April 10, 2025

In a sudden escalation, the United States and China have each imposed massive tariffs on each other’s goods, with the US placing a temporary hold on further tariff increases for other countries. Specifically:

- U.S. Tariff on Chinese Imports: Now 125% – an unprecedented jump from earlier lower rates.

- China’s Tariff on U.S. Imports: Increased to 84% in retaliation.

- All Other Countries: A 90-day pause on any further escalations, with a baseline 10% tariff still in place for non-China imports to the U.S.

For medical imaging—where supply chains often rely on Chinese components or final assembly—this environment is a drastic departure from the historically open market. Despite these disruptions, adaptable businesses can still find pathways to success by reconfiguring supply chains, refining GTM strategies, and pursuing innovations to mitigate cost shocks and preserve market access.

This playbook provides:

- Before vs. After Tariffs – Contrasting the stable pre-2025 era with today’s crisis-level duties.

- Scenario-Based Planning – Three potential outcomes, updated with 125%/84% reality for China and 10% for other nations under a 90-day hold.

- Region-by-Region Perspective – Tailored strategies for the U.S., China, Europe, India, Japan, LATAM, and the Middle East under the new tariff rules.

- Stakeholder-Specific Tactics – Guidance for OEMs, AI startups, PACS vendors, hospital executives, and research institutions.

- Action Plan – A structured 12–18 month roadmap for reconfiguring supply chains, product portfolios, and commercial models.

Use this updated GTM plan to respond decisively, reduce tariff exposure, and maintain competitiveness in an era of sharply higher duties for U.S.-China trade—but only moderate (10%) for other markets.

1. The Tariff Context in Medical Imaging: Before vs. After

1.1 Before Tariffs (Pre-2025)

- Global Supply Chains Medical imaging manufacturers operated in a mostly frictionless environment. X-ray tubes, magnets, rare-earth elements, and other components moved freely with minimal or zero tariffs.

- China as a Growth Engine Many Western OEMs derived 10–15% of global imaging revenues from China. China’s dominance in rare-earth minerals (gadolinium, neodymium, tungsten) made it integral to MRI, CT, and X-ray production.

- Low-Cost Manufacturing Shifting assembly to China or other APAC regions reduced labor costs and supported competitive equipment pricing.

- Stable Capital Expenditures Hospitals replaced imaging modalities on predictable 7–10 year cycles, counting on stable equipment costs and supply continuity.

1.2 After Tariffs (Current State, April 2025)

- U.S.-China Tariff War

- U.S. Tariffs on China: 125% on virtually all imports, including imaging components and finished devices.

- China Tariffs on U.S.: 84% on all inbound U.S. goods, severely complicating OEMs that export to Chinese hospitals.

- Other Countries: 90-Day Hold & 10% Baseline

- The White House declared a 90-day pause on further escalations with allies. Non-China imports still face a 10% baseline duty (unchanged from earlier this year), but no immediate jump beyond that.

- Price Spikes & Supply Uncertainty

- Hospitals expecting mild 5–15% cost hikes must now grapple with 125% for any China-origin equipment in the U.S.

- Some are delaying capital upgrades or sourcing from non-China suppliers.

- Manufacturing Shifts

- OEMs are accelerating “nearshoring” to Mexico, India, Eastern Europe, or the Middle East for the U.S. or other major markets.

- However, reliance on Chinese rare earth exports remains a serious concern.

Implication: The U.S.-China tariff confrontation has escalated to near-prohibitive levels, upending supply chains. For other countries, a 10% baseline remains significant but is comparatively moderate, creating a two-tiered global trade environment in imaging.

2. Scenario-Based Planning

While the tariffs on U.S.-China trade are already at crisis levels (125% vs. 84%), the rest of the world sees only a 10% baseline. Companies should still plan around how these rates might evolve or be negotiated.

GTM Implication: The “Most Likely” scenario is that the 125% (U.S.) and 84% (China) remain for at least several months, while non-China trade stays at 10%. This demands immediate supply chain relocation for U.S. imports from China and a local-China strategy for continuing to sell into that market.

3. Regional Playbooks (Updated for 125%/84% and 10% Baseline)

3.1 United States

Key Issues:

- 125% Tariff on Chinese imaging systems/components is near-prohibitive.

- 10% baseline for non-China remains in effect.

- Hospitals delaying capital purchases or seeking alternative sourcing.

Recommended Actions:

- Local Assembly & Friend-Shoring: Move final assembly from China to Mexico or other “friendly” countries. Even with a 10% baseline, it’s far more viable than 125%.

- Flexible Financing: Help providers cope with cost spikes. Offer “pay-per-study” or operating leases with a multi-year lock.

- Supply Chain Overhaul: Identify all Chinese parts in your BOM. Rapidly qualify alternative suppliers in India, Southeast Asia, or the U.S. itself.

