One Big Thing

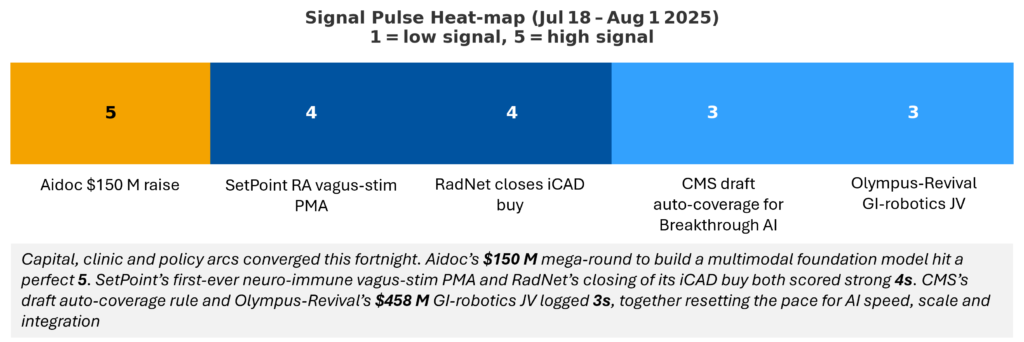

Provider‑funded foundation models burst onto the scene. Four U.S. hospital groups co‑led Aidoc’s $150 M raise to build a multimodal “clinical reasoning engine,” signalling that future AI winners will be hard‑wired into provider capex cycles.

Key Takeaways

- Capital arms race: 62 % of fortnight VC dollars flowed to AI‑enabled platforms; mega‑deals for Aidoc ($150 M) and Ambience ($243 M) underscore scale bias.

