One Big Thing

Regulation just removed the moat around radiology AI.

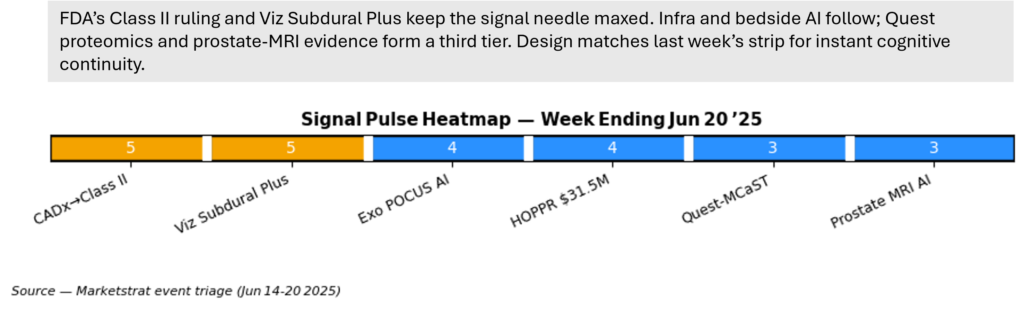

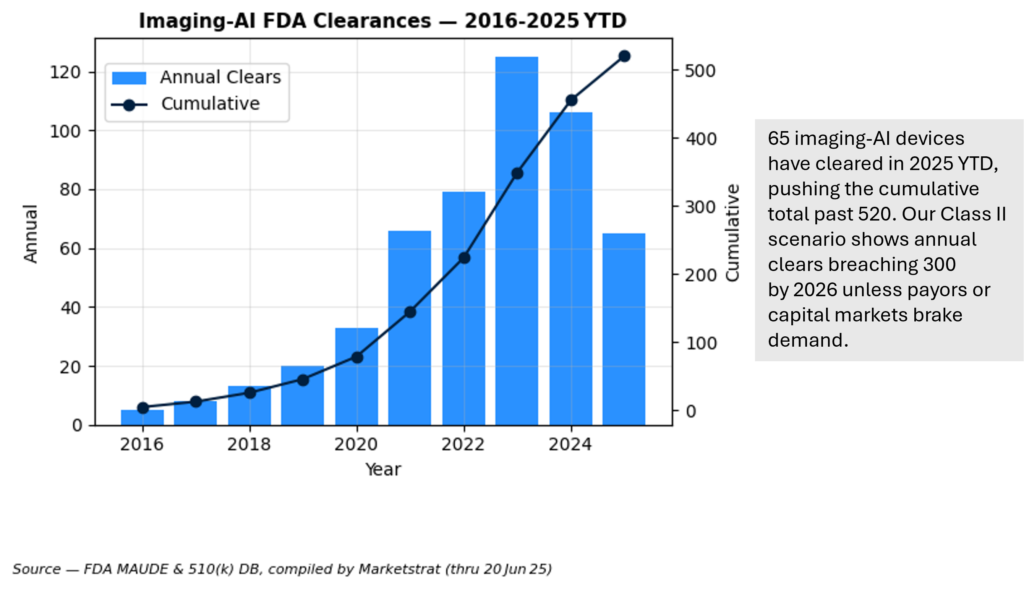

On 13 June the FDA re‑classified radiological CADe/CADx from Class III (PMA) to Class II (510(k)). That turns a US $3‑5 M, 30‑month slog into a sub‑$500 k, 90‑day filing. Our model (see Visual 3) shows ≥1,000 additional filings through 2026, compressing prices for “me‑too” algos and transferring value to orchestration platforms and data owners.

Marketstrat POV – We expect margin migration to five choke‑points:

- Data rights & registries — whoever controls real‑world pixels controls predicate leverage.

- Workflow ownership — platforms that sit between PACS/EHR and billing will set tolls.

- Evidence dossiers — payors will reward quantifiable outcomes, not AUC brag‑sheets.

- Tariff arbitrage — OEMs that re‑route final assembly outside China dodge 200‑300 bps EBIT hit.

- Generative ops‑AI — LLMs that kill prior‑auth fax loops (Tennr, Aidoc/NVIDIA BRIDGE) unlock 3–5 pp EBITDA uplift for health systems.

