Individual License: $4,950 | Team and Enterprise License Options Available

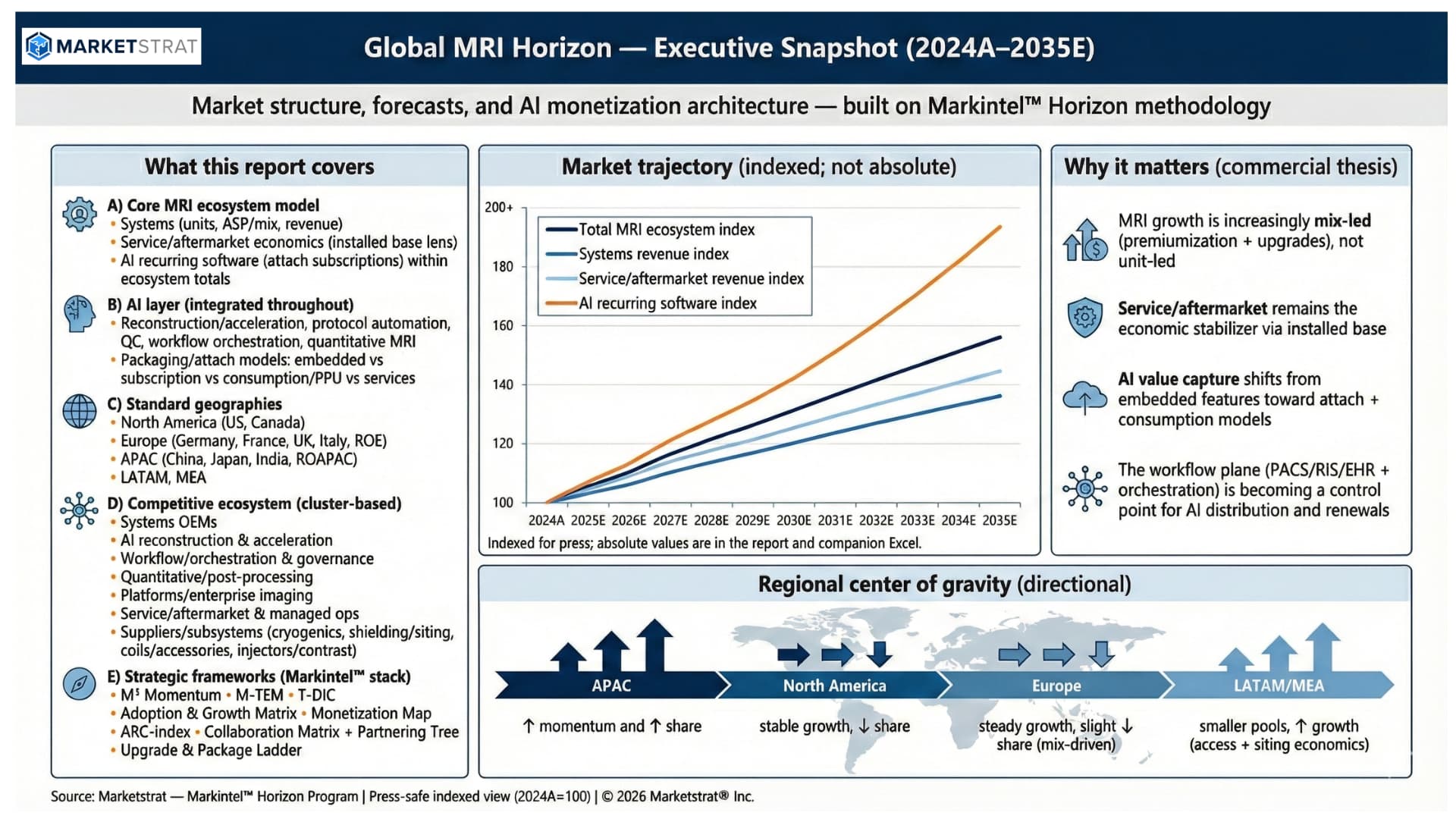

This Horizon report is Marketstrat’s in‑depth global analysis of the MRI market—built for MRI OEM executives, strategy and corporate development teams, services/aftermarket leaders, investors, provider procurement/operations, and AI/platform vendors adjacent to MRI.

