One Big Thing

Remote imaging operations just crossed a regulatory threshold. The FDA cleared RadNet/DeepHealth’s TechLive platform for remote operation/supervision of MR, CT, PET/CT, and ultrasound—validating command‑center scanning as a category, not a feature. In the same week, public markets reopened for regulated imaging software (HeartFlow’s $316.7M IPO), and policy moved in ways that will shape AI rollouts and pricing power (PCCPs, MHRA CE‑mark pivot, PFAS clarity).

Key numbers (this week)

- $316.7M — HeartFlow IPO proceeds; priced at $19/share, opened near $28. Signal: investors will back revenue‑generating, reimbursed digital diagnostics.

- 300+ scanners — Systems already connected to DeepHealth TechLive across MR/CT/PET‑CT/US, per company. Workflow leverage now has an FDA footing.

- +63% vs –8.3% — Telix Q2 revenue +63% YoY ($204M) while Lantheus’ Pylarify fell 8.3% YoY; read‑through: PSMA tracer competition and mix are biting.

- Up to 3× faster MR — Philips’ SmartSpeed Precise dual‑AI software cleared; speed and sharpness remain the MR battleground.

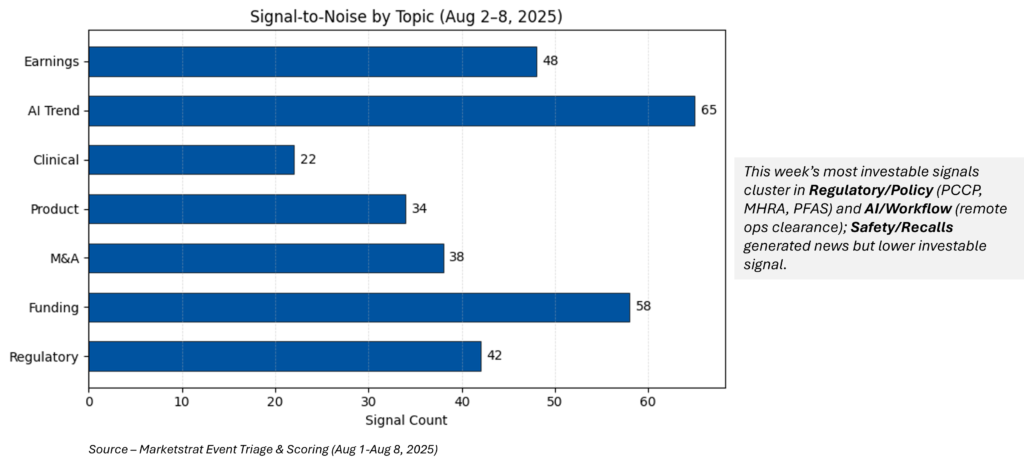

Signal-to-Noise Heatbar

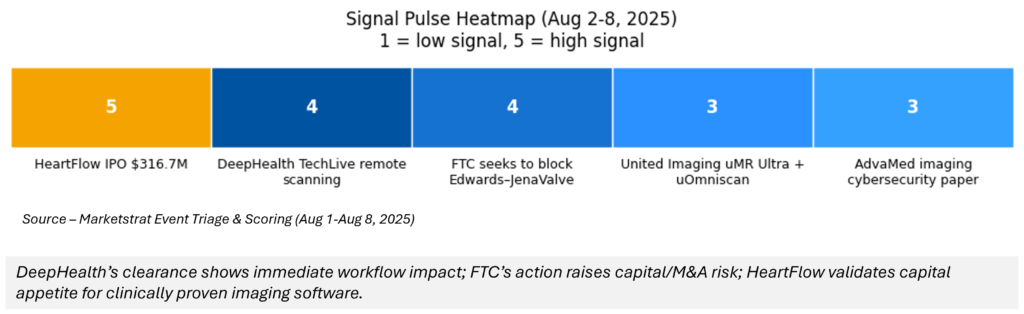

Signal Pulse Heatmap

Quick glance (fast‑read)

| Item | What happened | Why it matters |

|---|---|---|

| Remote scanning | FDA cleared TechLive for remote operation/supervision across MR/CT/PET‑CT/US. | Opens staffing leverage & standardization playbooks; vendors will race to full fleet “tele‑orchestration.” |

| HeartFlow IPO | Raised $316.7M; stock opened ~50% above IPO price. | Re‑rates regulated imaging software; creates a comp for exits beyond M&A. |

| AHRA product cadence | United Imaging launched uMR Ultra 3T and previewed uOmniscan remote platform. | Confirms command‑center ops + AI‑driven speed/quality as MR differentiation. |

