ONE BIG THING

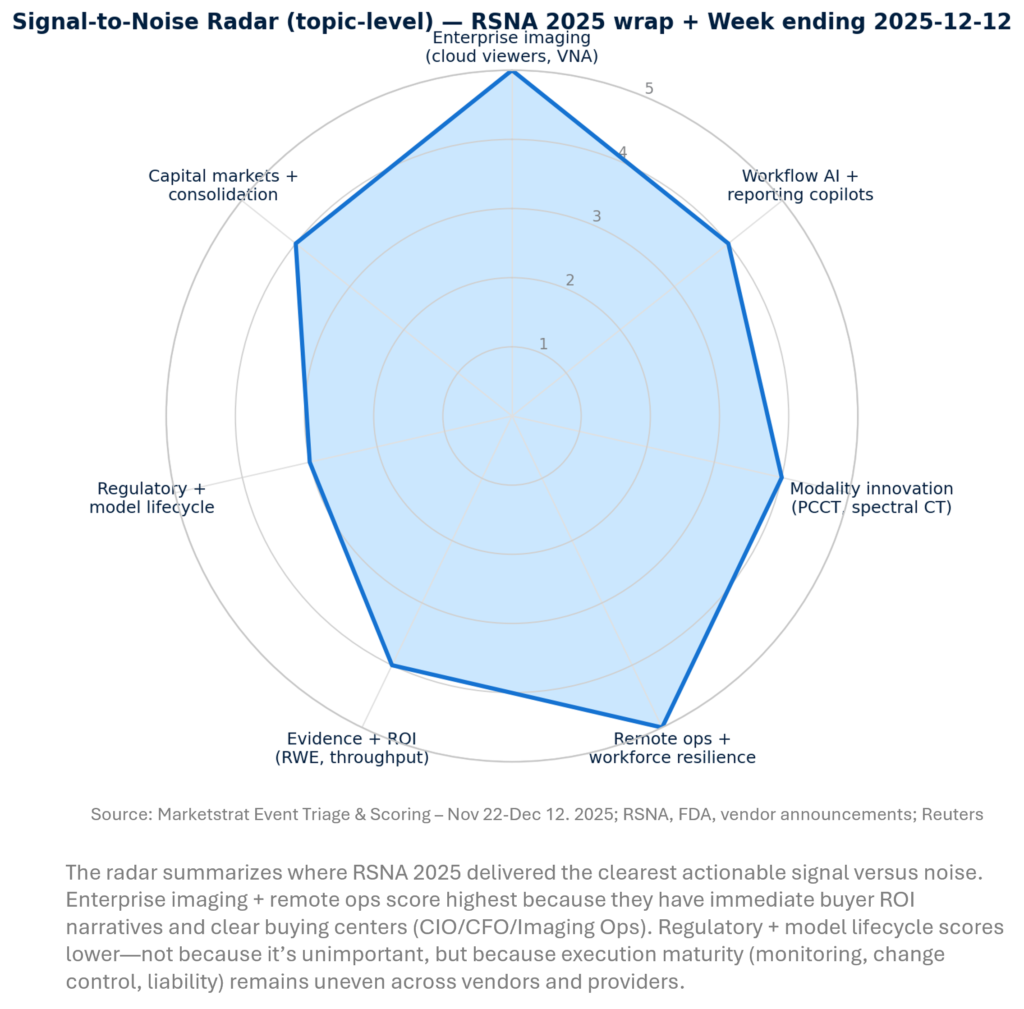

One Big Thing: RSNA 2025 confirmed that “AI in imaging” is no longer a feature race—it’s an operating-layer land grab where cloud enterprise imaging, workflow copilots, and hardware-native AI converge into platform economics (recurring revenue, attach, and lock-in) with early, measurable productivity proof-points.

