ONE BIG THING

Randomized, population-scale evidence now shows AI-supported mammography can reduce interval cancers while materially lowering radiologist reading workload, pushing imaging AI from “pilot productivity tool” to quality-and-capacity infrastructure for national screening programs.

KEY TAKEAWAYS

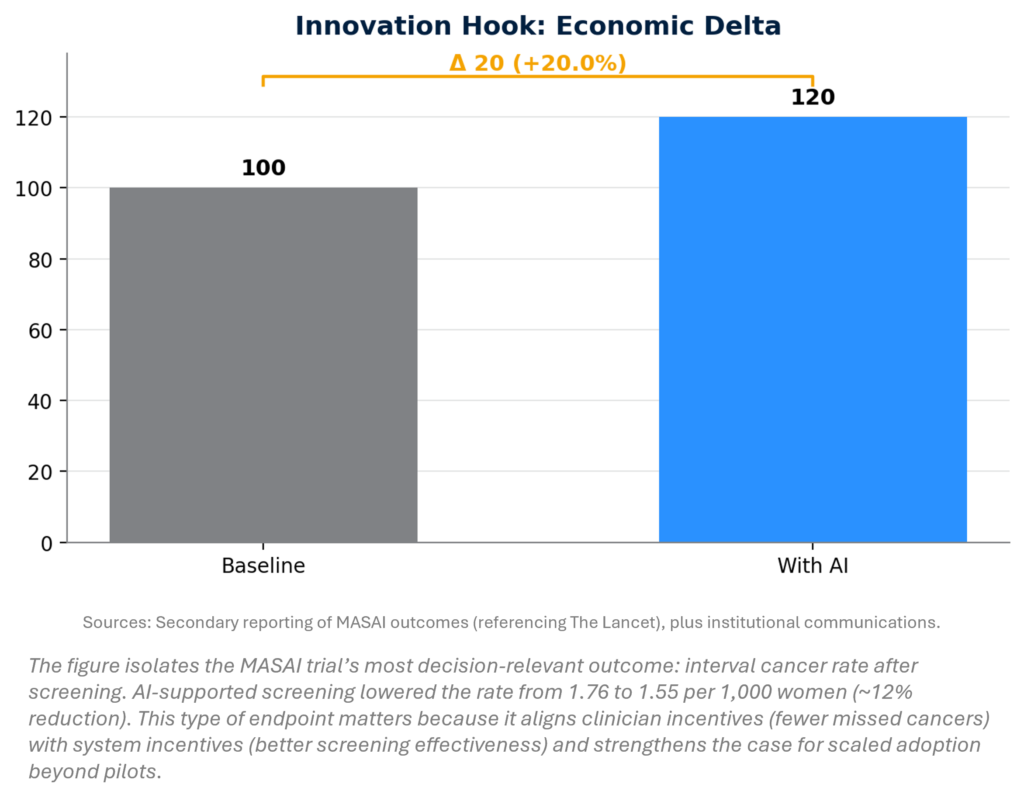

- Clinical proof finally clears the “outcomes bar” for imaging AI. The MASAI RCT reports a 12% lower interval cancer rate (1.55 vs 1.76 per 1,000) with AI-supported mammography—this is the type of endpoint that moves tenders, guidelines, and payer posture, not just pilots.

- Quantification + throughput are the new “must-win” imaging AI value pools. Two late-month clearances—AI noise reduction for SPECT/CT (scan-time reduction claims up to ~50%) and automated whole-body tumor burden analytics for PSMA PET/CT—signal continued shift from “detection-only AI” to “operational + measurement AI.”

- Reimbursement momentum is concentrating first where AI creates billable, defensible incremental value. Coronary plaque AI is benefitting from Category I CPT 75577 (effective Jan 1, 2026), plus expanding commercial payer coverage—an important template for what “billable AI” looks like in imaging.

- Scale buyers are increasingly multi-site networks (not single departments). A large enterprise rollout of chest X-ray AI by a major hospital network in India underscores that the commercial battlefield is moving toward fleet deployment, standardization, and governance.

- Capital discipline + consolidation continue underneath the innovation cycle. The week featured a take-private proposal in aesthetics medtech and a contract manufacturing consolidation move—signals of sponsor appetite to buy “cyclically discounted” growth assets and strengthen supply-chain control.

