ONE BIG THING

FDA’s Jan‑6 guidance pair (CDS + General Wellness) materially widens the “non‑device” lane for AI in care delivery—shifting near‑term advantage from model performance to defensible deployment economics (workflow fit, evidence, liability controls, and integration).

KEY TAKEAWAYS

- Regulatory clarity is the near‑term catalyst: FDA’s final Clinical Decision Support (CDS) guidance tightens the rules for what qualifies as non‑device software while still leaving room for AI tools that are transparent and allow clinician independent review—highly relevant to LLM copilots and imaging workflow tools that avoid “black box” recommendations.

- “General wellness” becomes a bigger beachhead for GenAI: FDA’s final general‑wellness guidance reinforces a commercialization path for low‑risk consumer features—raising the odds of faster iteration in consumer health while shifting the risk burden to claims discipline, monitoring, and labeling.

- Imaging is converging on platform economics: Siemens’ Magnetom Flow clearance, GE HealthCare’s edge‑AI collaboration with NXP, and Aidoc’s leadership move are signals that the next differentiation wave is hardware + embedded AI + deployment services, not point algorithms.

- Provider adoption is moving from pilots to “systemwide”: Perimeter’s Intermountain agreement and continued imaging‑services consolidation (RadNet, Envision) reflect a 2026 playbook: lock in volume, standardize workflows, then layer AI to expand capacity without proportional staffing.

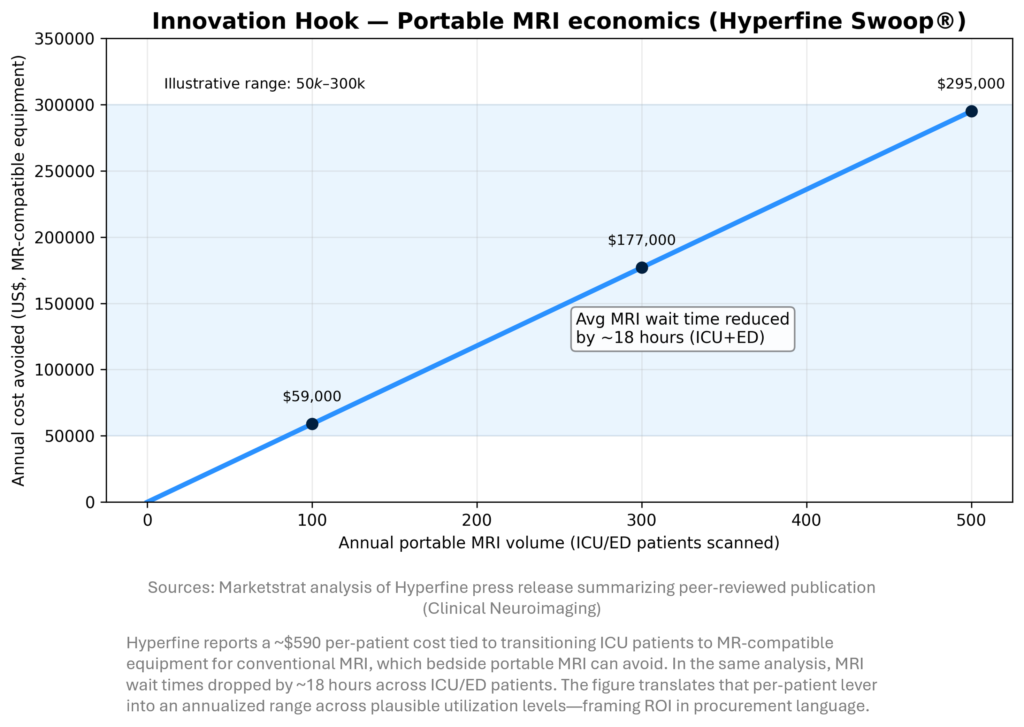

- ROI evidence is getting sharper: Hyperfine’s peer‑reviewed health‑economic analysis (cost avoided and materially faster time‑to‑diagnosis) is the type of dataset buyers now expect—especially as reimbursement and staffing constraints intensify.