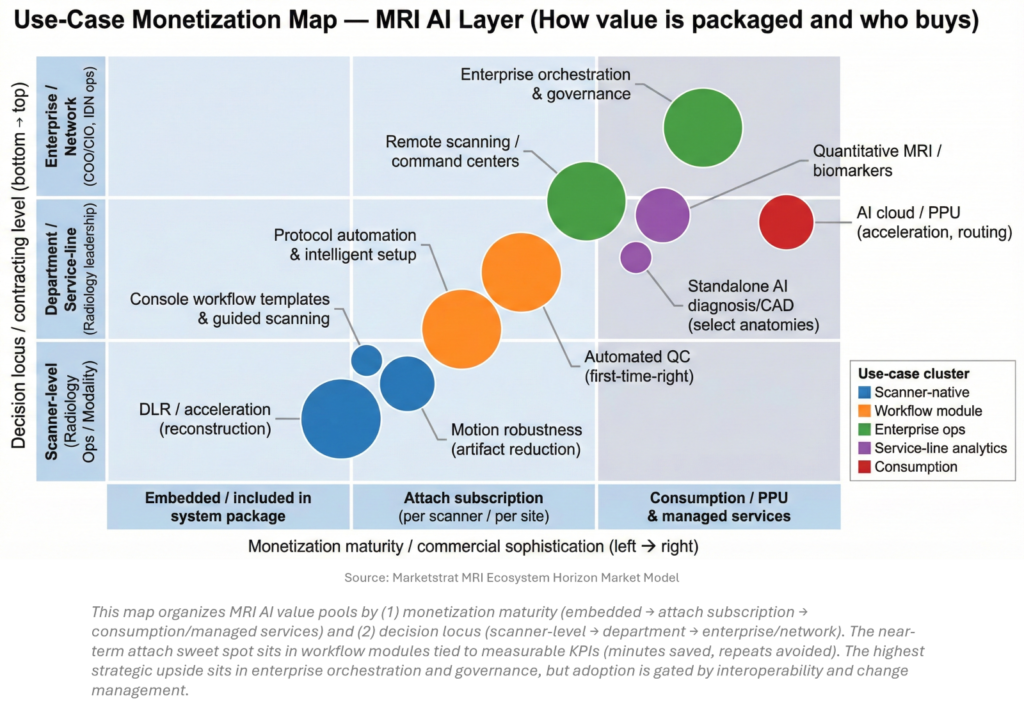

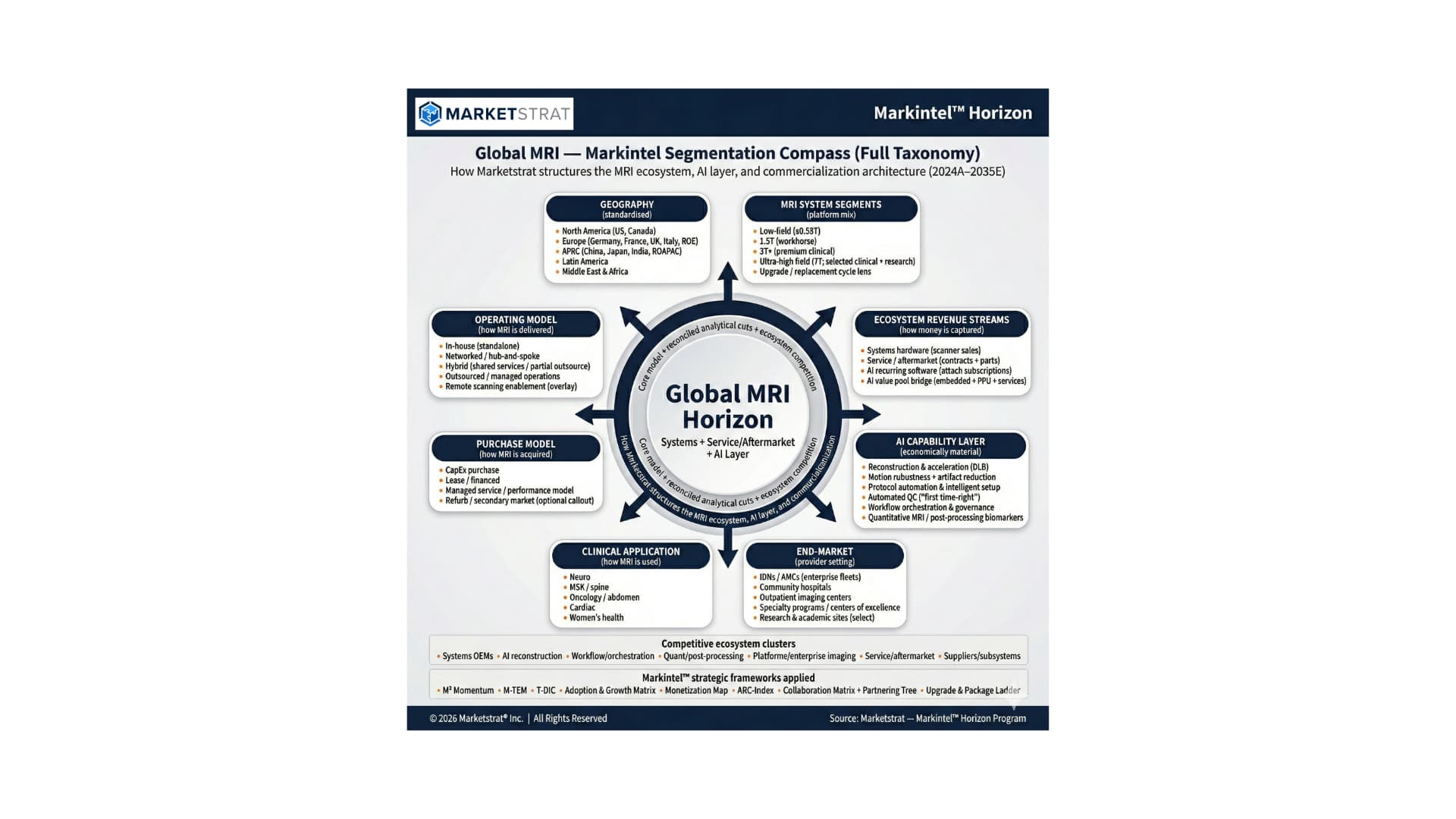

Unlike conventional MRI market reports that treat AI as an add‑on chapter, this report integrates AI as a first‑class economic and commercialization layer across system mix, upgrades, service/aftermarket economics, workflow, and enterprise contracting.

The goal is not just to describe the market—it is to explain where value is forming, how it is being monetized, and what commercial plays will matter most over the next decade.

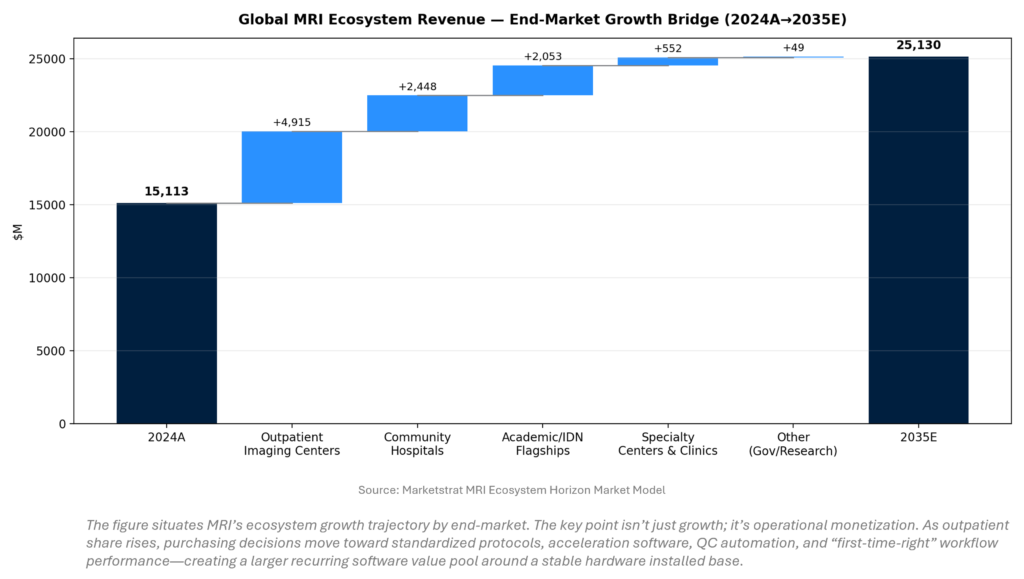

MRI remains one of the most strategically important imaging modalities because it sits at the intersection of high clinical value, complex operations, and long‑lived installed base economics. Over the horizon, MRI growth is increasingly mix‑led: premium tiers, upgrade cycles, software/AI packaging, and service lifecycle monetization drive value capture more than unit shipment growth.

A second structural shift is underway: MRI economics are becoming more explicitly tied to workflow plane control—protocol standardization, automation/QC (“first‑time‑right”), routing, and remote scanning enablement—rather than scanner performance alone. This is also where AI monetization shifts from embedded value to attach + enterprise + consumption models.

The report quantifies MRI across standardized geographies (North America, Europe, APAC, LATAM, MEA) with consistent country-level rollups and region narratives. Public content on this page is intentionally directional; detailed market tables, country views, and segment sizing are contained in the report and companion Excel deliverables.