3.2 Rest of North America (Canada, Mexico)

Canada:

- Only 10% baseline on U.S. imports from Canada, minimal new friction.

- For Canadian hospitals, watch for any pass-through costs if parts originally from China.

Mexico:

- Expanding role as nearshoring assembly hub to circumvent 125%.

- JV or wholly owned assembly lines near the border drastically reduce landed costs for the U.S. market.

3.3 China

Key Issues:

- 84% Tariff on U.S. exports drastically raises prices.

- Potential local bias for domestic imaging OEMs.

- Rare earth restrictions hamper Western manufacturing if not locally sourced.

Recommended Actions:

- Local Production: If China is strategically vital (≥10% revenue), set up local plants or JVs to classify products as “China-made,” avoiding 84% inbound duties.

- AI Partnerships: Co-develop with Chinese tech companies to meet “buy local” preferences, especially in advanced imaging + AI solutions.

- Risk Mitigation: Stockpile rare earth materials if still feasible or cultivate relationships with non-Chinese suppliers for magnet metals.

3.4 Japan

- 10% baseline in the U.S. but was previously ~24% under older “reciprocal” plans; that’s currently on hold.

- Maintains a robust domestic imaging sector (Canon Medical, FujiFilm) with minimal direct reliance on China.

Tactics:

- Accelerate R&D on advanced modalities to differentiate from Chinese vendors.

- Consider partial relocation of sub-assemblies from China to ASEAN or home facilities to avoid 125% if shipping to the U.S.

3.5 India

- Typically 10% or less for U.S. imports and local manufacturing is encouraged.

- Government invests in rural diagnostics, large volume but cost-sensitive.

Tactics:

- Expand or establish Indian assembly for both domestic consumption and exports (at only 10% tariff to the U.S.).

- Partnerships with Indian hospital networks to push mid-tier imaging solutions at scale.

3.6 Europe (EU)

- The 90-day hold suggests minimal near-term escalation, so about 10% baseline to the U.S.

- Risk if U.S.-EU negotiations fail, but currently overshadowed by the U.S.-China conflict.

Tactics:

- Consider finishing final assembly in Eastern Europe for shipments to the U.S. at 10%.

- Long-term service contracts with EU hospital consortia to maintain stable demand despite currency or tariff fluctuations.

3.7 Latin America (LATAM, ex-Mexico)

- Brazil, Chile, Colombia: still see moderate (10%) duties on the U.S. side for now.

- If Chinese components are integral, watch for cost pass-through from 125% on upstream parts.

Tactics:

- Evaluate local assembly in Brazil if volumes justify it.

- Offer refurbished or cost-effective imaging lines to match budget constraints if input costs spike.

3.8 Middle East

- Typically reliant on imports from U.S., EU, or China, with a mix of trade deals.

- Saudi Arabia, UAE continuing large hospital investments, less price sensitive.

Tactics:

- Possibly route shipments from non-China production lines to avoid 125%.

- Explore JVs under local content rules (e.g., Saudi Vision 2030) for partial manufacturing.

