Individual License: $2,950 | Team and Enterprise License Options Available

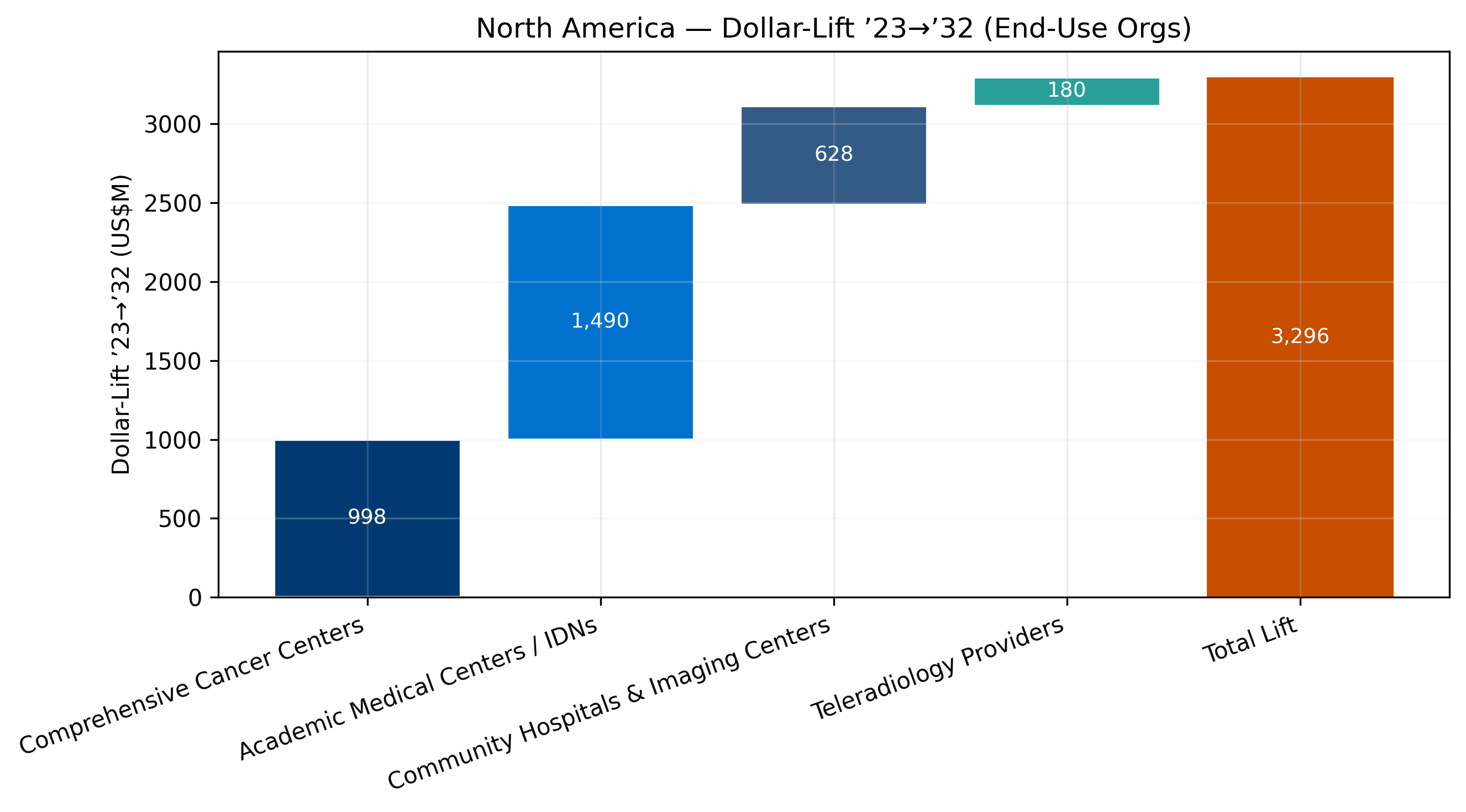

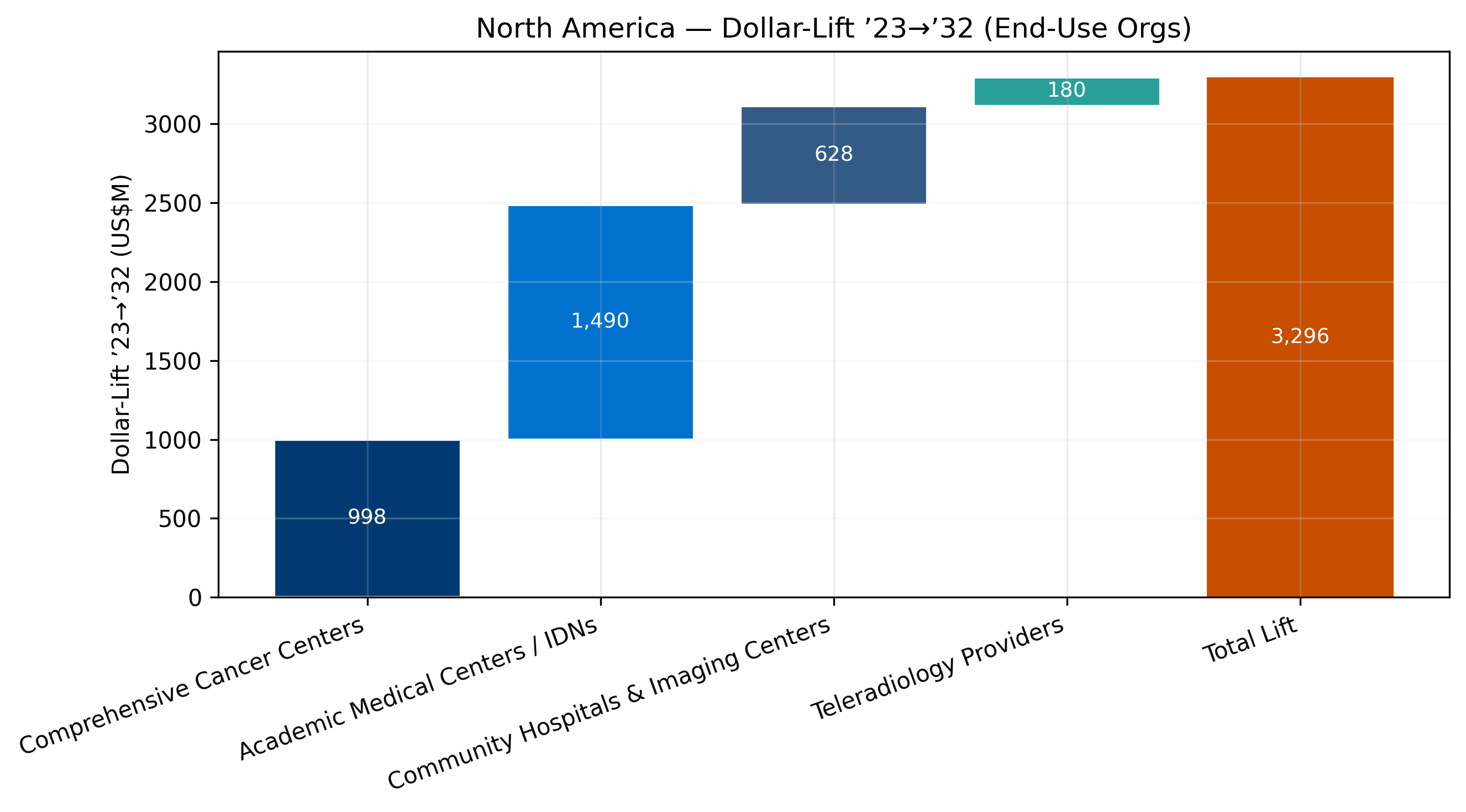

North America’s Oncology Imaging AI market is forecast to grow from US$268.4M in 2023 to US$3.56B by 2032 (33.3% CAGR)—the largest regional value pool globally, driven by enterprise adoption across U.S. IDNs, cancer centers, and scaled screening and treatment planning workflows. Academic Medical Centers / IDNs and Comprehensive Cancer Centers represent the largest purchasing lanes; teleradiology is the fastest-growing channel, signaling accelerating usage-based and workflow-orchestration demand.

Overview

North America Oncology Imaging AI Pulse 2025–2032 is Marketstrat’s regional market sizing and forecasting report focused on AI in cancer imaging across North America, including regional analysis plus dedicated country chapters for the United States and Canada.

This Pulse is designed for strategy, product, commercial, and investment teams who need a practical answer to:

- How big is the U.S. and Canada oncology imaging AI opportunity, and how fast is it scaling through 2032?

