Key Takeaways

- The center of gravity shifted from “AI apps” to the AI supply chain. Day 2 saw a wave of infrastructure moves: Aidoc + NVIDIA MONAI + Quibim, HOPPR’s AI Foundry programs, RapidAI + AWS, and Ferrum + Avicenna building a stack for AI development, governance and deployment at scale.

- Screening and risk programs are where AI looks most mature. Lunit’s 14‑study breast portfolio, Clairity’s deep‑learning risk model for women under 50, DeepHealth’s Breast Suite and new breast imaging sessions from Hologic all emphasize pathway‑level impact, not just per‑case AUC.

- Photon‑counting CT competition expanded beyond the “big three.” Neusoft’s NeuViz P10—an 8 cm wide‑coverage photon‑counting CT—joined Canon and others in pushing CT differentiation on coverage, dose and AI integration.

- Digital twins, AI education tools and policy shifts rounded out the picture. A lung digital‑twin platform from L&T Technology Services and NVIDIA, AI “attending” tools for training, new AI‑ready data repositories and doubled reimbursement for CEUS all signal that infrastructure and economics are catching up with innovation.

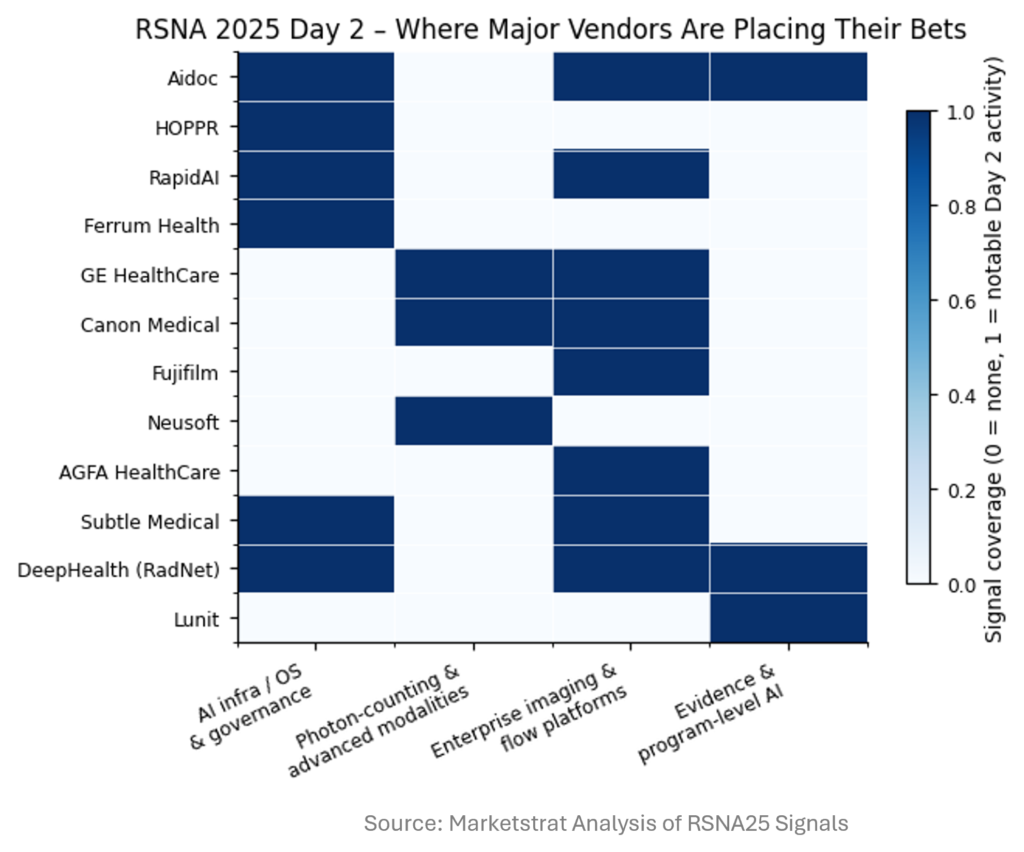

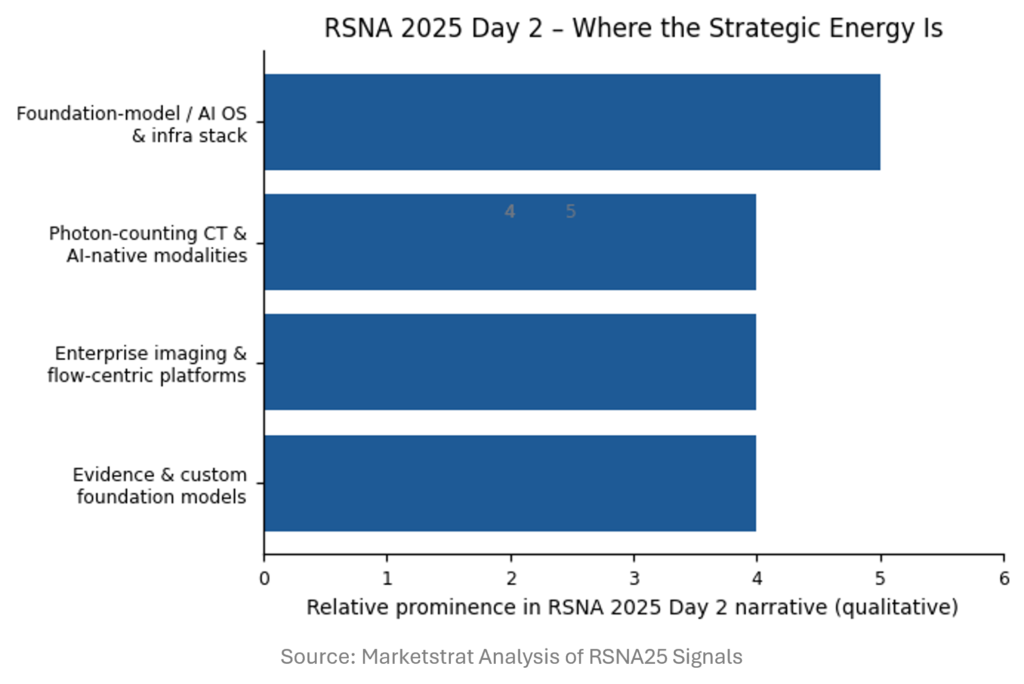

Major Vendor Bets

RSNA25 – Day 2 Signals