MARKETSTRAT POV (ACTIONABLE STRATEGY)

- Stop selling “algorithms,” start selling capacity. The winning imaging AI story in 2026 is throughput, time‑to‑diagnosis, and standardization—supported by peer‑reviewed operational and economic outcomes (not only AUC/sensitivity charts).

- Design to the FDA lane you want to live in. If you want CDS/wellness regulatory leverage, build transparent logic, clinician independent review, disciplined claims, and strong monitoring; otherwise assume device‑grade evidence and lifecycle controls.

- Pick your oncology wedge by modality + stage. Mammography (X‑ray/DR screening), PET staging/response, and MRI treatment planning have different buyer personas and evidence needs; product strategy and partnerships should mirror that segmentation.

INNOVATION HOOK

Bedside imaging is becoming an economic weapon

For imaging providers, the next productivity frontier is where imaging happens, not just how fast it is read. Hyperfine’s peer‑reviewed analysis suggests portable MRI can remove meaningful per‑patient prep/transport costs and reduce ICU/ED MRI wait times—two levers that map directly to length‑of‑stay and throughput pressure. In a constrained staffing environment, that kind of operations‑first ROI can unlock adoption faster than incremental accuracy gains.

MARKET LENS

With AI‑in‑Imaging TAM anchored at $28.4B in 2032 (Marketstrat baseline), oncology imaging AI growth concentrates where imaging is both high‑volume and decision‑critical. The stage‑by‑modality view clarifies where AI spend will cluster: screening remains X‑ray/DR‑heavy, while PET dominates staging and MRI anchors treatment planning and response assessment. For vendors, this implies different go‑to‑market motions by modality and stage, not one universal playbook.