| Cyber risk | AdvaMed issued imaging cybersecurity outage/response white paper; ACR/SIIM endorsed. | Remote ops + AI expand attack surface; SBOMs and runbooks now RFP basics. |

| Radiopharma divergence | Telix reaffirms FY guide; Lantheus trims outlook as Pylarify declines. | PSMA tracer competition & logistics are moving share—and margins. |

| M&A guardrails | FTC moved to block Edwards–JenaValve. | Antitrust lens has shifted upstream to innovation pipelines; deal risk rises. |

| Policy | CMS 2026 rules (IPPS/OPPS/PFS) propose modest rate lifts; FDA finalized PCCP guidance; MHRA to consult on indefinite CE recognition; FDA clarified PFAS device stance. | Faster AI iteration (PCCP), smoother UK access (CE), lower material risk; ROI must come from productivity, not price. |

Deeper dive

1) Imaging ops & workforce: command‑center scanning goes mainstream

- What’s new: FDA clearance makes remote scanning an enterprise‑grade option. Early adopters claim throughput uplift and overtime compression; standardization should improve first‑pass yield for complex exams (cardiac MR, PET/CT). Risk shifts to single‑point‑of‑failure and cyber.

- Competitive response: Expect GEHC/Siemens/Philips/Canon to harden remote‑ops stacks, telemetry, and fleet management to protect modality share; United Imaging is already there with uMR Ultra + uOmniscan.

- What to watch: Credentialing for remote techs, union issues, interstate logistics, and payer lens on access/wait‑time gains.

Implications

- Hospitals/IDNs: Pilot remote CT during evenings/weekends; tie ROI to wait‑time reduction and OT savings; require SBOMs and outage runbooks in RFPs.

- Vendors: Sell labor productivity + cyber‑resilience bundles; offer unified monitoring dashboards and credentialing toolkits.

2) Capital markets: a bellwether IPO

- HeartFlow raised $316.7M, pricing above range; shares popped on debut. This reprices regulated imaging software with clear endpoints and coverage.

- Aidoc secured $150M to scale its CARE foundation model and aiOS; enterprise deployments continue at large systems (Advocate, Sutter).

Marketstrat take

- Investors: The market is paying for proof (clearance + coverage + workflow ROI), not promise.

- OEMs/PACS: Expect deeper “app‑store” and API tie‑ups around FFR‑CT, hemodynamics, and foundation models to lock in workflows.

3) Policy & guardrails: faster AI iteration; easier UK access; material clarity

- PCCPs: FDA’s final guidance makes AI change‑control a strategic asset; teams with authorized PCCPs will ship improvements faster.

- UK MHRA: Consulting on indefinite recognition of CE‑marked devices—reduces GB launch friction and cost.

- PFAS: FDA clarified there’s no reason to restrict certain fluoropolymers (e.g., PTFE) in devices—reduces near‑term material risk while “green” alternatives mature.

Why it matters

- PCCP‑ready roadmaps become competitive weapons in imaging AI.

- UK market access looks simpler for global portfolios.

- PFAS clarity stabilizes supply for critical implants & accessories.

4) Radiopharma divergence: PSMA economics in motion

- Telix: Q2 $204M, +63% YoY; FY25 guide $770–800M intact. Gozellix gets HCPCS effective Oct 1—a code that supports pass‑through bids.

- Lantheus: Q2 $378M, Pylarify –8.3% YoY; FY25 outlook trimmed.

Marketstrat take

Diversify tracer sourcing; watch HCPCS/passthrough dynamics and generator vs. cyclotron logistics; expect pricing pressure and share shifts through 2026.

Marketstrat POV (actionable)

- Stand up an imaging command‑center blueprint (networking, credentialing, cyber tabletop drills) before capex cycles. Start with CT pilots.

- Negotiate outcomes‑linked SLAs for AI/remote‑ops (scan time, repeat rates, first‑pass yield). Build protocol governance councils with OEMs.

- Leverage PCCP narratives in product roadmaps and sales decks; position faster iteration as a measurable benefit (e.g., time‑to‑improvement).

- For oncology imaging: use our Growth‑Maturity quadrant to benchmark companies (Aidoc Onco modules, GE Onco‑AI, Siemens AI‑Rad Companion Onco, Lunit, iCAD/RadNet, etc.) and update attach‑rate scenarios.

Stakeholder‑specific implications

Hospitals/IDNs

- Build a central imaging command center blueprint now (networking, credentialing, cyber tabletop drills). Start with CT pilots to quantify wait‑time and OT reduction; scale to MR/PET‑CT.

