ONE BIG THING

Imaging AI is splitting into two winning lanes—multi‑indication “operational triage” that earns enterprise budgets and clearances, and a GenAI “explainability layer” forced by transparency rules—while payer scrutiny tightens the bar for anything that can’t prove measurable outcomes.

KEY TAKEAWAYS

- Platform AI > point AI: Aidoc’s FDA-cleared Comprehensive Abdomen CT Triage bundles 14 findings (11 new + 3 prior) with reported ~97% sensitivity / 98% specificity for newly cleared indications—reinforcing “enterprise bundle” economics and integration as the moat.

- Pharma + cloud are now imaging AI builders: Bristol Myers Squibb and Microsoft’s “Precision Imaging Network” signals imaging is becoming a strategic data/compute partnership domain, not just radiology vendor procurement.

- Clearance ≠ coverage: Medicare contractor activity (NGS draft + CGS final) on noncoverage for certain brain MRI AI underscores payer focus shifting to HEOR and clinical utility, not FDA status.

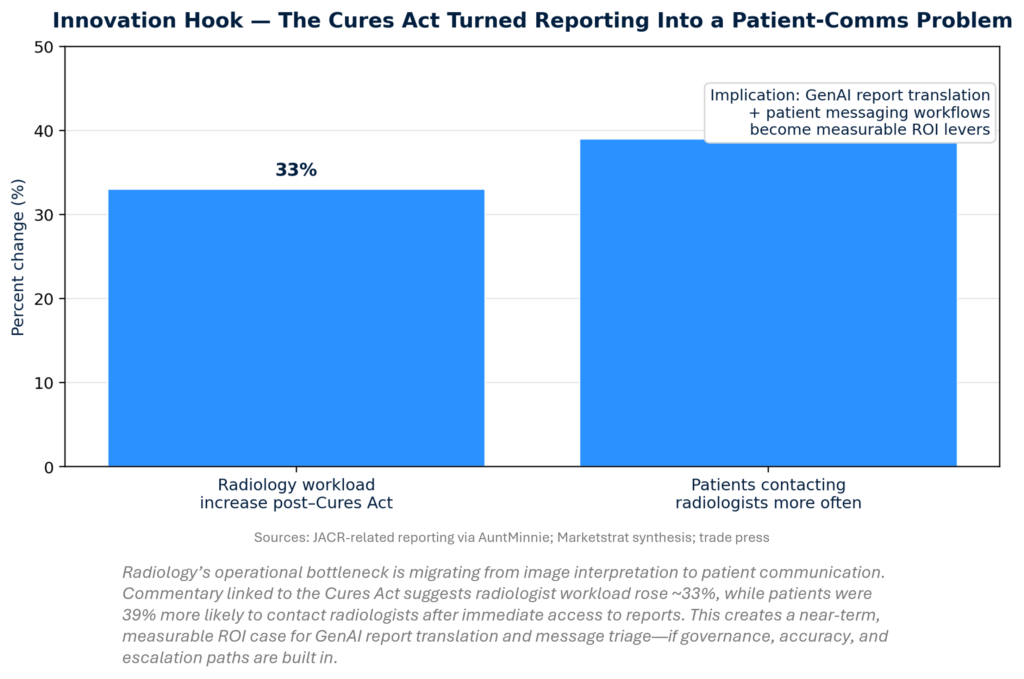

- The Cures Act quietly rewired radiology economics: Report transparency is driving ~1/3 workload uplift and +39% patient outreach—creating a near-term ROI market for safe GenAI report translation, patient Q&A triage, and messaging workflows.

- Governance is becoming procurement-grade: ECRI ranking AI chatbot misuse as a top health-tech hazard elevates guardrails, monitoring, and workflow containment from “nice-to-have” to RFP requirements.

- Capital is flowing to “quantified imaging biomarkers”: 4DMedical’s US$100M+ financing (pro forma cash >$130M) to scale CT:VQ—with rapid deployments and a Philips partnership—highlights investor preference for platforms that can embed into care pathways and trials.

MARKETSTRAT POV (ACTIONABLE STRATEGY)

- Stop selling “algorithms,” start selling “operating leverage.” Package triage + orchestration + reporting into one workflow with hard KPIs: turnaround time, downstream utilization, staffing impact.

