One Big Thing

Enterprise‑scale imaging AI moved from pilots to operations—Sutter’s systemwide rollout, Akumin’s 150+‑site DBT AI, and Ontario’s cloud consolidation signal that health systems are standardizing on AI‑enabled imaging stacks.

Key Takeaways

- Scale beats point solutions. Sutter began a 7‑year enterprise AI imaging program with GE HealthCare spanning 300+ facilities, a blueprint for stack‑level standardization.

- Breast AI is the beachhead. Akumin will deploy Lunit INSIGHT DBT across 150+ U.S. sites, raising the adoption bar for 3D mammo AI.

- Cloud unlocks cross‑site leverage. Six Ontario hospitals are moving ~1M exams/year to Sectra One Cloud, enabling pooled coverage and managed‑services economics.

- Regulatory tempo persists. FDA cleared IMRIS InVision 3T Recharge and Claritas PET quant, while ZEISS PathFinder earned CE Mark—momentum across MR, PET and OCT AI.

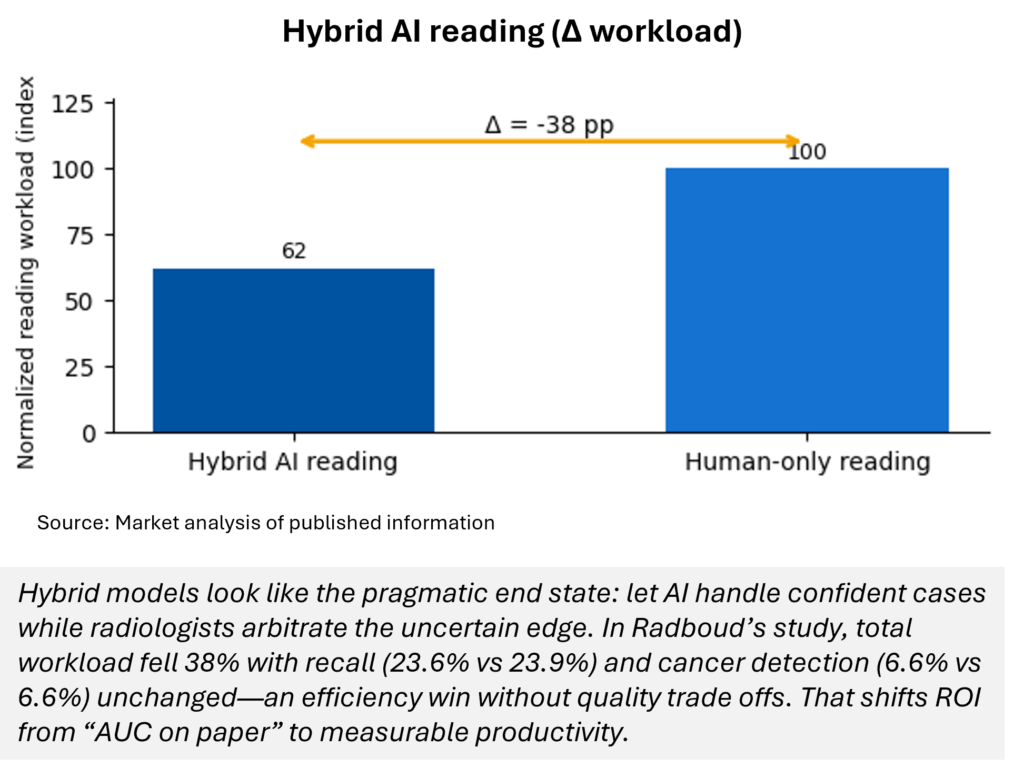

- Evidence matures. A Radiology study (Radboud) showed 38% workload reduction with hybrid AI+reader in screening mammo, with parity on recall and cancer detection.

