ONE BIG THING

Imaging AI’s “center of value” moved upstream this week—away from interpretation-only tools and toward acquisition automation + open foundation models that directly translate into throughput, staffing leverage, and faster access.

KEY TAKEAWAYS

- MRI capacity is becoming the economic battleground. Vista AI’s JPM-week momentum (Series B + provider-backed validation) points to acquisition automation as a faster ROI lever than another “incremental AUC gain.”

- Open-access clinical models are compressing the AI “prototype cycle.” Google’s MedGemma 1.5 and MedASR push the market toward commoditized model layers and differentiated distribution (workflow integration, governance, evidence, reimbursement).

- Strategic M&A is reaccelerating—buyers are paying for scale + adjacency. Boston Scientific’s agreement to acquire Penumbra highlights appetite for premium assets that expand growth vectors and cross-sell pathways.

- “Opportunistic screening” is moving from concept to cleared product. HeartLung’s AI-CVD clearance advances the thesis that routine CT can become a prevention platform—setting up new reimbursement and downstream utilization debates.

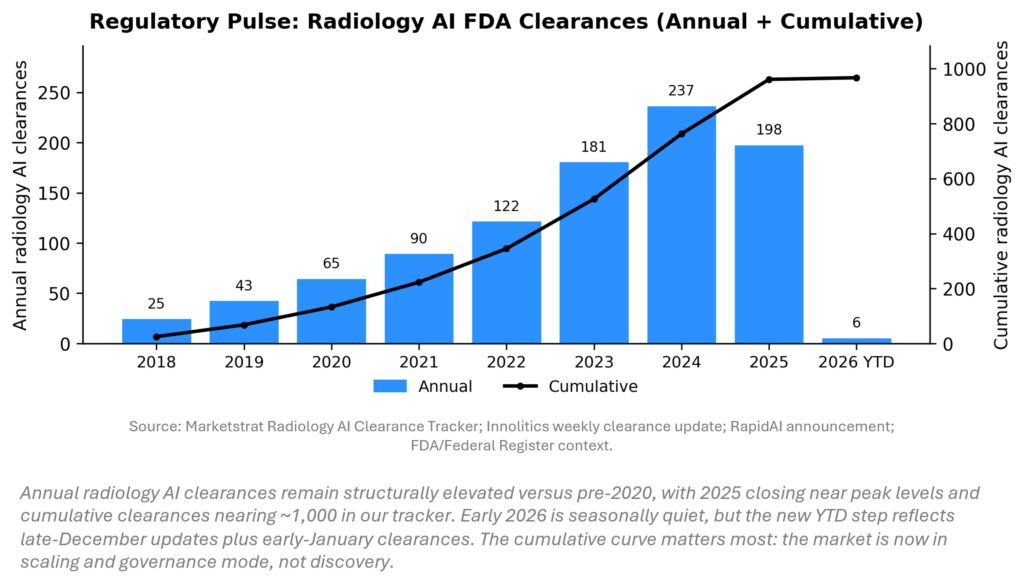

- Radiology AI governance, not discovery, is the new bottleneck. Late-2025 and early-2026 clearances keep the cumulative curve steep; FDA’s parallel exploration of alternative pathways for CAD updates signals pressure to reduce update friction.

- MRI supply-chain visibility is strengthening. Bruker’s ~$500M superconducting wire order book is a “quiet signal” supporting a multi-year MRI upgrade/expansion cycle (and more installed-base surface area for AI attach).

MARKETSTRAT POV (ACTIONABLE STRATEGY)

- AI vendors in imaging: Stop competing on “model performance alone.” Build defensible moats in distribution (OEM + enterprise stack integration), governance (monitoring, drift, audit), and economics (time-to-report, slots-added, staffing leverage). Open models accelerate commoditization.

- Imaging providers: Treat AI as capacity planning, not a departmental experiment. Your KPI set should be throughput (slots/day), backlog days, report TAT, and repeat-scan reduction—then structure contracts around those outcomes.