Selected Day 2 Vendor Initiatives

Selected RSNA 2025 Day 2 initiatives mapped to Marketstrat’s core signals and strategic implications

| Vendor / initiative | RSNA 2025 highlight (Day 2 cluster) | Signal(s) touched | Marketstrat read‑out |

| Aidoc | Partners with NVIDIA MONAI & Quibim to let health systems deploy in‑house models and QP‑Prostate via aiOS. | AI infra / OS; Enterprise; Evidence | Moves aiOS toward a true operating system for mixed portfolios (commercial + homegrown) and specialty apps. |

| HOPPR | Launches Catalyst Program and Forward Deployed Services for its AI Foundry at RSNA 2025. | AI infra / OS | Positions HOPPR as a development engine and R&D partner for organizations without deep in‑house AI teams. |

| RapidAI + AWS | Expands collaboration to co‑develop AI tools and foundational‑model infrastructure for Rapid Enterprise. | AI infra / OS; Enterprise | Signals convergence between cloud FMs and disease‑specific platforms; strengthens Rapid’s enterprise story. |

| Ferrum Health + Avicenna | Uses the AI Governance Suite as deployment and monitoring fabric for Avicenna’s emergency imaging AI. | AI infra / OS; Governance | Reinforces “governance fabric” as a category; Ferrum becomes a key gatekeeper for multi‑vendor AI portfolios. |