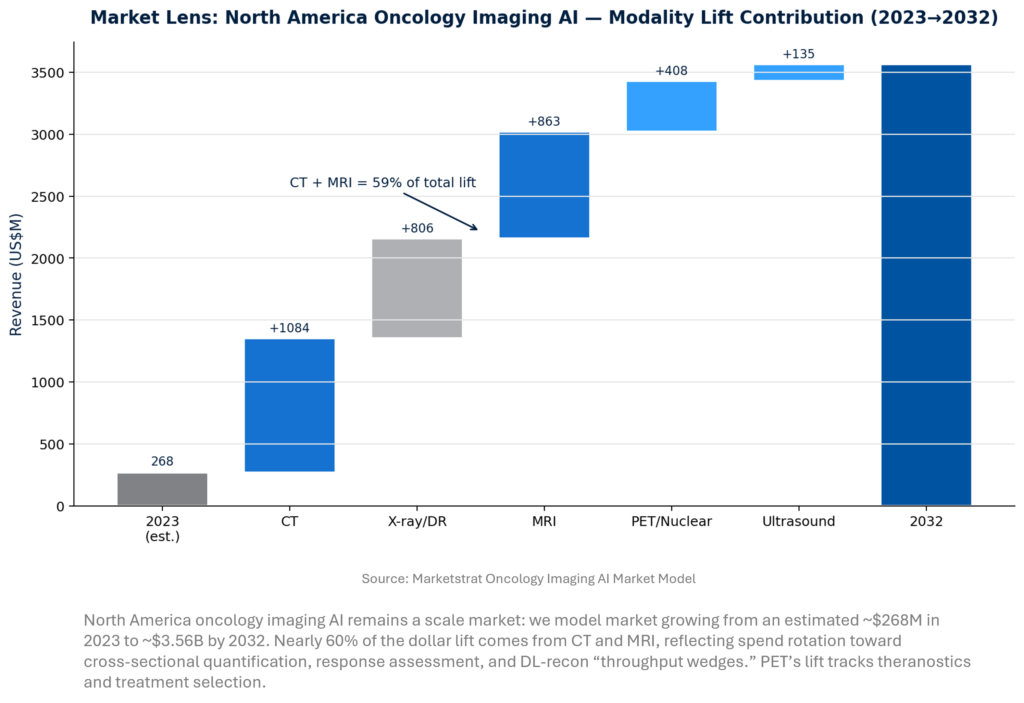

Market Lens baseline (house view): AI-in-Imaging TAM = $28.4B (2032).

KEY TAKEAWAYS

- Platformization won RSNA. Cloud enterprise imaging moved from “IT modernization” to the control plane for AI distribution, accelerated by GE’s Intelerad deal and a wave of cloud-first viewers/workspaces.

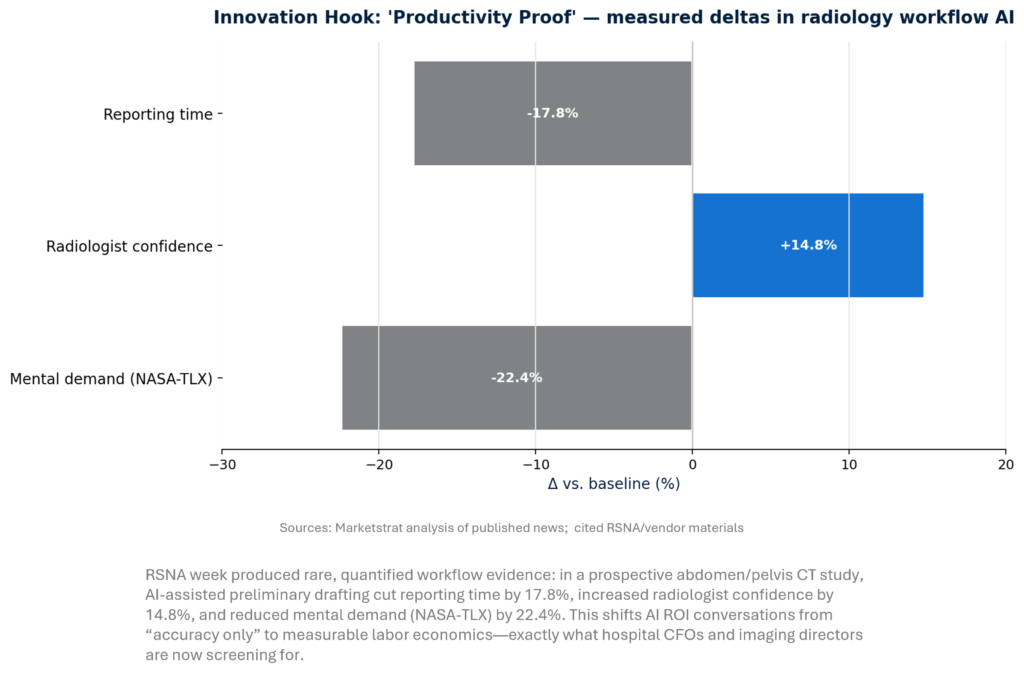

- Workflow AI finally has “productivity proof.” Prospective data at RSNA (abdomen/pelvis CT) showed -17.8% reporting time, +14.8% confidence, -22.4% mental demand, shifting procurement from “AI curiosity” to CFO-grade capacity economics.