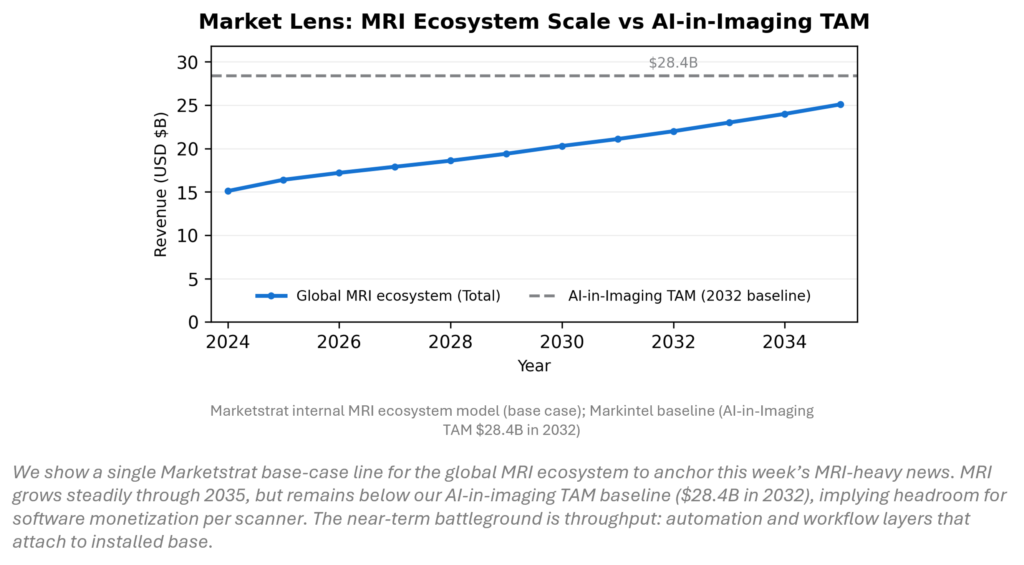

- OEMs and strategics: The next product wedge is acquisition automation + installed-base monetization. Magnet/gantry replacement cycles are slow; software and service layers can compound faster—especially if the supply chain supports steady system deployment.

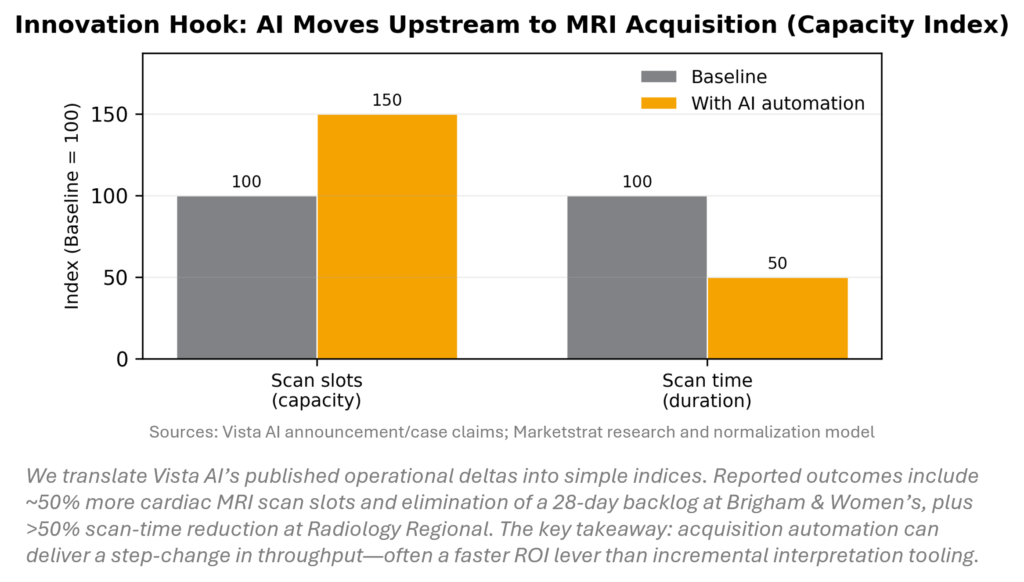

INNOVATION HOOK

MRI demand continues rising while technologist scarcity and protocol complexity cap throughput. This week’s Vista AI financing—backed by health systems—signals a shift from “AI pilot” to AI as scanner operating system. The differentiator is upstream automation (protocoling, planning, and remote scanning) that creates capacity without adding magnets or staff, compressing payback cycles and expanding advanced MRI access beyond top academic sites.