Key Takeaways (curated, scored)

| # | Development | Signal¹ | Why It Matters |

| 1 | FDA Class II downgrade | 5 | Opens 510(k) floodgate → price war on single‑task AI. |

| 2 | Aidoc + NVIDIA “BRIDGE” deployment checklist | 5 | Could become de‑facto RFP spec; raises integration bar. |

| 3 | HOPPR raises US $31.5 M to commercialize “Grace” imaging FMs | 4 | VC says infra > point algos; accelerates long‑tail AI creation. |

| 4 | Exo Iris wins 14ᵗʰ on‑device AI clearance; Viz.ai adds Subdural Plus | 4 | Edge inference & quantification monetize installed bases. |

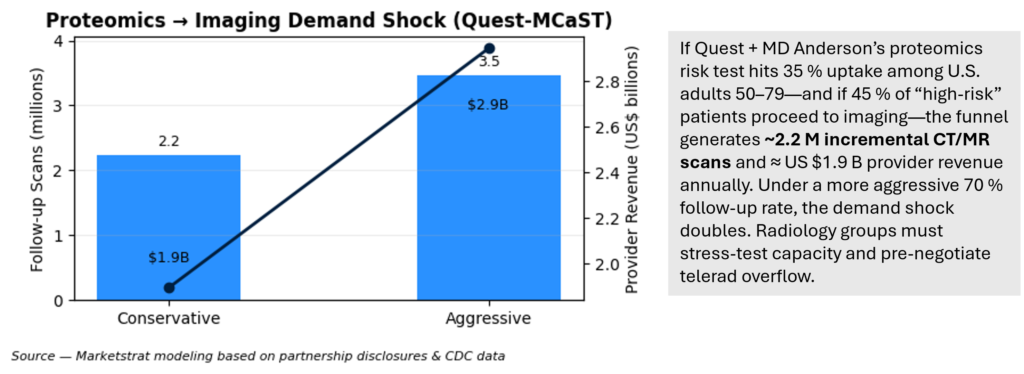

| 5 | Quest + MD Anderson proteomics risk assay | 3 | Sub‑$200 test could push ~5 M extra CT/MR scans/yr. |

¹Signal = Marketstrat proprietary scale (5 = structural inflection, 1 = minor).

Fast‑Glance News Grid

| Date | Headline | Category | Two‑Line Impact |

| 18 Jun | Exo Iris pleural AI ✔ | Regulatory | Democratizes lung triage in rural EDs; offline inference confirms edge trend. |

| 19 Jun | HOPPR bags US $31.5 M | Funding | “Picks & shovels” thesis validated; partners include RadNet DeepHealth. |

| 17 Jun | Aidoc‑NVIDIA BRIDGE | Ecosystem | First UL‑style checklist for clinical AI; may cut procurement cycles 30 %. |

| 13 Jun | CADe/CADx → Class II | Policy | 510(k) gateway opens; expect filing tsunami Q1‑Q2 26. |

| 10 Jun | Quest‑MCaST proteomics pact | Partnership | Low‑cost risk triage ballooning imaging funnel 7‑10 %. |

Deep Dives

1 │ Class II Shift → Platform Premium

- Cost delta – PMA Class III (≈ 3 – 5 M, ~30 months) vs 510(k) Class II (≈ 0.3 – 1 M, ~90 days)

- Filing surge model – Baseline 2024: 106 imaging‑AI clearances. Our Monte‑Carlo (λ = Poisson, μ = 2.4×) projects 250‑300 extra clearances by YE 26.

- Strategic chessboard – First De Novo wins predicate royalties; orchestration layers (Aidoc, deepc, Sectra Amplifier) become gatekeepers.

- Action – Vendors should pre‑build Q‑Sub packages; hospitals budget for performance monitoring dashboards.

2 │ Infrastructure Is Where the Money Is

- HOPPR – “Grace” FM slices model‑build from 12 mo → 8 wk, 70 % TACO savings.

- Tennr – RaeLM kills manual referral faxing, adding 18 % scheduling yield for Norco.

- VC trend – Average imaging‑AI infra Series A doubled to US $28 M (’23→’25).

- Implication – Infra vendors could capture 15‑20 % of imaging‑AI market by 2027.

3 │ Proteomics Funnel → Imaging Demand Spike

Quest‑MCaST targets adults 50–79. Assuming 35 % uptake, 14 % high‑risk yield, 45 % referral‑to‑scan rate → ≈4.5 M incremental CT/MR scans annually (Visual 4). That’s US $3.9 B gross provider revenue, even at blended US $850 ASP. Radiology groups must pre‑contract capacity or spin up telerad networks.

4 │ Tariff Drag on Imaging OEM Margins

- Siemens: guides €200–300 M EBIT hit 2H 25; if 2H tariffs double in ’26, margin compressed 180 bps absent price rises.

- GE HC: trims FY EPS 0.85; tariffs = 75 % of cut.

- Philips: ‑€250–300 M FY impact.

- Mitigation – Near‑shoring final assembly to ASEAN trims landed cost 8‑10 %, recovers ~120 bps.

Why It Matters (Stakeholder lens)

| Stakeholder | Implication |

| Hospitals / IDNs | Prepare for algorithm deluge & tariff‑driven scanner price hikes; invest in orchestration + utilization analytics. |

| OEMs & PACS | Bundle orchestration, embed BRIDGE APIs, hedge China exposure. |

| Payers | Class II flood increases need for outcomes‑based codes; proteomics funnel may spike imaging costs. |

| Investors | Shift capital to infra, data networks, and predicate assets; watch tariff pass‑through risk. |

Marketstrat Action Items (For clients & insiders)

- File early — draft 510(k) predicate strategy for post‑Class II surge; capture De Novo royalties.