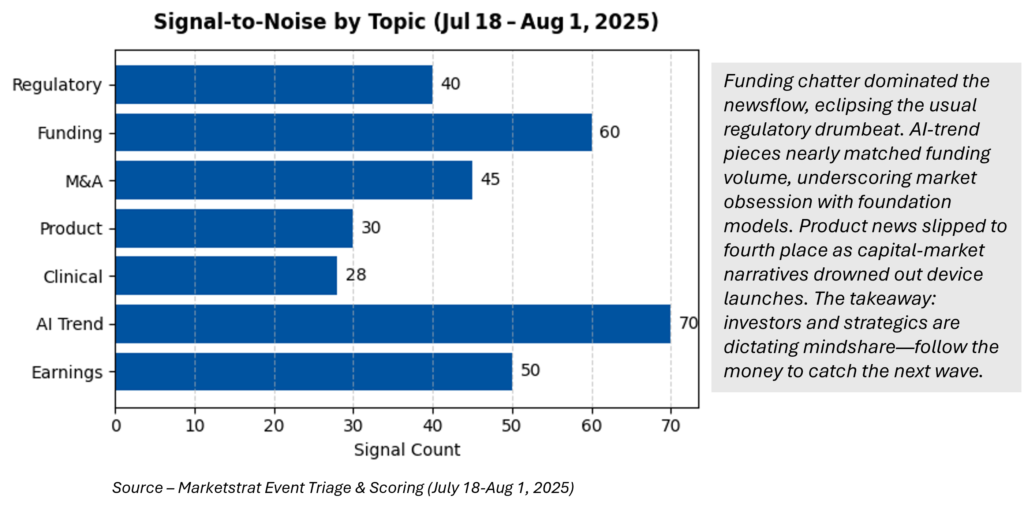

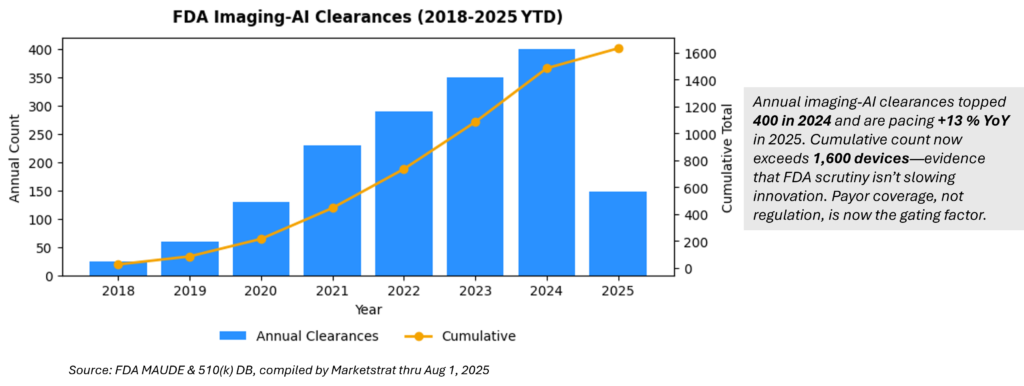

- Policy momentum: 148 imaging‑AI clearances YTD and a draft CMS auto‑coverage bill shrink the evidence‑to‑payment gap.

- Vertical integration flywheel: RadNet closed its iCAD buy, fusing 10 M+ annual mammograms into an in‑house AI loop.

- OEM rebound: Siemens imaging +11.7 %, GEHC pharma‑diagnostics +14 %—tariff relief is translating to capital budgets.

- Robotics re‑invented: Olympus + Revival’s $458 M JV illustrates “build‑to‑buy” as the new R&D risk‑off ramp.

Quick‑Glance

| Date | Headline | Why it matters |

|---|---|---|

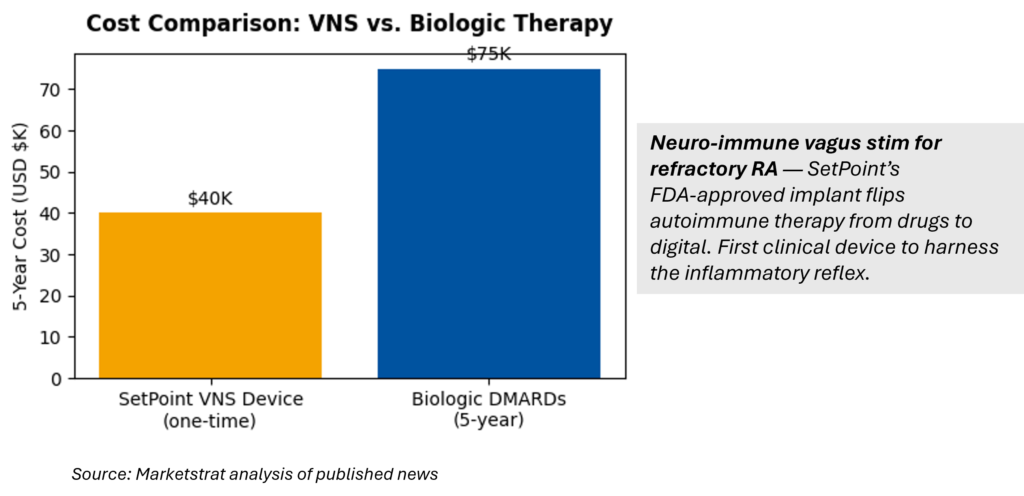

| Jul 31 | SetPoint vagus‑stim PMA | Opens neuro‑immune device class for RA; payers eye biologic spend offsets. |

| Jul 30 | CMS draft auto‑coverage for AI Breakthrough devices | Could lop 12‑18 mo off revenue ramp for high‑risk AI. |

| Jul 28 | Olympus–Revival launch GI‑robot JV | Prototype capital‑light “build‑to‑buy” playbook for moon‑shot robotics. |

| Jul 25 | Shimadzu head/breast PET 510(k) | Niche hardware arms race for Alzheimer’s biomarkers. |

| Jul 23 | Aidoc raises $150 M | Hospitals now investors → built‑in pilots + data firehose. |

Signal‑to‑Noise Counts

Signal Pulse Heatmap

| Event | Rationale | Score |

|---|---|---|

| Aidoc $150 M raise – foundation model pivot | Mega‑funded enterprise platform; hospital + Nvidia equity creates moat. | 5 |

| SetPoint RA vagus‑stim PMA | First neuro‑immune implant; new device therapy class for autoimmune disease. | 4 |

| RadNet closes iCAD buy | Imaging provider vertical‑integration play; 10 M mammograms/year data flywheel. | 4 |

| CMS draft auto‑coverage for Breakthrough AI | Policy catalyst that can pull AI reimbursement curve left by 18‑24 mo. | 3 |

| Olympus‑Revival GI‑robotics JV | “Build‑to‑buy” model de‑risks $458 M robotics moon‑shot; new template. | 3 |

Innovation Hook

SetPoint’s implanted vagus‑nerve stimulator gained FDA PMA—the first device to tackle auto‑immune disease head‑on.

