong performance in Black women (150k+ participants).

Why it matters — quantified

- If a typical 3D mammography program detects ~6 cancers per 1,000 screens, a 21.6% uplift implies ~1.3 extra cancers per 1,000 women.

- That corresponds to an illustrative number‑needed‑to‑screen (NNS) of ~770 with AI to detect one additional cancer—powerful at population scale.

- With recall rates stable and PPV up 15%, the economics are favorable: more cancers caught earlier, fewer false‑positive downstream costs and malpractice risk.

ASSURE moves AI mammography from promising RCTs to population‑scale validation in routine U.S. practice. The workflow marries algorithmic detection with human safeguard review, improving detection while stabilizing recalls and improving PPV—precisely the trade‑off payers and guidelines have demanded. For health systems, the study de‑risks AI deployment in community settings; for vendors, it sets a new bar: incremental AUC is not enough—quantified clinical benefit and operationally embed‑ded workflows are becoming table stakes.

COMPANY SPOTLIGHT – ABBOTT LABORATORIES

What happened: Abbott announced a $21 billion agreement to acquire Exact Sciences, adding Cologuard, Oncotype DX, and a pipeline of liquid biopsy and multi-cancer early detection tests to its diagnostics franchise. The deal is expected to add roughly $3B in annual revenue and is being described as one of 2025’s largest and most strategic medtech transactions.

- Why it matters: This is a sector-defining move in cancer diagnostics that repositions Abbott beyond its traditional strengths in cardiology and diabetes into the high-growth oncology screening market. It validates multi-cancer early detection as a core diagnostic category, pressures peers (Roche, BD, Danaher, Thermo Fisher) to respond, and accelerates the shift toward screening-led, earlier-stage cancer care with major downstream implications for imaging volumes, pathology workflows, and value-based oncology models.

MARKET LENS – EUROPE ONCOLOGY IMAGING AI BY TUMOR SITE

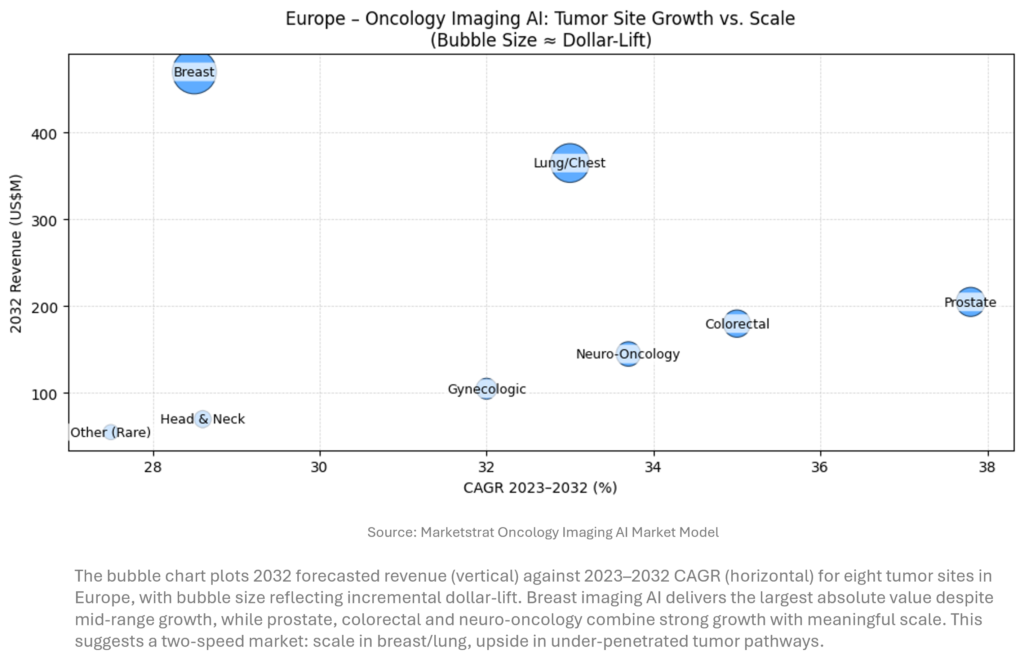

Baseline reminder: Marketstrat’s global AI‑in‑Imaging TAM reaches $28.4B by 2032. For this week’s lens we zoom into Europe’s oncology imaging AI market.