- Build the “coverage-grade” evidence stack now. If MAC noncoverage expands, vendors must defend value with outcomes, pathway impact, and HEOR—not sensitivity/specificity alone.

- Invest in the explainability layer as a product. GenAI report translation, patient messaging triage, and portal integration is becoming a measurable capacity lever post–Cures Act.

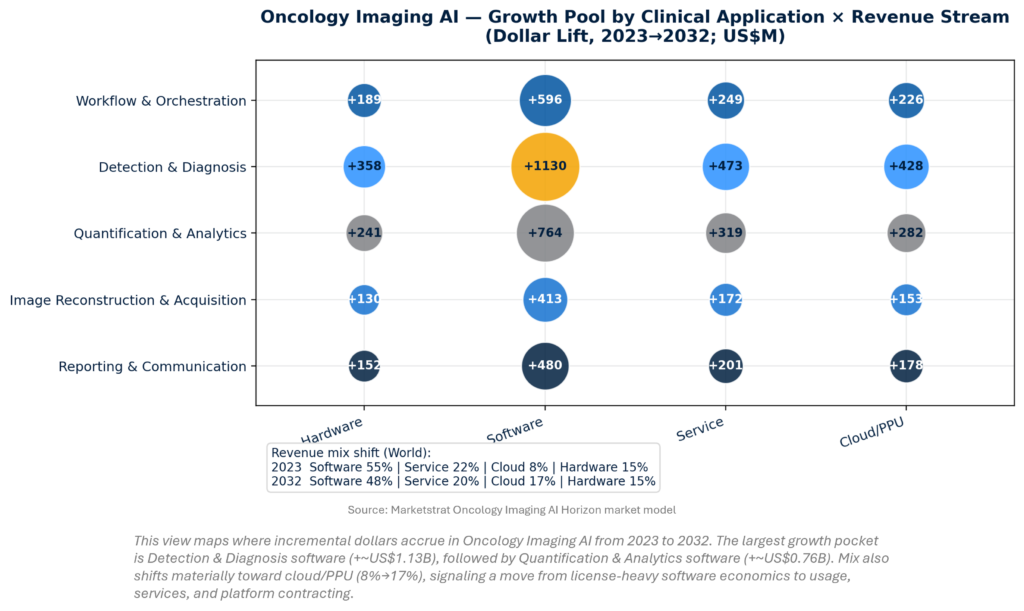

- Design for cloud/PPU economics. Our Oncology Lens shows cloud share doubling; align packaging with enterprise security, uptime, and auditability to win platform contracts.

INNOVATION HOOK

The “Explainability Layer” Becomes the New ROI Engine in Imaging

The Cures Act’s rapid release of imaging results is turning radiology into a patient-communications workflow, not just interpretation. Report transparency raises downstream questions, messages, and dissatisfaction risk—work that radiologists and staff absorb. With workloads estimated up ~1/3 and patient outreach +39%, GenAI is shifting from “nice summary” to capacity infrastructure: translating reports, triaging patient messages, documenting follow-ups, and reducing non-clinical cognitive load.

What it means (actionable):

- Hospitals / imaging groups: Treat “report-to-patient” as a workflow with KPIs: message volume per 1,000 studies, response-time SLA, escalations, and malpractice-risk flags.

- Vendors: Winning products will be PACS-native + patient-portal aware—not standalone chat. Guardrails and auditability become features, not compliance overhead.

- Payers: Expect growing interest in “admin burden reduction” as a value story—especially if message triage lowers downstream ED revisits and unnecessary follow-ups (requires proof).

MARKET LENS

Oncology Imaging AI is large enough to dictate platform design choices. In our Horizon model, the market reaches ~US$7.74B by 2032, ~27% of the broader AI‑in‑Imaging TAM (US$28.4B in 2032). Growth pools concentrate in Detection & Diagnosis software and attached services/cloud. Importantly, monetization shifts toward cloud/PPU, reinforcing a platform thesis: procurement will increasingly reward vendors that package outcomes, uptime, and integrations—not just algorithms.