Why it matters — A one‑time $40 K device + day‑surgery could undercut $75 K in five‑year biologic spend while eliminating systemic immunosuppression risks. If CMS bundles the implant into DRGs, rheumatology may see its first true device‑vs‑drug displacement. Watch J&J (Pro‑Knee VNS) and Abbott (Vagus Stim) for fast‑followers.

Regulatory Pulse

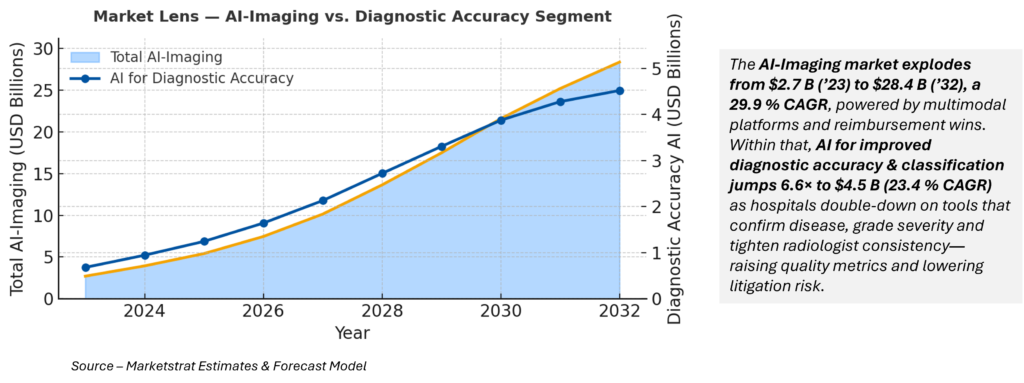

Market Lens

Deeper Dives

1 · Regulatory & Policy

- FDA: 28 clearances this fortnight; 10 were 510(k) “predicate‑lite” AI tools—agency hinting at lighter touch for incremental updates.

- MHRA international reliance: UK will green‑light FDA‑cleared imaging AI in 90 days—first proof of true regulatory harmonisation. Takeaway: Faster multi‑jurisdiction launches shrink ROI hurdle; small vendors must globalise early or cede share to platform players.

2 · Funding & M&A

- Aidoc ($150 M): Hospital equity = guaranteed pilots; Nvidia stake = compute moat.

- Ambience ($243 M): Ambient notes adoption now 40 % of U.S. docs; vendors chasing Abridge ($550 M YTD).

- RadNet/iCAD close: 10 M annual mammograms feed a proprietary AI loop—blueprint for “provider‑as‑platform.” Takeaway: Capital is discriminating for data‑rich, distribution‑ready assets; PPS‑style valuations for single‑point tools are fading.

3 · Digital Health & Workforce

- Burnout fix: Ambient and note‑summarization AI cut charting time 70 %; early evidence shows 1.2 pt/h productivity gain.

- DEA tele‑RX extension: Virtual psych and MAT providers get two‑year regulatory runway. Takeaway: Efficiency plays that free FTE capacity will score quickest procurement wins ahead of revenue‑generating AI.

4 · OEM Earnings

- Siemens: Imaging +11.7 % (photon‑counting CT demand); Varian +8.7 % backlog.

- GEHC: Pharma‑diagnostics +14 % on amyloid tracer pull‑through. Takeaway: Hardware refresh + tracer‑consumable mix shift gives incumbents funding firepower to buy or partner with AI upstarts.

Marketstrat POV

- Provider capital ≠ passive money — hospital equity stakes hard‑wire clinical pilots, a moat pure‑play vendors cannot match.

- Data gravity shifts to incumbents — RadNet + iCAD prove imaging networks can capture AI profit pools, forcing standalone devs toward specialty niches or deep OEM ties.