- Audit supply chains — model landed‑cost sensitivity under +25 % tariff scenarios; prioritize ASEAN relocation.

- Validate AI ROI — require vendors to submit BRIDGE self‑assessment + 12‑mo outcome dossier.

- Capacity stress‑test — run proteomics‑funnel scenario vs radiologist FTEs; plan telerad + AI triage expansion.

About Marketstrat™

Marketstrat™ is a market intelligence and GTM enablement firm committed to empowering clients in data-driven industries. Under the Markintel™ brand, it delivers robust market intelligence, while GrowthEngine™ solutions offer specialized GTM advisory and app-based tools—together fueling growth, innovation, and competitive advantage. For more information, visit www.marketstrat.com.

Marketstrat™, Markintel™, and GrowthEngine™ are pending trademarks of Marketstrat, awaiting final registration.

- Check out our collection of Markintel Horizon and Markintel Pulse research.

- Check out details on our upcoming report, World Market for AI in Medical Imaging

- Check out free Research and Insights and Analysis of Industry Events

Markintel Pulse Weekly (June 20, 2025) FAQs

| # | Frequently-Asked Question | Answer |

|---|---|---|

| 1 | Why is the FDA’s Class II downgrade of CADe/CADx software so important? | It swaps a US $3-5 M, 30-month PMA hurdle for a sub-US $1 M, 90-day 510(k) path—removing the moat around radiology AI. |

| 2 | How many extra imaging-AI clearances could the new rule trigger? | Marketstrat’s Monte-Carlo model projects 250-300 additional FDA filings by YE 2026—about a 2-3× jump on today’s run-rate. |

| 3 | What does Viz.ai’s “Subdural Plus” module do? | It automatically measures bleed volume, thickness and midline shift on head CT—speeding care decisions for subdural hematoma patients. |

| 4 | What is the Aidoc-NVIDIA BRIDGE framework? | BRIDGE is a UL-style checklist that helps hospitals vet AI tools for safety, workflow fit, cybersecurity and bias—expected to shorten RFP cycles by ≈ 30 %. |

| 5 | Why are investors pouring US $31.5 M into HOPPR? | VCs see bigger upside in “picks-&-shovels” infrastructure: HOPPR’s foundation model lets vendors fine-tune imaging AI in eight weeks, not twelve months. |

| 6 | How could Quest & MD Anderson’s proteomics test affect imaging volumes? | If 35 % of U.S. adults 50-79 adopt it, the high-risk referrals would add ≈ 2.2 M CT/MRI scans and US $1.9 B revenue each year. |

| 7 | How is this proteomics test different from ctDNA liquid biopsies? | It measures blood proteins, not tumor DNA, making the assay cheaper and designed for risk-stratifying large, healthy populations. |

| 8 | What’s the exact cost gap between PMA and 510(k) for imaging-AI software? | Out-of-pocket spend falls from about US $3-5 M to US $0.3-1 M; FDA user-fees alone drop 22-fold. |

| 9 | What immediate actions does Marketstrat recommend for hospitals? | Budget for AI-orchestration layers, run BRIDGE self-assessments and stress-test radiologist capacity against the proteomics funnel. |

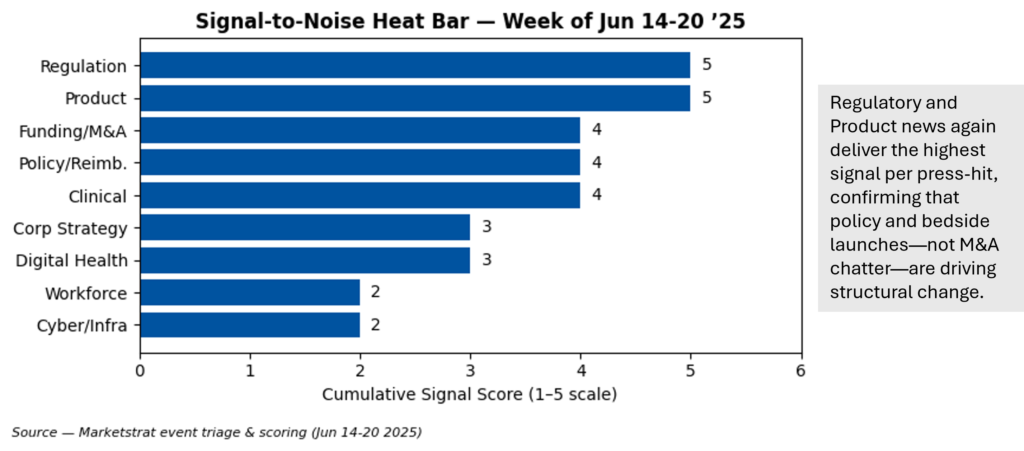

| 10 | How does the newsletter’s Signal-to-Noise score work? | Every major story is scored 1-5 on structural impact; we chart cumulative scores by category so readers compare momentum week-over-week. |