One Big Thing

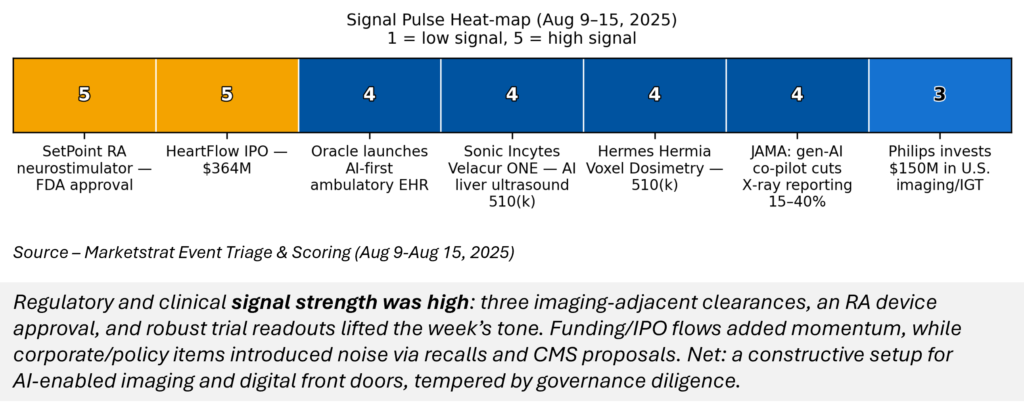

Clinical AI crossed from pilot to infrastructure this week—fresh FDA actions in imaging, hospital‑grade productivity data, and Oracle’s AI‑first EHR collectively signal the next phase of real deployment.

Key Takeaways

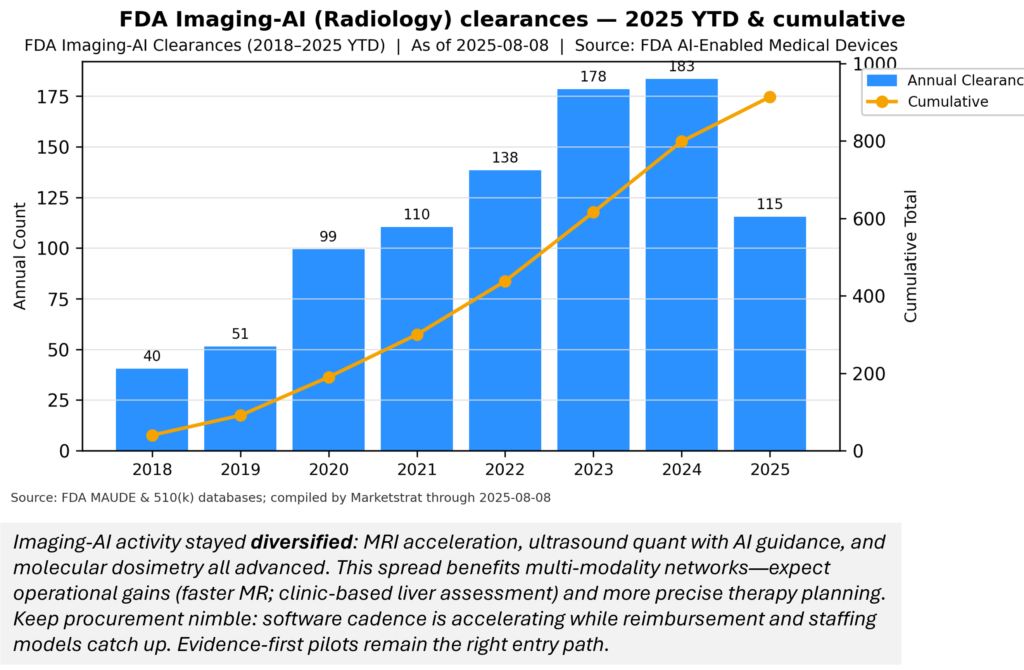

- Regulators are green‑lighting real tools. Imaging‑adjacent AI and software advances landed U.S. clearances (Sonic Incytes’ liver ultrasound with AI overlay; Hermes’ dosimetry; plus recent Philips MRI software), while SetPoint won first‑in‑class neuroimmune therapy approval.

- Capital confidence is back. HeartFlow raised $364M in a surging IPO; SetPoint ($140M) and Apreo ($130M) closed big rounds; cardiology devices drew more mid‑cap checks.

- EHR goes agentic. Oracle launched a voice‑first, AI‑backed cloud EHR for ambulatory providers; Epic will preview its own AI assistant.

