ONE BIG THING

Imaging AI crossed a commercial Rubicon this week: reimbursement tightened (NGS draft noncoverage for brain MRI AI quantification) while “ROI telemetry” emerged as the winning sales language—AI is increasingly bought as measurable capacity-and-revenue infrastructure, not a standalone accuracy feature.

KEY TAKEAWAYS

- Reimbursement just became the gating constraint for neuro-AI. The NGS draft LCD proposing noncoverage for automated brain MRI AI quantification (0865T/0866T) is a high-signal warning: “FDA-cleared” no longer implies “commercially fundable.”

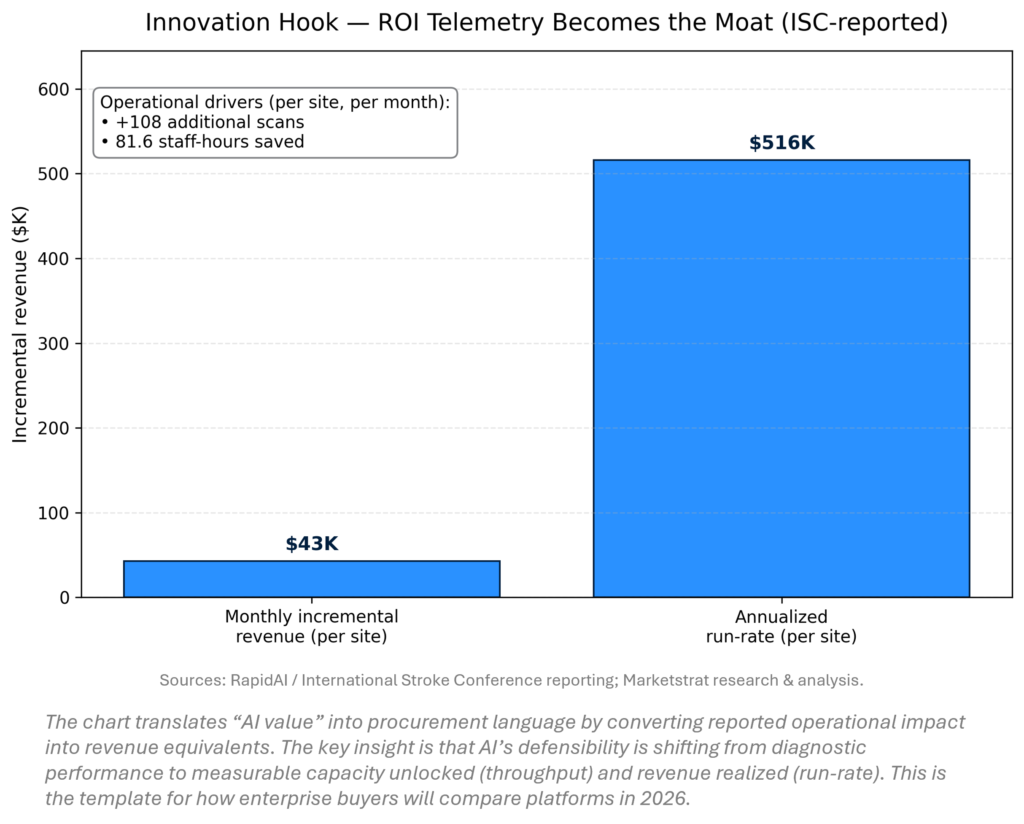

- The new moat is ROI telemetry, not ROC curves. RapidAI’s ISC-disclosed operational metrics (hours saved, incremental scans, incremental revenue) exemplify how AI now wins budget review: measurable throughput and revenue capture that survives renewal scrutiny.

- Vertical integration is accelerating in cardiology AI. Medtronic’s move to acquire CathWorks signals tighter coupling of AI decision support with cath lab hardware + data platforms—raising switching costs and pushing consolidation pressure onto independents.

- Regulatory flow continues—but the “Valley of Death” widens. Multiple FDA clearances (Neuro AI, lung nodule risk, breast workflow AI, synthetic 2D) add to momentum, yet coverage + integration remain the real conversion levers.

- OEM demand is resilient, but China is structurally resetting diagnostics economics. Siemens’ earnings (China diagnostics pressure) and GE’s upbeat imaging outlook reinforce a bifurcating global demand picture.

- Safety events are ecosystem events now. Abbott’s Libre recall underscores that connected device ecosystems (sensor + app + data flows) carry “software-speed expectations” but “device-grade liability.”