| John Snow Labs + AWS | Showcases healthcare generative AI on AWS for summarization and report automation. | AI infra / OS | Illustrates how LLM‑style generative tools may plug into imaging workflows as summarization and authoring aids. |

| GE HealthCare | Highlights Photonova Spectra PCCT, new SIGNA MRI systems and Imaging 360 / Genesis workspace. | PCCT & modalities; Enterprise | Strong push to combine advanced devices with AI reconstruction and operations control tower. |

| Canon Medical | Promotes CT and MR portfolio with AI‑enabled workflow and vertically integrated stack. | PCCT & modalities; Enterprise | Vertical integration story—hardware, AI and education—aimed at stickier CT/MR relationships. |

| Fujifilm | Launches Synapse One, an all‑in‑one enterprise imaging solution for outpatient centers. | Enterprise | Plays into the shift of imaging to outpatient and ambulatory sites with unified RIS/PACS/workflow. |

| Neusoft | Introduces NeuViz P10, an 8‑cm wide‑coverage photon‑counting CT as work‑in‑progress. | PCCT & modalities | Shows PCCT is no longer a single‑OEM game; brings PCCT narrative into cost‑sensitive and emerging markets. |

| AGFA HealthCare | Showcases cloud Enterprise Imaging and RUBEE AI packages as part of “Life in Flow” positioning. | Enterprise | Explicitly frames enterprise imaging as a flow / experience platform with AI embedded, not bolted on. |

| Subtle Medical | “Doubles growth,” highlights AI suite for accelerated acquisition, image enhancement and workflow gains. | Enterprise; AI infra | Example of a vendor‑neutral AI layer that can ride multiple OEM stacks and focus on operational wins. |

| DeepHealth (RadNet) | Unveils next‑gen imaging informatics + Breast Suite of AI solutions for screening and workflow. | Enterprise; Evidence | Combines clinical AI + informatics; strong play for integrated breast programs and multi‑site networks. |

| Lunit + SimonMed | Presents 14‑study evidence portfolio and custom foundation models for chest X‑ray reporting. | Evidence; Custom FMs | Uses both evidence volume and tailored FMs to differentiate in breast and chest imaging. |

| Coreline Soft | Extends AVIEW chest AI for national lung screening programs with proven throughput and efficiency gains. | Evidence; Program‑level AI | One of the clearest examples of program‑scale AI deployment in lung screening. |

| Median Technologies | Promotes eyonis LCS and RSNA Theater presentation on AI/ML lung cancer screening pathways. | Evidence; Program‑level AI | Competing to define the AI standard for lung cancer screening pathways, not just nodule detection. |

| HeartFlow | Uses RSNA platform to reinforce CAD pathway outcomes from FFR‑CT and plaque analysis. | Evidence; Pathway AI | Flagship example of AI reshaping a specific diagnostic pathway and cath lab utilization. |

Signal 1 – AI Development & Deployment Infrastructure Becomes a Product Category

What’s new

- Aidoc + NVIDIA MONAI + Quibim: Aidoc is expanding its clinical AI scope so hospitals can deploy in‑house imaging models built with NVIDIA MONAI into routine workflows via aiOS, alongside commercial apps and partner solutions like Quibim’s QP‑Prostate.

- HOPPR AI Foundry + new programs: HOPPR launched two RSNA‑specific programs—Forward Deployed Services (FDS) and the Catalyst Program—to embed its ML experts with partner teams and offer early access to foundation models, curated datasets and compute credits, all wrapped in a regulated development environment.

- RapidAI + AWS: RapidAI and AWS are tightening their collaboration around Rapid Edge Cloud, a cloud‑native but on‑prem‑capable platform for deploying deep clinical AI globally while meeting regional security and privacy requirements.

- Ferrum + Avicenna + HOPPR: Ferrum’s AI Governance Suite—already hosting more than 50 algorithms—is now the commercialization channel for Avicenna.AI’s emergency imaging portfolio in the U.S. and is being tied into HOPPR’s Foundry for an end‑to‑end development‑to‑governance stack.