MARKETSTRAT POV (ACTIONABLE STRATEGY)

- Treat outcomes-grade evidence as a contracting weapon. MASAI-style endpoints (interval cancers) will increasingly drive tender scoring and adoption; vendors without outcomes evidence risk being priced as commodity workflow utilities.

- Follow reimbursement “pinch points.” CPT 75577 shows how imaging AI becomes commercially durable: code clarity + payer coverage + workflow integration. Expect the next winners to cluster where billing pathways are explicit.

- Quantification AI is the bridge between imaging and pharma economics. Tumor burden tools in PET/SPECT are strategically positioned for theranostics and trials—areas where standardization and measurement can be monetized through enterprise and sponsor channels.

- Platformization is accelerating—but governance is the gating constraint. Developer ecosystems (ultrasound APIs) and enterprise deployments increase velocity, but they raise the bar on cybersecurity, validation, and lifecycle management.

INNOVATION HOOK

Outcomes-grade screening AI becomes a capacity lever, not just a detection tool

This week’s inflection is that breast screening AI is no longer anchored solely to detection uplift—it is now tied to population outcomes. MASAI reports a ~12% lower interval cancer rate (1.55 vs 1.76 per 1,000), implying ~21 fewer interval cancers per 100,000 screened and an implied NNT of ~4,800 women screened to avert one interval cancer over follow-up (directionally). For procurement, this reframes AI as a quality KPI and a workforce relief valve.

MARKET LENS

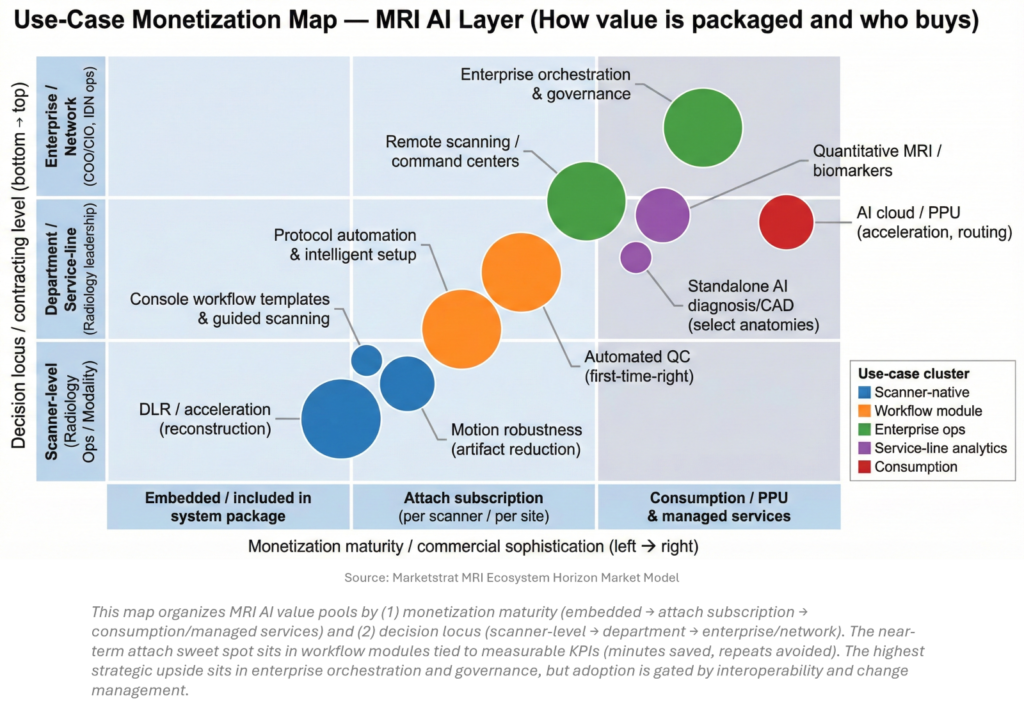

Marketstrat’s baseline frames AI-in-imaging as a large, expanding value pool (AI-in-imaging TAM $28.4B by 2032E). Within MRI, the key commercial question is not whether AI works—it’s where AI value is packaged and who signs the contract. The MRI AI layer is increasingly bifurcating: scanner-native “hygiene AI” becomes table-stakes, while attach and enterprise layers (QC, remote ops, orchestration) carry the cleaner monetization levers.