SIGNAL DASHBOARD

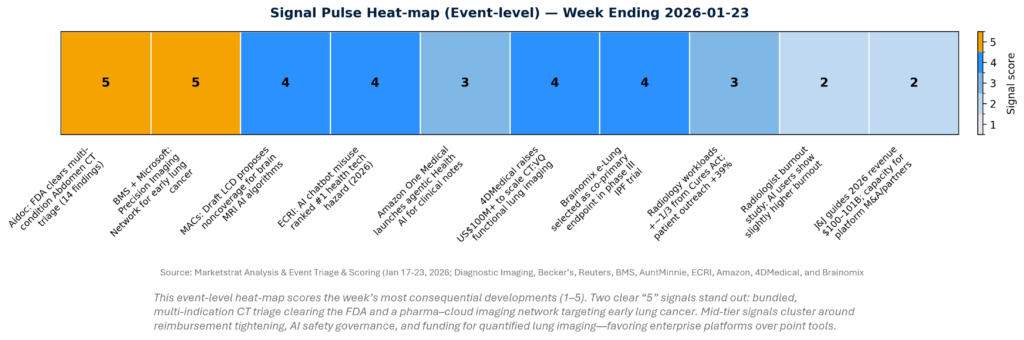

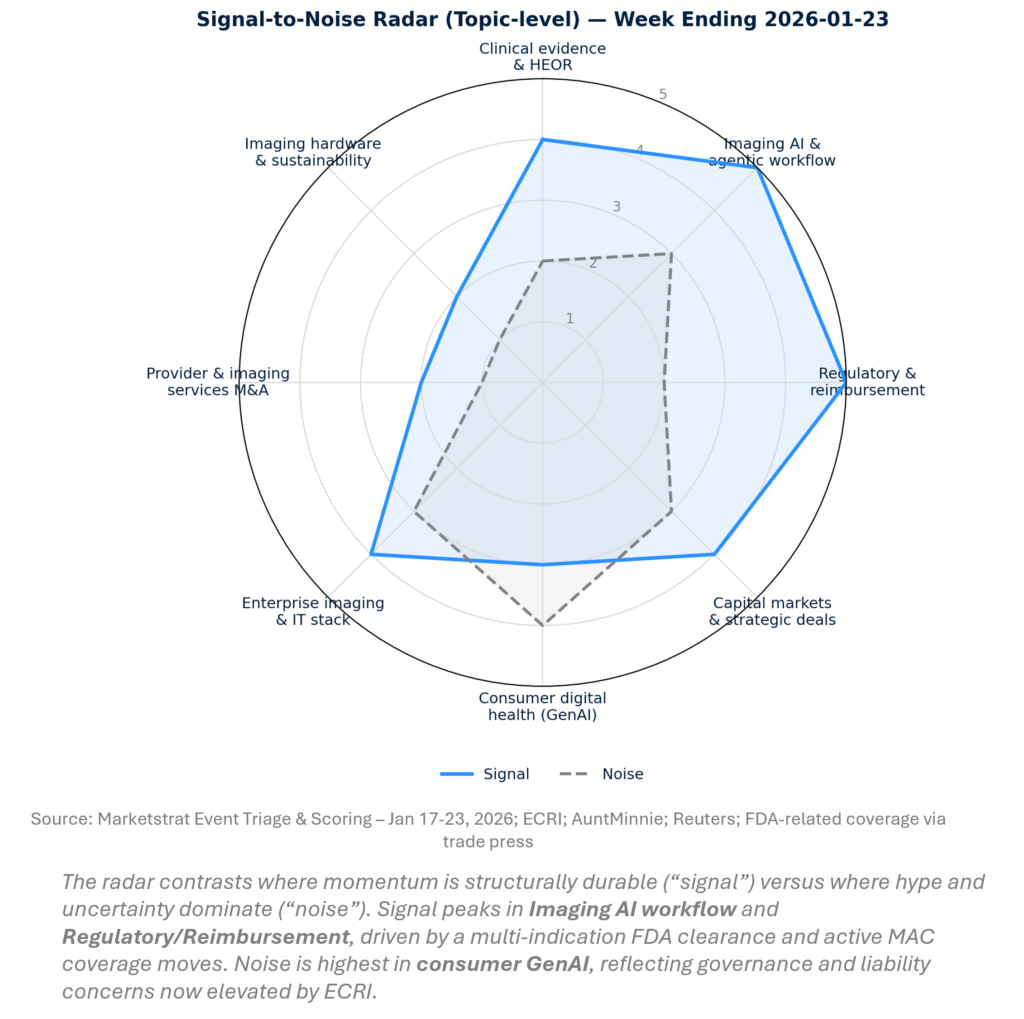

This week’s signal concentrates where adoption friction is being removed (multi‑indication triage, enterprise partnerships) and where friction is rising (coverage constraints, AI governance). The highest-conviction moves are not “better models” in isolation—they’re models embedded in workflows and backed by distribution (cloud/pharma networks) and risk management (guardrails, documentation). The implication: budget owners will increasingly buy platform outcomes, not algorithm features.

SIGNAL PULSE HEATMAP – JAN 17-23, 2026

SIGNAL-TO-NOISE RADAR BY TOPIC – JAN 17-23, 2026

REGULATORY PULSE

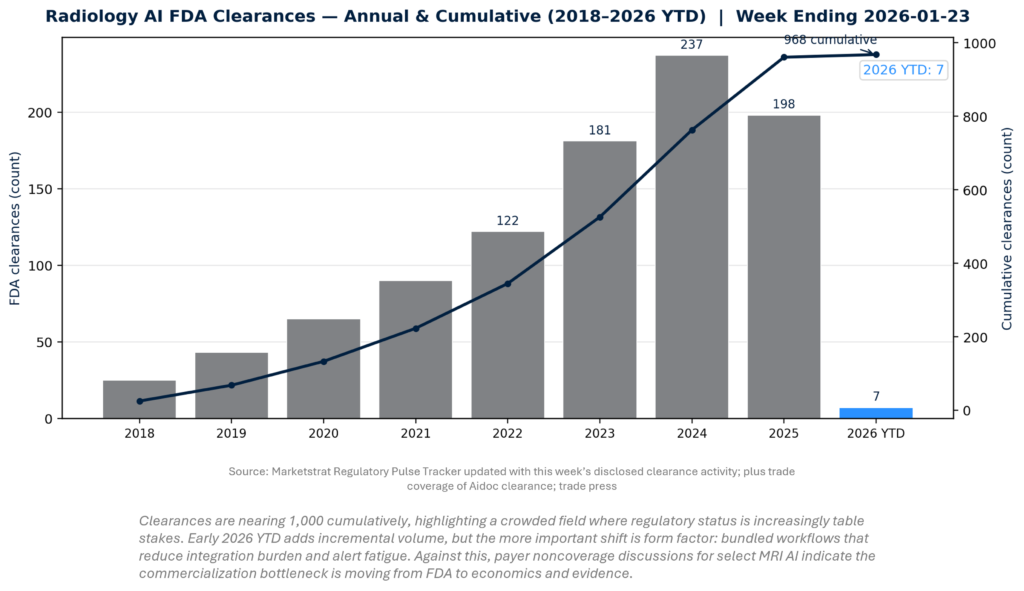

Radiology AI clearances continue compounding, but the strategic narrative is shifting from “more devices” to “more platforms.” The historical curve shows rapid expansion through 2024, moderation in 2025, and a steady early 2026 cadence. The key development this week is qualitative: multi-indication workflows are clearing, while payers simultaneously tighten coverage—raising the importance of enterprise ROI and real-world evidence for sustained adoption.

QUICK-GLANCE TABLE

| Date | Headline | Our Take | Source |

| Jan 21 | FDA clears Aidoc “Comprehensive Abdomen CT Triage” (14 findings; ~97% sens / 98% spec for newly cleared set) | Bundling + workflow is the adoption wedge; expect consolidation around platforms that reduce alert fatigue + integration cost. | (Becker’s Hospital Review) |

| Jan 22 | BMS + Microsoft launch Precision Imaging Network for early lung cancer | Imaging data + cloud compute partnerships could become a distribution channel for imaging AI beyond radiology budgets. | (Yahoo Finance) |

| Jan 22 | NGS opens comment period on noncoverage for brain MRI AI; CGS final LCD effective Jan 19 | Payers are testing a tougher line on utility and outcomes; vendors need RWE + cost offsets or pivot to enterprise value-based deals. | (AuntMinnie) |