Our Europe oncology imaging AI model tracks eight tumor sites to 2032. Aggregate 2032 revenue is roughly $1.7B, or ~6% of global AI‑in‑Imaging TAM, with breast and lung/chest representing more than half of the pool. Prostate, colorectal and neuro‑oncology show the fastest growth (mid‑30s % CAGR) from smaller bases, benefiting from emerging screening and surveillance programs. Vendors should treat breast and lung as scale anchors while using high‑growth niches like neuro‑oncology and prostate to differentiate.

SIGNAL PULSE HEATMAP – NOV 15-21, 2025

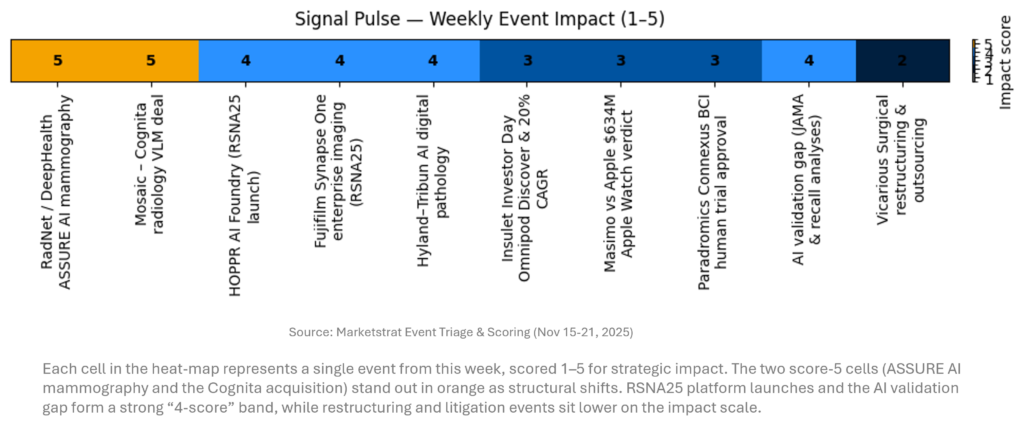

The week’s heat‑map is dominated by two “5‑score” events: ASSURE’s AI mammography data and RP’s Cognita deal. Together they validate AI’s ability to improve outcomes and to re‑architect radiology workflows via VLMs. A cluster of “4s” around RSNA25 infrastructure (HOPPR, Synapse One, Hyland–Tribun) highlights a pivot toward platforms. Insulet’s roadmap, Masimo’s verdict, Paradromics’ trial and the evidence gap findings are meaningful but more segment‑specific. This visual scores individual events this week by impact (1–5), focusing on imaging, AI, and adjacent medtech.