- Bake downtime runbooks + SBOMs into procurement; require unified device monitoring for remote ops.

Radiology groups

- Negotiate outcomes‑linked service credits (scan time, first‑pass yield, repeat rates). Establish protocol governance councils with OEMs to scale AI‑assisted protocols.

OEMs & AI vendors

- Position around labor productivity and cyber‑resilience; document PCCP‑driven iteration speed in value stories.

Investors

- Focus on proof over promise: clearances, coverage, deployment scale, and workflow integration; monitor radiopharma share shifts as a forward indicator for imaging economics.

Regulatory Pulse

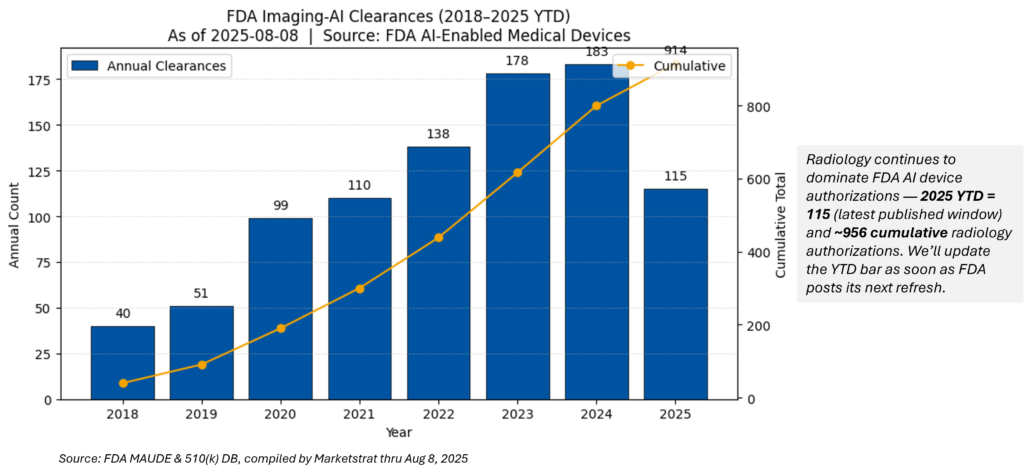

FDA Imaging‑AI (Radiology) clearances — 2025 YTD & cumulative

Note: The FDA’s July 10 update enumerated 211 AI‑enabled devices added since Sept 28, 2024; radiology remains the dominant category. We’ll roll new YTD adds as soon as the next FDA refresh posts.

Innovation Hook

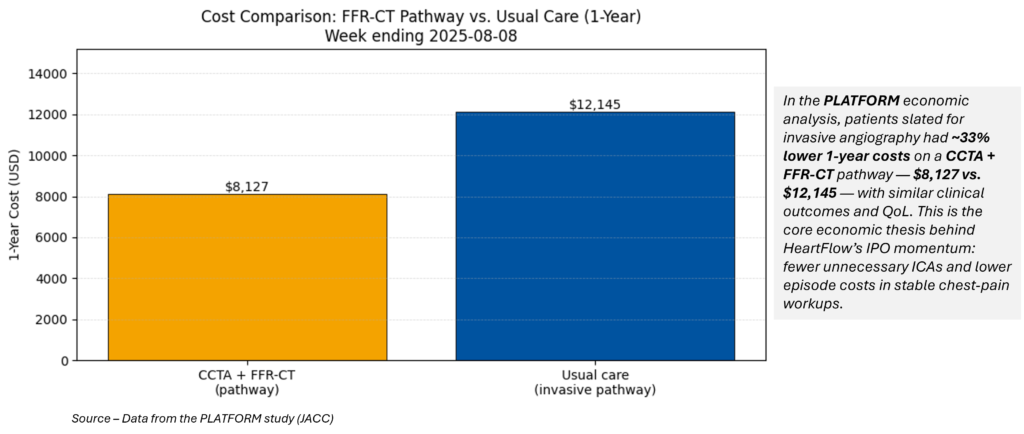

HeartFlow’s successful listing lands as systems push to deflate chest‑pain workups and cath‑lab overuse. CCTA+FFR‑CT cuts ~$4,000 per patient at one year and cancels a majority of unnecessary ICAs in stable chest‑pain cohorts—an economics‑plus‑experience story that payers and ED leaders understand. Look for renewed pipeline interest in functional imaging add‑ons and pathway‑level contracting anchored on avoided ICAs.

Marketstrat take:

The IPO creates a fresh comp for imaging‑software exits and a commercial proof‑point for workflow‑embedded, reimbursed AI—the same thesis we flagged in this week’s research package (remote ops + clinical value) and our ongoing coverage of imaging AI maturity.