- Regulatory is quietly enabling faster iteration. FDA’s Predetermined Change Control Plan (PCCP) authorized in a radiology triage 510(k) is a concrete signal that lifecycle updates can become operationalized—if governance is built in.

- Hardware-native AI is becoming the data advantage. Photon-counting CT and detector-based spectral CT launches emphasize AI embedded across acquisition → reconstruction → quantification, creating a flywheel of better inputs for downstream models.

- Trust boundaries are clearer than vendors admit. Patient data shows strong support for AI with radiologist partnership, but low acceptance for AI-only interpretation—meaning “human-in-the-loop” remains the adoption constraint and the commercial design point.

MARKETSTRAT POV

- Buyers (IDNs / imaging chains): Build an “AI Operating Layer” RFP: (1) cloud viewer/workspace, (2) reporting copilot, (3) governance/monitoring + PCCP-ready change control, (4) measurable ops KPIs (TAT, addenda, follow-up closure, uptime). Use this to force vendors into outcomes-based commitments rather than pilot demos.

- Vendors / startups: Stop competing algorithm-to-algorithm. Compete on distribution + instrumentation: embed in the reading/reporting surface, publish prospective operational metrics, and package suites priced to KPIs (capacity, SLA, quality).

- Investors: Expect 2026 to reward companies owning the control plane (enterprise imaging + reporting workflow) and punish single-SKU tools without distribution—especially as clearance counts saturate.

INNOVATION HOOK

“Productivity Proof” becomes the new procurement wedge

RSNA 2025 confirmed buyers are moving from “AI curiosity” to “AI procurement,” but only when value is provable inside the reporting workflow. The most investable frontier is time-to-report and cognitive load reduction—where even mid‑teens percentage gains can translate into backlog clearance, fewer after-hours reads, and higher downstream capture. Leaders should treat AI like an operations program: baseline KPIs, pilot in one service line, then scale via orchestration and governance.

So what / what to do (operators + vendors):

- Providers: Convert % time savings into a standardized unit: minutes saved per 1,000 studies, tied to backlog days reduced and telerad coverage hours gained. Then require vendors to contract to measurement.

- Vendors: Stop selling “accuracy.” Sell capacity recovery with instrumentation: time stamps, interruption rates, addenda rates, follow-up adherence, and audit trails.

- Payers/partners: Expect a push to outcome-linked imaging AI contracts once capacity metrics stabilize (especially in screening pathways).

