Date: February 4, 2026 | Sector Lens: MRI + Embedded AI | Provider ops | Sustainability/TCO | Siting & infrastructure

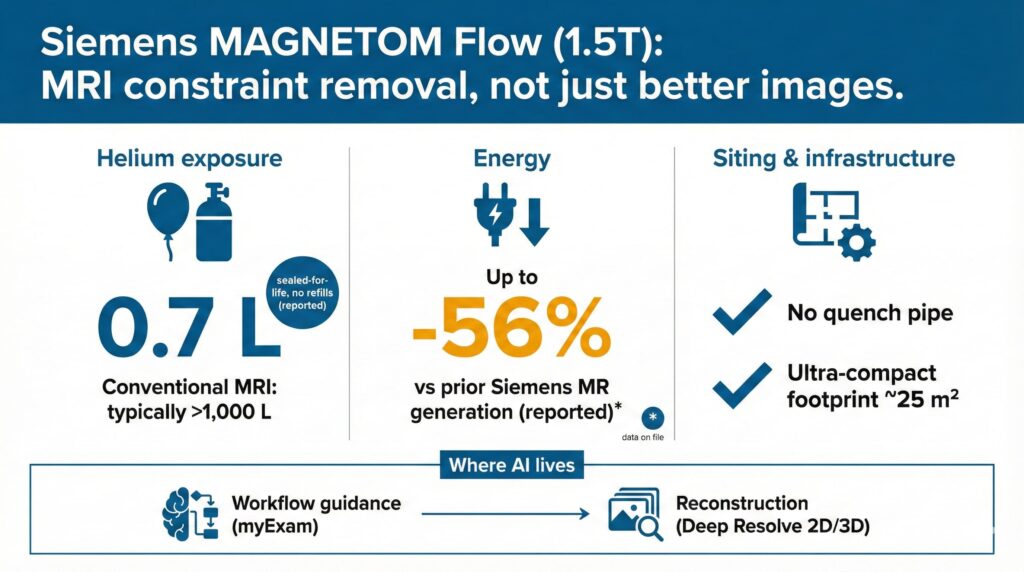

Siemens’ FDA-cleared 70cm MAGNETOM Flow platform signals an MRI procurement shift toward constraint removal—helium exposure, siting friction, and energy intensity—supported by embedded workflow and reconstruction AI. The strategic question for providers is not “better images,” but whether Flow measurably improves install speed, throughput, and TCO under real-world operating conditions.

Key Takeaways

- The signal: MAGNETOM Flow pushes MRI competition into resource constraints—0.7L helium, no quench pipe, and energy‑efficiency tooling—rather than the traditional “better images” messaging.

- Where value is captured: Value accrues in deployment economics (siting footprint, venting infrastructure, floorloading complexity) and operational economics (energy + uptime + standardization), supported by embedded AI (workflow + reconstruction).

- Stakeholder impact: Providers get a more viable path to add scanners in difficult sites; technologists gain workflow guidance/automation; patients benefit indirectly through capacity expansion and reduced delays.

- Competitive implication: MRI is moving toward platform procurement (hardware + AI + service/upgrades). “Helium/energy/siting” become procurement line items on par with clinical capability and service SLAs.

- What to watch: Siemens’ energy delta is “data on file” and the installation benefit will vary by local code/site; buyers should demand measured baselines, third‑party validation, and install playbooks to de-risk adoption.

Signal in one chart

Date/Event Snapshot

| Field | Detail |

|---|---|

| Event | FDA clearance announcement |

| Product | MAGNETOM Flow (70cm), 1.5T |

| Key claims | 0.7L helium; no quench pipe; energy reduction up to 56% (company-reported) |

| Geography | U.S. |

| Terms | Not disclosed (product event) |

Evidence Snapshot

| Evidence type | What it supports | Our confidence |

|---|---|---|

| Peer-reviewed | DL reconstruction can materially reduce scan time with maintained image quality in some settings | Medium (method-dependent; artifact governance needed) (OUP Academic) |

| Company-reported | Helium, energy, footprint, upgradeability | Medium-low until independently validated (Siemens Healthineers) |

Catalysts (next 6–18 months)

- Independent site-level ROI validation (energy metering + throughput distributions)

- Early installs in constrained siting environments

- Competitive counter-launches bundling sustainability + AI workflow

Risks

- Company “data on file” claims don’t generalize (energy/throughput)

- DL reconstruction confidence/artifact governance hurdles

- Local facility standards still impose safety infrastructure even without quench pipe

Sources: Siemens Healthineers; FDA Devices@FDA; USGS; select peer-reviewed literature.

About Marketstrat

Marketstrat® is a market intelligence and GTM enablement firm focused on medtech, healthcare, and life sciences. Under the Markintel™ brand, Marketstrat delivers robust market intelligence and proprietary frameworks; through GrowthEngine advisory and tools, it helps clients turn insights into execution. Together, these capabilities support clients in converting evidence‑weighted insight into practical action across strategy, product, and commercial execution.

Marketstrat® and Markintel™ are trademarks of Marketstrat Inc. All other trademarks are the property of their respective owners.

Check out free Research and Insights and Analysis of Industry Events

Check out our collection of Markintel Horizon and Markintel Pulse research.

Check out details on our reports, World Market for AI in Medical Imaging and World Market for Oncology Imaging AI and other Pulse Reports in the Imaging space.