Why it matters

- This is infrastructure as strategy. Instead of competing only on single‑use AI apps, vendors are now selling:

- Data pipelines and labeled corpora (HOPPR, MIDRC).

- Foundation‑model tooling (HOPPR, NVIDIA MONAI).

- Governance and monitoring fabric (Ferrum).

- Deployment engines that bridge edge and cloud (Rapid Edge Cloud, aiOS).

- For health systems, the strategic question shifts from “Which AI app do we buy?” to “Which stack will let us run the portfolio we want—commercial plus homegrown—under one governance and deployment model?”

How to act

- OEMs and AI vendors: Decide whether you want to be:

- A platform owner (operating system / foundry / governance),

- A deep application vendor that rides multiple platforms, or

- A hybrid (e.g., platform in some domains, app partner in others).

- Providers and IDNs: Start treating AI infrastructure selection like PACS or EMR selection:

- RFPs should test ability to host multi‑vendor and in‑house models,

- Require explicit governance and performance‑drift monitoring,

- Clarify commercial terms for future models, not just those shipping today.

Signal 2 – Screening and Risk Programs are Where AI Looks Most “Real”

What’s new

- Lunit’s 14‑study RSNA program: Lunit is presenting 14 studies (8 oral, 6 posters) across screening mammography, DBT, breast density and risk modeling—its largest RSNA evidence package to date.

- Real‑world data from Capio S:t Göran (≈193,000 exams) showed that AI‑supported single‑reader screening with Lunit INSIGHT MMG improved invasive cancer detection and PPV while reducing unnecessary recalls versus human double reading.

- Clairity risk stratification <50: Clairity is showcasing an image‑only deep‑learning model trained on 400,000+ mammograms, designed to provide finer risk stratification for women under 50—an increasingly important cohort as incidence rises.

- DeepHealth Breast Suite: DeepHealth unveiled its Breast Suite, a set of AI‑powered applications for breast cancer screening and detection, tightly coupled with reading workflows.

- Hologic and others: Hologic’s RSNA programming emphasizes contrast‑enhanced mammography, DBT performance and AI solutions for breast imaging, while Medimaps is demoing AI‑driven bone fragility screening software—another population‑scale risk tool.

Why it matters

- The center of gravity is shifting from “AI as second reader” to “AI reshapes the screening model.”

- AI‑enabled single reading with strong evidence and workforce benefits is now credible for national programs.

- Risk‑stratified screening—by density, age and image‑only models—opens the door to more personalized recall intervals and modality mixes.

- Vendors that can pair algorithm performance + operational evidence + program economics (e.g., recalls avoided, radiologist capacity released) will have a defensible edge in payer and public‑health discussions.

How to act

- Screening programs and health ministries:

- Begin scenario modeling for AI‑supported single reading vs. current double reading, including workforce implications and recall patterns.

- Pilot risk‑stratified pathways for specific age bands or density categories.

- AI companies:

- Move beyond ROC curves and emphasize program‑level KPIs: cancers per 1,000 screened, interval cancers, recalls, radiologist FTEs, and budget impact.

Signal 3 – Photon‑Counting CT Enters a More Competitive Phase

What’s new

- Neusoft’s NeuViz P10: Neusoft launched the NeuViz P10, described as the world’s first 8 cm wide‑coverage photon‑counting CT, combining a cadmium zinc telluride detector with AI‑integrated clinical solutions.

- Canon and others: Canon is highlighting “world’s firsts” in CT and new X‑ray systems that pair low‑dose imaging with AI‑based technologies like Clear‑IQ, plus expanded CT education programs at RSNA.

- Context – big OEM PCCT push: These announcements sit alongside GE’s Photonova Spectra PCCT and Siemens’ NAEOTOM Alpha programs, reinforcing that PCCT is now a multi‑vendor race with increasingly differentiated coverage and workflow claims.