Market Lens

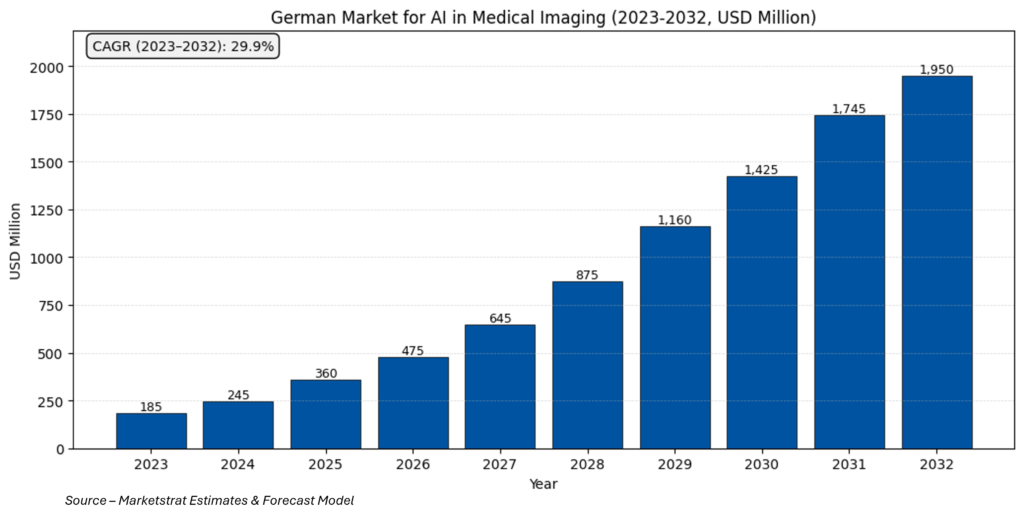

With nearly US $ 2 B in spend by 2032, Germany will remain Europe’s single largest imaging‑AI market. Capital digitization funding, strict—but stabilizing—regulation, and clear clinical KPI (wait‑time, double‑reading relief) make it a “proof‑ground” for scalable, evidence‑driven AI. Vendors that achieve early MDR certification, local data‑protection compliance, and KHZG alignment will capture the steepest share of the coming growth curve.

About Marketstrat™

Marketstrat™ is a market intelligence and GTM enablement firm committed to empowering clients in data-driven industries. Under the Markintel™ brand, it delivers robust market intelligence, while GrowthEngine™ solutions offer specialized GTM advisory and app-based tools—together fueling growth, innovation, and competitive advantage. For more information, visit www.marketstrat.com.

Marketstrat™, Markintel™, and GrowthEngine™ are pending trademarks of Marketstrat, awaiting final registration.

Check out free Research and Insights and Analysis of Industry Events

Check out our collection of Markintel Horizon and Markintel Pulse research.

Check out details on our upcoming report, World Market for AI in Medical Imaging

FAQs

FAQs — Markintel Pulse (Week Ending Aug 8, 2025)

What’s the one big thing this week?

Which modalities and use cases are covered by TechLive’s clearance?

How widespread is deployment today?

Why does remote imaging ops matter for health systems?

What are the key numbers from this week?

- $316.7M — HeartFlow IPO proceeds (priced at $19/share; opened near $28).

- 300+ scanners — TechLive connected systems.

- +63% vs –8.3% — Telix Q2 revenue +63% YoY ($204M) vs. Lantheus’ Pylarify −8.3% YoY.

- Up to 3× faster MR — Philips SmartSpeed Precise (dual‑AI) emphasizes speed/sharpness gains.

What does HeartFlow’s IPO signal for imaging software?

What policy changes should I know about (PCCP, MHRA, PFAS, CMS)?

- PCCP (FDA): final guidance makes approved change‑control a speed advantage for AI updates.

- MHRA (UK): consulting on indefinite CE‑mark recognition, reducing GB launch friction.

- PFAS: FDA clarified certain fluoropolymers (e.g., PTFE) remain acceptable—lower near‑term material risk.

- CMS 2026: modest IPPS/OPPS/PFS updates (~2–3% headline); ROI must come from productivity and mix.

What’s behind the “radiopharma divergence” call‑out?

What do the Signal‑to‑Noise heatbar and Signal Pulse heatmap represent?

What should hospitals/IDNs do next?

- Pilot remote CT during evenings/weekends; measure wait‑time and OT reduction.

- Require SBOMs, outage runbooks, and unified device monitoring in RFPs.

- Negotiate outcomes‑linked SLAs (scan time, first‑pass yield, repeat rates).