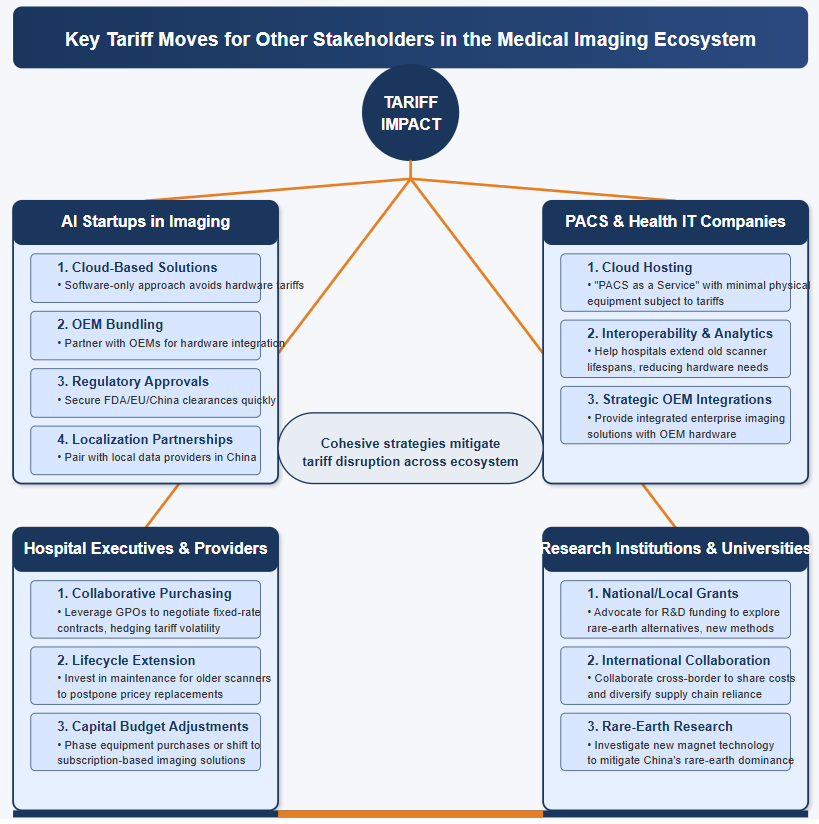

4. Other Stakeholder-Specific Approaches

4.1 OEMs (e.g., GE HealthCare, Siemens, Philips, Canon)

4.2 Other Stakeholder Groups in Medical Imaging Ecosystem

5. Action Plan Roadmap (12–18 Months, Updated for 125%/84% + 10%)

5.1 Immediate (0–3 Months)

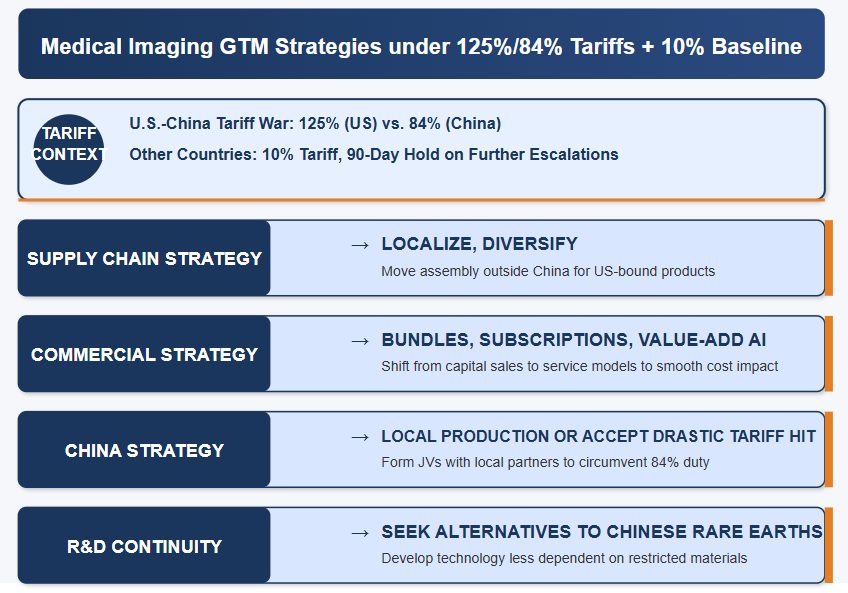

6. Imaging GTM Strategies Under Tariffs

7. Conclusion & Key Takeaways

- Severe U.S.-China Duties: At 125% from the U.S. and 84% from China, conventional cross-border imaging trade is nearly cost-prohibitive.

- 10% Baseline Elsewhere: Non-China imports face a more moderate tariff, with a 90-day pause on further increases—an opening to re-route supply chains and re-source components.

- Must-Do Localization: Immediate realignment of assembly to Mexico, India, or other low-tariff sites is paramount for U.S.-bound scanners.

- China Market Decision: Either localize fully to circumvent the 84% inbound duty or risk ceding share to domestic Chinese OEMs.

- Commercial/Financial Innovation: Hospitals face uncertainty; flexible leasing, pay-per-use models, and AI-driven solutions can mitigate some short-term shocks.

- Sustain R&D: Even under margin pressures, advanced imaging, rare-earth alternatives, and AI can define future competitive advantage.

Despite the stark escalation of tariffs between the U.S. and China, and a 10% baseline for others, medical imaging companies can pivot supply chains, adapt GTM tactics, and continue delivering essential imaging solutions worldwide.

Questions to Guide Your Next Steps

- Supply Chain: Which product lines face the biggest “China pinch,” and how fast can you relocate assembly?

- Pricing: Do you raise list prices, absorb partial costs, or adopt subscription-based approaches?

- Regulatory & Lobbying: Can you obtain partial exemptions for imaging (vital to public health)?

- China Market: Remain or partial exit? If remain, do you localize manufacturing?

- Rare Earth Risk: How will you secure stable supplies of MRI-critical materials outside China?

- Innovation Pipeline: Which R&D areas need protection or acceleration to maintain long-term growth?

About Marketstrat™

Marketstrat™ is a market intelligence and GTM enablement firm committed to empowering clients in data-driven industries. Under the Markintel™ brand, it delivers robust market intelligence, while GrowthEngine™ solutions offer specialized GTM advisory and app-based tools—together fueling growth, innovation, and competitive advantage. For more information, visit www.marketstrat.com.

Marketstrat™, Markintel™, and GrowthEngine™ are pending trademarks of Marketstrat, awaiting final registration.

- Check out our collection of Markintel Horizon and Markintel Pulse research.

- Check out free Research and Insights and Analysis of Industry Events