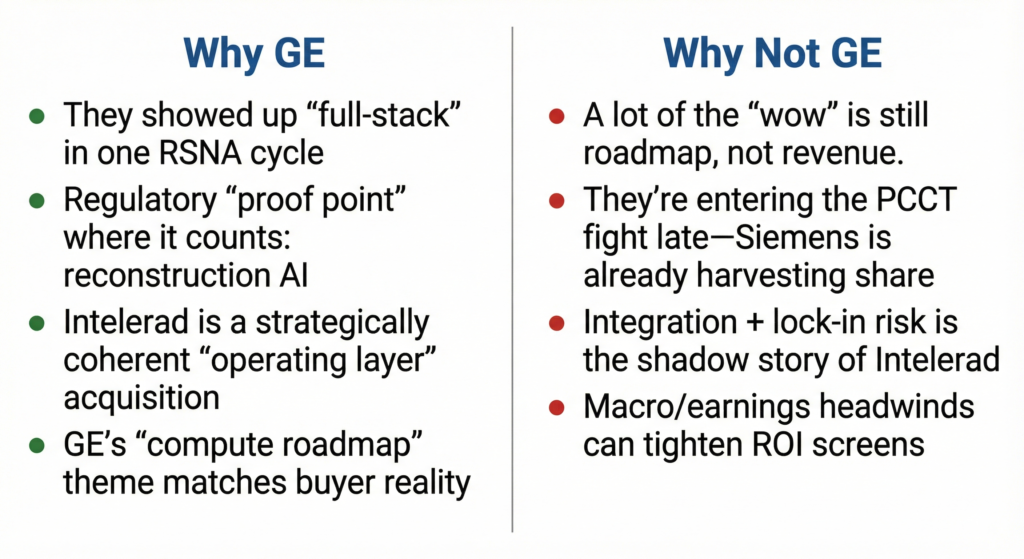

COMPANY SPOTLIGHT – GE HEALTHCARE

Spotlight: GE HealthCare — because it is increasingly the gravity well where three compounding advantages meet: (1) the industry’s largest regulated radiology AI footprint, (2) unmatched modality breadth and installed base leverage, and (3) a strategy that is converging hardware‑native AI (acquisition/recon) and workflow AI (routing/reporting/governance) into a cohesive “operating layer” procurement story. In the latest FDA tally referenced by The Imaging Wire, GE HealthCare remains the #1 company by count of radiology AI authorizations (110), aided by both internal development and acquisitions.

What makes GE particularly “impactful” for RSNA‑adjacent market dynamics is that its scale changes the buying conversation from “Which point solution do we trial?” to “Which platform rail do we standardize?” When a single vendor can credibly bundle AI‑assisted acquisition (e.g., denoising/recon), enterprise imaging distribution, and governed deployment across an IDN, it compresses vendor sprawl, shifts contracting toward multi‑year enterprise terms, and raises the bar for standalone AI vendors who must now justify incremental ROI on top of OEM‑embedded functionality.

Why this matters now: GE’s footprint (regulatory volume + modality penetration) means its product decisions set practical norms for the ecosystem: what “baseline AI” becomes table stakes, how AI performance is measured in procurement, and which integrations become mandatory. For competitors, the implication is clear—matching single‑product performance won’t be enough; they must match suite economics + workflow time savings + governance. For startups, the opportunity is still real, but it migrates toward adjacent value layers (orchestration, monitoring, longitudinal analytics, domain‑specific quantification) that an OEM bundle doesn’t fully solve—or toward distribution partnerships that accept tighter platform gatekeeping.

MARKET LENS

North America Oncology Imaging AI — modality lift

RSNA’s platform story shows why oncology is the “gravity well” for imaging AI adoption: it couples high-volume staging/surveillance with measurable endpoints (response, progression) and expanding PET/radioligand pathways. The modality mix implies where budgets will concentrate—CT/MRI attach rates via OEM stacks and cloud workflow bundles, with PET/Nuclear accelerating as response analytics and theranostics scale. Vendors should sell suites tied to operational KPIs, not per‑algorithm SKUs.

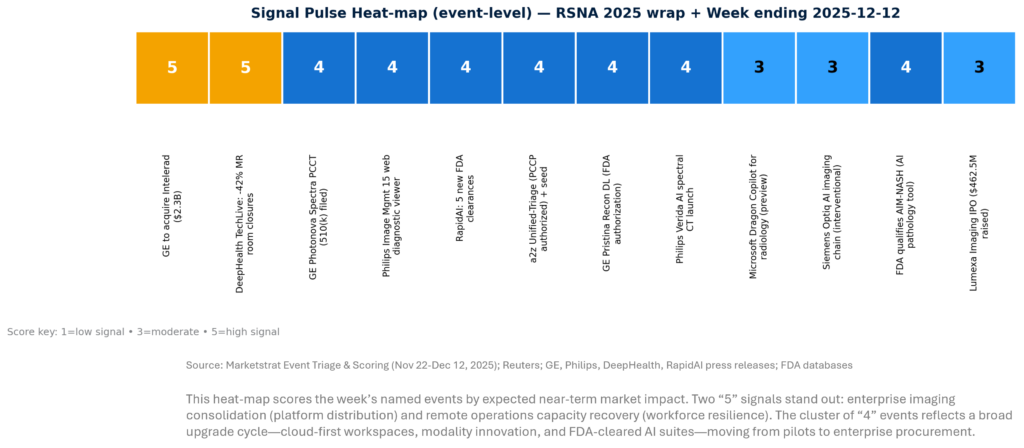

SIGNALS OVERVIEW (RSNA 2025 Wrap)

RSNA 2025’s signal was not “more AI”—it was where AI sits in the stack. Winners are building (1) enterprise imaging control planes, (2) workflow copilots embedded in reading/reporting, and (3) modality-native AI that improves acquisition/reconstruction. These layers create compounding advantages: distribution (PACS/workspace), adoption (workflow), and performance (better physics + data). The ecosystem is consolidating around platforms rather than point algorithms.

