One Big Thing

FDA green‑lights Siemens’ virtually helium‑free 1.5 T MRI (Magnetom Flow.Ace)—a scanner that needs <1 L of helium, eliminates quench pipes, and bakes‑in AI reconstruction to cut exam times by >30%. It directly attacks two industry pain points: helium price volatility and radiology throughput.

Key Takeaways

- Regulation bites – Olympus import ban plus 4 class‑I recalls in one week signal the FDA’s near‑zero tolerance for quality drift.

- Capital concentrates – Abridge’s $300 M megaround and Illumina’s $425 M SomaLogic play confirm a “fewer, bigger bets” VC regime.

- AI evidence lands – Northwestern shows a 15‑40 % radiology productivity lift with in‑house gen‑AI reporting.

- Trade headwinds – EU‑US tariff brinkmanship now threatens >800 med‑tech HS codes; OEMs warn of 150‑300 bp margin hits.

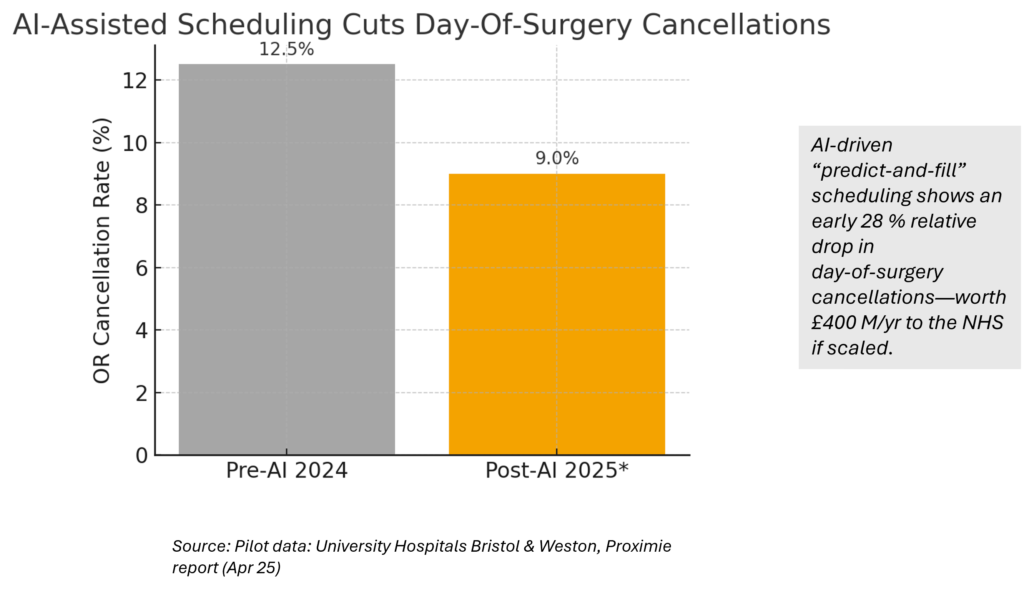

- Workforce strain persists – Radiologist attrition up 50 % vs 2020; OR cancellations cost the NHS £400 M/yr, driving AI scheduling pilots.