MARKETSTRAT POV (ACTIONABLE STRATEGY)

- Treat reimbursement readiness as a product feature. Build an “evidence ladder” that maps each algorithm to decision impact, downstream utilization, and payer logic. For neuro AI, align to therapy pathways (ARIA monitoring, trial endpoints) or measurable operations ROI.

- Instrument ROI telemetry by default. Buyers will increasingly demand real-world KPI dashboards (time saved, rescan reduction, throughput, revenue capture) and contractable outcomes. If you can’t measure it, you can’t renew it.

- Win the “pipes,” not just the model. The next durable advantage is distribution infrastructure: integration into PACS/RIS/enterprise workflows, cloud connectivity, monitoring, and governance. RadNet/DeepHealth is a blueprint.

- Assume global bifurcation persists. US/EU demand resilience plus China price reset means OEM strategy should shift from “China growth” to “margin protection + service excellence + software pull-through.”

INNOVATION HOOK

ROI telemetry becomes the moat”: imaging AI is increasingly sold on measurable capacity unlocked and revenue captured—not accuracy claims.

This week’s most actionable shift is the commercial interface for imaging AI: buyers are standardizing on KPIs that finance teams recognize (minutes saved, scans added, revenue captured, denials avoided). RapidAI’s ISC-reported productivity outcomes show how AI survives procurement and renewals when value is instrumented, auditable, and tied to operational throughput. The implication: vendors must ship measurement + governance, and providers must demand KPI‑linked contracts.

MARKET LENS

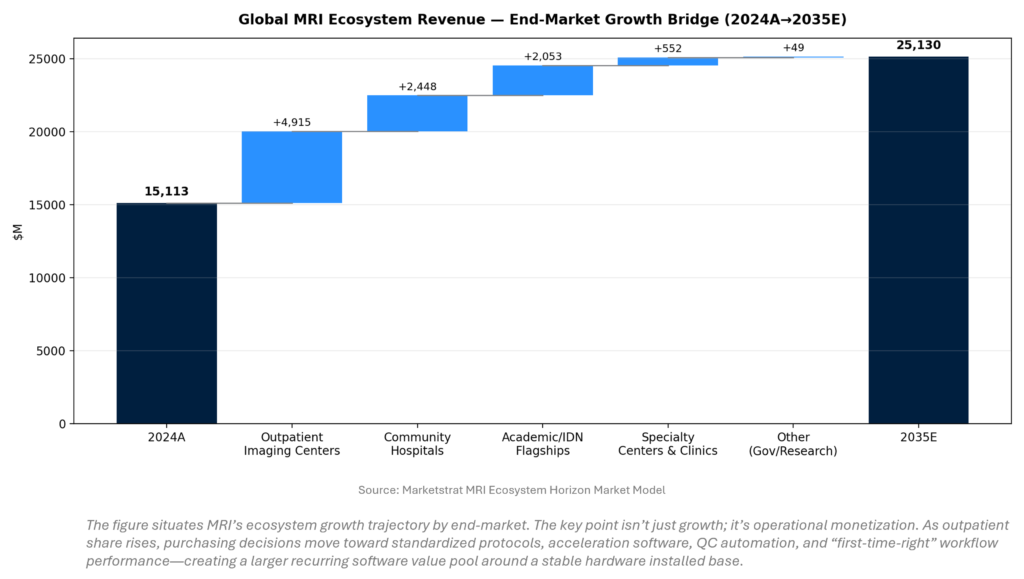

MRI ecosystem revenue growth is increasingly driven by where MRI runs as a high‑utilization operational asset. Marketstrat’s forecast expands the global MRI ecosystem from ~$15.1B (2024A) to ~$25.1B (2035E), with mix shifting toward outpatient imaging centers. The implication is commercial: outpatient operators value throughput governance (minutes per exam, repeats avoided), pushing OEMs and AI vendors toward productivity bundles and KPI-tied pricing.

Note: MRI ecosystem includes Systems (hardware) revenue; Service/aftermarket revenue (field service + service contracts; lifecycle economics); AI recurring software revenue (core) (subscriptions/attach—economically material workflow + reconstruction capabilities priced recurring).

