April 4, 2025

1) ONE BIG THING: TARIFFS HIT MEDTECH

The Short Version:

President Trump’s sweeping new “reciprocal tariff” plan—effective April 5 (10% universal import tariff), plus higher (20–34%+) rates on imports from China, the EU, Japan, and others—is sending shockwaves through the medical imaging and broader MedTech sectors. While pharmaceuticals were exempt, medical devices were not, and China immediately retaliated with its own 34% tariffs plus rare-earth export restrictions. The result: higher costs, supply chain shakeups, and uncertainty around big-ticket imaging technology purchases.

“Tariffs act like an excise tax on medtech, diverting funds from R&D and inflating healthcare costs.” — AdvaMed statement, April 3

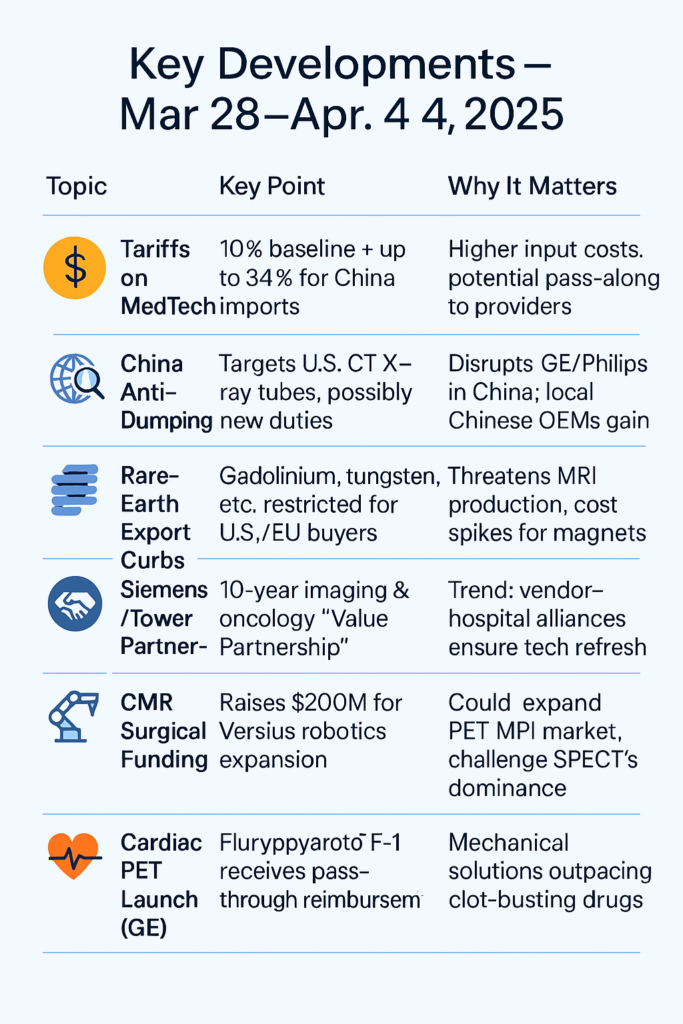

2) AT A GLANCE: TOP WEEKLY DEVELOPMENTS

- Tariff Turmoil & Anti-Dumping Probe

- U.S. announces sweeping tariffs, Medtech (but not pharma) is on the hook.

- China fires back with 34% tariffs on U.S. goods, plus an anti-dumping probe into American X-ray tubes used in CT scanners.

- Rare earth elements (like gadolinium, used in MRI) fall under new Chinese export curbs, impacting MRI system production.

- Regulatory Roundup

- GE HealthCare launched Flyrcado™ (flurpiridaz F-18) PET tracer for cardiac MPI, newly approved with Medicare pass-through reimbursement.

- Siemens Healthineers & Tower Health sign a 10-year “Value Partnership” for imaging and oncology—embedding Siemens and Varian tech across Tower’s network.

- FDA clearances for AI chest X-ray triage (Azmed, Gleamer), new 3D knee implant system (restor3d), and Sonio’s AI for fetal anomaly detection.

- M&A & Funding

- CMR Surgical raises $200M for its Versius robotic surgery system.

- Volpara Health acquires MRS Systems to expand in breast imaging analytics.

- Medtronic partners with AI stroke detection platforms (Methinks AI, Brainomix) to speed thrombectomy triage.

- Clinical Breakthroughs

- Large real-world data from iRhythm’s Zio patch shows 64% of arrhythmias missed by standard 24–48 hr Holter monitors.

- Penumbra’s vacuum thrombectomy tech sees strong data for pulmonary embolism, peripheral clots.

- ECLIPSE trial: intravascular imaging guidance reduces complications in complex coronary stenting.