SIGNAL PULSE HEATMAP – NOV 22-Dec 12, 2025

SIGNAL-TO-NOISE RADAR BY TOPIC – NOV 22-DEC 12, 2025

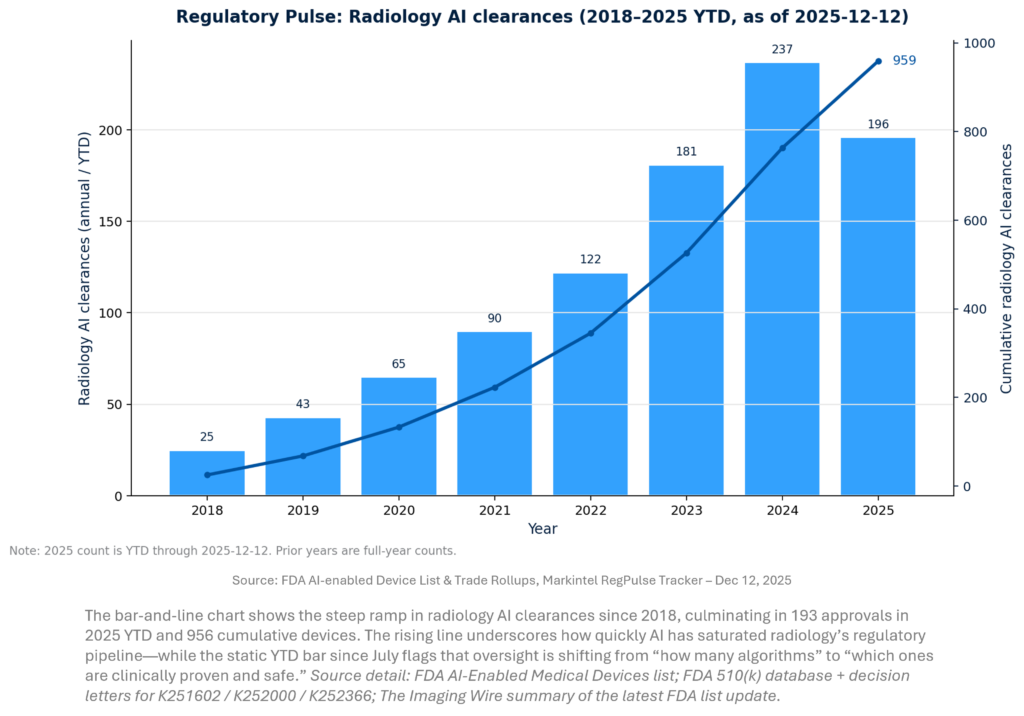

REGULATORY PULSE

RSNA reinforced that “regulatory cleared” is table stakes; the next differentiation is deployment speed, monitoring, and safe iteration. As clearance counts compound, procurement and clinical leaders are responding with “curated gardens”—OEM stacks, PACS marketplaces, and AI orchestration layers that standardize integrations and audit trails. For vendors, the play is to pair approvals with change-control (PCCP), evidence packages, and enterprise controls (SLAs, cybersecurity) that de-risk scale.

DEEPER DIVES

RSNA 2025 CAPSTONE — “Radiology’s Operating Layer”

RSNA 2025’s center of gravity was the operating layer: cloud workspaces/viewers, workflow copilots, and modality-native AI enhancements that reshape how radiology is produced and monetized. This is why platform M&A (enterprise imaging) and reporting copilots (agentic workflows) dominated mindshare: they sit at the choke points of distribution and daily behavior. Meanwhile, the show’s scale and AI footprint reinforce that the vendor ecosystem is now optimized for enterprise deployment, not pilots.

Context: RSNA footprint (data point): RSNA’s technical exhibits described 660+ exhibitors registered, 415k+ sq ft show floor, and 200+ AI-related companies, with an AI showcase and 228 AI exhibitors across the show.

What mattered most:

- Enterprise imaging becomes the AI “app store.” GE’s Intelerad acquisition is the clearest proof that OEMs are buying distribution and recurring SaaS economics, not just features.