SIGNAL DASHBOARD

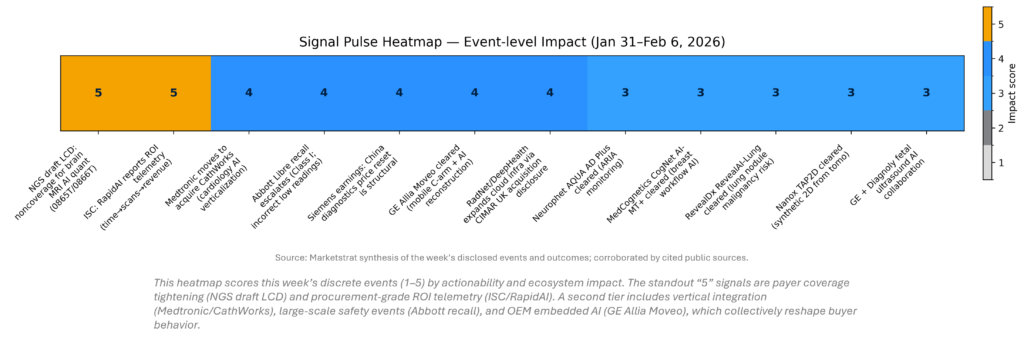

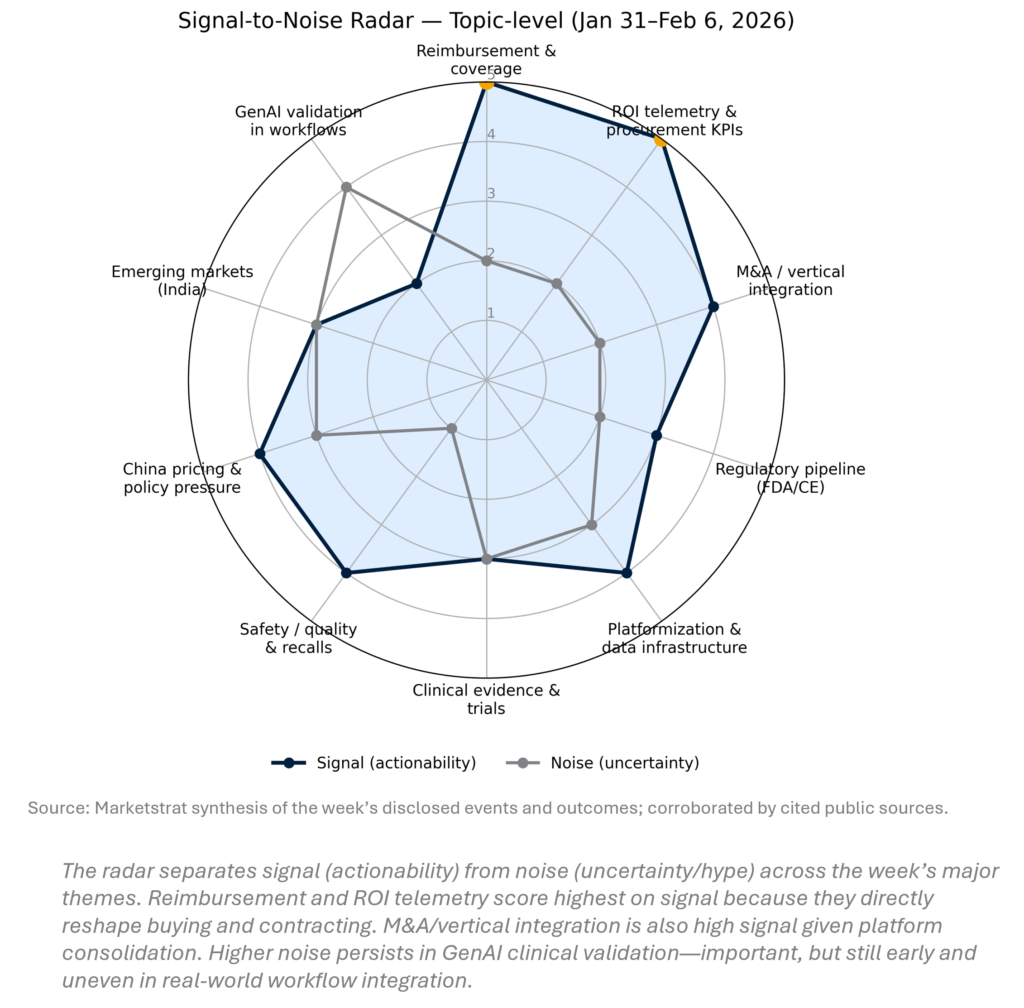

This week’s signal concentrates in two commercialization forces: (1) payers tightening coverage for “nice-to-have” quantification, and (2) buyers demanding KPI‑verified ROI. The heatmap ranks event-level impact (what to act on now). The radar then separates signal vs. noise at the topic level, highlighting where the market is settling into durable patterns (reimbursement, consolidation, ROI telemetry) versus areas that remain exploratory (GenAI validation in imaging workflows).

