Edition: March 21, 2025

1) ONE BIG THING

AI-Driven Autonomy Is Reshaping MedTech

Medical imaging and robotics are moving from assistance to near-autonomy, with major players (GE, J&J, Philips, Siemens, Nvidia) investing heavily in AI-based workflow automation. This shift aims to tackle industry-wide staffing challenges, expand global access to advanced diagnostics, and unlock data-driven, real-time decision-making—potentially redefining healthcare delivery in imaging suites, operating rooms, and even patient homes.

Why It Matters: Whether it’s AI-assisted bronchoscopy for early lung cancer detection or advanced wearable ultrasound patches for continuous cardiac monitoring, the adoption of autonomy is pushing cost savings, clinical efficacy, and new revenue models to the fore.

2) QUICK SCAN: TOP HEADLINES (MARCH 14–22)

Regulatory & Approvals

- J&J MedTech gains FDA nod for a Monarch robotic bronchoscopy software update, leveraging Nvidia computing and GE’s C-arm imaging for enhanced peripheral lung lesion biopsy.

- Guerbet & Intrasense receive EU MDR clearance for DUOnco™ Bone, an AI solution detecting bone metastases on CT, reflecting growing adoption of AI-driven oncology diagnostics.

- Telix wins FDA approval for Gozellix® gallium-68 tracer for prostate cancer PET imaging, expanding advanced radiopharmaceuticals in precision oncology.

M&A & Funding

- DispatchHealth merges with Medically Home, consolidating hospital-at-home services across 50 U.S. metros, partnered with 40+ health systems and payors.

- Sibel Health raises $30M in Series C, gaining an FDA clearance for wearable patient-monitoring patches that track continuous vitals, furthering the shift to untethered inpatient monitoring.

- Jutro Medical secures €12M to scale AI-driven telehealth, demonstrating Europe’s appetite for digital-first primary care solutions.

Product Launches

- Siemens Healthineers debuts the Magnetom Terra.X 7T MRI, pushing ultra-high-field MRI toward routine clinical use with faster scans and enhanced neuro/ortho imaging.

- SyntheticMR introduces SyMRI 3D in the U.S., enabling single-scan multi-contrast MRI with volumetric analysis—one more sign of MRI moving into quantitative territory.

- GE Healthcare unveils nCommand Lite (by Ionic), a vendor-neutral remote scanner operation system, letting expert technologists run CT/MRI/PET across multiple sites from a central console.

Clinical Trial Highlights

- ESCAPE-MeVO & DISTAL trials show no net benefit in thrombectomy for mid/distal vessel strokes—reorienting stroke-care guidelines to large-vessel occlusions only.

- New Swedish mammography trial indicates AI-driven recalls had a 22% positive predictive value vs. 3.4% with radiologists alone. Fewer callbacks, higher detection yield.

- Quest Diagnostics partners with Google Cloud on generative AI to streamline data management of 80B lab data points, broadening AI’s role from imaging into diagnostics operations.

3) DEEP DIVE: MEDTECH & IMAGING

A. Autonomous Imaging & Robotics

- GE-Nvidia Collaboration:

- Driving the News: Joint development of “autonomous imaging” for X-ray and ultrasound aims to solve radiographer shortages, standardize image quality, and accelerate remote scanning.

- Strategic POV: By leveraging Nvidia’s AI hardware (IGX Orin, Holoscan) and virtual simulation (Omniverse), GE can train algorithms on synthetic “digital twins” before real-world deployment. This shortens R&D cycles and may set a template for next-gen “push-button” imaging.

- Stakeholder Impact:

- Hospitals: Potentially run multiple scanning rooms with fewer specialized staff.

- Payors: Embrace cost efficiencies if re-scans and staff overhead drop.

- OEM Competition: Siemens, Philips must keep pace as GE takes the lead in applied imaging autonomy.

- Johnson & Johnson (Monarch) & Intuitive Surgical (Ion):

- Implication: FDA’s new clearance for AI in robotic bronchoscopy underscores how integrated imaging-robotics can detect small lung nodules earlier and with greater accuracy.

- Business Lens: This synergy could open a multi-billion-dollar lung cancer diagnostics market as payors push for earlier detection and better outcomes.

B. AI in Diagnostic Imaging

- Photon-Counting CT (Siemens, et al.): Next-gen CT promises higher resolution at lower dose. Real-world cost-effectiveness models from ECR show it could save ~$795/patient in cardiac workups.

- Bone Metastases Detection (Guerbet & Intrasense): AI that catches subtle skeletal mets addresses a known gap; missed bone lesions are a major liability and cost driver if not caught early.

