Date: January 26, 2026 | Sector Lens: Medical Imaging + AI | Radiology workflow + acute triage (CADt)| Company: Aidoc

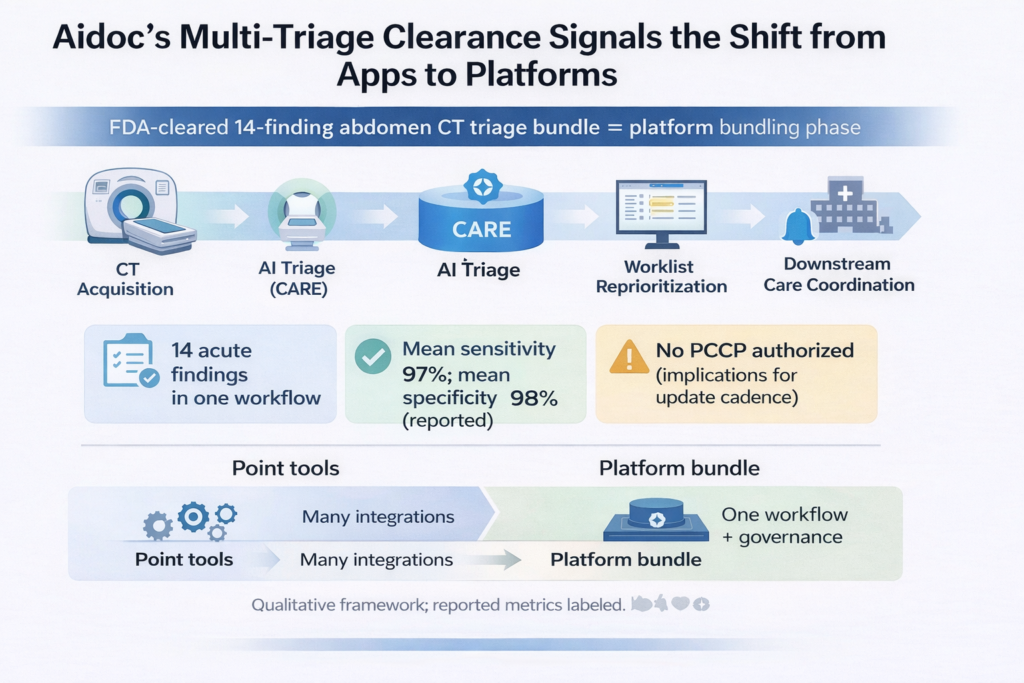

Aidoc received FDA 510(k) clearance for BriefCase‑Triage: CARE Multi‑triage CT Body, enabling a single abdominal CT triage workflow spanning 14 acute findings (11 newly cleared + 3 previously cleared). This is a clean “market signal” that imaging AI is shifting from point algorithms to enterprise platforms where value is captured through integration depth, governance, and bundle economics, not only model performance. For IDNs, this supports consolidating point tools into a single triage/workflow layer with governance and measurable TAT/LOS impact.

Next watch items: (i) whether Aidoc can convert “foundation model” clearance into faster multi‑indication expansion, (ii) whether independent evidence emerges for workflow + outcomes impact, and (iii) whether IDNs use this as a trigger for vendor consolidation.

Key Takeaways

- Signal: FDA cleared a double‑digit, abdomen CT “multi-triage” bundle—a notable inflection from “one algorithm = one finding” toward platform bundles.

- Where value is captured: the winner is the vendor that reduces the integration tax (PACS/EHR/worklist, governance, monitoring) and packages breadth into a single workflow experience—not the vendor with the 10th best point model.

- Stakeholder impact: for IDNs, this supports a procurement pivot to fewer vendors + deeper deployments; for radiology/ED, the promise is earlier surfacing of critical findings amid throughput constraints.

- Competitive implication: acute‑care imaging AI is converging toward enterprise workflow platforms (not just “CAD apps”), raising switching costs and pressuring standalone point tools.