COMPANY SPOTLIGHT – VISTA.AI

The week’s strongest imaging-AI signal wasn’t “another algorithm” — it was AI being positioned as throughput infrastructure (i.e., selling capacity rather than selling detection). Vista AI sits squarely in that thesis, particularly for MRI where staffing, protocol complexity, and scanner utilization are persistent constraints.

What happened

Vista AI raised new funding (~$29.5M referenced in the research pack) to scale its AI-driven MRI acquisition / automation trajectory (positioned around accelerating deployment and product expansion).

What it means (our take)

- MRI’s “hidden bottleneck” is not magnet strength — it’s repeatability + labor. MRI is workflow-fragile: protocol selection, slice planning, coil setup, motion, and scan rework consume technologist time and reduce daily slots.

- Automation that standardizes acquisition steps converts directly into incremental scan capacity, which is the cleanest ROI narrative imaging buyers will accept in 2026 (especially under reimbursement pressure and technologist scarcity).

- Strategic wedge: MRI automation is a defensible entry point because it sits at the intersection of (1) OEM workflow, (2) site-level protocols, and (3) operational metrics. If Vista AI (or peers) becomes “embedded” in the acquisition layer, it becomes harder to displace than a post-processing algorithm.

Competitive context

- OEM-native automation (embedded in scanner platforms) will remain the default route for many IDNs; the opportunity for Vista AI is to win where sites want cross-fleet standardization and faster “time-to-value” than multi-year OEM upgrade cycles.

- Expect OEMs and large imaging platforms to increasingly bundle automation + enterprise imaging + AI (software pull-through for hardware, and vice versa).

What to watch (next 1–2 quarters)

- Proof of throughput: documented % improvement in scan slots/day or reduction in rescans (site-level case studies beat sensitivity metrics in today’s buyer environment).

- Indication/modality expansion: any move beyond initial MRI domains into higher-volume protocols (and how quickly it can be deployed without “specialist technologist” dependency).

- Commercial packaging: whether they price as (a) per-scanner SaaS, (b) per-study, or (c) enterprise license tied to guaranteed throughput metrics.

MARKET LENS

MRI is a durable equipment-and-services ecosystem with long replacement cycles, but growth is increasingly software‑pulled. Our base‑case model shows global MRI ecosystem revenue rising from ~$15.1B (2024) to ~$22.0B (2032) and ~$25.1B (2035). Against the AI‑in‑imaging TAM baseline ($28.4B in 2032), MRI looks underpenetrated for recurring software value capture—creating runway for automation, protocoling, and workflow orchestration to monetize the installed base.

