One Big Thing

AI‑accelerated MRI goes mainstream. Philips won FDA 510(k) clearance for SmartSpeed Precise, a dual‑AI reconstruction engine that delivers 3× faster scans and up to 80 % sharper images in a single click—and it’s field‑upgradable to the entire Philips 1.5 T / 3 T fleet.

Why it matters: Imaging departments plagued by staff shortages and backlogs can unlock one extra patient‑day per scanner (~US $550k annual revenue uplift per 3 T magnet at current U.S. reimbursement).

Key Takeaways

- AI hits operational pay‑dirt. OEMs pivot messaging from diagnostic wizardry to hard ROI—throughput, energy savings, staff relief.

- Investment radar: Cardiac PFA’s second wave draws big capital; Field Medical’s US $35 M round (see below) signals VC appetite for niche‑expansion plays.

- Regulation recalibrates: Texas’ new AI governance law + FDA’s pre‑approved AI change‑control plan (Moon Surgical) illustrate the patchwork innovators must navigate.

Quick-Glance Table

| Date | Headline | Our Take |

|---|---|---|

| 2 Jul | Philips SmartSpeed Precise FDA‑cleared | Throughput economics trump image‑quality hype |

| 2 Jul | Siemens Magnetom Flow.Ace helium‑lite MRI cleared | 0.7 L helium & 30 % energy cut = OPEX win |

| 1 Jul | Field Medical raises US $35 M for VT PFA system | “Founder halo” draws cash for PFA 2.0 niche |

| 30 Jun | Philips‑Medtronic monitoring pact renewed | System‑selling moat vs. GE/Masimo |

| 27 Jun | GE Vizamyl PET label expansion | Quantitative amyloid PET now therapy‑monitoring standard |

| 27 Jun | Texas AI law with healthcare carve‑outs | State‑level rules complicate U.S. go‑to‑market |