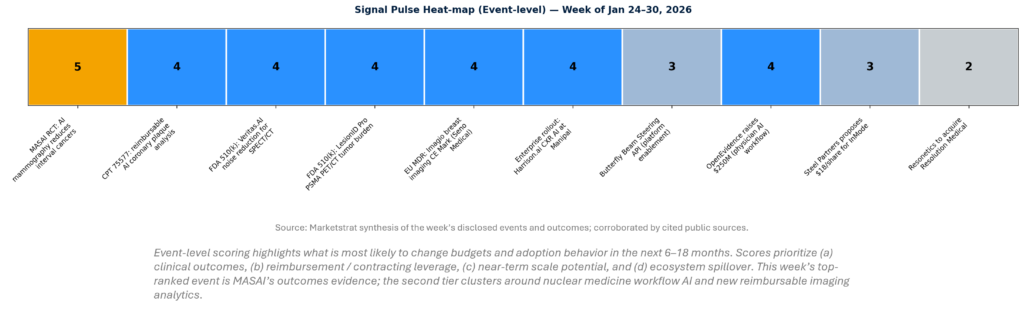

SIGNAL DASHBOARD

This week’s signal is concentrated in three places: (1) outcomes-grade evidence in screening AI (hardest proof to generate), (2) accelerating “quant + throughput” regulatory wins in nuclear medicine and oncologic imaging, and (3) reimbursement scaffolding for AI plaque analysis that can translate into repeatable commercial models. Noise remains highest where platform claims outpace governance—especially in developer ecosystems and broad clinical “copilot” positioning without mature accountability structures.

SIGNAL PULSE HEATMAP – JAN 24-30, 2026

SIGNAL-TO-NOISE RADAR BY TOPIC – JAN 24-30, 2026

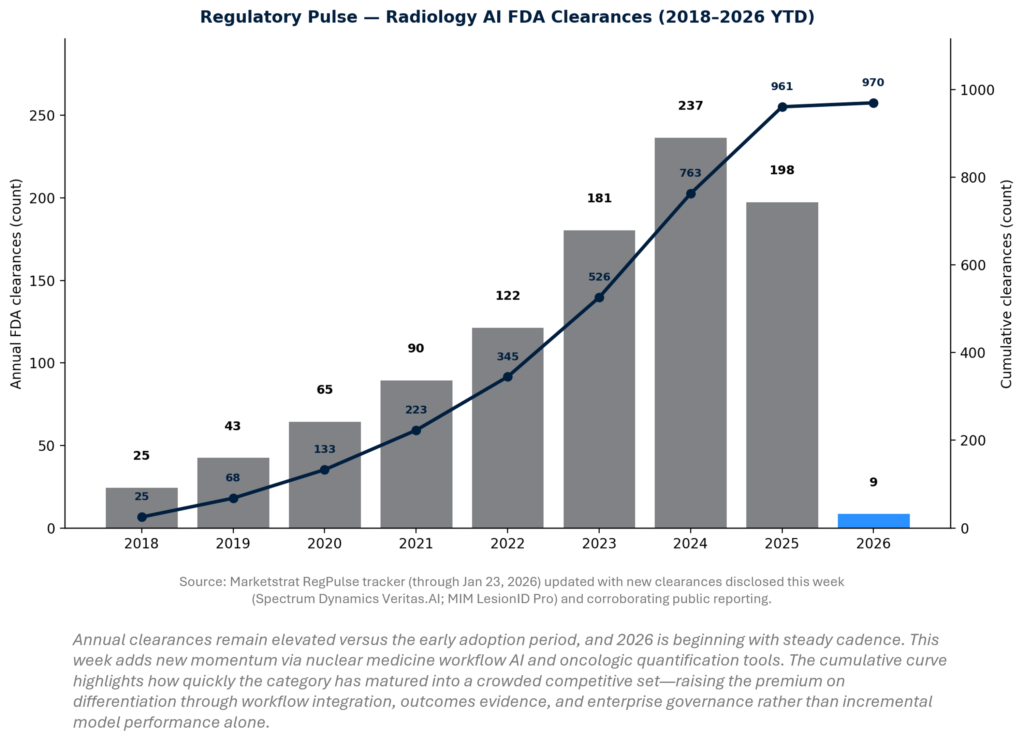

REGULATORY PULSE

Radiology AI clearances remain one of the best “leading indicators” for how fast imaging AI is being industrialized. The last two years show high absolute volumes, but the more important shift is qualitative: more workflow-centric and multi-condition solutions, and more quantification tools tied to downstream economic endpoints. For 2026, early-year YTD tracking matters because it sets investor expectations and signals whether the FDA pipeline pace is sustaining post-2024/2025 peaks.

