Individual License: $2,950 | Team and Enterprise License Options Available

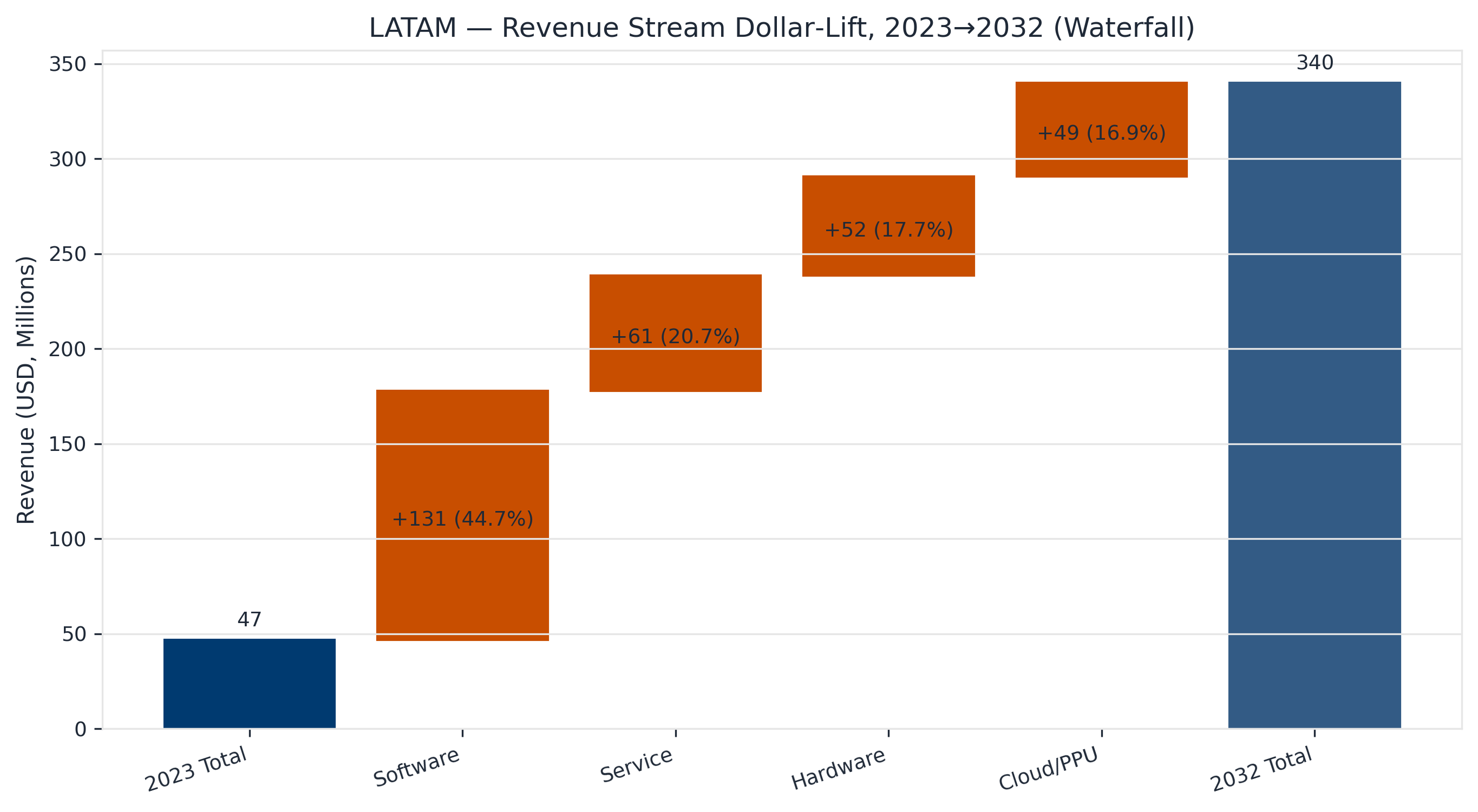

Latin America’s Oncology Imaging AI market is forecast to grow from US$46.8M in 2023 to US$340.0M by 2032 (24.7% CAGR)—a smaller base than North America/Europe/APAC, but a meaningful decade of compounding driven by screening throughput needs, constrained specialist capacity, and expanding cloud-first deployment models.

Latin America Oncology Imaging AI Pulse 2025–2032 is Marketstrat’s regional market sizing and forecasting report focused specifically on AI in cancer imaging across LATAM. It delivers a decision-grade view of market size, growth, and mix shifts across the core segmentation axes that matter for strategy and GTM:

This Pulse is designed for executives who need a clean LATAM-specific market view for commercial planning, product sequencing, partnership strategy, and investment screening—without requiring a full global Horizon package.

This Pulse focuses on how the LATAM market is captured—not vendor market shares. Key commercial realities include:

Readers can use this report to answer questions such as:

Latin America is often underserved by generic global AI narratives. This Pulse provides a LATAM-specific quantitative baseline to support real decisions:

Driving healthcare innovation through actionable intelligence, strategic execution, and transformative solutions for global impact and growth.