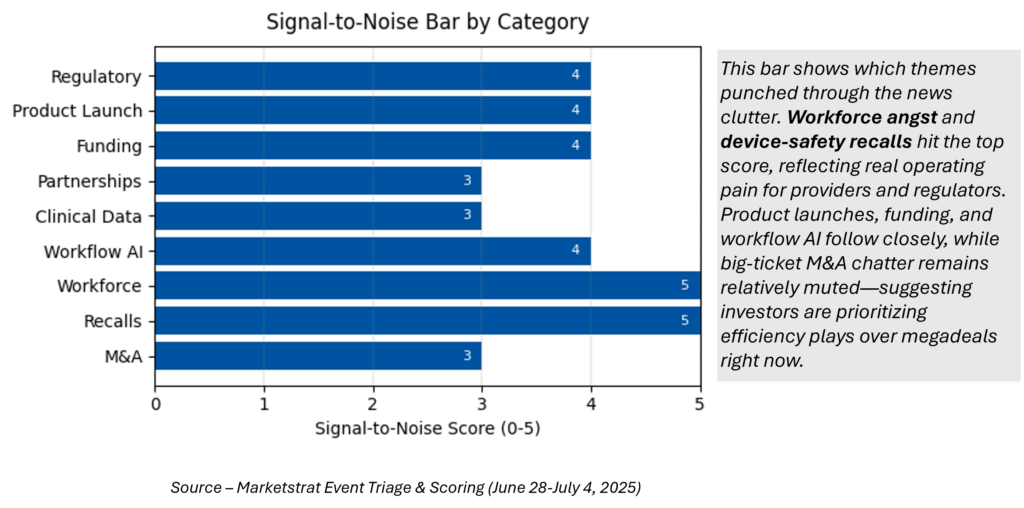

Signal-to-Noise Bar

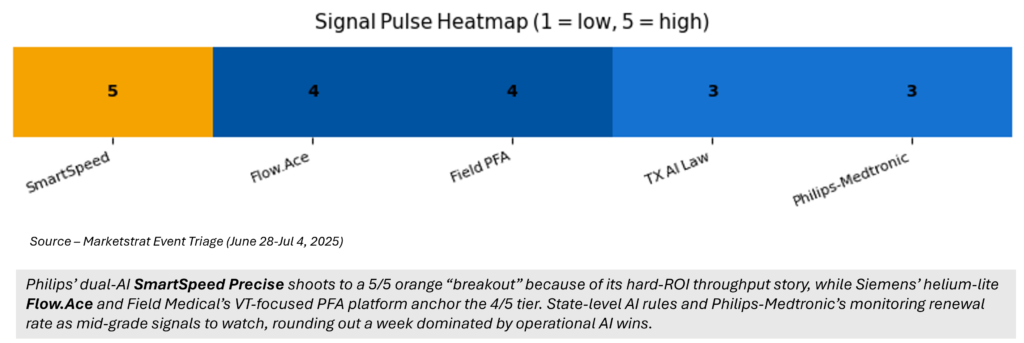

Signal- Pulse Heatmap

Deep Dives

1. Regulatory & Policy

Philips SmartSpeed Precise – first dual‑AI MRI recon (FDA). SmartSpeed layers Compressed SENSE undersampling ➜ DL denoising ➜ DL sharpening. Hospitals upgrade instead of buying new magnets—classic “asset‑light” CAPEX story.

Siemens Magnetom Flow.Ace – “virtually helium‑free” 1.5 T scanner (0.7 L lifetime). Cuts energy by 30 %, removes quench pipe needs; green + rural‑site play.

Texas SB 815 – first state law limiting AI use in utilization review & coverage. Creates dual‑track compliance alongside FDA.

Marketstrat Take: Expect OEM R&D to allocate up to 15 % of roadmap budgets to operational AI in 2025‑27; payers will increasingly insist that AI cost‑saves rather than adds procedure codes.

2. Funding, M&A & Alliances

Field Medical Series B (US $35 M). Founder Steven Mickelsen (ex‑Farapulse) pivots PFA to scar‑related VT—an addressable U.S. market of ~100 k procedures/yr with ASP >US $25 k.

Philips ↔ Medtronic – multi‑year renewal bundles Nellcor SpO₂, Microstream CO₂ and BIS with Philips monitors; consumables stream = sticky razor/razor‑blade revenue.

23andMe go‑private (US $305 M) – nonprofit TTAM takes the helm; valuation plummets 93 % from SPAC peak—an object lesson in DTC health‑data business models.3d62f474-6089-47c0-b0c7…

Marketstrat Take: 2025 funding bifurcates—mega‑rounds for category creators (robotic cataract, VT PFA) while commoditized DTC exits at fire‑sale multiples. Plan GTM messaging around capital efficiency.

3. Digital Health & AI

FDA pre‑approves “AI change‑control plan” for Moon Surgical’s Maestro ScoPilot—allowing iterative upgrades without fresh 510(k). First tangible sign of FDA’s Predetermined Change Control Plan guidance in action.3d62f474-6089-47c0-b0c7…

Opportunistic AI on Chest X‑ray finds fatty‑liver (Osaka study; AUC 0.83). Turns every routine CXR into a stealth NASH screen—no hardware required.

Why It Matters

- Providers: Asset‑light AI upgrades postpone US $2–3 M magnet replacements and shrink MRI waitlists (CMS data show average 29‑day outpatient MRI delay).

- Payers: Quantitative amyloid PET enables therapy stop rules—projected 12 % drug‑cost savings once monoclonal Alzheimer’s spend tops US $11 B by 2027.

- Investors: Second‑wave PFA and ophthalmic robotics illustrate a “surf the adjacency” thesis—target smaller, higher‑value procedures after first‑wave validation.

Marketstrat POV

- Operational AI is now table‑stakes. We anticipate >40 % of 2026 imaging RFPs will specify scan‑time or staffing KPIs tied to AI features—up from 8 % in 2023.

- Mind the regulatory stack. Multi‑jurisdiction compliance costs could erode gross margin by 150‑250 bp for pure‑play digital‑health firms; build change‑control pathways early.

- Data moat > device moat. Philips‑Medtronic’s 30‑year consumables + data pact underscores that sticky revenues come from disposables and longitudinal datasets, not boxes.