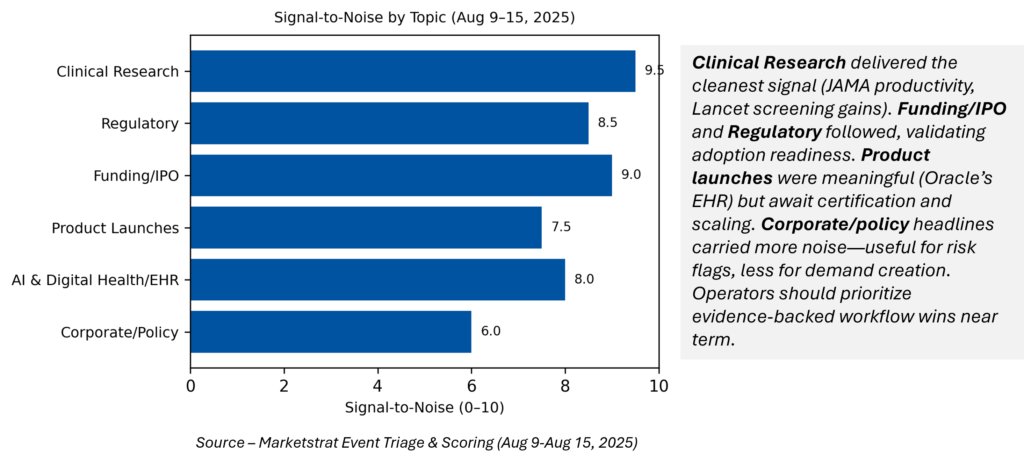

- Clinical proof stacked up. AI matched/exceeded double‑reading in mammography (Lancet Digital Health) and cut radiology reporting time 15–40% in a real‑world JAMA study.

- Industry structure shifts. Philips committed $150M to expand U.S. manufacturing; safety alerts (Boston Sci, Dräger, Tandem) and policy noise (CMS) underline governance risk.

Quick‑Glance Table

| Date | Headline | Our Take |

|---|---|---|

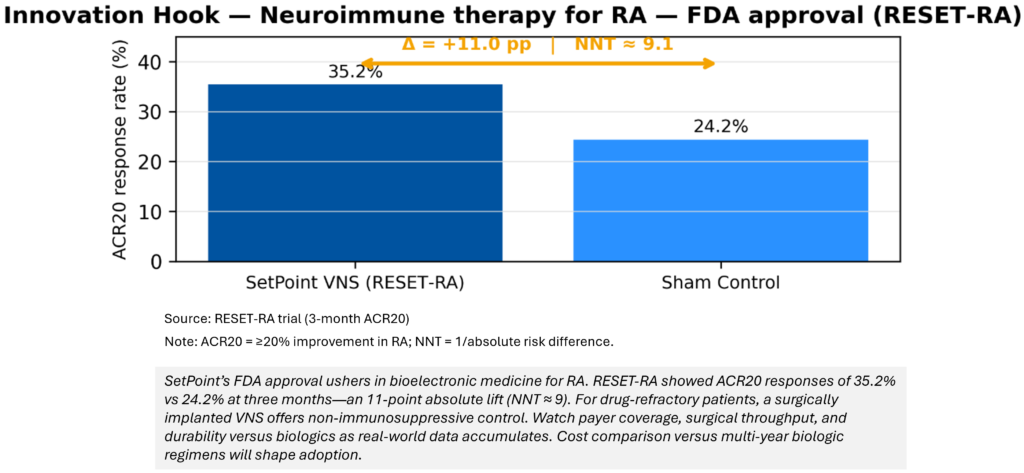

| Aug 14 | FDA approves SetPoint RA neurostimulator | First FDA‑approved bioelectronic RA therapy; signals new front for neuroimmune devices. |

| Aug 12 | Sonic Incytes Velacur ONE 510(k) | POCUS liver tool + AI overlay improves fibrosis/steatosis quant. Primary care screening tailwind. |

| Aug 14 | Hermes Hermia Voxel Dosimetry 510(k) | Personalized dosimetry step‑change for theranostics programs. |

| Aug 12 | HeartFlow IPO raises $364M | Public markets rewarding proven imaging AI with payer traction. |

| Aug 14 | Oracle launches AI‑first EHR | Agentic, voice‑driven workflows could cut “pajama time”—watch ONC certification. |

| Aug 14 | Apple restores Watch SpO₂ | Consumer tech keeps edging into medtech; IP and labeling matter. |

| Aug 14 | Mammography AI > two humans | Strongest screening evidence yet for AI as independent second reader. |

| Aug 14 | JAMA: gen‑AI radiology co‑pilot | 15–40% faster X‑ray reporting; triage gains for critical findings. |

| Aug 15 | Philips +$150M U.S. build‑out | Reshoring + AI‑enabled ultrasound/IGT; supply resilience story. |

| Aug 8–14 | Safety alerts & CMS signals | Risk management: Watchman adjunct IFU update; Dräger filter recall; insulin‑tech policy overhang. |

Signal Pulse Heat‑map

Signal‑to‑Noise Bar

Innovation Hook

Deeper Dives

Regulatory — Imaging & devices

- What happened: Sonic Incytes’ AI‑guided liver elastography won 510(k); Hermes’ Hermia Voxel Dosimetry cleared; SetPoint’s RA bioelectronic therapy approved.

- Why it matters: Point‑of‑care quant and personalized dosimetry expand precision pathways; neuromodulation enters autoimmune care—an adjacent growth vector for large OEMs.