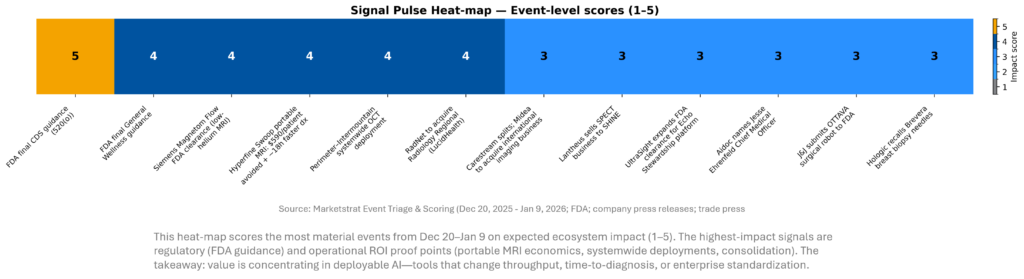

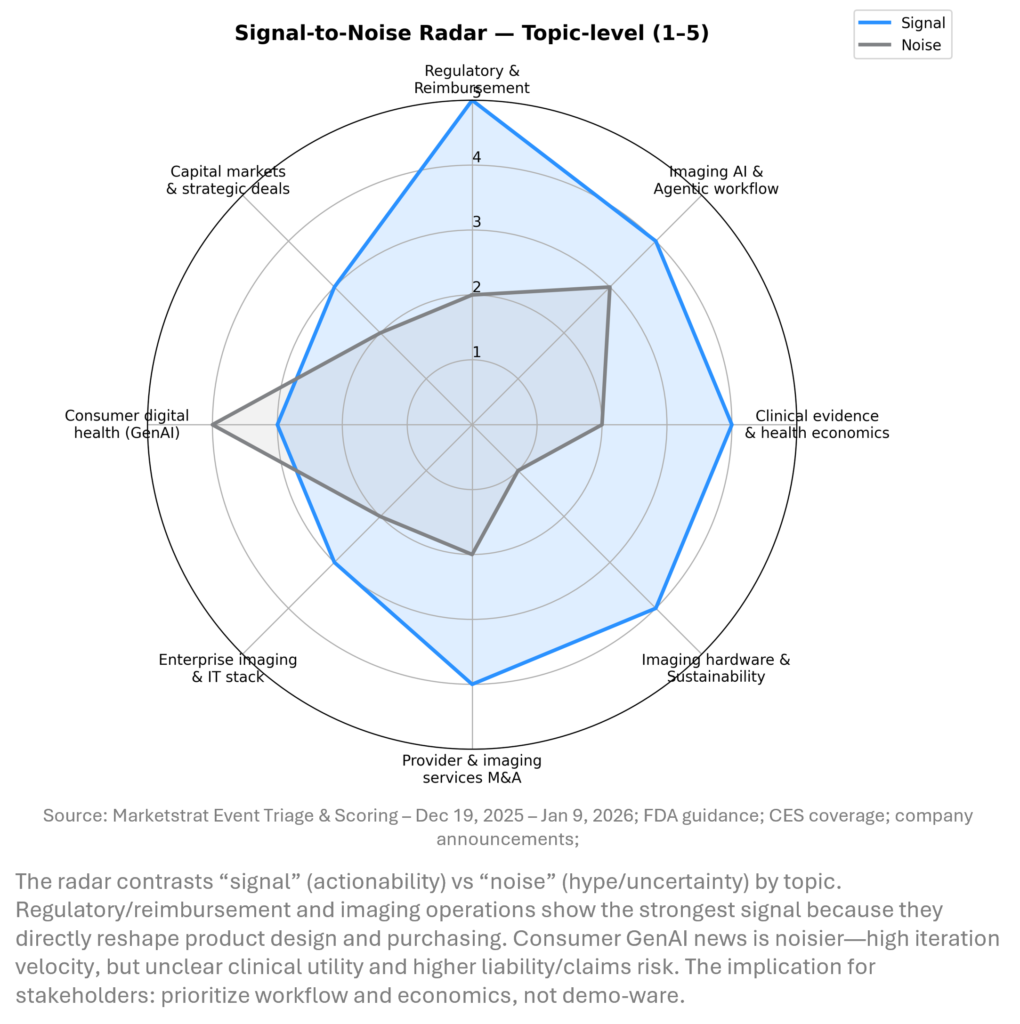

SIGNAL DASHBOARD

Across the holiday window, the highest‑signal developments cluster around regulatory clarity and deployment economics. FDA guidance expands the feasible design space for LLM‑enabled workflows outside traditional device oversight, while systemwide provider deals and peer‑reviewed ROI data show buyers increasingly demand measurable operational impact. Meanwhile, OEMs and platform vendors are positioning for an “agentic” era where integration, edge compute, and service contracts determine who scales.

