Individual License: $2,950 | Team and Enterprise License Options Available

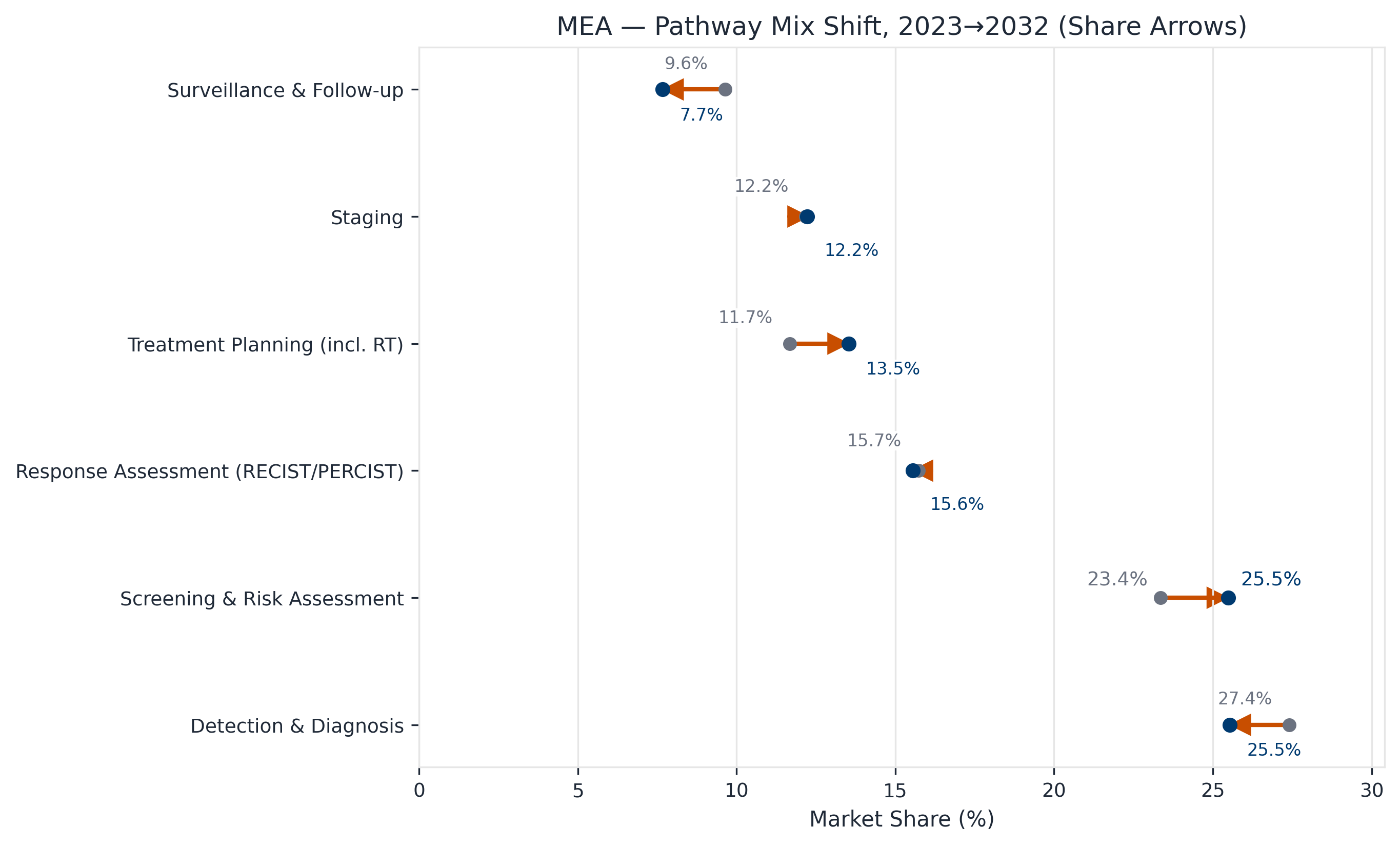

The Middle East & Africa (MEA) Oncology Imaging AI market is forecast to grow from US$19.6M in 2023 to US$177.5M by 2032 (27.7% CAGR)—a fast-compounding region where adoption often concentrates in hub systems, cancer centers, and multi-site programs that prioritize standardization, throughput, and clinical governance.

Middle East & Africa Oncology Imaging AI Pulse 2025–2032 is Marketstrat’s focused regional market sizing and forecasting report on AI in cancer imaging across MEA. It quantifies market growth and identifies where demand concentrates across the oncology imaging pathway—especially in workflows that scale across sites and support constrained specialist capacity.

Coverage includes segmentation and forecasts by:

This Pulse is designed for commercial teams, platform partners, OEMs, investors, and health systems looking for a clear MEA market baseline and a segmentation-consistent view of opportunity.

This Pulse emphasizes commercial rails and adoption economics rather than vendor market shares. Key dynamics include:

Readers commonly use this Pulse to answer:

MEA is not a uniform market—and that is exactly why regional forecasting and segmentation matter. This Pulse supports:

Driving healthcare innovation through actionable intelligence, strategic execution, and transformative solutions for global impact and growth.