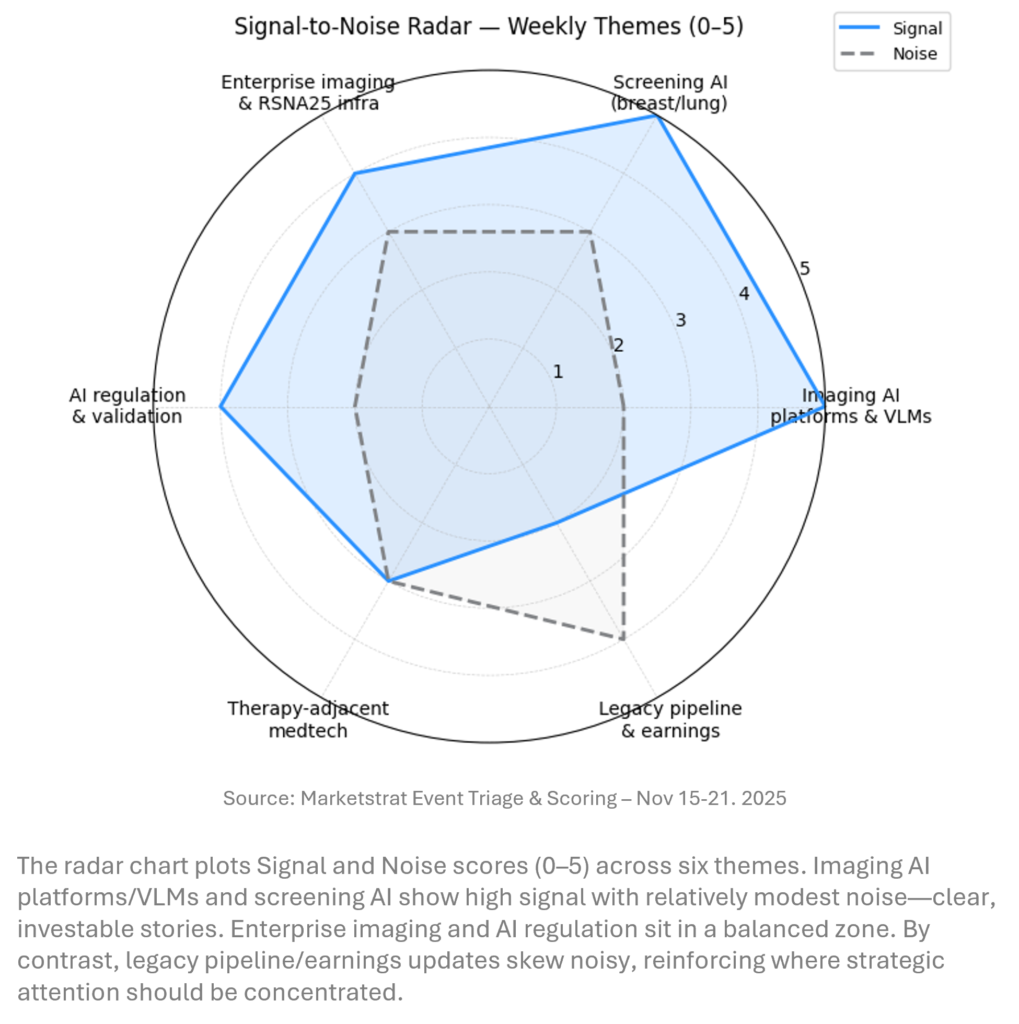

SIGNAL-TO-NOISE RADAR BY TOPIC – NOV 15-21, 2025

At the topic level, imaging AI platforms/VLMs and screening AI are the highest‑signal nodes this week, driven by the Cognita acquisition and ASSURE. Enterprise imaging and regulatory/validation form a strong second tier. Structural heart and neuromodulation are important but more specialized. Traditional medtech earnings updates remain relatively noisy: important for stock pickers but offering less structural insight for imaging and AI strategy than this week’s platform and evidence developments.

REGULATORY PULSE

Data (unchanged vs last week)

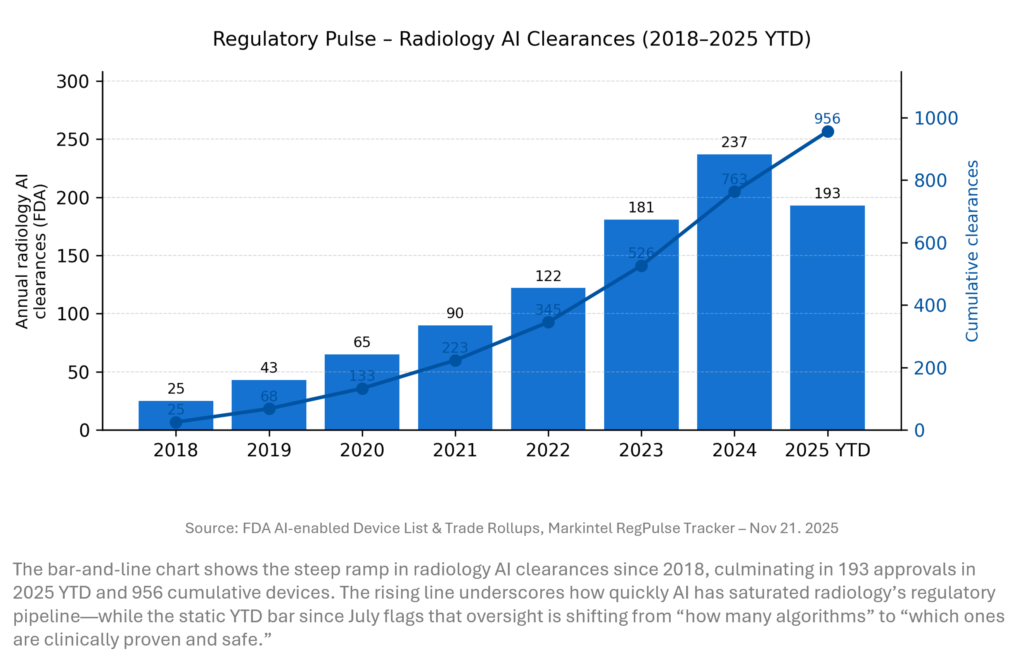

- Annual FDA radiology AI clearances (approximate)

