Individual License: $2,950 | Team and Enterprise License Options Available

The global Oncology Imaging AI market is forecast to grow from US$604.7M in 2023 to US$7.74B by 2032 (32.7% CAGR)—making oncology one of the fastest-scaling categories inside medical imaging AI and a leading indicator for where enterprise buyers will place their next AI budgets.

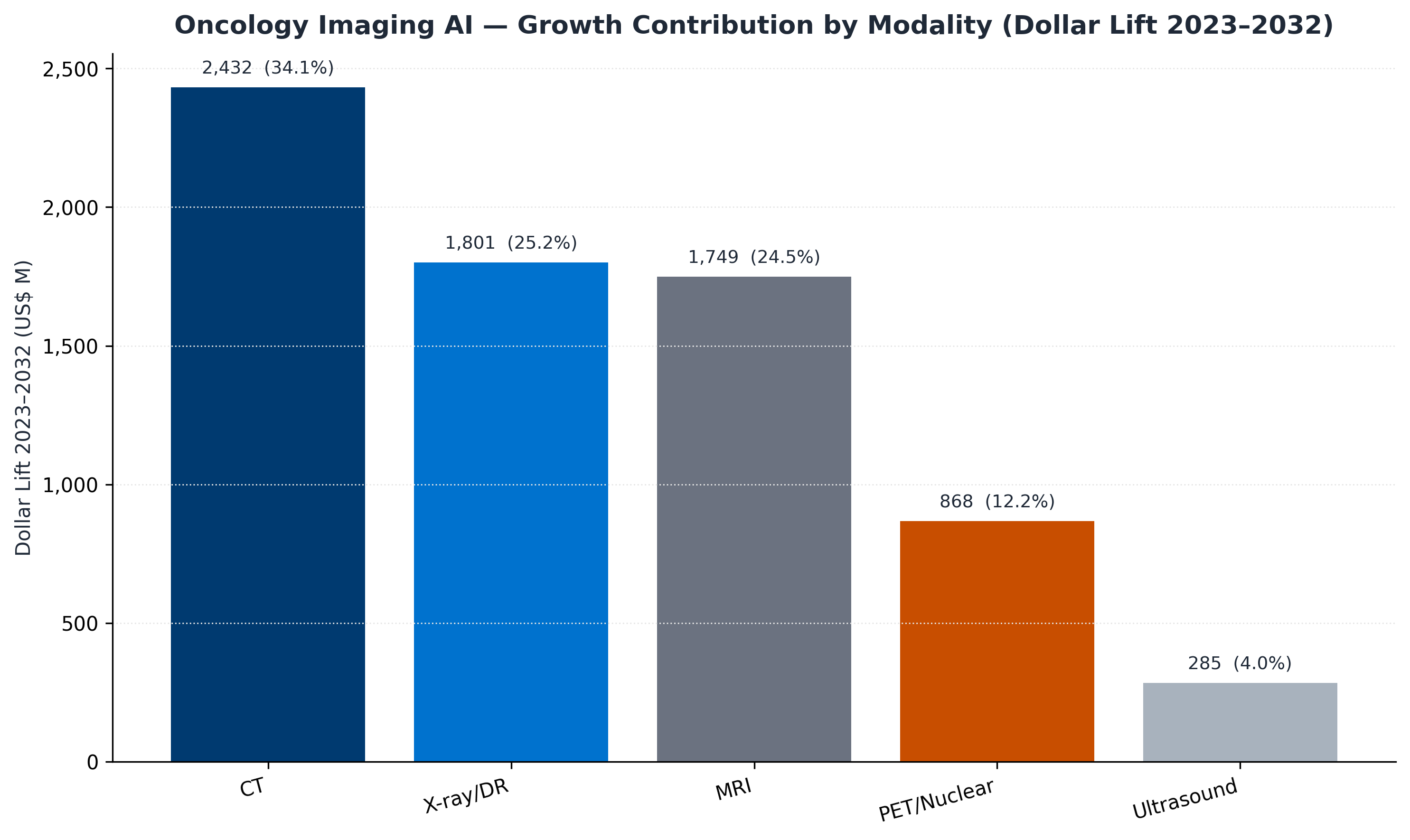

Global Oncology Imaging AI Market Pulse 2025–2032: Size, Mix & Momentum is Marketstrat’s world-market sizing and forecasting report for AI in cancer imaging—covering how demand is shifting across regions, modalities (CT, mammography/DBT, MRI, PET/Nuclear, ultrasound), clinical applications, tumor sites, care pathway stages, end-use settings, and revenue models.