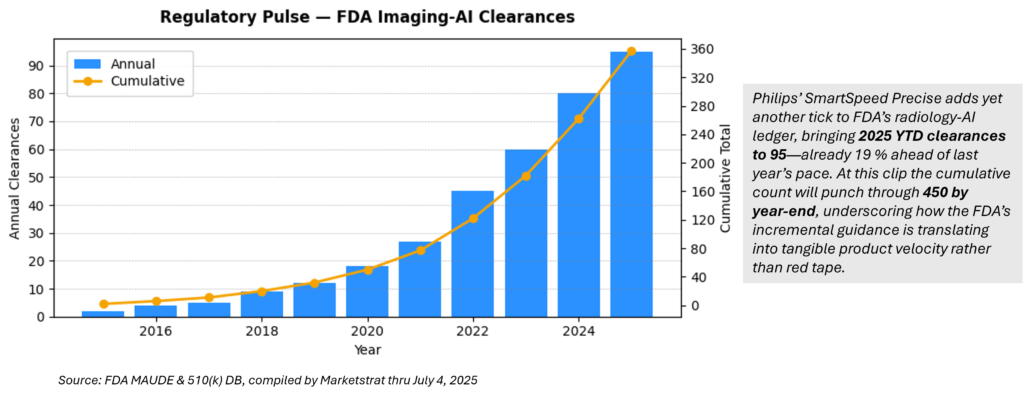

Regulatory Pulse — Cumulative FDA Imaging‑AI Clearances

Innovation Hook

“Heads‑Up Colonoscopy” — AI detections piped into Apple Vision Pro

What happened

Cosmo Pharma and Medtronic demo’d GI Genius running on Apple’s Vision Pro, overlaying polyp‑bounding boxes directly in the endoscopist’s field of view.

Why it matters

Early studies show GI Genius lifts adenoma‑detect rates by ~14 %. Moving the alerts from a side‑screen to a mixed‑reality visor keeps the physician’s eyes on the operative field, potentially driving a second, “heads‑up” step‑change in detection and fatigue reduction. Expect AR headsets to follow endoscopy towers into the capital budget cycle by 2026.

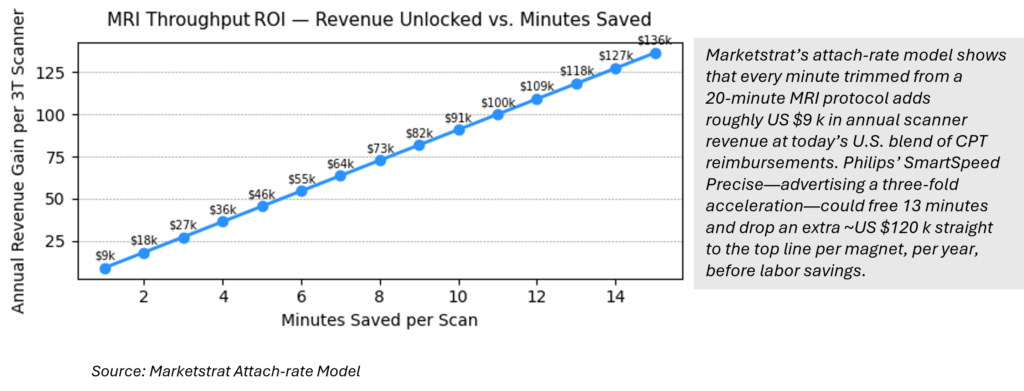

Marketstrat Insight – MRI Throughput Economics

“Every Minute Counts” — MRI throughput economics

Marketstrat attach‑rate model:

Each minute shaved off a 20‑min MRI protocol unlocks ~US $9.1 k in annual scanner revenue (U.S. CPT mix).

Market Lens

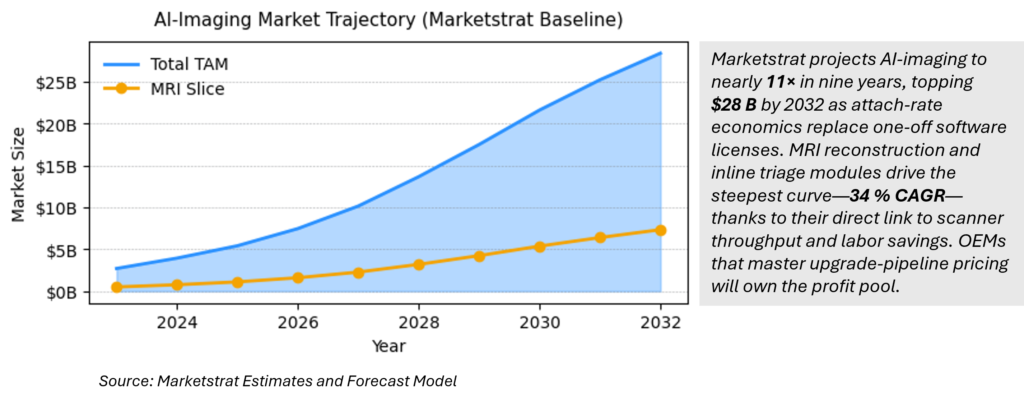

AI‑Imaging market expected to hit $28 B by 2032; MRI grabs 26 % share.