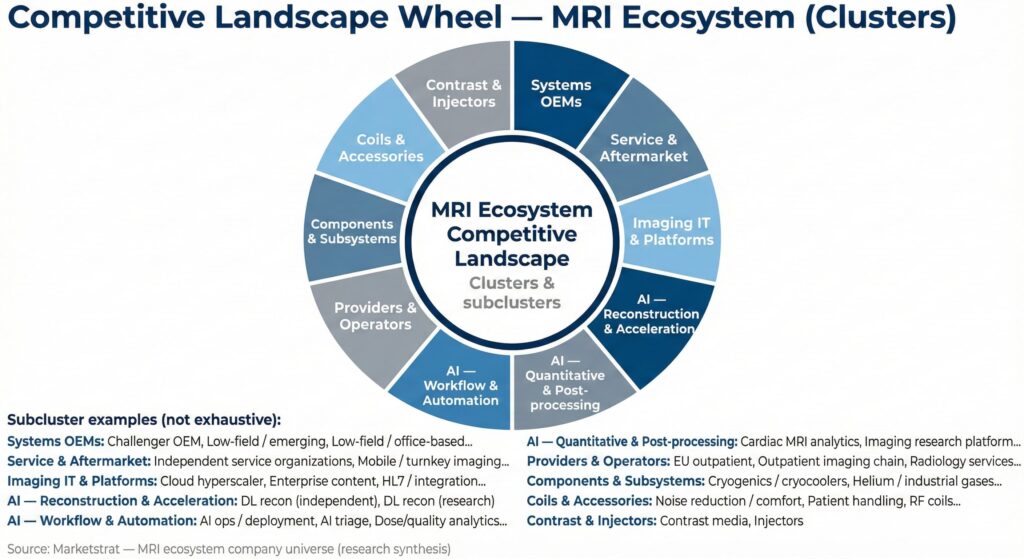

Marketstrat structures MRI competition into clusters to clarify where value is captured and who controls distribution:

Within clusters, the report applies Markintel frameworks and evidence‑weighted competitive datasets, plus concise company spotlights that explain:

Company Spotlights

Affidea; AGFA HealthCare; Aidoc; Air Liquide; Air Products; AIRS Medical; Alliance Medical; Amazon Web Services (AWS); Amuneal; Analog Devices; Avante Health Solutions; Bayer; Blackford Analysis; Block Imaging; Bracco; Bruker; Canon Medical Systems; Circle Cardiovascular Imaging; Cortechs.ai; Cryomech; EnvoyAI; Epic; Esaote; ETS-Lindgren; Flywheel; Fujifilm (Synapse); Fujifilm Healthcare (incl. Hitachi legacy); Furukawa Electric; GE HealthCare; Google Cloud; Guerbet; Hyland; Hyperfine; Icometrix; InHealth; Integrity Imaging; Intelerad; Japan Superconductor Technology (JASTEC); Kopp Development; LeanTaaS; Linde; Mach7 Technologies; MediGlobe; Medis Medical Imaging; Metrasens; Microsoft (Azure); Nemoto Kyorindo; Neusoft Medical; NORAS MRI products; Nuance (Microsoft); Oracle Cerner; Paramed Medical Systems; PartsSource; Perspectum; Philips; Philips (IntelliSpace); Pneumacoustics (Serene Sound); Pro Medicus (Visage); Promaxo; Quibim; Qure.ai; Qynapse; Radiology Partners; RadNet; RadNet (DeepHealth); RAPID Biomedical; Sectra; Shared Medical Services (SMS); Siemens Healthineers; Soma Tech Intl; Subtle Medical; Sumitomo Electric Industries; Sumitomo Heavy Industries (SHI); SyntheticMR; Texas Instruments; Time Medical; ulrich medical; United Imaging Healthcare; Vista.ai (Formerly HeartVista); Viz.ai; vRad (Virtual Radiologic); Wandong Medical.

The report is built on Marketstrat’s Markintel™ Horizon program, combining:

The framework stack is applied as an “insight-to-action engine,” including:

This report is designed for decision-makers with product, commercial, operational, or capital exposure to MRI, including:

Marketstrat® is a market intelligence and GTM enablement firm focused on medtech, healthcare, and life sciences. Under the Markintel™ brand, Marketstrat delivers robust market intelligence and proprietary frameworks; through GrowthEngine advisory and tools, it helps clients turn insights into execution. Together, these capabilities support clients in converting evidence‑weighted insight into practical action across strategy, product, and commercial execution.

Marketstrat® and Markintel™ are trademarks of Marketstrat Inc. All other trademarks are the property of their respective owners.

Check out free Research and Insights, Strategic Frameworks & Market Signals and Analysis of Industry Events

Check out our collection of Markintel Horizon and Markintel Pulse research.

Check out details on our reports, World Market for AI in Medical Imaging and World Market for Oncology Imaging AI and other Pulse Reports in the Imaging space.

Driving healthcare innovation through actionable intelligence, strategic execution, and transformative solutions for global impact and growth.