Funding & IPOs

- What happened: HeartFlow raised $364M in a strong debut; SetPoint ($140M), Apreo ($130M), Reprieve ($61M) and Conformal ($32M) extended cardiology momentum.

- Why it matters: Capital is favoring clinical‑proof + near‑term economics—cardiac and pulmonary devices with clear endpoints.

Digital Health & EHR

- What happened: Oracle unveiled an AI‑first, voice‑driven ambulatory EHR; Epic to preview its own assistant.

- Why it matters: Ambient/agentic EHR moves will shape documentation costs and clinician capacity. Watch ONC certification, transparency of AI‑generated content, and plug‑in ecosystems.

Clinical Evidence

- What happened: AI second‑reader outperformed two humans in screening mammography; gen‑AI assistant sped radiology reporting. (pp. 4–5)

- Why it matters: Expect screening programs to pilot AI as the independent second reader; ER/acute workflows will adopt AI triage and drafting first.

Regulatory Pulse (FDA Imaging‑AI—this week)

- MRI (software): Philips SmartSpeed Precise—recent clearance (context), faster recon + sharpening.

- Ultrasound (POCUS + AI overlay): Sonic Incytes Velacur ONE 510(k).

- Molecular/Nuclear software: Hermes Hermia Voxel Dosimetry 510(k).

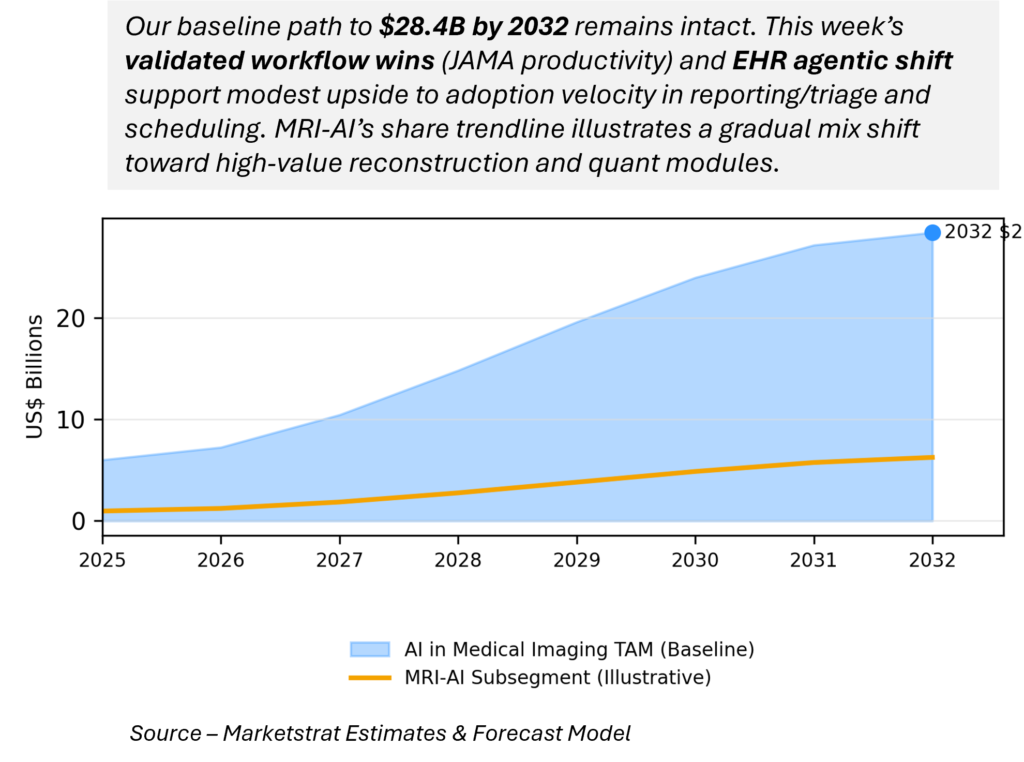

Market Lens (Baseline 2032 TAM = $28.4B)

Marketstrat POV — 3 things that matter now

- Deploy where friction is lowest. Start with radiography triage/report drafting—validated gains and minimal integration debt.

- Budget for platform, not point apps. EHR‑native agents and orchestrated imaging AI will compress vendor lists.

- Mind governance. Safety advisories and CMS moves argue for strong post‑market monitoring and payer‑savvy contracting.

About Marketstrat™

Marketstrat™ is a market intelligence and GTM enablement firm committed to empowering clients in data-driven industries. Under the Markintel™ brand, it delivers robust market intelligence, while GrowthEngine™ solutions offer specialized GTM advisory and app-based tools—together fueling growth, innovation, and competitive advantage. For more information, visit www.marketstrat.com.

Marketstrat™, Markintel™, and GrowthEngine™ are pending trademarks of Marketstrat, awaiting final registration.

Check out free Research and Insights and Analysis of Industry Events

Check out our collection of Markintel Horizon and Markintel Pulse research.

Check out details on our report, World Market for AI in Medical Imaging