This Pulse is built for teams who want a clean, quantitative global view—without needing to navigate a full multi-hundred-page Horizon program. It delivers a fast, decision-grade answer to:

Market expands from US$604.7M (2023) to US$7.74B (2032) at a 32.7% CAGR, driven primarily by attach-rate expansion and workflow adoption, not scanner unit growth.

From “point AI” to pathway adoption

Oncology imaging AI is shifting from single-task CAD toward pathway-wide workflows—screening, detection, staging, treatment planning (including RT), response assessment, and surveillance—where standardized measurement becomes a clinical and economic requirement.

Screening programs anchor predictable AI volumes

Breast screening (mammography/DBT) and LDCT lung screening continue to expand and industrialize, increasing demand for AI that supports triage, QA, second reads, and program operations at scale.

Measurement-grade quantification becomes the value center

Across MRI (prostate/liver), CT (lung pathways), and PET/Nuclear (theranostics), growth increasingly concentrates in quantification, analytics, and structured reporting—tools that make cancer imaging more reproducible and operationally scalable.

Premium pools rise in MRI and PET/Nuclear (high ARPU lanes)

MRI is the fastest-growing major modality, and PET/Nuclear grows as a high-value niche as therapy-linked imaging (including theranostics) expands demand for quantification and dosimetry-oriented AI.

Monetization shifts toward software + usage + lifecycle services

Software remains the core revenue engine, while cloud/usage-based (PPU) models accelerate in high-volume workflows (screening hubs, teleradiology, and enterprise multi-site networks). Services expand alongside validation, monitoring, and governance requirements.

This Global Pulse focuses on how the market is captured—not vendor-by-vendor market shares. The report highlights the commercial rails that shape winners and pricing power across segments:

The following companies/divisions have been mentioned (not profiled): Aidoc; AIQ Solutions; Annalise.ai; Arterys; Bayer; Blackford; Calantic; Canon Medical; CARPL.ai; DeepHealth; Deepwise; Densitas; EXINI Diagnostics; Fujifilm; GE HealthCare; Hermes Medical Solutions; Hologic; Imbio; Incepto; Kheiron; Koios Medical; Lantheus; Lunit; Median Technologies; MIM Software; Mindray; Mirada Medical; MVision AI; Nuance; Oxipit; Perspectum; Philips; Ping An Healthcare; Quibim; Qure.ai; Rad AI; RadNet; RaySearch; Riverain; ScreenPoint; Sectra; Segami; Siemens Healthineers; Subtle Medical; Tempus; TheraPanacea; United Imaging; Vara; Varian

If you need deeper strategy frameworks, cluster scorecards, and competitive playbooks, this Pulse pairs naturally with the companion Oncology Imaging AI Strategy Pulse.

Inside this report, readers gain immediate answers to questions such as:

This Pulse includes 41 figures and 36 tables, structured to be reusable in planning decks, investment briefs, and GTM prioritization.

Global Oncology Imaging AI Market Pulse 2025–2032 is built for teams that need high-confidence sizing plus practical segmentation—the combination required to make real decisions:

For a deeper, end-to-end view of the Oncology Imaging AI market—including full regional and country chapters, strategic frameworks, and the complete segmentation model—please see Marketstrat’s World Market for Oncology Imaging AI 2025–2032 (Horizon Report).

Driving healthcare innovation through actionable intelligence, strategic execution, and transformative solutions for global impact and growth.