- Copilots move from “dictation assist” to “workflow control.” Microsoft’s Dragon Copilot positioning explicitly frames generative + multimodal + agentic AI as embedded in reporting and partner ecosystems.

- Physics + AI is now a bundled narrative. GE PCCT and Philips spectral CT both frame AI as spanning acquisition-to-reconstruction-to-results, designed for throughput and routine use—not niche research.

- Workforce resilience is becoming a product category. Remote scanning + expert oversight at scale (e.g., TechLive) is a direct response to staffing scarcity and operational volatility.

REGULATORY APPROVALS & CLEARANCES

Regulatory momentum is increasingly about operationalizing change rather than merely clearing new algorithms. Two signals stand out: (1) continued volume growth in radiology AI clearances and (2) the emergence of PCCP-authorized pathways that can reduce re-submission cycles if vendors adopt disciplined change control. Meanwhile, the FDA’s qualification of an AI drug development tool shows regulators are also building AI “standards infrastructure” outside radiology that will spill back into imaging biomarker validation.

Regulatory highlights (with “why it matters”)

- a2z Unified‑Triage: FDA 510(k) with PCCP authorized (K252366).

Why it matters: PCCP is an early blueprint for “ship improvements with guardrails.” Providers should treat this as a contract requirement: model monitoring, versioning, and explicit update notices. - RapidAI: five new FDA clearances (new modules).

Why it matters: Clearance density is now a competitive moat—buyers increasingly prefer platforms that expand modules over time with consistent UI, governance, and contracting. - GE Pristina Recon DL: FDA premarket authorization (DL reconstruction for mammography).

Why it matters: Reconstruction AI is a high-attach “physics wedge” that can anchor broader screening workflow upgrades and supports OEM service economics. - Canon αEvolve Imaging: FDA 510(k) for interventional imaging upgrade.

Why it matters: Interventional is adopting AI quality chains; expect “procedure time” and “contrast/dose” to become the ROI language, not generic AI claims. - FDA qualifies AIM‑NASH (AI drug development tool).

Why it matters: Qualification (not just clearance) is a stronger standardization step and a precedent for AI’s role in trial endpoints—important for imaging biomarkers and digital pathology ecosystems.

FUNDING / IPO / CAPITAL MARKETS

Capital markets re-engaged with imaging services and workflow infrastructure because the narrative shifted from “AI hype” to “AI as operating leverage.” RSNA helped by supplying product proof points (productivity, remote ops, throughput) that support margin stories. The key investor question is durability: which models create recurring revenue with high switching costs (enterprise imaging + workflow control planes) versus those exposed to commoditization (single-algorithm tools).

- Lumexa Imaging IPO: ~$462.5M raised; ~$1.75–$1.76B valuation range; 184 centers/13 states; revenue/loss details reported.

Why it matters: Imaging roll-ups are again marketable as “high-value modality platforms” (MRI/CT) with AI-driven efficiency narratives—raising competitive pressure on independent centers and smaller regional groups. - a2z: $4.5M seed (Khosla, SeaX) after FDA clearance and RSNA debut.

Why it matters: Early capital is chasing “comprehensive interpretation” wedges, not single-finding detectors—suggesting the next startup wave will bundle triage + drafting + workflow rather than narrow point tools.

M&A, STRATEGIC PARTNERSHIPS, AND ECOSYSTEM MOVES

RSNA 2025 validated a consolidation thesis: the control plane (enterprise imaging + reporting workflow) is where value accrues, so acquirers and alliances will target distribution and embedded user touchpoints. GE’s Intelerad move is the archetype—buy installed base + cloud economics + outpatient access—and immediately reframes how OEMs think about AI monetization (bundled, recurring, attach-driven). Meanwhile, RSNA Ventures signals that societies are entering the product ecosystem as content and workflow partners, not just conference organizers.

- GE HealthCare ↔ Intelerad ($2.3B cash).

Why it matters: Outpatient enterprise imaging is described as a $2B+ opportunity; Intelerad SaaS economics and cloud imaging distribution can accelerate GE’s internal AI algorithm adoption. - RSNA Ventures ↔ Rad AI strategic partnership (Oct 7 release; RSNA context into RSNA season).

Why it matters: “Trusted knowledge into workflow” becomes a differentiator as copilots expand; this also sets a pattern for societies/registries to become product-layer partners. - Abbott ↔ Exact Sciences (up to $23B, incl. debt). (just before window; included due to materiality)

Why it matters: Diagnostics scale plays are back; impacts oncology pathways that ultimately drive imaging volume (screening, staging, monitoring), and may tighten integration between diagnostics + imaging in IDN procurement.