SIGNAL PULSE HEATMAP – DEC 20, 2025 – JAN 9, 2026

SIGNAL-TO-NOISE RADAR BY TOPIC – DEC 20, 2025 – JAN 9, 2026

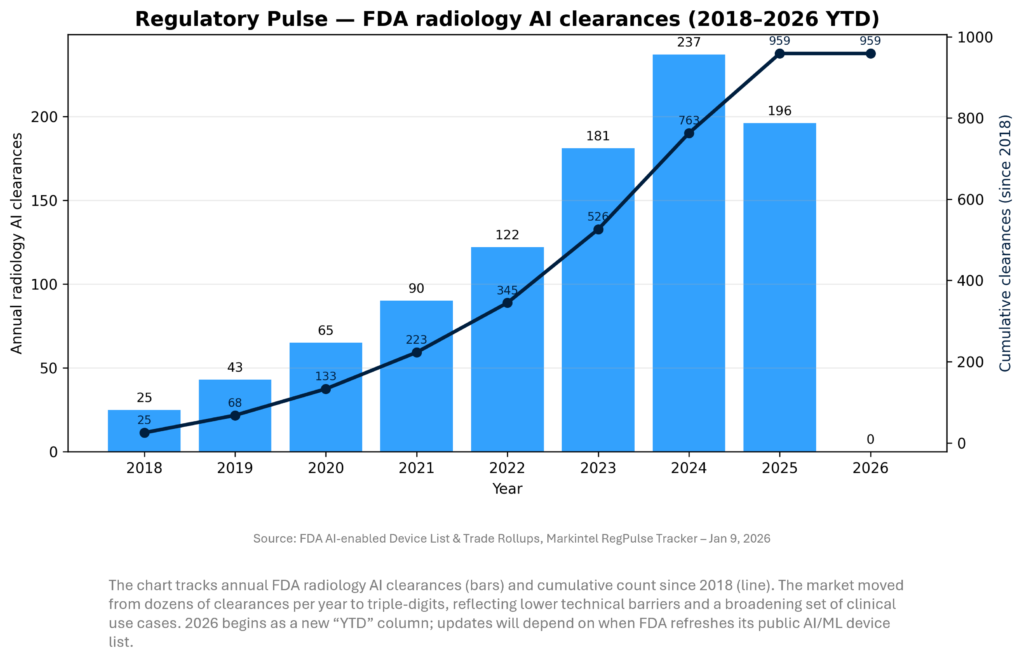

REGULATORY PULSE

Our radiology AI clearance tracker shows a multi‑year acceleration in FDA authorizations, peaking in 2024 and remaining elevated into 2025 (as last published). For 2026, early weeks are typically quiet; the more important read is when the FDA’s AI/ML device list updates to reflect late‑2025 and early‑2026 decisions. Strategically, clearance velocity matters less than the shift toward enterprise platforms and clear reimbursement/ROI pathways.

COMPANY SPOTLIGHT – SIEMENS HEALTHINEERS (SHL.DE)

Key takeaways (why Siemens “wins the week”)

- Most impactful imaging innovation in the window: Siemens Healthineers secured FDA clearance for Magnetom Flow (70cm, 1.5T)—a virtually helium-free MR platform with a closed helium circuit, no quench pipe, and AI-enabled reconstruction/workflows

- Why it matters now: Helium is a persistent strategic vulnerability for MRI uptime and operating cost; hospitals are also under mounting pressure to show energy and sustainability improvements. Siemens is directly tying sustainability to throughput and total cost of ownership (TCO).

- Strategic read-through: This is not just a new scanner—it’s a procurement logic shift toward TCO + install flexibility + workforce efficiency, which can accelerate fleet refresh decisions and raise the bar for competitors’ mid-field portfolios.

What’s new vs. “typical” 1.5T MR (technical + operational)

- Helium dependency collapses: Requires 0.7 liters of liquid helium (vs. conventional systems often cited at >1,000 liters).

- No quench pipe: Eliminates the traditional venting infrastructure requirement, a meaningful driver of facility complexity and retrofit cost.

- Energy and sustainability message is explicit: Siemens claims up to 56% lower annual energy consumption versus its prior MR generation and highlights Eco Power Mode and upgradeability to reduce lifecycle footprint.

- AI is “embedded,” not bolt-on: The platform emphasizes AI reconstruction (Deep Resolve 2D/3D) and automation tools (myExam Assist / myExam Autopilot; implant workflows; new cardiac workflow automation) aimed at faster exams, less variability, and reduced technologist burden.

Why we’re calling it the most impactful innovation this cycle

- It addresses a structural constraint, not a feature gap. Helium supply risk has been flagged repeatedly as a looming imaging vulnerability; hospitals are among the largest helium consumers (often cited as >1/3 of global helium demand in reporting), making MRI uniquely exposed.

- It scales across mainstream demand. A 1.5T, 70cm-bore platform is squarely in the volume segment where capacity constraints, outpatient growth, and staffing gaps are most acute.

- It shifts the purchasing conversation. Moving from “best images” to “best uptime + install + energy + throughput economics” is a durable procurement reframe—and Siemens is supplying a clear numeric narrative (0.7L helium; 56% energy claim) that procurement teams can put directly into RFP scoring.