2018: 25; 2019: 43; 2020: 65; 2021: 90; 2022: 122; 2023: 181; 2024: 237; 2025 YTD: 193 - Cumulative radiology AI clearances: 956 (through mid‑2025), consistent with FDA’s AI‑enabled device list and external analyses.

Radiology AI remains the workhorse of FDA AI approvals, with cumulative clearances nearing 1,000 and 2023–25 annual volumes far above pre‑2020 levels. Yet this week’s JAMA‑linked work is a reminder that volume ≠ validation. Roughly one‑third of devices have limited or no reported clinical testing, and recall risk is concentrated in under‑validated products. For hospitals, the message is clear: treat the FDA list as a starting point, then layer on your own evidence bar.

DEEPER DIVES

Regulatory & Policy Pulse — Evidence, Oversight and BCIs

Regulators did not issue blockbuster new imaging rules this week, but the evidence base around AI oversight tightened. JAMA‑linked studies show that only ~29% of radiology AI devices had clinical testing pre‑clearance, and that tools without validation are almost twice as likely to be recalled, often within 12 months. In parallel, FDA’s green light for Paradromics’ high‑bandwidth BCI trial highlights how AI‑native neuro‑devices are entering human studies faster than the broader regulatory framework is evolving.

Key items & implications

- Clinical testing gap in radiology AI (JAMA Network Open).

- ~76% of 950 FDA‑authorized AI/ML devices are radiology‑focused; only 29% of radiology tools had clinical testing, and just 5% underwent prospective trials.

- Implication: Hospital HTA committees and radiology departments will increasingly scrutinize pre‑clearance evidence; vendors that invest in prospective, multi‑site validation gain trust and pricing leverage.

- Recall risk linked to lack of validation.

- Analysis of 950 AI devices showed 6.3% associated with recalls; devices lacking validation data were almost 2× as likely to be recalled and more often involved large‑scale software errors.

- Implication: Boards and risk committees will push for “validation‑first” procurement and time‑limited deployments, especially where AI influences diagnostic or triage decisions.

- EU AI Act & serious‑incident reporting (context from prior weeks).

- Ongoing guidance clarifies how high‑risk medical AI must align with MDR/IVDR and serious‑incident reporting templates; bias monitoring and post‑market surveillance will be central.

- Implication: Vendors selling into Europe must operationalize continuous performance monitoring and documentation; this favors platform providers with built‑in QMS and observability.

- BCIs enter human communication trials.

- Paradromics’ Connexus BCI received FDA approval for a first human safety and efficacy trial aiming to restore speech at up to 60 words per minute for locked‑in patients.

- Implication: BCIs are AI‑native devices that rely heavily on imaging for planning and follow‑up; neuro‑imaging vendors should treat them as a new adjacent market, not a curiosity.

Funding, M&A & Strategic Partnerships — Platformization of Imaging AI

The most important capital this week flowed into infrastructure, not standalone algorithms. Radiology Partners’ $80M purchase of Cognita gives it proprietary VLMs tuned on radiology data, while HOPPR’s AI Foundry and Hyland–Tribun’s digital pathology alliance extend “platform thinking” into development and workflow layers. These moves consolidate bargaining power around a small set of data‑rich platforms—good for scalability, but they raise questions for niche algorithm vendors about distribution, pricing, and eventual consolidation.

Highlights

- Mosaic Clinical Technologies (Radiology Partners) acquires Cognita Imaging ($80M).

- Cognita’s radiology‑focused VLMs are already powering Mosaic Drafting, which in early testing boosted detection by 52%, cut errors 4×, and reduced reading time by up to 76%.

- RP gains a proprietary model stack running across 4,000+ radiologists and 55M+ annual studies, creating a formidable data flywheel.