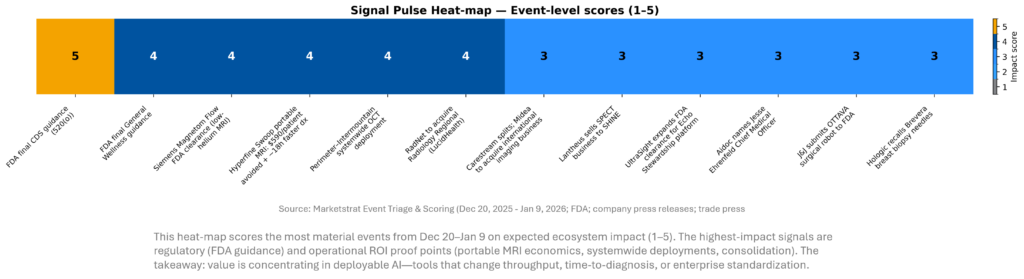

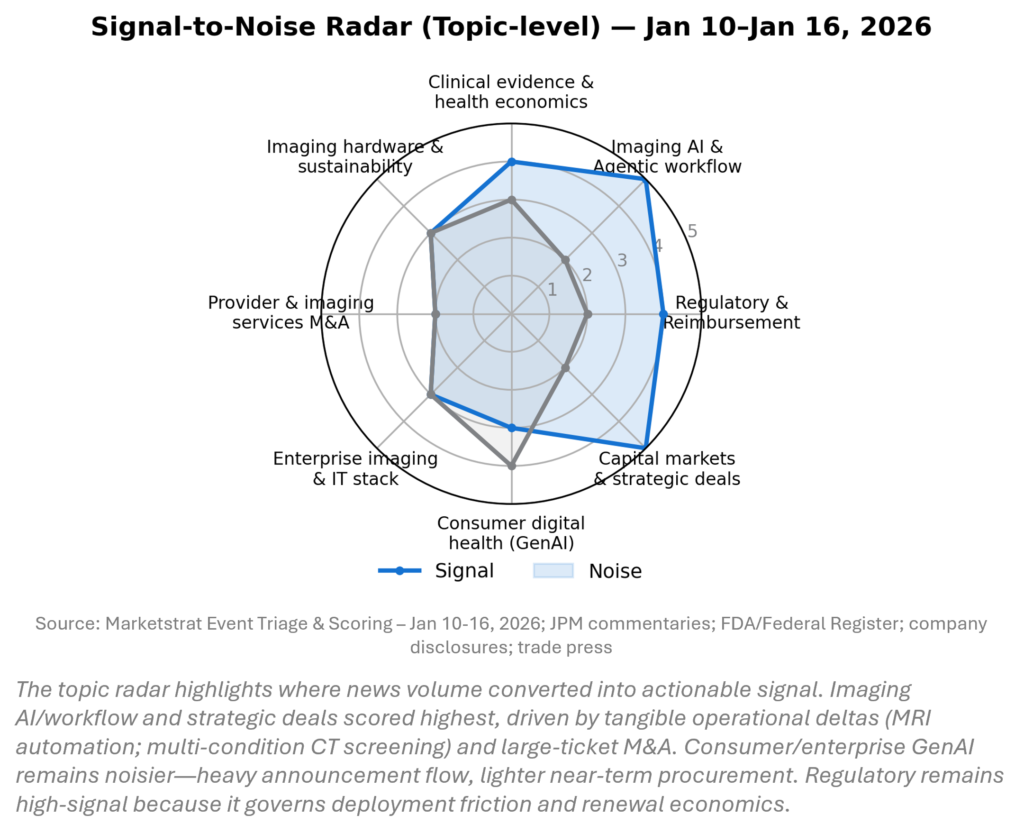

SIGNAL DASHBOARD

This week’s signal clusters around (1) AI as operating leverage (scanner automation, multimodal open models, platform portfolios) and (2) renewed strategic deal-making. The heat‑map scores discrete events by expected 12–24 month impact on competitive positioning and provider economics. The radar separates “actionable” movement (capacity, governance, reimbursement) from high‑volume but low‑procurement hype. Net: infrastructure beats demos.

SIGNAL PULSE HEATMAP – JAN 10-16, 2026

SIGNAL-TO-NOISE RADAR BY TOPIC – JAN 10-16, 2026

REGULATORY PULSE

Radiology AI clearance velocity remains high, but the strategic question is lifecycle management: how quickly vendors can update models and maintain performance across sites. Two late‑December imaging AI clearances plus early‑January modules push our tracker forward into 2026, while FDA’s exploration of alternative pathways for CAD updates underscores pressure to reduce iteration friction. For providers, procurement is shifting toward governed platforms with monitoring, evidence generation, and reimbursement strategy.