Quick‑Glance Table

| Date | Headline | Our Take |

| Aug 16–22 | Sutter begins systemwide AI imaging rollout (GEHC alliance) | Playbook shift: fleet refresh + AI protocols + workforce program → enterprise ROI and lock‑in. |

| Aug 18–19 | Akumin to deploy Lunit INSIGHT DBT at 150+ sites | Breast AI becomes “expected standard”; raises operational KPI bar (reader time, recalls). |

| Aug 20 | Six Ontario hospitals move to Sectra One Cloud | Cloud EI is the substrate for cross‑site routing and AI orchestration. |

| Aug 19 | FDA 510(k): IMRIS InVision 3T Recharge | Installed‑base monetization: back‑port AI features without full room replacement. |

| Aug 19 | FDA 510(k): Claritas PET segmentation & quant | Quant PET software moving from pilots to daily tools. |

| Aug 21 | CE Mark: ZEISS CIRRUS PathFinder (ophthalmic OCT AI) | Ophthalmic analytics joins the weekly cadence; AI extends across specialties. |

| Aug 21 | Method AI raises $20M (surgical oncology visualization) | Capital still favors AI with direct workflow value; selective scale thesis. |

| Aug 21 | AbbaDox AI GA (ops automation; 67% data entry cut; 86% confirmations) | Ops AI monetizes faster than pure diagnostic reads in centers. |

| Aug 19–20 | Hybrid AI+reader study; FES‑PET ILC study | Evidence supports selective AI utilization and targeted tracers for staging. |