QUICK-GLANCE TABLE

| Date | Headline | Our take |

| Jan 6, 2026 | FDA issues final CDS software guidance | Sets clearer “rails” for which AI decision tools can stay outside device regulation; expect product design to pivot toward transparency + clinician independent review. |

| Jan 6, 2026 | FDA issues final General Wellness guidance | Reinforces wellness as the fast lane for consumer AI; biggest risk is claims overreach + post‑market trust. |

| Jan 8, 2026 | Siemens Healthineers gets FDA clearance for Magnetom Flow | Low‑helium / operationally simplified MRI is a “capacity + sustainability” lever; meaningful for constrained sites and lifecycle service models. |

| Jan 6, 2026 | Hyperfine publishes economic benefits for portable MRI | Strong buyer‑language: quantified per‑patient cost avoided + large time‑to‑diagnosis improvement; supports ROI‑first procurement. |

| Jan 8, 2026 | Perimeter signs systemwide agreement with Intermountain | Indicates intra‑op imaging + AI is graduating to enterprise rollouts (not just trials), with immediate workflow implications in oncology surgery. |

| Jan 7, 2026 | RadNet to acquire Radiology Regional | Adds scale + ~$100M annual revenue; reinforces consolidator playbook where AI drives utilization upside on fixed assets. |

| Dec 31, 2025 | Carestream to split; Midea to acquire international imaging business | Another signal of “portfolio reshaping” in imaging hardware—expect renewed price pressure in DR/portable segments and more channel competition. |

| Jan 9, 2026 | Bruker secures ~$500M MRI magnet supply agreements | Under‑appreciated: magnet supply is a gating factor; supply commitments suggest confidence in future MRI buildout and upgrades. |

| Jan 6, 2026 | GE HealthCare + NXP collaborate on acute‑care AI | Edge compute + “agentic” frameworks aim to make AI deployable at the bedside; strategic because latency, privacy, and uptime are acute‑care constraints. |

| Jan 6, 2026 | UltraSight expands FDA clearance for Echo Stewardship platform | Echo is a high‑volume workflow domain; clearance expansion signals continued regulatory openness to ultrasound AI as assistive/standardizing tech. |

| Jan 8, 2026 | Aidoc appoints Jesse Ehrenfeld as CMO | A “clinical credibility” move as AI shifts from triage tools to broader reasoning + orchestration; watch for enterprise‑scale deployments and new FDA pathways. |

| Jan 5, 2026 | Ceribell receives FDA Breakthrough Device Designation for LVO | Extends AI‑interpreted neuro‑signals into acute stroke workflows; not imaging per se, but competes for the same “time‑critical” stroke pathway budgets. |

| Jan 7, 2026 | Hologic recalls Brevera biopsy needles | Operational risk reminder: even “routine” consumables can create patient safety + downtime events; strengthens QA and inventory resilience requirements. |

DEEPER DIVES

1) Regulatory approvals, clearances, and policy

Regulatory signals this period were less about a flood of new AI clearances and more about rule clarity and precedent setting. FDA’s final CDS and general‑wellness guidance pair will influence how LLM copilots, imaging workflow assistants, and consumer clinical features are marketed, validated, and monitored. Simultaneously, select clearances and designations (ultrasound AI, stroke detection) reinforce that regulators remain supportive when claims are bounded and workflows are clinician‑supervised.

Key developments (with why it matters):

- Jan 6 — FDA final guidance: Clinical Decision Support (CDS) software.

Why it matters: The guidance operationalizes when CDS can be considered non‑device software under statutory exemptions (and when it cannot). Expect LLM products to evolve toward (1) transparent logic, (2) clear data provenance, and (3) UX that supports clinician independent review—otherwise they fall back into device oversight with higher evidence burden. - Jan 6 — FDA final guidance: General Wellness products.

Why it matters: Reinforces a safer commercialization lane for low‑risk wellness claims, which is where many consumer GenAI features will live. For imaging and medtech companies, the strategic question is whether wellness becomes a top‑of‑funnel for clinical products—or a brand risk if claims creep ahead of evidence. - Jan 6 — UltraSight expands FDA clearance for Echo Stewardship Platform.