- Where is spending concentrated by modality (CT, mammography/DBT, MRI, PET/Nuclear) and by pathway stage (screening, diagnosis, staging, treatment planning/RT, response, surveillance)?

- Which buyer settings (IDNs/AMCs, cancer centers, community providers, teleradiology) are driving adoption—and what does that imply for routes to market and monetization models?

Key Market Trends (North America)

- Enterprise AI procurement becomes the default

AI adoption is increasingly tied to multi-site governance, platform deployment, and standardized oncology workflows—favoring vendors that win enterprise contracts, not just departmental pilots.

- From detection to measurement and monitoring

Growth is shifting toward quantification, longitudinal tracking, response assessment (RECIST/PERCIST), and treatment planning/RT enablement—use cases that monetize beyond initial detection wins.

- CT + MRI define the premium growth pools

CT anchors screening and oncology CT workflows, while MRI expands as a premium quantification/staging platform—together shaping roadmap priorities and platform leverage.

- Cloud/usage-based monetization expands

Cloud/PPU and services expand alongside governance requirements, validation, monitoring, and operational deployment—shaping pricing strategy and renewal durability.

Competitive / Commercial Snapshot

This Pulse is intentionally focused on market sizing and commercialization dynamics rather than vendor-by-vendor market shares. North America tends to be shaped by:

- IDN and cancer-network standardization (enterprise deployment, integration, governance)

- OEM attach + platform distribution (PACS marketplaces and neutral platforms)

- Scaled screening programs (mammography/DBT and LDCT lung)

- RT planning and response workflows as high-value “downstream” expansion lanes

Sample Insights & Figures (what readers can cite)

- Where North America over- or under-indexes by modality, pathway stage, and revenue stream versus global benchmarks

- Which combinations (e.g., lung × CT, breast × mammography/DBT, prostate × MRI) create the largest incremental dollars through 2032

- How buyer mix shifts toward enterprise systems—and what that means for packaging, governance, and deployment models

What’s Inside

- North America-focused Executive Summary (size, growth, and structural shifts)

- Condensed methodology tailored to this Pulse scope

- Regional market sizing and forecast splits (2023–2032) across:

modality, tumor site, pathway stage, clinical application, end-use, revenue stream

- Country chapters: United States and Canada, with country-specific segmentation and forecasts

Why This Report

Use this report to support:

- Market entry & expansion plans in the U.S. and Canada

- Product sequencing across CT, MRI, mammography/DBT, PET/Nuclear oncology workflows

- Commercial strategy (enterprise vs departmental selling, platform partnerships, usage-based pricing)

- Investment and diligence grounded in segmentation-consistent forecasts

Report Stats

- No. of Pages: 99

- No. of Figures: 51

- No. of Tables: 21

- Price: Individual License: $2,950 | Team License: $3,450 | Enterprise License $3,950

- SKU: MINTP-M01119-3

North America Pulse FAQ (US + Canada)

Q1) What is the North America Oncology Imaging AI market size and forecast (2023–2032)?

A: North America Oncology Imaging AI is forecast to grow from US$268.4M (2023) to ~US$3.56B (2032) at a 33.3% CAGR (nominal USD).

Q2) How much of the North America market is the United States vs Canada?

A: The United States is the dominant driver, reaching ~US$3.24B in 2032 (~91%), while Canada reaches ~US$324M (~9%).

Q3) Which imaging modalities drive Oncology Imaging AI spend in North America?

A: By 2032, the largest pools are CT (~US$1.15B), MRI (~US$943M), and X‑ray/DR including mammography/DBT (~US$882M), followed by PET/Nuclear (~US$450M).

Q4) Which cancer types (tumor sites) are the biggest Oncology Imaging AI opportunities in North America?

A: The largest 2032 tumor-site pools are Breast (~US$995M), Lung/Chest (~US$753M), and Prostate (~US$453M)—the highest-leverage pathways for prioritization.

Q5) Who are the primary buyers of Oncology Imaging AI in North America?

A: The largest buying segments are Academic Medical Centers / IDNs and Comprehensive Cancer Centers, with meaningful growth in Community Hospitals & Imaging Centers; Teleradiology is a smaller base but a fast-growing channel.

Q6) What does the North America Pulse report include beyond a regional summary?

A: The report includes North America regional sizing and segmentation plus country chapters for the United States and Canada, with forecasts by modality, tumor site, pathway stage, clinical application, end-use setting, and revenue stream.