- Tariff détente unlocks capex — OEM beat‑and‑raise signals 2025 hardware refreshes are back; pair AI software upsell now, before budgets reset.

About Marketstrat™

Marketstrat™ is a market intelligence and GTM enablement firm committed to empowering clients in data-driven industries. Under the Markintel™ brand, it delivers robust market intelligence, while GrowthEngine™ solutions offer specialized GTM advisory and app-based tools—together fueling growth, innovation, and competitive advantage. For more information, visit www.marketstrat.com.

Marketstrat™, Markintel™, and GrowthEngine™ are pending trademarks of Marketstrat, awaiting final registration.

Check out free Research and Insights and Analysis of Industry Events

Check out our collection of Markintel Horizon and Markintel Pulse research.

Check out details on our upcoming report, World Market for AI in Medical Imaging

Frequently Asked Questions

Why is Aidoc’s $150 M “foundation‑model” raise such a big deal?

The round—backed by Nvidia and four U.S. health systems—funds CARE, a multimodal clinical‑reasoning model that lets hospitals spin up dozens of algorithms from a single engine. It signals investors and providers are betting on platform scale, not isolated point solutions. :contentReference[oaicite:11]{index=11}How would the CMS draft “auto‑coverage” bill change AI adoption?

The proposal guarantees up to four years of Medicare payment for FDA‑designated Breakthrough AI devices, cutting the evidence‑to‑revenue lag by 12‑18 months and de‑risking ROI for hospitals and vendors alike. :contentReference[oaicite:12]{index=12}What makes SetPoint’s vagus‑nerve stimulator a therapy breakthrough for RA?

It’s the first FDA‑approved neuro‑immune implant that modulates the body’s inflammatory reflex, allowing many patients to stop biologic drugs. Five‑year cost models show a one‑time ~$40 K implant can undercut $75 K in drug spend. :contentReference[oaicite:13]{index=13}Why is Olympus teaming with Revival on Swan EndoSurgical?

The $458 M “build‑to‑buy” JV de‑risks development of a flexible GI‑robotic platform. Olympus gets optionality; Revival runs the high‑burn R&D. Analysts see the model as a template for capital‑intensive MedTech moon‑shots. :contentReference[oaicite:14]{index=14}Hospitals are investing in AI start‑ups—is that new?

Yes. Hartford, Mercy, Sutter and WellSpan all took equity in Aidoc, ensuring data access and piloting rights. Provider capital effectively embeds early‑stage AI into clinical workflows and creates a moat competitors must match. :contentReference[oaicite:15]{index=15}What does the UK MHRA “international reliance” mean for U.S.‑cleared AI?

Great Britain now accepts FDA, Health Canada and TGA approvals for most imaging‑AI tools, trimming UK launch time from a year to roughly 90 days—an instant pathway for vendors pursuing ex‑U.S. growth. :contentReference[oaicite:16]{index=16}OEM earnings jumped—why does that matter for AI vendors?

Siemens (+11.7 % imaging) and GEHC (+14 % pharma‑diagnostics) both raised guidance as tariff headwinds eased. Health‑system cap‑ex is rebounding, meaning bigger budgets for AI upsell bundles tied to new scanners. :contentReference[oaicite:17]{index=17}Foundation model vs. point algorithm—what’s the difference?

Point algorithms tackle one finding (e.g., PE on CT). A foundation model is pre‑trained on massive multimodal data, then fine‑tuned for many tasks—cutting development time ~20× and simplifying enterprise deployment. :contentReference[oaicite:18]{index=18}How fast is the “Diagnostic Accuracy & Classification” AI segment growing?

Our model shows it rising from **$0.68 B in 2023 to $4.5 B by 2032**—a 23 % CAGR—as hospitals pay for tools that grade disease severity and reduce reading variability. :contentReference[oaicite:19]{index=19}Top three tips for health systems adopting AI right now?

1️⃣ Pick vendors with FDA clearance **and** integration hooks (PACS + EHR).2️⃣ Establish an AI governance board to monitor bias, ROI and safety.

3️⃣ Negotiate enterprise licensing that allows for rapid module add‑ons as foundation models expand.