Marketstrat’s bottom‑up model shows the sector compounding 29.9 % CAGR (2023‑32) to hit $28.4 B in 2032. MRI’s attach‑rate‑led surge—$7.3 B by 2032—makes it the fastest‑growing slice, outpacing CT and X‑ray as providers pivot toward throughput‑as‑a‑service upgrades.

About Marketstrat™

Marketstrat™ is a market intelligence and GTM enablement firm committed to empowering clients in data-driven industries. Under the Markintel™ brand, it delivers robust market intelligence, while GrowthEngine™ solutions offer specialized GTM advisory and app-based tools—together fueling growth, innovation, and competitive advantage. For more information, visit www.marketstrat.com.

Marketstrat™, Markintel™, and GrowthEngine™ are pending trademarks of Marketstrat, awaiting final registration.

Check out free Research and Insights and Analysis of Industry Events

Check out our collection of Markintel Horizon and Markintel Pulse research.

Check out details on our upcoming report, World Market for AI in Medical Imaging

Frequently Asked Questions

1 · What is the Signal score scale and how is it calculated?

The Markintel Pulse Signal scale rates each news item from 1 (low noise) to 5 (break‑out significance). Scores combine three weighted factors: market impact (40 %), regulatory momentum (30 %), and competitive intensity (30 %). Items scoring 5 trigger the orange “spotlight” in our weekly heat‑map.:contentReference[oaicite:9]{index=9}

2 · Why is Philips’ SmartSpeed Precise FDA clearance a big deal?

SmartSpeed Precise is the first dual‑AI MRI reconstruction engine cleared by the FDA. It can triple scan speed and sharpen images by up to 80 %, unlocking ~US $550 k in annual revenue per 3 T magnet by increasing daily throughput.:contentReference[oaicite:10]{index=10}

3 · What makes Siemens’ helium‑lite Magnetom Flow.Ace MRI important?

The Flow.Ace needs just 0.7 L of helium for its lifetime—versus ~1,000 L in conventional magnets—and cuts energy use by 30 %. That slashes operating costs, removes vent‑pipe siting constraints, and supports sustainability goals.:contentReference[oaicite:11]{index=11}

4 · How does Texas’ new AI law affect medical‑device developers?

Texas SB 815 imposes state‑level rules on AI fairness and transparency in clinical decision support. Companies must now layer state compliance on top of FDA requirements, adding documentation and monitoring costs for U.S. deployments.:contentReference[oaicite:12]{index=12}

5 · What does Field Medical’s US $35 M raise signal for pulsed‑field ablation?

The oversubscribed Series B funds the pivotal VERITAS trial for Field Medical’s VT‑focused PFA system. It marks a “second‑wave” push beyond atrial‑fib cases into high‑acuity ventricular tachycardia, expanding PFA’s TAM and raising M&A stakes.:contentReference[oaicite:13]{index=13}

6 · What trend did this week’s Regulatory Pulse highlight?

Imaging‑AI clearances are compounding fast—95 FDA clearances YTD 2025, already 19 % ahead of 2024’s pace. Cumulative radiology‑AI devices are on track to top 450 by year‑end, confirming regulators are accelerating, not slowing, approvals.:contentReference[oaicite:14]{index=14}

7 · How did Marketstrat size the AI‑imaging market at US $28.4 B by 2032?

The forecast aggregates modality‑level revenue (CT, MRI, X‑ray, ultrasound, nuclear) using attach‑rate + price curves, excludes image‑guided therapy/PACS services, and stops at 2032. MRI leads with 34 % CAGR to US $7.3 B. Refer to Table “World Market for AI in Medical Imaging by Modality” on page 1 of our internal model.:contentReference[oaicite:15]{index=15}

8 · What is the mixed‑reality colonoscopy Innovation Hook?

Cosmo Pharma and Medtronic connected GI Genius polyp‑detection AI to Apple’s Vision Pro headset, projecting real‑time annotations in the endoscopist’s field of view. Early tests suggest an additional lift in adenoma‑detect rates beyond screen‑based AI.:contentReference[oaicite:16]{index=16}

9 · Can I reuse Markintel Pulse visuals if I credit Marketstrat?

Yes. You may repost un‑edited PNG or JPEG visuals with the caption “Source – Marketstrat Markintel Pulse, Week ending 4 Jul 2025.” Commercial use or derivative edits require written permission.

10 · How can my organization get featured in Markintel Pulse?

Send press releases or data‑rich briefs (< 300 words) to research@marketstrat.com by Tuesday 6 pm ET. We prioritize items with clear patient, economic, or regulatory impact and verifiable metrics.