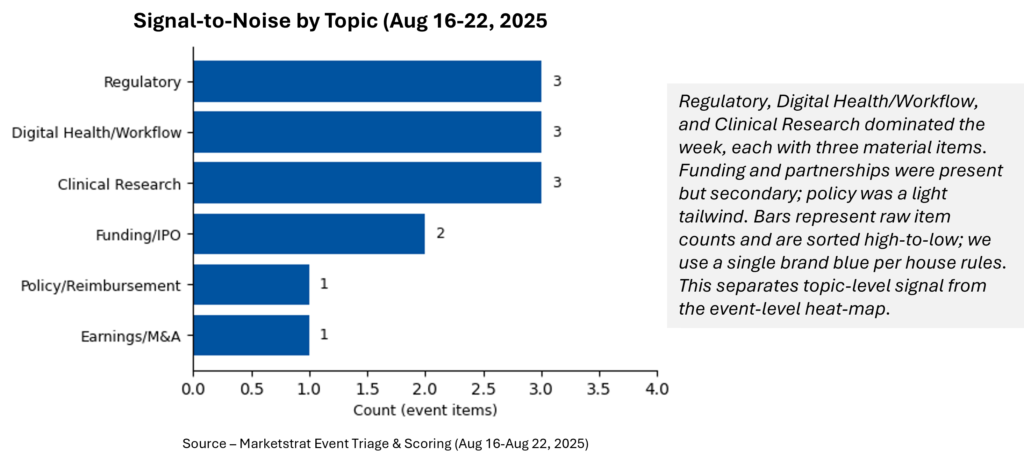

Signal-to-Noise by Topic – Aug 16-22, 2025

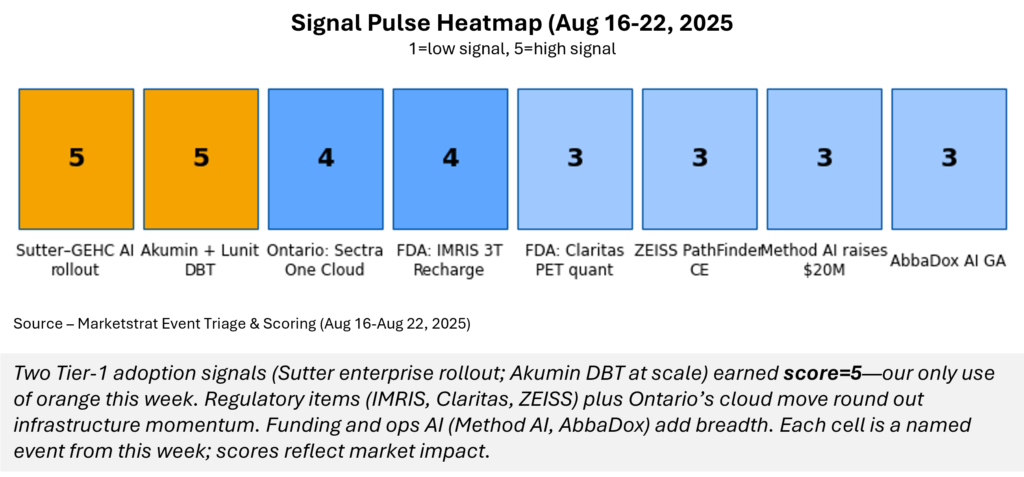

Signal Pulse Heatmap – Aug 16-22, 2025

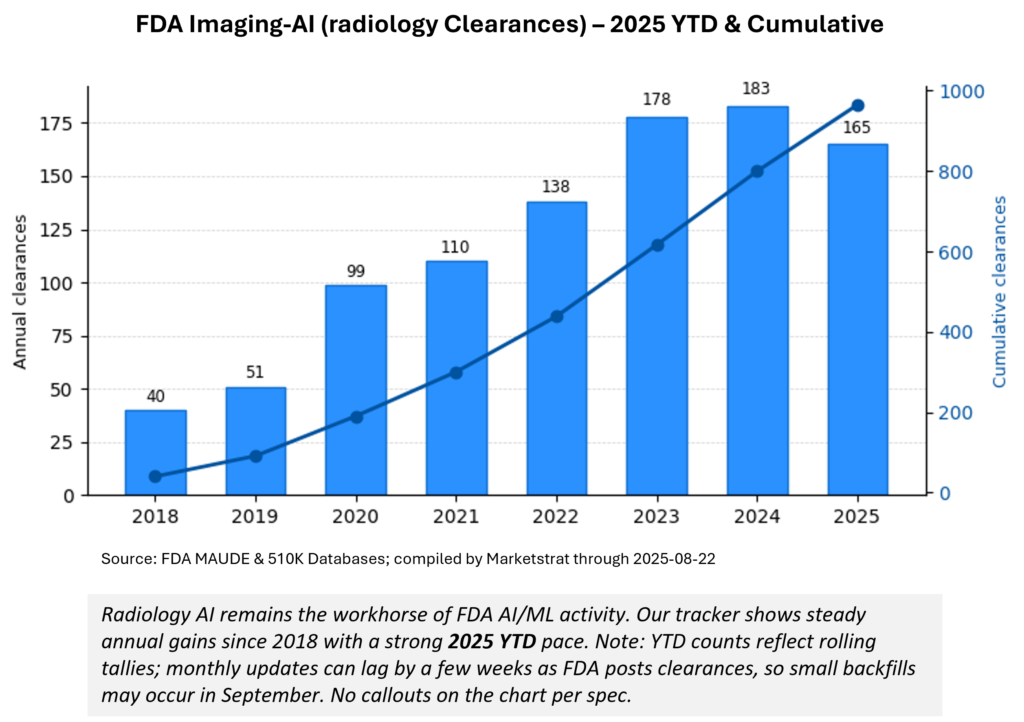

Regulatory Pulse – Aug 16-22, 2025

Deeper Dives

Regulatory

- Intra‑op MR upgrade path: FDA cleared IMRIS InVision 3T Recharge, enabling installed OR suites to step into Siemens Skyra Fit/Biomatrix with AI‑enabled protocols—lowering friction for AI recon and post‑processing in intra‑op workflows.

- PET quant at the elbow: Claritas NucMed software adds automated PET segmentation/quantification—another sign that quant + workflow is going mainstream.

- Sightline to scale: ZEISS PathFinder secured CE Mark for automated OCT analytics; ophthalmology joins weekly AI cadence.

Funding/IPO & Partnerships

- Method AI closed $20M (surgical oncology visualization).

- OneMedNet × Circle CVI pivoted to a subscription model for image‑data solutions—signal for data‑as‑a‑service pricing.

Digital Health/AI & Cloud

- Sectra One Cloud for six Ontario hospitals consolidates ~1M exams/year—regional load‑balancing and unified worklists set the table for multi‑site AI orchestration.

- AbbaDox AI GA: pilot results show 67% data‑entry reduction, 86% reminder confirmations—operations AI is monetizing.

- Talkdesk‑Epic integration deepens AI‑powered outreach—adjacent to imaging referral completion.

Clinical Evidence

- Hybrid AI reading (Radboud, Radiology): 38% workload cut, no loss in recall/cancer detection.

- FES‑PET in ILC (n=20): 100% specificity for axillary metastases; sensitivity 67–75%—promising for surgical planning.

- X‑ray diffraction 4D mammo (Calidar) launched first‑in‑human study.

Innovation Hook

Hybrid AI reading cut radiologist workload 38% in screening mammo with no penalty in recall or cancer detection. We visualize the delta as normalized reading time (AI+reader = 62 vs human‑only = 100). Δ = −38 pp; NNT not applicable here.