QUICK-GLANCE TABLE

| Date | Headline | Our Take | Source |

| Jan 29–30, 2026 | MASAI RCT: AI-supported mammography reduces interval cancer rate | The strongest “procurement-grade” evidence to date for screening AI: outcomes + capacity in one package | The Lancet (reported by secondary sources) (prnewswire.com) |

| Jan 29, 2026 | Spectrum Dynamics: Veritas.AI Noise Reduction cleared (SPECT/CT) | Throughput-driven AI is landing in nuclear medicine; expect attach/subscription + fleet economics focus | PR Newswire (prnewswire.com) |

| Jan 29, 2026 | MIM Software: LesionID Pro cleared for PSMA PET/CT tumor burden | “Quant AI” strengthens theranostics workflows; creates pathway to standardized response metrics across sites | AuntMinnie.com (AuntMinnie) |

| Jan 27, 2026 | Circle Cardiovascular Imaging: cvi42 v6.4 + CPT 75577 tailwind | Clear reimbursement scaffolding for AI plaque quant could unlock a repeatable imaging-AI business model | GlobeNewswire (GlobeNewswire) |

| Jan 26, 2026 | Seno Medical: Imagio Model 9100 EU MDR CE Mark | EU MDR clearance is itself a market signal; adds credible non-mammo modality option in breast imaging | Company press release |

| Jan 28, 2026 | Manipal Hospitals deploys Harrison.ai CXR AI across radiology | Proof point that “enterprise AI” is now a network standardization purchase, not a departmental experiment | Company news (Harrison.ai) |

| Jan 27, 2026 | Butterfly Network launches Beam Steering API (developer enablement) | The ultrasound AI ecosystem is being “platformized” via APIs—good for innovation, hard for governance | Company press release (Butterfly Network) |

| Jan 28, 2026 | Steel Partners Holdings proposes $18/share for majority of InMode | Sponsor logic: buy depressed growth asset, reset capital allocation, rationalize product/geo focus | Business Wire (Business Wire) |

| Jan 27, 2026 | Resonetics to acquire Resolution Medical | CDMO consolidation for complex Class II/III device scale; strengthens vertical integration for OEMs | Company press release (MedTech Innovation) |

| Jan 21, 2026 (late-breaking) | OpenEvidence raises $250M at $12B valuation | “Physician workflow AI” is scaling fast; sets competitive bar for evidence + trust + distribution | (Business Wire) |

DEEPER DIVES

Regulatory Approvals & Clearances

Regulatory actions this week reinforce a clear pattern: imaging AI is moving beyond one-off CAD into workflow performance (scan-time, image quality, repeat reduction) and quantification (tumor burden, standardized metrics). This matters because throughput and measurement are easier to tie to economic proof and multi-site contracting than “diagnosis-only AI.” In parallel, EU MDR clearance remains a meaningful barrier; clearing it is itself a competitive signal for smaller innovators.

- Jan 29 — Spectrum Dynamics: Veritas.AI Noise Reduction, FDA 510(k).

What happened: Clearance for an AI noise-reduction solution supporting SPECT/CT, positioned around improving image quality and enabling scan-time reduction claims (up to ~50% cited in disclosures).

Why it matters: Nuclear medicine is capacity-constrained and increasingly oncology-driven; throughput AI has a clearer line to ROI than many diagnostic AI tools. This is also a “scanner-adjacent” wedge that can later expand into fleet and enterprise standardization.

Stakeholder impact:- Providers: potential patient throughput lift and fewer repeats.

- Technologists: workflow simplification and more consistent quality.

- Payers: will look for evidence that quality gains don’t drive overutilization.

- Vendors/OEMs: strengthens attach-module / service revenue posture.

- Jan 29 — MIM Software: LesionID Pro, FDA 510(k) (PSMA PET/CT + SPECT/CT tumor burden).

What happened: Clearance for automated whole-body tumor burden analysis targeted to prostate cancer imaging (PSMA PET/CT) with extension to SPECT/CT workflows.

Why it matters: Theranostics and oncology imaging are structurally shifting toward quantitative endpoints (response assessment, eligibility, progression tracking). Tools that standardize measurement across sites reduce variability—an adoption driver for networks and trials.