- Strategic lens: This is a vertical integration move—platform + data + clinicians—and foreshadows VLM‑powered reading becoming a core operating model, not just an efficiency tool.

- HOPPR launches AI Foundry under full QMS, backed by a 19M‑study dataset.

- The Foundry offers curated imaging datasets, multiple foundation models (including ViT‑based breast imaging), and fine‑tuning/inference tools, debuting at RSNA25.

- Strategic lens: HOPPR is positioning itself as “AWS for imaging AI development”—attractive to smaller algorithm developers that lack compliance and data pipelines.

- Hyland–Tribun Health digital pathology alliance.

- Integrates Tribun’s AI‑enabled pathology suite into Hyland’s enterprise imaging platform, enabling combined radiology/pathology review and AI analytics for oncology.

- Strategic lens: Moves pathology from separate “glass slide” workflows into the same data layer as radiology, strengthening the case for integrated oncology imaging platforms.

- Insulet: device + ML data platform thesis.

- At Investor Day, Insulet guided to ~20% revenue CAGR (2025–28) and >25% EPS CAGR, built on Omnipod Discover (ML‑driven data platform), Omnipod 6 (2027), and a fully closed loop system for type 2 in 2028.

- Strategic lens: Reinforces the economic value of closed‑loop, algorithm‑rich device ecosystems—a pattern likely to be mirrored in imaging, neuromodulation, and structural heart.

Digital Health & AI — RSNA25 as Infrastructure Showcase

This week’s RSNA25 pre‑announcements signal a shift from “yet another algorithm” to full‑stack platforms combining enterprise imaging, AI orchestration, and cloud‑scale data. Synapse One, Hyland–Tribun, HOPPR’s Foundry, and AWS’s RSNA agenda all point toward a world where hospital IT teams buy imaging AI as part of an integrated platform—bundling workflow, security, observability, and regulatory tooling—rather than stitching together stand‑alone apps.

Key developments

- Fujifilm Synapse One enterprise platform.

- Cloud‑hosted on AWS, Synapse One unifies PACS, advanced visualization, scheduling, patient and physician portals into a single EI stack, designed for outpatient imaging networks.

- Why it matters: Competes head‑on with leading EI vendors (GE, Philips, Sectra) and provides a natural home for multi‑modality AI, with RSNA demos likely to emphasize cloud elasticity and cost per study.

- Hyland showcases EI innovation at RSNA25.

- Hyland is using RSNA to highlight AI‑enabled imaging workflows and its new digital pathology integration, with emphasis on personalized, connected care and multi‑disciplinary collaboration.

- HOPPR AI Foundry RSNA debut.

- HOPPR positions the Foundry as a secure, QMS‑backed environment where developers and providers can build and validate models on curated datasets, with RSNA billed as a launchpad for early adopters.

- AWS at RSNA25.

- AWS’s RSNA program emphasizes Bedrock, HealthImaging, HealthLake, and HealthOmics as building blocks for AI‑enhanced imaging workflows. Expect co‑announcements with partners such as Fujifilm and HOPPR.

Clinical Research & Product Launches — Imaging‑Intensive Therapies

Beyond diagnostic AI, imaging‑intensive therapies saw major AI‑adjacent news. Philips and Edwards’ DeviceGuide exemplifies AI‑enabled navigation in structural heart, while Cardiovalve’s TARGET data and CE submission broaden the competitive field in tricuspid interventions. These developments increase demand for high‑fidelity echo, CT, MR and integrated guidance platforms, and they give imaging OEMs new opportunities to bundle AI‑driven planning and intra‑procedural support around high‑value therapy workflows.

Highlights

- AI co‑pilot for mitral TEER (Philips DeviceGuide with Edwards).

- DeviceGuide fuses real‑time echo and X‑ray, overlaying an AI‑generated 3D visualization of repair devices during minimally invasive mitral valve repair.

- Implication: Expect similar AI navigation layers in LAAC, TAVR, and complex structural cases, with CT‑based planning and intra‑procedure echo playing a central data role.

- Cardiovalve TARGET study and CE file submission.

- TARGET (150 patients) demonstrated significant reduction in tricuspid regurgitation with the Cardiovalve TTVR system; Venus Medtech has now submitted CE technical files, targeting a 2027 European launch.