PRODUCT LAUNCHES & MARKET ENTRIES (RSNA-centered)

This RSNA cycle was heavy on “AI across the chain” launches: OEMs are productizing AI as part of modality performance (dose, speed, clarity) and informatics vendors are pushing cloud-first workspaces and web diagnostics that lower friction for AI deployment. Expect the purchasing unit to keep moving upward—from department-level radiology buys to enterprise CIO/CFO platforms—because the primary value now comes from integration, governance, and scaling across sites and modalities.

Key launches (and implications):

- GE Photonova Spectra PCCT (510(k) submitted).

Why it matters: PCCT is positioned as an innovation reset; if GE closes the gap, competitive advantage shifts from “only PCCT” to “best AI-enabled PCCT workflows,” pressuring incumbent premium segments. - Philips Verida (detector-based spectral CT powered by AI).

Why it matters: Philips frames spectral as routine-ready (speed + AI reconstruction). This pushes spectral differentiation into throughput and workflow standardization, not only physics performance. - Siemens Optiq AI imaging chain (interventional).

Why it matters: “Imaging chain” productization suggests AI quality improvements become standardized SKUs; over time, this can reshape competitive bidding from “system specs” to “AI chain + clinical outcomes.” - GE Genesis Radiology Workspace (cloud-first).

Why it matters: Cloud workspaces are becoming the new front door for AI, reporting, and collaboration—reducing the friction that historically killed pilot-to-scale transitions. - Philips Image Management 15 (web-based diagnostic viewer).

Why it matters: Web diagnostics + secure access supports distributed reading and “AI anywhere,” tightening competition with traditional thick-client PACS. - Canon Alphenix/Evolve Edition with αEvolve Imaging (510(k)).

Why it matters: Interventional AI clarity tools are marketed as procedural confidence + efficiency, which can support value analysis committees beyond radiology leadership.

AI & DIGITAL HEALTH INNOVATIONS (medical imaging focus)

The AI story is maturing into two dominant categories: (1) copilots and agents embedded in reporting and operations, and (2) AI infrastructure (cloud imaging, data platforms, remote scanning) that makes deployment repeatable. Both categories are distribution-led: the winners are those who own the workflow surface area and can instrument outcomes. Expect a sharp increase in “evidence packets” (time saved, throughput, error reduction) as vendors compete for enterprise standardization.

- Microsoft Dragon Copilot for radiology (preview; PowerScribe One companion).

Why it matters: “Agentic inside the report” reframes dictation vendors into workflow platforms; partner ecosystems (screening AI, billing intelligence) will determine real value. - DeepHealth TechLive (remote expert oversight; scale metrics).

Why it matters: 42% fewer MR room closures at RadNet with 400+ connected scanners is an unusually tangible KPI; remote ops becomes a board-level capacity lever for IDNs and imaging chains. - RapidAI expansion (5 new clearances).

Why it matters: Neurology platforms are evolving into longitudinal care coordination tools; strong example of “module attach” as growth strategy. - Rad AI next-gen speech recognition (context-aware dictation).

Why it matters: Speech recognition is re-emerging as a competitive battlefield because it’s the on-ramp to broader copilots (impressions, follow-up, billing optimization). - AI-native PACS viewer prototypes (Raidium).

Why it matters: Foundation-model-first PACS is an early signal, but commercial success depends on governance, latency, and workflow fit—areas where incumbents still have structural advantages. - AWS cloud imaging economics (context).

Why it matters: AWS cited >40% faster ingestion/retrieval and ~50% storage cost reduction in cloud imaging use cases—supporting the CFO narrative for migrating imaging infrastructure.

CLINICAL RESEARCH & EVIDENCE (RSNA + adjacent)

Clinical evidence at RSNA 2025 showed a pragmatic shift: instead of aiming to replace radiologists, the most persuasive work uses AI to reduce perceptual misses, streamline reporting, and support shared decision-making. This aligns with patient trust data that strongly prefers AI + radiologist partnership over standalone AI. For vendors, this suggests the winning claims will be “second reader,” “closure,” and “capacity” rather than autonomy. For providers, it means adoption should focus on measurable safety and workflow metrics first.