- AI & Digital Health

- GE HealthCare & Nvidia deepen partnership on “autonomous” X-ray and ultrasound.

- Hospitals deploy AI triage solutions (e.g., Qure.ai) to speed up radiology reads.

- Roche & GE integrate tumor board data + imaging viewer in a single digital platform.

3) DEEPER DIVE: TARIFF SCENARIOS & MARKET INSIGHTS

A) Why It Matters

- Hospitals: Facing potential 5–15% hikes in imaging equipment costs—capital budgets may tighten. Rural or mid-size centers might delay scanner purchases, risking older equipment downtime.

- OEMs: Major imaging players (GE, Siemens, Philips, Canon, United Imaging) must navigate new import duties and possible anti-dumping penalties in China. Expect margin pressure and supply chain reshuffling (e.g. local assembly, alternate sourcing).

- Investors: Valuations could fluctuate as trade spats intensify, especially for companies deeply exposed to China (~12% of GE’s revenue). R&D budgets might take a hit if tariffs persist.

- Patients: Potential knock-on effect on imaging access or wait times if hospitals postpone equipment refresh cycles; advanced imaging innovation could slow if R&D funds get squeezed.

B) The Three Scenarios

- Best Case: “Managed Tension”

- Tariffs partially relaxed or medical imaging gets carved out.

- Limited cost pass-through, ~5% price uptick.

- Supply chain shifts remain “in progress,” but no major disruptions in MRI or X-ray component availability.

- Most Likely: “Adaptive Disruption”

- Sustained tariffs (10–25%), no broad exemptions.

- OEMs pivot to alternate manufacturing (Mexico, India), passing moderate cost increases (~10–15%) to providers.

- China’s probe leads to some duties on U.S. imaging components—Western players lose modest share in Chinese hospital tenders.

- Worst Case: “Full Trade War Shock”

- 34% (or higher) tariffs stand, plus new rare-earth export bans.

- Supply chain meltdown for MRI magnets (e.g. gadolinium, tungsten).

- Equipment prices soar 20–30%, hospitals freeze big purchases. Patient access dips, diagnostic backlogs rise.

Marketstrat, Industry Estimates

4) QUICK GLANCE

- Stay Agile: OEMs should fast-track supply chain localization (e.g., U.S. or Mexico assembly) to mitigate tariff risk.

- Long-Term Partnerships: Providers can lock in “value partnerships” (like Tower Health’s Siemens deal) for stable upgrades and cost certainty amid trade volatility.

- AI as Differentiator: Despite macro headwinds, AI and digital health remain top investment areas (e.g., stroke triage, breast imaging analytics). Offering integrated hardware + AI software can justify premium pricing, even in a cost-conscious environment.

- Scenario Planning: Hospitals and imaging centers should scenario-plan for 5–25% potential price hikes, revisiting capital budgets. For OEMs, factoring supply chain reconfiguration timelines into 2025–2026 product roadmaps is critical.

5) MARKETSTRAT ANGLE & STRATEGIC TAKEAWAYS

- Stay Agile: OEMs should fast-track supply chain localization (e.g., U.S. or Mexico assembly) to mitigate tariff risk.

- Long-Term Partnerships: Providers can lock in “value partnerships” (like Tower Health’s Siemens deal) for stable upgrades and cost certainty amid trade volatility.

- AI as Differentiator: Despite macro headwinds, AI and digital health remain top investment areas (e.g., stroke triage, breast imaging analytics). Offering integrated hardware + AI software can justify premium pricing, even in a cost-conscious environment.

- Scenario Planning: Hospitals and imaging centers should scenario-plan for 5–25% potential price hikes, revisiting capital budgets. For OEMs, factoring supply chain reconfiguration timelines into 2025–2026 product roadmaps is critical.

6) FINAL WORD & CALL TO ACTION

As trade tensions escalate, the medical imaging industry stands at a pivotal crossroads. Tariffs and anti-dumping probes threaten to inflate costs and disrupt supply chains, but the need for advanced diagnostics has never been greater. Long-term vendor-provider partnerships, robust supply chain strategies, and AI-driven innovation can offset near-term shocks.

Marketstrat can help navigate these complexities—partner with us for research on:

- Scenario Modeling & Risk Assessments

- Supply Chain Optimization

- Strategic Positioning in Imaging & Digital Health

Stay tuned for next week’s Pulse as we track how the US–China trade standoff unfolds, plus more regulatory updates and clinical breakthroughs.

- Check out our collection of Markintel Horizon and Markintel Pulse research.

- Check out free Research and Insights and Analysis of Industry Events