| Jan 20 | Radiology workload up ~1/3 post–Cures Act; patients 39% more likely to contact radiologists | “Explainability + patient comms” is now measurable ROI—GenAI can meaningfully reduce message volume and non-clinical work. | (AuntMinnie) |

| Jan 21 | ECRI flags AI/chatbot misuse as a top hazard | Governance becomes mandatory (guardrails, auditability, training, human-in-the-loop) before scale. | (MedTech Dive) |

| Jan 22 | Amazon One Medical launches agentic “Health AI” | Agentic documentation is moving from pilots to production; raises bar for safety + workflow containment (and sets new UX expectations). | (Amazon News) |

| Jan 20 | 4DMedical raises US$100M+; pro forma cash >$130M; CT:VQ scaling | Investors want platforms with deployability + endpoint potential—not just accuracy claims. | (PR Newswire) |

| Jan 20 | Brainomix e‑Lung selected as co-primary endpoint in phase III IPF trial | Imaging biomarkers are gaining “trial-grade” legitimacy; this is a path to broader payer acceptance if endpoints translate to outcomes. | (AuntMinnie) |

| Jan 22 | J&J guides 2026 revenue $100–101B | Large-cap balance sheets + “platform” priorities can accelerate imaging AI tuck-ins and partnerships. | (Reuters) |

| Jan 20 | GSK to acquire RAPT (~$2.2B) | Not imaging-specific, but underscores deal appetite and capital recycling that can spill into medtech/diagnostics. | (GSK) |

DEEPER DIVES

1) Regulatory Approvals & Clearances

Regulatory signal this week reinforces a clear direction: the FDA is increasingly comfortable with multi-indication, workflow-bundled AI, especially when positioned as triage and prioritization rather than autonomous diagnosis. The strategic impact is commercial: bundled clearances enable vendors to sell platform contracts (IT + clinical workflow) rather than single algorithm SKUs. This shifts competition toward integration quality, alert management, and enterprise deployment capability.

- Jan 21 — Aidoc FDA clearance: Comprehensive Abdomen CT Triage (14 findings)

- What happened: FDA cleared a bundled abdomen CT triage workflow covering 14 findings (11 newly cleared + 3 previously cleared), with reported ~97% sensitivity and 98% specificity for newly cleared indications.

- Why it matters:

- Budget-owner fit: ED throughput and radiology turnaround time are CFO-visible. “Triage” budgets are easier than “per finding” budgets.

- Competitive pressure: Raises the bar for point-solution competitors (who must either bundle, partner, or become distribution within larger platforms).

- Risk posture: Multi-condition tools increase potential alert volume; vendors that can prove low false-positive burden and manage alert routing will win.

2) Reimbursement & Policy

This week underscored the market’s central contradiction: regulatory progress is accelerating, while payer coverage logic is hardening. MAC actions on brain MRI AI signal a willingness to deny reimbursement where evidence is thin or outcomes are unclear—effectively forcing imaging AI vendors to build an “evidence stack” that looks more like pharma: RWE, endpoints, utilization impact, and cost offsets. Net: commercialization strategies must diversify beyond fee-for-service reimbursement.

- Jan 22 — NGS draft LCD proposes noncoverage for brain MRI AI; CGS final LCD effective Jan 19

- What happened: Medicare contractor NGS opened a comment period for a draft policy that would not cover certain automated detection/quantification AI applied to brain MRI; CGS reportedly finalized a related LCD effective Jan 19.

- Why it matters:

- Reimbursement is becoming indication-specific and evidence-driven, not “AI-friendly” by default.

- Vendors selling brain MRI post-processing should prioritize utility studies (time saved isn’t enough; demonstrate impact on outcomes/management).

- Hospitals may still buy tools under operational budgets—but will demand clearer ROI if reimbursement is uncertain.

- Jan 20 — Cures Act workload impact (workload ~+1/3; patient outreach +39%)

- What happened: Reporting notes suggest radiologist workload rose substantially with immediate patient access; patients were significantly more likely to contact radiologists.

- Why it matters: This is the clearest near-term ROI case for GenAI in imaging: fewer inbound messages, faster responses, better patient satisfaction—with governance as the gating factor.