- Paradromics Connexus BCI trial approval (see regulatory section).

- Implies long‑term EEG/ECoG imaging follow‑up and high‑resolution structural imaging for targeting—an adjacent demand driver for neuro‑imaging centers.

QUICK-GLANCE TABLE

| Date (2025) | Headline | Our Take |

| Nov 17 | RadNet/DeepHealth ASSURE study shows 21.6% higher cancer detection with AI mammography, +15% PPV, stable recall | First large‑scale, U.S. community‑based evidence that AI mammography can improve outcomes without inflating callbacks—shifts payer and guideline discussions from “if” to “how fast.” |

| Nov 18–20 | Radiology Partners’ Mosaic acquires Cognita Imaging for $80M to integrate VLMs into MosaicOS | Marks the first major scale play for radiology‑specific VLMs; early data show up to 76% reading‑time reduction and 4× fewer errors, signaling disruptive productivity potential. |

| Nov 20 | HOPPR launches AI Foundry, a QMS‑backed development environment with 19M+ imaging studies, debuting at RSNA25 | Puts “innovation infrastructure” on the agenda: a cloud‑native foundry with curated datasets and foundation models lowers time‑to‑market for compliant imaging AI. |

| Nov 18 | Hyland partners with Tribun Health to embed agentic digital pathology into enterprise imaging | Unifies whole‑slide pathology and radiology images under one viewer and AI layer—critical for oncology pathways and for hospitals rationalizing archives and AI budgets. |

| Nov 18 | Fujifilm to debut Synapse One cloud enterprise imaging platform at RSNA25 | Highly integrated RIS/PACS/3D/portal stack on AWS aimed at outpatient imaging networks—directly competitive with incumbent EI platforms and a natural host for third‑party AI. |

| Nov 17–19 | Philips & Edwards launch DeviceGuide AI co‑pilot for mitral TEER guidance | Cross‑modality (echo + X‑ray) 3D navigation tool exemplifies AI moving into the cath lab; early focus is on complex mitral repair but concept extends to structural heart and IR. |

| Nov 20 | Insulet Investor Day: targets ~20% revenue CAGR (2025–28) and >25% EPS CAGR, unveils Omnipod Discover data platform & roadmap to full closed loop for type 2 | Reinforces the “device + ML platform + data services” model; insulin automation remains one of the most mature real‑world embodiments of medtech‑AI convergence. |

| Nov 15–19 | Jury orders Apple to pay Masimo $634M for Watch pulse‑ox patents; ITC opens new probe of redesigned models | Sets precedent on IP value of clinical‑grade sensing and could chill “move fast” strategies where consumer OEMs repurpose regulated medtech IP. |

| Nov 17–20 | Multiple analyses show <30% of FDA‑cleared AI devices have clinical testing and that unvalidated tools are almost 2× as likely to be recalled | Strengthens the case for institutional HTA‑style review of AI and creates regulatory tailwinds for vendors that invest in robust prospective evidence. |

| Nov 20 | Paradromics receives FDA approval for first human trial of its high‑bandwidth Connexus BCI for speech restoration | Early‑stage but strategically important: fully implantable BCIs with AI decoding engines foreshadow a new class of neuro‑prosthetic platforms, with implications for imaging‑guided implantation and long‑term monitoring. |

| Nov 17–20 | Cardiovalve submits CE Mark file after TARGET study shows tricuspid TR reduction in 150‑patient cohort | Adds momentum to structural heart pipelines with imaging‑heavy planning and intra‑procedural guidance needs—an important downstream demand driver for 3D echo, CT, and AI fusion tools. |

About Marketstrat

Marketstrat® is a market intelligence and GTM enablement firm committed to empowering clients in data-driven industries. Under the Markintel™ brand, it delivers robust market intelligence, while GrowthEngine solutions offer specialized GTM advisory and app-based tools—together fueling growth, innovation, and competitive advantage. For more information, visit www.marketstrat.com.

Marketstrat® is a registered trademark and Markintel™ is a pending trademark of Marketstrat.

Check out free Research and Insights and Analysis of Industry Events

Check out our collection of Markintel Horizon and Markintel Pulse research.

Check out details on our reports, World Market for AI in Medical Imaging and other Pulse Reports in the Imaging space.