QUICK-GLANCE TABLE

| Date | Headline | Our take |

| Jan 15 | Boston Scientific agrees to acquire Penumbra (~$14.5B) | Premium strategic deals are back; neurovascular scale + adjacency is compelling in a capacity-constrained stroke landscape. |

| Jan 14 | Vista AI raises $29.5M Series B (MRI automation) | Providers are underwriting “AI as MRI operating system.” The ROI conversation is shifting from reads to scanner throughput. |

| Jan 14 | Google releases MedGemma 1.5 + MedASR (open access) | Open models pressure point solutions; winners differentiate on workflow, compliance, and evidence at scale. |

| Jan 12–13 | HeartLung AI‑CVD receives FDA clearance | “Incidental findings” becomes “incidental prevention”—expect payer scrutiny + new care pathways. |

| Jan 16 | Elekta receives FDA 510(k) for Evo CT‑Linac | Imaging + adaptive RT integration accelerates; U.S. entry matters for share recovery and modernization cycles. |

| Jan 15 | VizMark VM1 tumor marker gets FDA 510(k) | Small device, big workflow value: artifact reduction + better longitudinal imaging consistency (breast pathways). |

| Jan 14 | iSono launches ATUSA wearable automated breast ultrasound | Wearable + automation aims to expand access and standardize ABUS—watch reimbursement + site-of-care adoption. |

| Jan 13 | Anthropic launches Claude for Healthcare | Enterprise GenAI is moving into regulated workflow; imaging vendors should expect “ambient + assistant” bundling pressure. |

| Dec 29 (late-breaking) | FDA explores alternative pathway for radiology CAD updates | Signals regulator appetite to reduce update friction—potential unlock for continuous-learning strategies (with guardrails). |

| Dec 23–24 (data refresh) | Late‑Dec AI/ML clearances incl. imaging | Two incremental imaging AI clearances matter mainly as “tracker refresh” inputs for 2025 close and 2026 start. |

DEEPER DIVES

1) M&A and strategic deals

JPM-week deal flow underscored a familiar pattern: scale + adjacency wins when hospitals prioritize total cost, reliability, and vendor consolidation. The Boston Scientific–Penumbra deal is notable not just for size, but for what it implies: strategics remain willing to pay up for platforms that expand procedural mix and unlock cross‑sell into capacity-constrained service lines. Expect renewed “bundle logic” across device + software ecosystems.

- Boston Scientific to acquire Penumbra (~$14.5B).

Why it matters: Penumbra’s neurovascular footprint sits in a high‑urgency care pathway where speed and availability are everything—making product + workflow integration valuable. Strategically, this looks like a bet on procedural growth plus portfolio adjacency rather than pure cost synergy. Watch integration into stroke networks and whether AI triage/analytics becomes part of the value proposition. - What this signals for imaging/AI:

M&A logic is increasingly “platformization”: distribution and installed base matter more than model novelty. Imaging AI vendors should assume strategic buyers will pay for proven deployment, not demo performance.

2) Funding and capital formation (AI + imaging)

Funding is concentrating in companies that can show operational deltas—time saved, slots added, backlog reduced—not just clinical metrics. This is a meaningful shift for imaging AI: adoption gating factors (IT integration, governance, staffing, reimbursement) are becoming the primary investment screen. JPM-week narratives also reinforce the rise of “provider‑backed” innovation (strategic health system investors) as a distribution and validation engine.

- Vista AI $29.5M Series B (MRI automation).

Why it matters: The investor mix (including provider systems) is the signal: automation is positioned as capacity infrastructure. If outcomes replicate beyond flagship sites, MRI AI spend could move from departmental budgets to enterprise capacity planning—changing procurement cadence and contract structure (multi-year, outcomes-linked).

3) Digital Health and AI (with a medical imaging lens)

The AI story is bifurcating: open model layers are accelerating experimentation, while enterprise buyers increasingly demand governed, auditable, integrated workflows. In imaging, this favors vendors who can embed AI into reporting, QA, and downstream orchestration. The risk is commoditization for “single‑feature” tools as health systems consolidate platforms and prefer fewer vendors. JPM messaging suggests 2026 is the year of scaling, not novelty.

- Google releases MedGemma 1.5 + MedASR (open access).