Why it matters: Ultrasound is a prime target for AI standardization because operator variability is structurally high. Clearance expansion supports broader deployments in cardiology departments looking to reduce variation, improve reporting consistency, and potentially expand scanning capacity with limited sonographer supply. - Jan 5 — Ceribell receives FDA Breakthrough Device Designation for LVO stroke detection/monitoring.

Why it matters: Although not classic imaging AI, it competes in the same stroke pathway budgets and reinforces a macro‑trend: AI is being accepted in time‑critical triage workflows when positioned as assistive, with clear clinical urgency and unmet need. - Jan 7 — Hologic recalls Brevera breast biopsy needles (consumables).

Why it matters: Consumable/kit recalls can create sudden downtime and disrupt women’s imaging schedules. From a system perspective, it increases the value of multi‑sourcing, inventory buffers, and proactive quality monitoring—especially in high‑volume screening/diagnostic pathways.

2) M&A, divestitures, and strategic partnerships

Deal flow in imaging continues to bifurcate: providers buy capacity while manufacturers reshape portfolios and platform players pursue integration. RadNet’s expansion reinforces scale economics in outpatient imaging; Carestream’s split and sale highlights global channel and pricing dynamics in DR; GE HealthCare’s partnership and pending enterprise‑imaging acquisition signal that workflow/IT integration remains strategic. The common thread: controlling distribution and data is now as important as shipping hardware.

Notable items:

- Jan 7 — RadNet to acquire Radiology Regional (via LucidHealth).

Deal context: Adds 13 imaging centers across Florida/Alabama and is described as adding roughly $100M in annual revenue.

Why it matters: Scale improves payor contracting, staffing flexibility, and AI deployment leverage (standardized protocols + centralized QA). It also increases “fixed asset utilization” upside—where workflow AI can translate directly to more appointments without proportional headcount. - Jan 7 — Envision Radiology completes acquisition of Rezolut imaging centers (Utah).

Why it matters: Reinforces consolidation of regional imaging assets; increases the urgency for AI solutions that can be deployed across multi‑site networks (protocol standardization, scheduling optimization, report automation) rather than single‑site pilots. - Dec 31 — Carestream: separation into two companies; Midea to acquire Carestream’s international imaging business.

Why it matters: Signals continued realignment in DR/X‑ray supply chains and competitive intensity. Midea’s ownership could sharpen pricing and distribution in international markets; for hospitals, it raises long‑term questions about service continuity, roadmap stability, and interoperability with PACS/AI layers. - Jan 6 — GE HealthCare + NXP partnership (acute care / edge AI).

Why it matters: Edge AI is a practical answer to acute care’s constraints: latency, reliability, data governance, and cybersecurity. Partnerships like this can accelerate “AI‑inside” device roadmaps—embedding inference closer to the data source rather than relying on cloud workflows that can be brittle in critical settings. - Context (late 2025 but still strategic): GE HealthCare to acquire Intelerad (enterprise imaging).

Why it matters: If/when closed, it would strengthen GE’s footprint in radiology IT and workflow orchestration—an area where AI value is increasingly captured (routing, triage, follow‑ups, analytics), not just detection.

3) Product launches and market entries

CES 2026 amplified a long‑running trend: consumer health features are converging with clinical workflows, and GenAI is becoming the default interface layer. For imaging stakeholders, the near‑term impact is indirect but real—more upstream data, more patient expectations, and more clinician workload if tools aren’t integrated safely. Meanwhile, imaging OEM innovation is emphasizing operational simplicity (installation, service, resource constraints) as much as image quality.

Highlights:

- Jan 5–6 — Abbott introduces Libre Assist (GenAI feature for Libre CGM ecosystem).

Why it matters: Moves GenAI closer to regulated/clinical chronic‑care workflows. Even when framed as “assistive,” these features pressure the ecosystem to standardize guardrails (data transparency, confidence indicators, escalation logic) to reduce misuse risk—and they raise the bar for clinical validation and post‑market monitoring. - Jan 5 — Samsung expands “AI Living” health vision at CES.