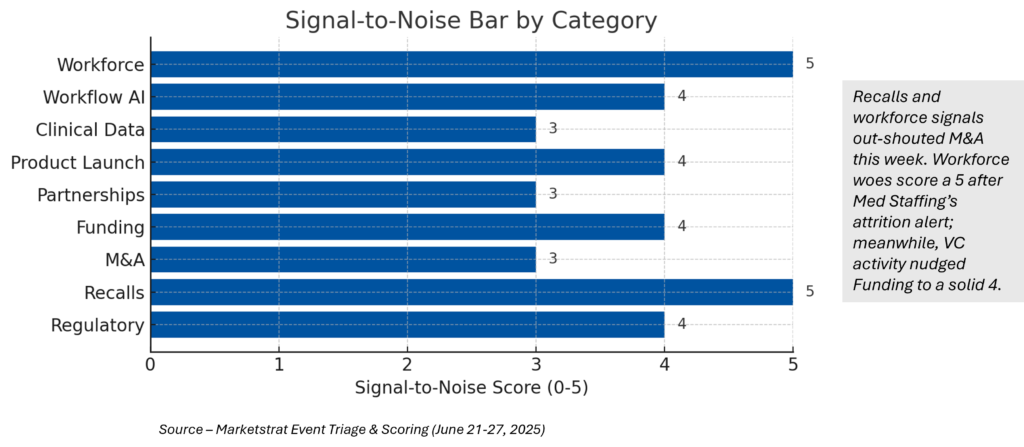

Signal-to-Noise Bar

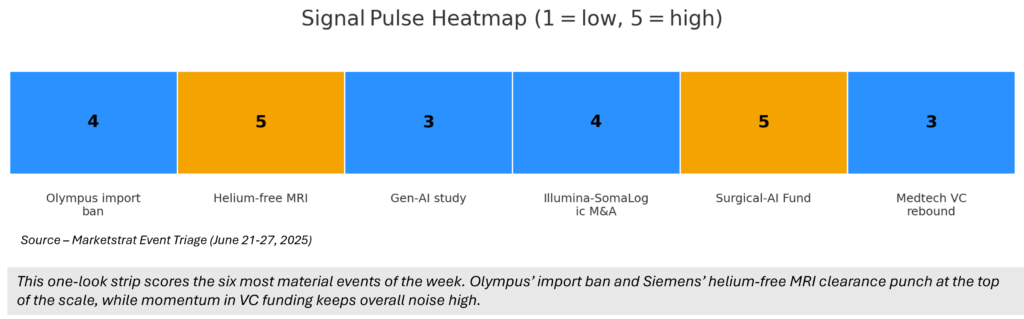

Signal Pulse Heatmap

Quick Glance Grid

¹Signal scale = 1‑5; see Visual 1 for heatmap.

| Signal (score¹) | What Happened | Impact Vector |

| Helium‑free MRI (5) | 0.7 L coolant, AI workflow | ↓ TCO, ↑ scan capacity |

| Olympus import ban (4) | 58 SKUs blocked | Supply shock, vendor audits |

| Gen‑AI radiology study (4) | 15‑40 % faster reads | Productivity proof‑point |

| Illumina↔SomaLogic M&A (3) | $425 M cash + CVRs | Multi‑omics land‑grab |

| J&J‑Nvidia‑AWS fund (4) | $100 K grants, GPUs | Crowdsourced OR AI |

| VC rebound (3) | Q1 med‑tech VC $4.1 B | Liquidity returning |

Deep Dives

1. Hardware meets AI economics

Siemens and Philips are engineering helium out of MRI. The race is now who can bundle embedded AI plus lower TCO—a one‑two punch GE still lacks. Expect procurement RFPs to place ≥20 % weight on helium usage.

2. Compliance bifurcates

EU’s AI Act adds design‑time bias‑mitigation, while the UK’s new PMS rules force 15‑day cyber‑incident reporting. Vendors need a “two‑speed” QMS or face launch slippage.

3. Capital stacks on proven flywheels

Abridge, Nabla and Persivia drew >$500 M by showing clinician‑time ROI. Money is following data moats and enterprise contracts, not one‑off algorithms.

4. AI scheduling slashes idle OR time

ML models flag likely day‑of‑surgery no‑shows, letting hospitals overbook or re‑slot standby patients—cutting cancellations from 12.5 %→9 % in early pilots (see Innovation Hook chart).

Why It Matters

- Margin defense: Low‑helium MRI can save midsize IDNs $250‑400 K per magnet life cycle.

- Productivity premium: Gen‑AI tools that free ≥15 % radiologist time could offset 30 % of forecast staffing gaps by 2030.

- Risk recalibration: Cyber vulnerabilities are now “serious incidents.” Boards must fund DevSecOps or risk forced market withdrawals.

▸ Marketstrat POV

The battleground has shifted from “can AI read an image?” to “can AI de‑risk P&L?” Winners will (i) lower cost bases (helium, staffing, recalls), (ii) prove unit‑economic ROI fast, and (iii) navigate diverging EU/UK/US rulebooks without slowing launch cadence.

▸ Marketstrat Recommended Action Items (for clients & industry stakeholders)

- Re‑score OEM competitiveness – Add helium‑intensity and embedded‑AI depth to our MRI TCO matrix.