Why it matters

- PCCT is shifting from single‑vendor novelty to multi‑vendor battleground:

- Neusoft’s entry underscores that PCCT is not just a premium Western‑OEM story; it may become a competitive lever for cost‑conscious markets as well.

- Canon’s and others’ emphasis on AI, dose and workflow links PCCT back to the same narrative driving MRI and CT more broadly: performance + sustainability + operations.

- For payers and providers, the key question is not “Do we need PCCT?” but “Where does PCCT create enough incremental clinical value and workflow efficiency to justify the premium?”

How to act

- CT OEMs and challengers:

- Clarify disease‑area‑specific value stories (e.g., coronary plaque, lung nodules, bone/oncology) backed by outcomes and dose data.

- Position PCCT as part of an AI‑enhanced pathway, not a standalone purchase.

- Providers:

- Build multi‑year modality roadmaps where PCCT is weighed against alternative investments (e.g., AI‑enhanced conventional CT, MR, or operational platforms).

Signal 4 – Digital Twins, Training AI and Policy Are Building the Scaffolding For Adoption

What’s new

- Lung digital twin diagnostics: L&T Technology Services, in collaboration with NVIDIA, is demonstrating an AI‑powered digital twin platform that integrates with CT to create 3D lung models—visualizing airways, vessels, lobes and lesions to support diagnostics and navigation.

- AI for education and workflow:

- Navigating Radiology is introducing a real‑time AI “voice attending” that provides case‑level feedback to trainees on its platform used by 150,000+ learners.

- Rad AI is expanding its speech‑recognition tech integrated into Rad AI Reporting, while partnering with RSNA Ventures on workflow innovation—pushing toward AI‑augmented reading environments.

- Data and scheduling infrastructure:

- MIDRC is running sessions on building multi‑site imaging repositories for outcome studies and AI validation—essential for robust model evaluation.

- BioSked is showcasing an AI‑driven scheduling platform (Momentum) that allocates radiology and teleradiology staff based on RVUs and time zones, already deployed at >1,000 sites.

- Policy & reimbursement:

- CMS will double reimbursement for noncardiac CEUS in 2026, aligning its payment with contrast CT/MRI and creating a stronger economic case for contrast‑enhanced ultrasound adoption.

- RSNA sessions highlighted sustainability pressures—reducing imaging energy use and waste as part of broader climate goals.

Why it matters

- Digital twins, scheduling and training tools are “horizontal enablers”:

- They don’t sit in one modality or disease area; they shape how radiology operates, trains and allocates resources.

- Policy changes like CEUS reimbursement can rapidly rebalance modality mix, especially in liver and abdominal imaging, and open new spaces for AI to assist protocol selection or interpretation.

- Sustainability is slowly moving from “nice to have” to operating constraint, particularly for large imaging fleets and 24/7 operations.

How to act

- Vendors:

- Integrate with emerging infrastructure (MIDRC‑like data environments, scheduling systems, training platforms) rather than building in isolation.

- Where possible, tie AI stories to policy and sustainability levers—reimbursement, energy use, consumables.

- Health systems:

- Evaluate digital twin and training tools not just for innovation value, but for their potential to standardize practice and de‑risk AI adoption across sites and staff.

About Marketstrat

Marketstrat® is a market intelligence and GTM enablement firm committed to empowering clients in data-driven industries. Under the Markintel™ brand, it delivers robust market intelligence, while GrowthEngine solutions offer specialized GTM advisory and app-based tools—together fueling growth, innovation, and competitive advantage. For more information, visit www.marketstrat.com.

Marketstrat® is a registered trademark and Markintel™ is a pending trademark of Marketstrat.

Check out free Research and Insights and Analysis of Industry Events

Check out our collection of Markintel Horizon and Markintel Pulse research.

Check out details on our report, World Market for Oncology Imaging AI

Check out details on our other reports, World Market for AI in Medical Imaging and other Pulse Reports in the Imaging space.