Why it matters: Large consumer platforms can normalize health‑data capture and AI coaching at scale. For providers/payers, the key question is integration: whether these signals reduce friction (better triage) or increase it (false positives, documentation burden). - Jan 6 — Butterfly opens 3D beam‑steering API (developer ecosystem).

Why it matters: Opens the door for third‑party and research workflows around ultrasound acquisition and interpretation—potentially accelerating niche applications and “agentic scanning” concepts where software guides acquisition in real time.

4) Clinical research and evidence

Evidence is shifting from “accuracy on curated datasets” to “impact in messy workflows.” The most decision‑useful signals this period include measurable time and cost outcomes (portable MRI economics) and enterprise deployment patterns (systemwide surgical imaging rollouts). For imaging AI companies, the competitive moat is increasingly a package: (1) clinical utility, (2) operational ROI, and (3) implementation infrastructure (integration + service + change management).

Evidence‑linked developments:

- Jan 6 — Hyperfine: peer‑reviewed health‑economic analysis (143 patients, 12 months, Jefferson Abington).

Key reported outcomes include ~$590 per patient in MR‑compatible equipment transition costs that could be avoided, and ~18 hours average reduction in MRI wait times across ICU/ED patients.

Why it matters: This is CFO‑readable ROI and directly addresses hospital throughput constraints. It also reframes imaging AI value as “time‑to‑diagnosis + throughput,” not just interpretation. - Jan 8 — Perimeter systemwide Intermountain agreement for OCT + ImgAssist AI (oncology surgery workflow).

Why it matters: Intra‑op margin assessment is one of the few areas where imaging can change downstream treatment burden (re‑excisions, delays, anxiety). Systemwide agreements imply standardized processes and training—raising the bar for competitors to prove integration and surgical team adoption, not just imaging performance. - Late‑breaking context — FDA approval of Ferabright (ferumoxytol) as an iron‑based brain MRI contrast agent (adult malignant neoplasms).

Why it matters: New contrast options can shift imaging pathways and vendor protocols; for AI vendors, it also creates data distribution change (new contrast dynamics) that can degrade model performance unless monitored and retrained.

5) Imaging hardware, supply chain, and installed‑base economics

Hardware differentiation is increasingly about operational constraints—helium availability, energy costs, serviceability, and installation complexity—because those factors determine uptime and true cost per scan. Siemens’ new clearance and Bruker’s supply agreements both point to a 2026 environment where capacity expansion must navigate physical bottlenecks (magnets, cooling, siting) alongside software ones. For OEMs, recurring revenue models make these operational advantages strategically compounding.

Key items:

- Jan 8 — Siemens Healthineers: FDA clearance for Magnetom Flow (1.5T).

Why it matters: Positions MRI as easier to site and operate amid helium and energy pressures—supporting distributed imaging strategies (community hospitals, constrained outpatient sites) and reinforcing “platform + service” economics. - Jan 9 — Bruker BEST: ~$500M multiyear magnet supply agreements.

Why it matters: Magnet supply is a real bottleneck. Large supply agreements can stabilize production planning and support longer‑horizon capacity expansion—especially relevant as demand grows for both clinical MRI and adjacent research/industrial applications.

About Marketstrat

Marketstrat® is a market intelligence and GTM enablement firm focused on medtech, healthcare, and life sciences. Under the Markintel™ brand, Marketstrat delivers robust market intelligence and proprietary frameworks; through GrowthEngine advisory and tools, it helps clients turn insights into execution. Together, these capabilities support clients in converting evidence‑weighted insight into practical action across strategy, product, and commercial execution.

Marketstrat® and Markintel™ are trademarks of Marketstrat Inc. All other trademarks are the property of their respective owners.

Check out free Research and Insights and Analysis of Industry Events

Check out our collection of Markintel Horizon and Markintel Pulse research.

Check out details on our reports, World Market for AI in Medical Imaging and World Market for Oncology Imaging AI and other Pulse Reports in the Imaging space.