Market Lens

Marketstrat POV

- Prioritize platform deals: Bundle hardware refresh, AI protocols, and workforce programs—Sutter’s approach is the reference model competitors will chase.

- Treat breast AI as a P&L wedge: DBT AI is scaling; compete on operational KPIs (reader time, recall stability), not AUC alone.

- Make cloud the default EI path: Regional cloud consolidations unlock routing, uptime, and continuous AI delivery—prerequisite for multi‑site QA.

About Marketstrat

Marketstrat™ is a market intelligence and GTM enablement firm committed to empowering clients in data-driven industries. Under the Markintel™ brand, it delivers robust market intelligence, while GrowthEngine™ solutions offer specialized GTM advisory and app-based tools—together fueling growth, innovation, and competitive advantage. For more information, visit www.marketstrat.com.

Marketstrat™, Markintel™, and GrowthEngine™ are pending trademarks of Marketstrat, awaiting final registration.

Check out free Research and Insights and Analysis of Industry Events

Check out our collection of Markintel Horizon and Markintel Pulse research.

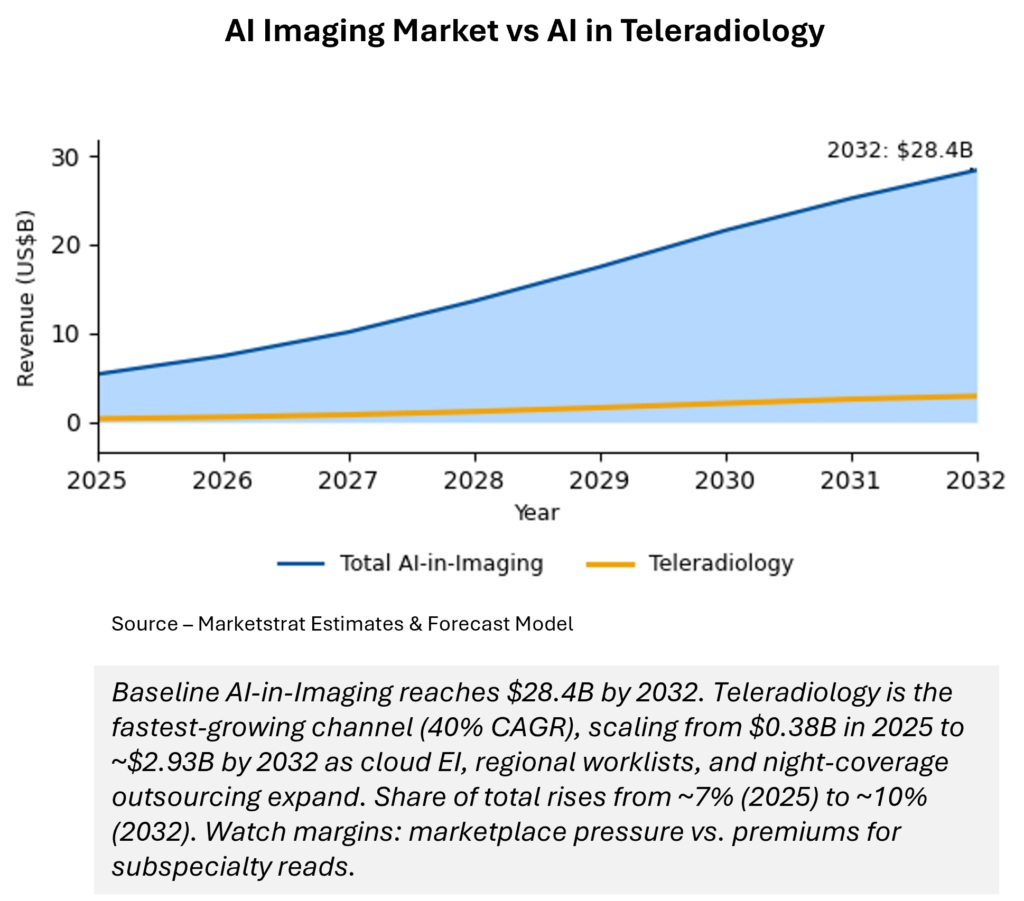

Check out details on our reports, World Market for AI in Medical Imaging and other Pulse Reports in the Imaging space.