- Breast Imaging Trials: Multiple large-scale prospective studies show AI can boost detection rates while reducing false positives—a big plus for population screening programs.

- Neuro Imaging & 7T MRI: Siemens’ Terra.X and advanced quantitative software (SyMRI 3D) are revealing minute neurological changes, opening new possibilities in early Alzheimer’s detection, epilepsy, and MS management.

Business Translation: Providers (inpatient and outpatient) adopting these new AI-powered or high-field imaging systems can differentiate themselves, garner better patient outcomes, and reduce certain downstream costs. But high capital costs and the still-evolving reimbursement environment remain hurdles. OEMs that effectively pitch ROI—through fewer repeat scans, faster workflows, and better outcomes—are likely to secure capital budgets even in lean cycles.

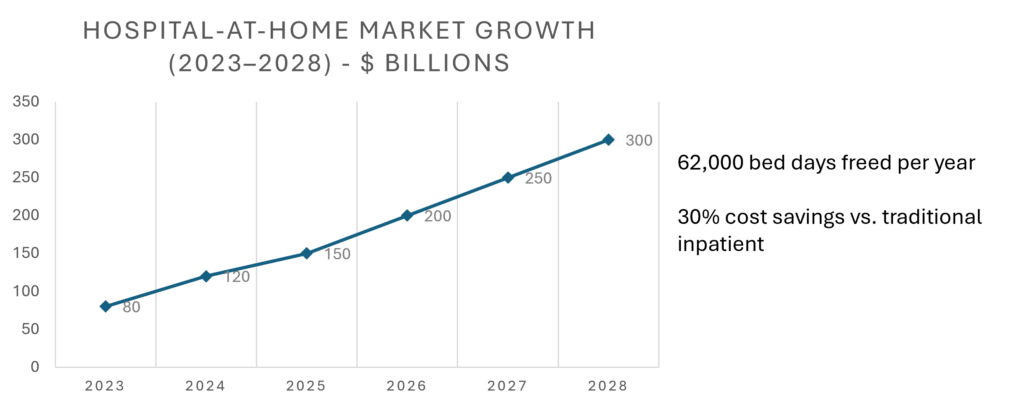

C. Hospital-at-Home Expansion

- DispatchHealth + Medically Home merges to create a powerhouse in hospital-at-home services.

- Why It Matters: Post-pandemic, more payors reimburse advanced care at home. Merging scale + technology solutions can reduce hospital length of stay and shift acute care to the home setting.

- Ecosystem:

- Investors: See synergy and potential IPO or big buyout.

- Hospitals: JV opportunities or extended capacity without brick-and-mortar expansions.

- Medical Imaging Tech: Ultra-portable CT, handheld ultrasound (like Vave, Exo, Butterfly) become critical to diagnosing at home or in micro-facilities.

D. Wearables & Continuous Monitoring

- Sibel Health and its newly cleared VitalsPatch exemplify the move to wire-free, continuous vitals tracking.

- Freed from cables, patients can ambulate, rest better, or even discharge earlier while still being monitored.

- Hospitals might see fewer nurse rounds, quicker detection of deterioration, and improved nurse productivity.

- Cardiac Monitoring Patches: Ongoing trials show real promise for diagnosing arrhythmias or subtle heart failure changes in real time.

Strategic POV: As remote/hybrid care accelerates, expect major medtech players to acquire or partner with wearable sensor startups. This synergy extends advanced imaging and diagnostics into everyday living environments.

4) AI & DIGITAL HEALTH

A. Generative AI in Operations

- Quest Diagnostics & Google Cloud:

- A bold example of “gen AI meets big healthcare data”—using chatbots to interpret lab results, triage test recommendations, or streamline R&D.

- Also signals how broader healthcare ops (beyond imaging) stand to be transformed—lab ops and patient portals can see major efficiency gains.

B. Primary Care AI

- Jutro Medical (Poland) harnessing AI to handle 68% of telehealth “intake tasks,” letting doctors spend more time on clinical judgment. Gains a €12M Series A.

- Why It Matters: Could lighten admin burden, accelerate triage, and offer a blueprint for “AI nurse triage” in large-scale telemedicine.

C. Cognitive BCIs & AR/VR

- Synchron’s BCI + Apple Vision Pro demonstration.

- Implication: A paralyzed individual controlling a consumer AR headset by thought alone.

- Long-Range Outlook: Merging consumer electronics with medical implants portends a future of universal accessibility—and eventually, mainstream “thought-based” device control.

- Business Impact: Pharma, device makers, and Big Tech might converge, requiring new reimbursement models for assistive technologies that morph into lifestyle devices.