SIGNAL PULSE HEATMAP – JAN 31-Feb 6, 2026

SIGNAL-TO-NOISE RADAR BY TOPIC – JAN 31-Feb 6, 2026

REGULATORY PULSE

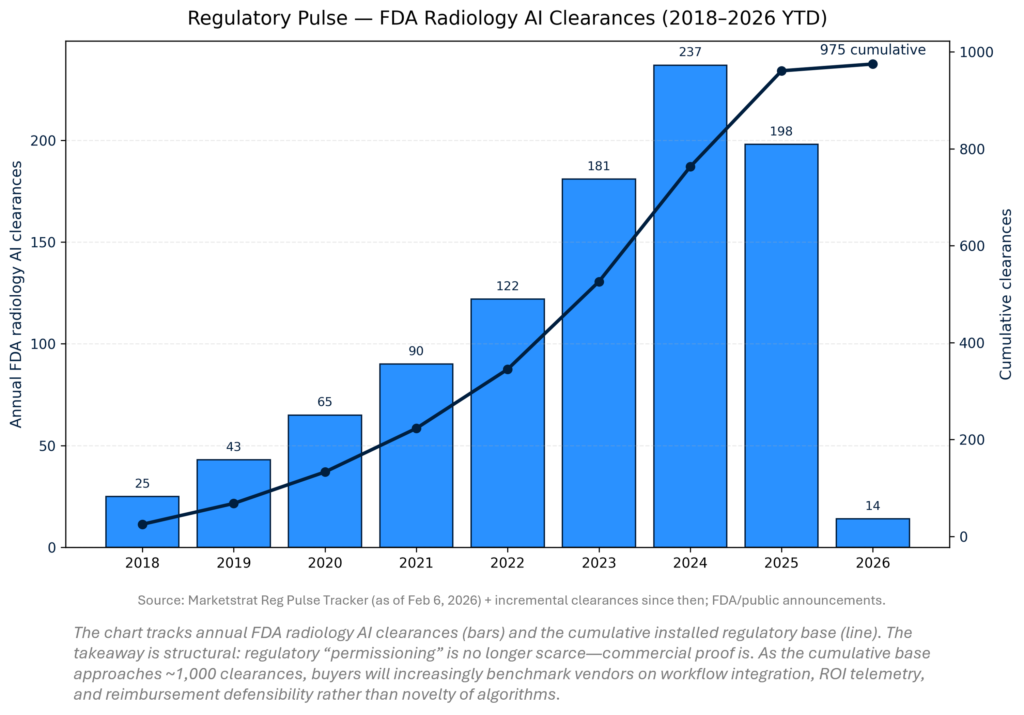

Radiology AI clearances continue at a high cadence, but the more important signal is commercial conversion. With 2025 already near ~200 FDA radiology AI clearances and 2026 tracking quickly early in the year, differentiation is shifting to reimbursement readiness, enterprise integration, and measurable operational value. This week’s clearances (neuro quantification, lung risk, breast workflow, synthetic 2D) add breadth—but the NGS LCD shows payment is the real funnel.

Companies that made news this week

Abbott; Brainomix; CathWorks; CIMAR UK; Diagnoly; FDA; GE HealthCare; MedCognetics; Medtronic; National Government Services (NGS); Nanox; Neurophet; RapidAI; RadNet/DeepHealth; RevealDx; Siemens Healthineers; (plus IRIA ecosystem: Fujifilm India, BPL Medical Technologies, 5C Network).

Sources & Methodology

- Proprietary Data: Marketstrat Frameworks, Data Models, and Regulatory Pulse Tracker (Data through Feb 6, 2026).

- Market Intelligence: Broker Research, Expert Transcripts, and Filings via AlphaSense.

- Trade Reporting

- Analysis: Marketstrat Research & Synthesis.

About Marketstrat

Marketstrat® is a market intelligence and GTM enablement firm committed to empowering clients in data-driven industries. Under the Markintel™ brand, it delivers robust market intelligence, while GrowthEngine solutions offer specialized GTM advisory and app-based tools—together fueling growth, innovation, and competitive advantage. For more information, visit www.marketstrat.com.

Marketstrat® is a registered trademark and Markintel™ is a pending trademark of Marketstrat.

Check out free Research and Insights and Analysis of Industry Events

Check out our collection of Markintel Horizon and Markintel Pulse research.

Check out details on our reports, World Market for AI in Medical Imaging World Market for Oncology Imaging AI and other Pulse Reports in the Imaging space.