Stakeholder impact:- Clinicians: faster, more consistent tumor burden assessment.

- Sponsors/CROs: potential standardization across multi-site trials.

- Providers: a credible “service-line analytics” attach opportunity.

- Jan 26 — Seno Medical: Imagio Model 9100, EU MDR CE Mark.

What happened: EU MDR CE Mark for an opto-acoustic + ultrasound breast imaging platform (Imagio).

Why it matters: EU MDR has become a gating constraint; clearance can act as a commercial signal that the regulatory “time-to-revenue” hurdle was crossed. In breast imaging, differentiated modalities can matter most where they reduce unnecessary biopsies or complement dense-breast pathways.

Stakeholder impact: EU providers get more modality options; incumbents face incremental competitive pressure in breast diagnostic pathways.

Funding / Capital Markets

Capital is concentrating in two “distribution-rich” AI categories: clinician workflow copilots and platform-like enterprise infrastructure. The market is rewarding companies that can claim (1) embedded usage at scale and (2) content/licensing legitimacy that reduces hallucination risk. For imaging AI vendors, the message is indirect but important: value is shifting from stand-alone algorithms toward distribution, governance, and measurable workflow integration—traits capital will increasingly demand.

- Jan 21 (late-breaking) — OpenEvidence raises $250M Series D at $12B valuation.

What happened: Funding round led by Thrive and DST (per disclosures), with adoption claims including daily use by >40% of U.S. physicians, ~10,000 hospitals/medical centers, and ~18M consultations in Dec 2025.

Why it matters: This is a “trust + distribution” valuation—positioned around citation-linked medical literature synthesis and publisher partnerships. It increases competitive pressure on every clinical AI vendor to show real utilization and governance, not just model performance.

Stakeholder impact:- Clinicians: faster evidence retrieval; governance remains key.

- Health systems: raises expectations for auditability and citations.

- Investors: reinforces premium for scaled adoption and defensible data rights.

M&A, Strategic Partnerships, and Ecosystem Moves

M&A activity this week is less about “new tech” and more about repositioning—private capital targeting cyclical dislocations and industrial players strengthening their build-and-buy platforms. For imaging AI, the implication is second-order but real: consolidation in medtech and manufacturing tends to increase preference for standardized, vendor-managed platforms (fewer point solutions), and can accelerate attach-rate strategies where AI becomes a bundle lever rather than a standalone product.

- Jan 28 — Steel Partners proposes $18/share for 51% of InMode.

What happened: Public letter discloses an $18/share proposal for majority ownership, framed as a premium to unaffected price and a reset of capital allocation.

Why it matters: Illustrates sponsor appetite for medtech assets where growth expectations and public multiples have compressed—often leading to operating model changes, SKU rationalization, and tighter ROI discipline in R&D.

Ecosystem impact: Competitors may face a more cost-disciplined, margin-focused rival if a transaction proceeds.

- Jan 27 — Resonetics to acquire Resolution Medical.

What happened: Agreement to acquire a complex device design/manufacturing partner, expanding capabilities in neuromodulation and structural heart; close expected in 2026 subject to approvals.

Why it matters: OEMs increasingly outsource complex subsystems; integrated CDMOs can compress time-to-market and improve quality-system consistency—especially under tighter regulatory regimes.

Stakeholder impact: Device OEMs gain broader end-to-end capability options; smaller suppliers face scale pressure.

Digital Health, Imaging IT, and AI Workflow Infrastructure

This week’s digital stack developments reinforce a platform thesis: value is increasingly captured by companies that (1) integrate into clinical workflow (reading/reporting), (2) enable new applications through developer ecosystems, or (3) sit at reimbursement “pinch points” where analytics become billable. The market is moving from “AI app shopping” to “AI operating layers,” with governance and interoperability as the primary adoption gates.

- Jan 27 — Circle CVI cvi42 v6.4 + reimbursement tailwind (CPT 75577).

What happened: Product updates and communications emphasize that AI-enabled coronary plaque analysis is now supported by permanent Category I CPT 75577 (effective Jan 1, 2026), replacing Category III codes, with expanding payer coverage.

Why it matters: This is what “commercial-grade imaging AI” looks like: a specific code, clear billing pathway, and payer adoption. Elucid cites national average payment levels (~$1,012 in imaging centers/physician offices; OPPS ~$951 in hospital outpatient settings).

Stakeholder impact:- Providers: incremental revenue line + justification for deployment.