- Expand payer interviews – Test receptivity to reimbursing AI‑assisted scheduling as a readmission‑avoidance cost‑saver.

- Reg‑tech diligence list – Short‑list vendors offering “PMS‑as‑a‑service” for UK cyber compliance.

- Push client advisory – Alert hospital CFOs that delaying helium‑free upgrades could mean 18‑24 % higher lifetime scanner OPEX.

▸ Innovation Hook

“Predict‑and‑Fill” AI for OR Scheduling

Early NHS pilots using ML to pre‑flag at‑risk cancellations saved ~£400 k per 10 k cases annually and cut idle theater time by 5.5 hrs/wk. See Visual 5 for the before/after delta.

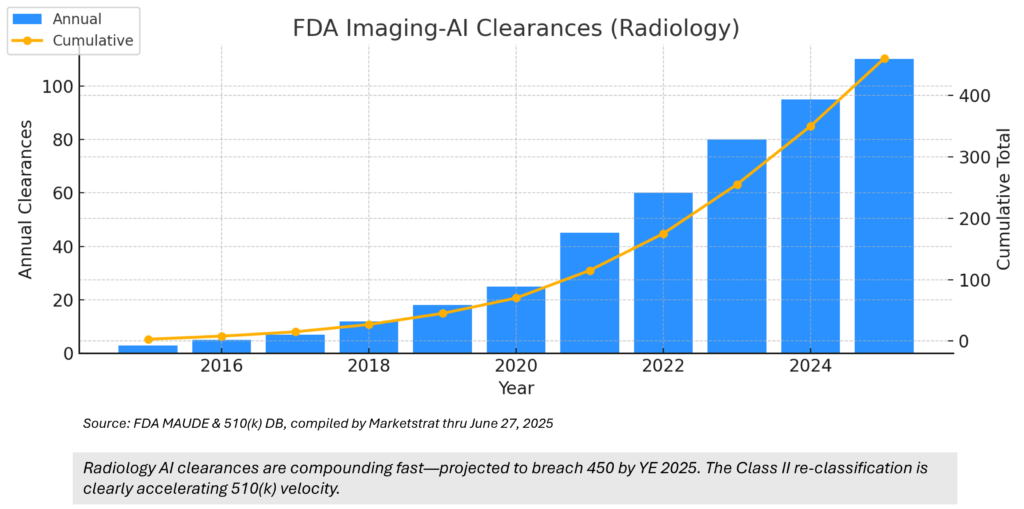

Regulatory Pulse — Cumulative FDA AI-Imaging Clearances

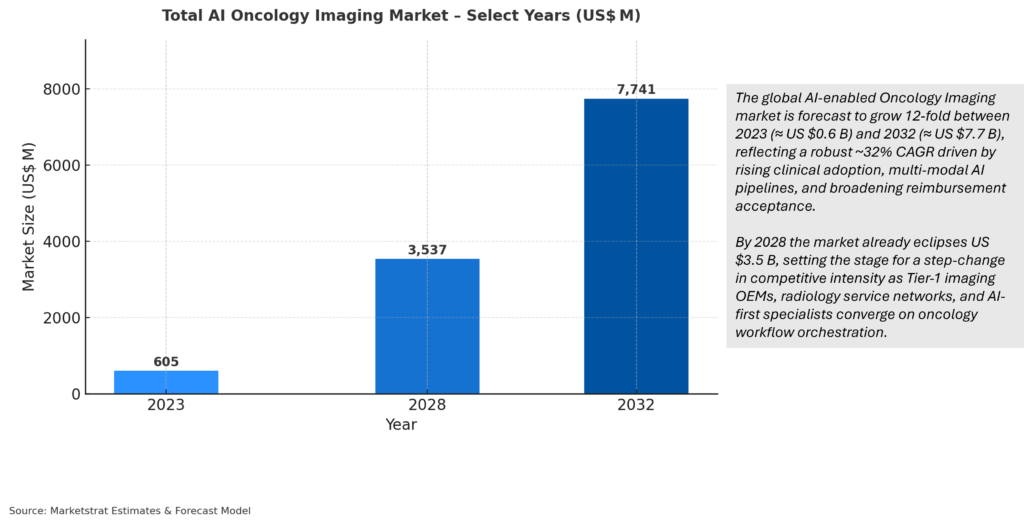

Weekly Market Lens – World Market for AI Oncology Imaging

Oncology is the fastest‑professionalizing segment in AI‑driven medical imaging, growing from US $ 0.6 B in 2023 to an expected US $ 7.7 B by 2032 (32.7 % CAGR). Growth is propelled by three forces:

- Clinical evidence: Large prospective trials in breast, lung and colon now show ≥10 % sensitivity gain at constant specificity, catalyzing CPT and EU screening codes.