- Patient attitudes toward AI in imaging (survey; n=1,041): 67.3% comfortable with radiologist + AI; only 20.4% accept AI alone.

Why it matters: Procurement and communications strategies should assume “human oversight” remains mandatory for trust, consent expectations, and medicolegal posture. - Collaborative AI to catch chest X-ray misses (CoRaX): integrated gaze + report signals; retrospective analysis reports error correction rates and referral acceptance rates.

Why it matters: Strong “AI as referral, not decision” framing—commercially safer and more adoptable than autonomy narratives. - Risk-based breast cancer screening debate + BI-RADS v2025 update (standardization).

Why it matters: Standards and structured reporting (BI-RADS updates) are foundational for scaling AI risk models and quality measurement across sites. - Lunit INSIGHT Risk: 510(k) submitted for mammography-based risk prediction.

Why it matters: Risk prediction + screening personalization will pressure imaging workflows toward longitudinal analytics and integrated patient context, not just per-exam reads.

QUICK-GLANCE TABLE

| Date (2025) | Headline | Our Take |

| Nov 20 | GE HealthCare to acquire Intelerad for $2.3B | “Enterprise imaging = AI distribution.” GE buys cloud + outpatient footprint; sets pricing/attach expectations for peers. |

| Nov 24 | Microsoft Dragon Copilot expands to radiologists (preview) | Big vendor move to own reporting UX; “agentic” features become table stakes for dictation/reporting stacks. |

| Nov 24 | a2z Unified‑Triage 510(k): PCCP authorized | Regulatory path is evolving from static to managed iteration—buyers should demand monitoring + change control in SOWs. |

| Nov 24 | GE Photonova Spectra PCCT: 510(k) submitted | PCCT is shifting from “physics story” to “AI data story”; competitive pressure rises on Siemens PCCT franchise. |

| Nov 25 | GE Genesis Radiology Workspace (cloud-first) | Workflow is the wedge: cloud-first workspaces compress IT friction and create the “storefront” for AI modules. |

| Nov 25 | RapidAI: five new FDA clearances | Suite depth wins; neurovascular platforms expand beyond stroke triage into longitudinal workflow + measurement. |

| Nov 25 | Canon αEvolve Imaging: FDA 510(k) | Interventional imaging is adopting AI noise reduction + clarity as a procedural efficiency lever. |

| Nov 26 | GE Pristina Recon DL: FDA premarket authorization | DL reconstruction shifts from “nice-to-have” to a quality/throughput attach; also primes AI screening workflows. |

| Nov 30 | DeepHealth TechLive: 400+ scanners; -42% MR room closures | Remote ops becomes the pragmatic workforce strategy; strong proof point for capacity recovery economics. |

| Nov 30 | Philips Verida spectral CT launch | AI across imaging chain + fast reconstruction targets throughput and dose—positioned as “spectral for routine.” |

| Nov 30 | Siemens Optiq AI imaging chain (interventional) | OEMs are productizing “AI image quality” as a standardized chain, not an add-on algorithm. |

| Dec 1 | Rad AI next-gen speech recognition | Reporting becomes a battleground: “context-aware dictation” is the on-ramp to broader agentic reporting. |

| Dec 9 | FDA qualifies AIM‑NASH (first AI drug development tool) | Beyond radiology: FDA qualification is a precedent for AI standardization in trials; imaging AI expands upstream. |

| Dec 11 | Lumexa Imaging IPO (diagnostic imaging platform) | Public markets reopen for imaging services scale plays; AI becomes an efficiency narrative for roll-ups. |

About Marketstrat

Marketstrat® is a market intelligence and GTM enablement firm focused on medtech, healthcare, and life sciences. Under the Markintel™ brand, Marketstrat delivers robust market intelligence and proprietary frameworks; through GrowthEngine advisory and tools, it helps clients turn insights into execution. Together, these capabilities support clients in converting evidence‑weighted insight into practical action across strategy, product, and commercial execution.

Marketstrat® and Markintel™ are trademarks of Marketstrat Inc. All other trademarks are the property of their respective owners.

Check out free Research and Insights and Analysis of Industry Events

Check out our collection of Markintel Horizon and Markintel Pulse research.

Check out details on our reports, World Market for AI in Medical Imaging and World Market for Oncology Imaging AI and other Pulse Reports in the Imaging space.