- Payers: will monitor utilization and appropriateness.

- Vendors: strengthens attach subscription economics vs per-study ambiguity.

- Jan 27 — Butterfly Network Beam Steering API (developer enablement).

What happened: API that enables developers to implement beam steering/off-axis imaging on next-gen ultrasound hardware (company cites up to ~20° off-axis beam tilt), with availability targeted for 1H 2026.

Why it matters: This is a classic platform play—expanding third-party innovation velocity. The tradeoff is governance: more apps means more variability in validation, cybersecurity, and clinical accountability.

Ecosystem impact: Increases pressure on procurement to formalize AI governance and app lifecycle controls (especially in point-of-care settings).

- Jan 28 — Manipal Hospitals rolls out Harrison.ai chest X-ray AI + reporting.

What happened: Enterprise adoption of chest X-ray AI across a large hospital network’s radiology practice; disclosures reference broad finding coverage and reporting workflow integration.

Why it matters: Network-wide AI deployment is a leading indicator that buyers are migrating from “department-level ROI” to “enterprise standardization.” It also signals that growth is global and not limited to U.S. reimbursement pathways.

Stakeholder impact: Radiologists gain throughput support; network leadership gains standardization; vendors gain a case study for fleet contracting.

Clinical Research & Evidence

The clinical bar for imaging AI is rising: performance metrics alone are increasingly insufficient; stakeholders want evidence that AI changes outcomes or system capacity safely. MASAI matters because it links AI to an outcomes endpoint (interval cancer) while also addressing the workforce bottleneck. This combination is rare—and it’s exactly what payers and national programs can operationalize into policy, tender scoring, and standard-of-care debates.

- Jan 29–30 — MASAI final results (AI-supported mammography).

What happened: Final reported outcomes include interval cancer rate reduction (1.55 vs 1.76 per 1,000 women) consistent with ~12% relative reduction.

Why it matters: “Interval cancer” is a screening quality KPI. An AI-driven reduction can support broader policy adoption, particularly in settings where double reading is capacity-constrained.

Controversies / gating: Programs will still require localized calibration, medicolegal clarity, and monitoring for false positives/overdiagnosis dynamics—especially in diverse populations and varying prevalence environments.

Company Updates & Earnings-Relevant Signals

Even when earnings aren’t the headline, corporate actions reveal where management teams believe sustainable profit pools are forming. In imaging, the biggest corporate meta-theme remains “bundle + platform”: companies that can attach AI to installed base renewal cycles and service-line analytics are better positioned than standalone algorithm vendors. Meanwhile, pending take-private processes can freeze near-term guidance and shift investment pacing—important for channel partners and competitors planning around tender cycles.

- Hologic take-private process watch (context update).

What happened: Pending acquisition by Blackstone and TPG at up to $79/share (announced Oct 2025) continues toward expected 1H 2026 close, subject to approvals. Separate reporting highlights litigation/disclosure dynamics.

Why it matters (imaging/AI): Hologic is core to breast imaging. Ownership transition can change R&D tempo, M&A appetite, and bundling strategy across mammography + AI ecosystems, influencing vendor partnerships and competitive intensity.

Sources & Methodology

- Proprietary Data: Marketstrat Frameworks, Data Models, and Regulatory Pulse Tracker (Data through Jan 23, 2026).

- Market Intelligence: Broker Research, Expert Transcripts, and Filings via AlphaSense.

- Trade Reporting: Reuters, ECRI, Amazon, Becker’s, Diagnostic Imaging, AuntMinnie, PR Newswire, and Brainomix.

- Analysis: Marketstrat Deep Research & Synthesis

About Marketstrat

Marketstrat® is a market intelligence and GTM enablement firm focused on medtech, healthcare, and life sciences. Under the Markintel™ brand, Marketstrat delivers robust market intelligence and proprietary frameworks; through GrowthEngine advisory and tools, it helps clients turn insights into execution. Together, these capabilities support clients in converting evidence‑weighted insight into practical action across strategy, product, and commercial execution.

Marketstrat® and Markintel™ are trademarks of Marketstrat Inc. All other trademarks are the property of their respective owners.

Check out free Research and Insights and Analysis of Industry Events

Check out our collection of Markintel Horizon and Markintel Pulse research.

Check out details on our reports, World Market for AI in Medical Imaging and World Market for Oncology Imaging AI and other Pulse Reports in the Imaging space.