5) MARKET & REIMBURSEMENT TRENDS

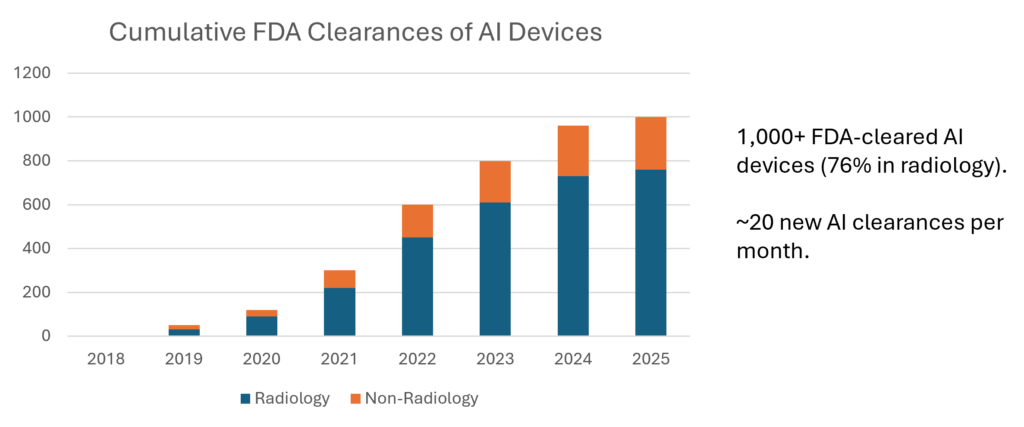

- Imaging AI Market to hit $28B+ by 2032 (CAGR 30%+), driven by validated improvements in diagnostic speed and accuracy.

- RadNet expansions underscore consolidation in outpatient imaging: driving multi-state acquisitions, deeper ties to hospital JVs, pushing AI integration.

- Regulatory Shifts:

- FDA staff cuts within the Center for Devices & Radiological Health raise concerns about potential slower approvals for new AI solutions.

- Meanwhile, the U.S. emerges as the preferred first-launch market over Europe due to stricter EU MDR hurdles.

6) MARKETSTRAT’S POV

- Convergence: Imaging is no longer siloed—AI, robotics, wearables, and digital health are merging into end-to-end solutions. Companies bridging these domains (GE, J&J, Philips, Siemens, Nvidia) are positioning for the next wave of “semi-autonomous” and distributed healthcare.

- Value Proposition: C-suites evaluating capital equipment must weigh AI’s proven cost offsets (fewer re-scans, less staff overhead, earlier detection) against big up-front costs and interoperability demands.

- Access & Equity: Handheld ultrasound, remote scanning, and hospital-at-home expansions are bringing advanced care closer to patients—but reimbursements, staffing readiness, and robust data validation remain constraints.

- Regulatory Uncertainty: With FDA staff cuts and extended EU MDR deadlines, time-to-market complexities rise. Firms might expedite U.S. approvals while carefully navigating Europe’s evolving frameworks.

- Strategic Imperatives:

- M&A / Partnerships: More synergy across tech, payors, and device OEMs to unify digital & physical solutions.

- AI Validation: ROI narratives must include clinical trial data and real-world evidence.

- Global Scale: Emerging markets want advanced diagnostic tools but need lower-cost versions; “autonomy + cloud” can help fill the gap if local regulations allow remote or minimal on-site staff.

7) WRAP-UP & WHAT’S NEXT

This week’s highlights—from AI autonomy in imaging to the massive hospital-at-home merger—underscore a pivotal moment for medtech. The next 12–18 months will likely see:

- Deeper AI Integrations in everyday workflows—like remote scanning hubs and reading expansions for outpatient networks.

- Escalating Consolidation across digital health, care-at-home, and imaging companies, aiming for scale and integrated offerings.

- Demand for Real-World Validation: As AI saturates the market, solutions that prove measurable cost savings or outcome improvements will stand out—and likely gain quicker reimbursement support.

Bottom Line: The adoption curve for AI in imaging and beyond is no longer a question of “if,” but “when” and “how fast.” Marketstrat will continue monitoring these shifts, providing strategic guidance on technology adoption, M&A moves, ROI analysis, and regulatory navigation. Stay tuned for next week’s pulse on major updates in portable imaging, robotics-assisted procedures, and any new breakthroughs from clinical or regulatory fronts.

Supporting data and charts based on Marketstrat Research and Analysis

For inquiries or custom research on emerging MedTech, AI validation, or market adoption strategies, please contact Marketstrat at research@marketstrat.com.

For last week’s Markintel Pulse newsletter, click here