- Outlook: catalysts over 6–18 months include expansion to broader CT/X‑ray workflows (Aidoc roadmap), more health-system rollouts, and stronger third‑party ecosystem traction on aiOS.

The Event

- Regulatory action: FDA 510(k) clearance for BriefCase‑Triage: CARE Multi‑triage CT Body (510(k): K252970)

- Decision date: 2026‑01‑07; database updated 2026‑01‑26

- Classification: Radiological computer‑assisted triage and notification software; Class II; product codes include QAS and QFM (per FDA record).

- Scope: combines 11 newly cleared + 3 previously cleared indications into a single abdominal CT triage workflow.

- Clinical scope (abdomen indications listed by Aidoc):

Abdominal‑Pelvic Abscess; Acute Diverticulitis; Appendicitis; Intestinal Ischemia and/or Pneumatosis; Kidney Injury; Liver Injury; Spleen Injury; Small Bowel Obstruction; Large Bowel Obstruction; Obstructive Kidney Stone; Pelvic Fracture; plus Abdominal Aortic Measurement; Aortic Dissection; Intra‑Abdominal Free Air. - Performance (company-reported, per Aidoc release): mean sensitivity 97% (up to 98.5%); mean specificity 98% (up to 99.7%).

- Deal terms / pricing: Not disclosed.

- Predetermined Change Control Plan (PCCP): FDA record indicates not authorized for this submission (relevant for how updates may be regulated).

Why It Matters

1) The market is moving from “apps” to “platform bundles” because the bottleneck is integration and governance—not algorithm count.

Radiology AI has accumulated “hundreds of tools,” but most are still effectively single‑task. Health systems struggle to operationalize them because each additional model adds integration work, clinical training, QA, and ongoing monitoring. This clearance is important because it packages breadth in a single workflow and reinforces the buyer thesis: consolidate vendors; standardize workflow; reduce vendor sprawl.

2) Abdomen CT is a high‑value target because it sits at the intersection of ED crowding and time-sensitive diagnostic pathways. The ROI case is typically built on TAT distribution shifts (median/90th percentile), escalation time, and ED LOS for flagged pathways—not on accuracy alone.

Aidoc’s stated positioning—improving patient flow by surfacing critical findings earlier—aligns with what hospital operators are actually trying to fix: throughput constraints and time‑to‑decision in urgent pathways. Even if clinical outcomes deltas vary by site, the operational thesis is intuitive: earlier triage can reduce avoidable delays and escalations.

3) “Foundation model” framing is strategically useful, but the regulatory nuance matters.

Aidoc is explicitly positioning CARE as a single model powering multiple findings, which—if it generalizes—could reduce marginal cost of launching new indications. However, FDA’s database shows no PCCP authorized for this clearance, implying meaningful model updates may still require standard regulatory pathways rather than continuous self-updating. For platform vendors, this increases the importance of a disciplined release cadence and performance monitoring (which Aidoc also emphasizes).

4) The industry is converging on “workflow-native” differentiation.

We view the next competitive wedge as: PACS/worklist integration + user experience + governance + outcomes evidence, with algorithms becoming increasingly commoditized at the point-solution level. Aidoc’s “aiOS + multi‑triage bundle” is a direct bet on that wedge.

About Marketstrat

Marketstrat® is a market intelligence and GTM enablement firm focused on medtech, healthcare, and life sciences. Under the Markintel™ brand, Marketstrat delivers robust market intelligence and proprietary frameworks; through GrowthEngine advisory and tools, it helps clients turn insights into execution. Together, these capabilities support clients in converting evidence‑weighted insight into practical action across strategy, product, and commercial execution.

Marketstrat® and Markintel™ are trademarks of Marketstrat Inc. All other trademarks are the property of their respective owners.

Check out free Research and Insights and Analysis of Industry Events

Check out our collection of Markintel Horizon and Markintel Pulse research.

Check out details on our reports, World Market for AI in Medical Imaging and World Market for Oncology Imaging AI and other Pulse Reports in the Imaging space.