Why it matters: Open medical models reduce time-to-prototype and lower barriers for incumbents and startups alike, but they shift differentiation to workflow integration, data rights, monitoring, and regulatory-grade documentation. MedASR’s reported error reductions also point to a near-term value pool in radiology reporting efficiency—often easier to monetize than incremental detection gains. - Anthropic launches Claude for Healthcare.

Why it matters: Enterprise GenAI is moving into regulated environments with “healthcare-packaged” offerings. Imaging vendors should anticipate a competitive wedge where ambient documentation and “assistant” capabilities become bundled expectations across RIS/PACS/enterprise imaging stacks.

4) Regulatory approvals and clearances (imaging‑heavy)

This week reinforces two realities: (1) FDA clearances continue to accumulate, and (2) the strategic axis is shifting to how quickly vendors can update, monitor, and govern deployed AI. FDA’s interest in alternative pathways for certain CAD updates is a strong meta‑signal that update friction is now a systemic issue. For buyers, the procurement bar rises: “clearance” is table stakes; governance + evidence + reimbursement readiness are the differentiators.

- HeartLung AI‑CVD receives FDA clearance (opportunistic CT screening).

Why it matters: Turning existing CTs into multi‑condition screening changes stakeholder incentives—radiology becomes upstream prevention infrastructure. Expect near-term debate over clinical ownership, follow-up utilization, and payer willingness to reimburse “incidental prevention.” - Elekta receives FDA 510(k) for Evo CT‑Linac.

Why it matters: Convergence of imaging and adaptive therapy continues; U.S. clearance matters for replacement cycles and competitive dynamics in RT. Watch whether hospitals frame ROI through throughput and adaptive planning efficiency rather than hardware specs alone. - FDA explores alternative pathway for radiology CAD updates (late‑breaking, but highly relevant).

Why it matters: If pathways evolve to reduce friction for certain updates, the competitive advantage shifts toward vendors with strong post‑market monitoring and change management. This is a structural tailwind for platform players and a governance burden for hospital AI committees.

5) Imaging product launches and market entries

Product innovation this week skewed toward access + standardization—wearable/portable formats and workflow-friendly consumables that reduce variability. For imaging, the theme is clear: adoption is limited less by “can it work” and more by “can it fit” (protocol consistency, training burden, and downstream workflow integration). Expect faster uptake where products either reduce staffing load or standardize operator-dependent steps.

- iSono Health launches ATUSA wearable automated breast ultrasound.

Why it matters: Automating acquisition is a recurring motif (echoing MRI automation). If wearable ABUS can standardize quality and fit existing screening pathways, it could expand access—particularly in dense breast workflows—while shifting economics toward higher throughput, lower operator dependency. Watch coding/reimbursement and patient acceptance. - VizMark VM1 tumor marker FDA 510(k).

Why it matters: Seemingly small devices can have outsized workflow effects: better longitudinal imaging alignment and fewer artifacts can reduce repeat studies and improve surgical planning handoffs—an underappreciated lever in breast pathways. - ASUS LU800 handheld ultrasound FDA clearance (POCUS).

Why it matters: Ultrasound continues its “democratization” arc. Competitive advantage is shifting from probe hardware toward software (guidance, automation, documentation) and distribution (health system contracts).

About Marketstrat

Marketstrat® is a market intelligence and GTM enablement firm focused on medtech, healthcare, and life sciences. Under the Markintel™ brand, Marketstrat delivers robust market intelligence and proprietary frameworks; through GrowthEngine advisory and tools, it helps clients turn insights into execution. Together, these capabilities support clients in converting evidence‑weighted insight into practical action across strategy, product, and commercial execution.

Marketstrat® and Markintel™ are trademarks of Marketstrat Inc. All other trademarks are the property of their respective owners.

Check out free Research and Insights and Analysis of Industry Events

Check out our collection of Markintel Horizon and Markintel Pulse research.

Check out details on our reports, World Market for AI in Medical Imaging and World Market for Oncology Imaging AI and other Pulse Reports in the Imaging space.