3) Funding, Partnerships & Capital Formation

Capital formation this week concentrated around platforms that can scale clinically and commercially—either through distribution (cloud partnerships) or via embedding into trials and care pathways (quantified biomarkers). Notably, the most strategically important “partnership” signals are no longer vendor-to-hospital alone; they are increasingly pharma + cloud + data ecosystems seeking durable advantage in early detection and patient stratification.

- Jan 22 — BMS + Microsoft: Precision Imaging Network (lung cancer)

- What happened: Partnership aimed at using AI and multimodal data to support early lung cancer detection via a “precision imaging” concept.

- So what: If executed, this creates a new demand channel for imaging AI—pharma-funded, cloud-native, multi-institutional—with implications for data governance, trial endpoints, and imaging site selection.

- Jan 20 — 4DMedical raises US$100M+ to scale CT:VQ

- What happened: US$100M+ institutional placement; pro forma cash >$130M; CT:VQ deployments across major academic centers; partnership with Philips.

- So what: Validates investor belief that functional/quantified imaging can become part of standardized workups and possibly clinical trial measurement—an important step toward payer confidence.

- Jan 22 — Amazon One Medical launches “Health AI”

- What happened: Amazon positions an agentic tool to support clinical documentation and workflow.

- So what: Sets a new UX benchmark for “AI that lives inside clinician workflow.” Imaging vendors will be expected to match this UX standard inside PACS, RIS, and portals.

4) Clinical Research & Evidence

The evidence bar is rising in two directions at once. On one side, imaging AI is being pulled into trial-grade endpoints (strong signal). On the other, real-world clinician experience highlights that AI can add workload or uncertainty when poorly integrated (noise). The net: winners will be those who treat deployment as a clinical product (change management, escalation logic, monitoring), not as a model drop-in.

- Jan 20 — Brainomix e‑Lung selected as co‑primary endpoint in phase III IPF trial

- Why it matters: This is a meaningful validation path for imaging biomarkers: trial endpoints create a credible bridge from “interesting metric” to “decision-grade evidence.”

- Watch: Whether endpoints correlate to hard outcomes and whether regulators/payers accept them as surrogate measures.

- Jan 20 — Burnout study: radiologists using AI show slightly higher burnout

- Why it matters: Reinforces that AI can increase cognitive burden when it adds alerts, uncertainty, or extra clicks—supporting the thesis that integration and governance determine ROI.

5) Company Updates & Earnings (select)

Large-cap earnings and guidance matter for imaging AI because they shape M&A appetite, “platform” strategy, and procurement power with providers. This week’s signal: majors are optimizing for portfolio mix and operational leverage, which typically favors scalable software and services attached to installed bases. Imaging AI vendors should expect tougher partnership terms but also greater willingness for tuck-ins that accelerate enterprise workflow and data moats.

- Jan 22 — Johnson & Johnson guidance ($100–101B revenue)

- Why it matters: Strong balance sheets + platform focus could increase competitive pressure via acquisitions/partnerships—especially in workflow software and procedure-adjacent imaging.

Sources & Methodology

- Proprietary Data: Marketstrat Frameworks, Data Models, and Regulatory Pulse Tracker (Data through Jan 23, 2026).

- Market Intelligence: Broker Research, Expert Transcripts, and Filings via AlphaSense.

- Trade Reporting: Reuters, ECRI, Amazon, Becker’s, Diagnostic Imaging, AuntMinnie, PR Newswire, and Brainomix.

- Analysis: Marketstrat Deep Research & Synthesis.

About Marketstrat

Marketstrat® is a market intelligence and GTM enablement firm focused on medtech, healthcare, and life sciences. Under the Markintel™ brand, Marketstrat delivers robust market intelligence and proprietary frameworks; through GrowthEngine advisory and tools, it helps clients turn insights into execution. Together, these capabilities support clients in converting evidence‑weighted insight into practical action across strategy, product, and commercial execution.

Marketstrat® and Markintel™ are trademarks of Marketstrat Inc. All other trademarks are the property of their respective owners.

Check out free Research and Insights and Analysis of Industry Events

Check out our collection of Markintel Horizon and Markintel Pulse research.

Check out details on our reports, World Market for AI in Medical Imaging and World Market for Oncology Imaging AI and other Pulse Reports in the Imaging space.