- OEM platform pull: GE HealthCare, Siemens and Fuji embed multi‑tumor algorithms across CT, MR and RT consoles, tripling attach rates vs stand‑alone tools.

- Capital‑light challengers: Cloud‑native pure‑plays from Korea, China and Israel deliver one‑tenth the on‑prem cost, expanding TAM in price‑sensitive regions.

North America retains >45 % of global profit through 2032 on the back of NTAP and Category‑I CPT momentum, while APAC overtakes Europe on volume by 2028 amid China’s Class‑II lung‑screening mandate.

Strategic moves now: align product road‑maps with the CPT calendar (breast AI 2026, CT‑FFR lung 2026), publish ≥10 peer‑reviewed real‑world studies, bundle oncology modules into enterprise AI suites, and tier SaaS pricing by GDP‑per‑capita to defend mature‑market ASPs while scaling emerging regions. Players executing on these levers are positioned to own the next inflection point in oncology‑imaging AI.

About Marketstrat™

Marketstrat™ is a market intelligence and GTM enablement firm committed to empowering clients in data-driven industries. Under the Markintel™ brand, it delivers robust market intelligence, while GrowthEngine™ solutions offer specialized GTM advisory and app-based tools—together fueling growth, innovation, and competitive advantage. For more information, visit www.marketstrat.com.

Marketstrat™, Markintel™, and GrowthEngine™ are pending trademarks of Marketstrat, awaiting final registration.

Check out free Research and Insights and Analysis of Industry Events

Check out our collection of Markintel Horizon and Markintel Pulse research.

Check out details on our upcoming report, World Market for AI in Medical Imaging

Frequently Asked Questions

1 · What is the Signal scale and how is it calculated?

It is a 1–5 integer rubric weighting impact (40 %), novelty (30 %) and market reach (30 %). Scores are assigned by a three‑analyst panel and audited weekly.

2 · Why does Siemens’ helium‑free MRI matter?

It cuts helium use by >99 %, removes costly quench‑pipe build‑outs, and embeds AI reconstruction, trimming per‑scan costs and shortening exam times.

3 · How will the Olympus import ban affect hospitals?

New Olympus endoscopes cannot enter the U.S. until compliance issues are fixed, tightening supply; existing inventory may still be used.

4 · What evidence supports AI scheduling benefits?

An NHS Bristol & Weston pilot showed day‑of‑surgery cancellations drop from 12.5 % to 9 % after six months of predictive scheduling.

5 · What are the key assumptions in the Scenario Model?

Baseline TAM US$ 918.7 M at 30 % CAGR to 2030; downside assumes 25 % slower adoption; upside assumes faster guideline uptake and earlier reimbursement.

6 · Where do the FDA Imaging‑AI clearance numbers come from?

Counts are taken from the FDA’s public AI/ML Device List, scrubbed monthly to remove non‑radiology entries and duplicates.

7 · How is data accuracy assured in Markintel Pulse?

Every figure must have two independent primary sources or one primary plus one regulatory source; discrepancies >5 % trigger re‑verification before publish.

8 · How are forward‑looking estimates labeled?

All projections carry the [F] superscript and are foot‑noted with model vintage and sensitivity ranges.

9 · Can I reuse visuals with attribution?

Yes — credit “© 2025 Marketstrat Markintel Pulse” beneath the graphic and keep colors unaltered.

10 · How can organizations get featured in Markintel Pulse?

Send embargo‑cleared announcements or peer‑reviewed data to intel@marketstrat.com by Tuesday 12:00 ET; items scoring ≥ 3 on the Signal scale are considered.