One Big Thing

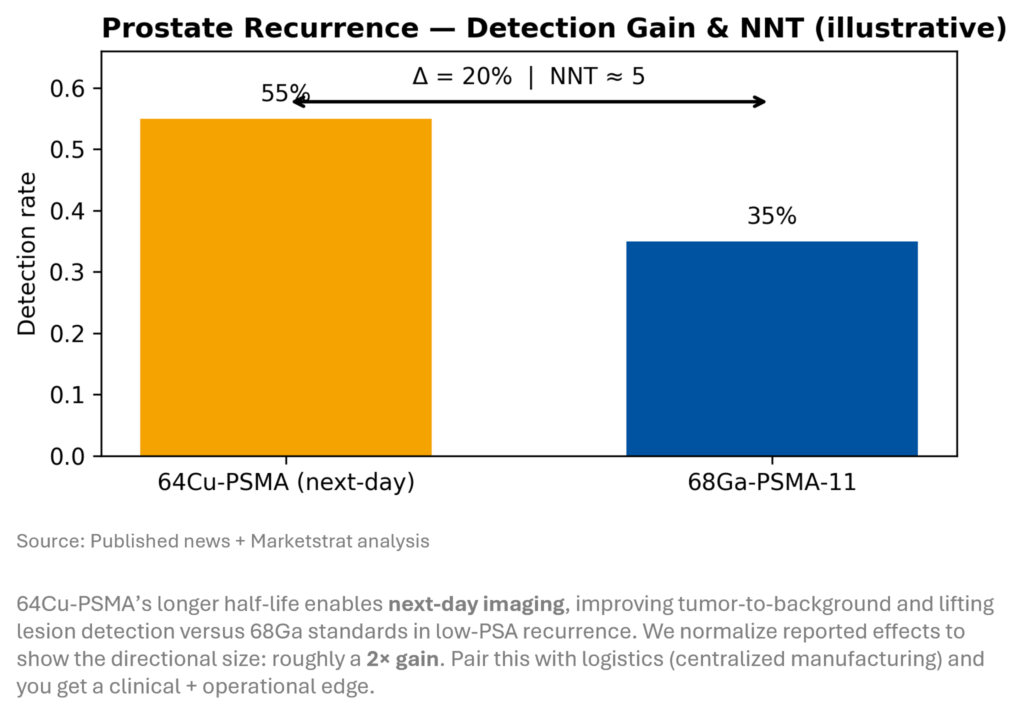

Prostate cancer imaging leapt forward this week—64Cu‑PSMA beat a standard PSMA agent head‑to‑head, sharpening detection where it matters most: low‑PSA recurrence.

Key Takeaways

- Prostate momentum: Superiority data for 64Cu‑PSMA tightens the link from earlier diagnosis to targeted therapy—and sets up a theranostic flywheel.

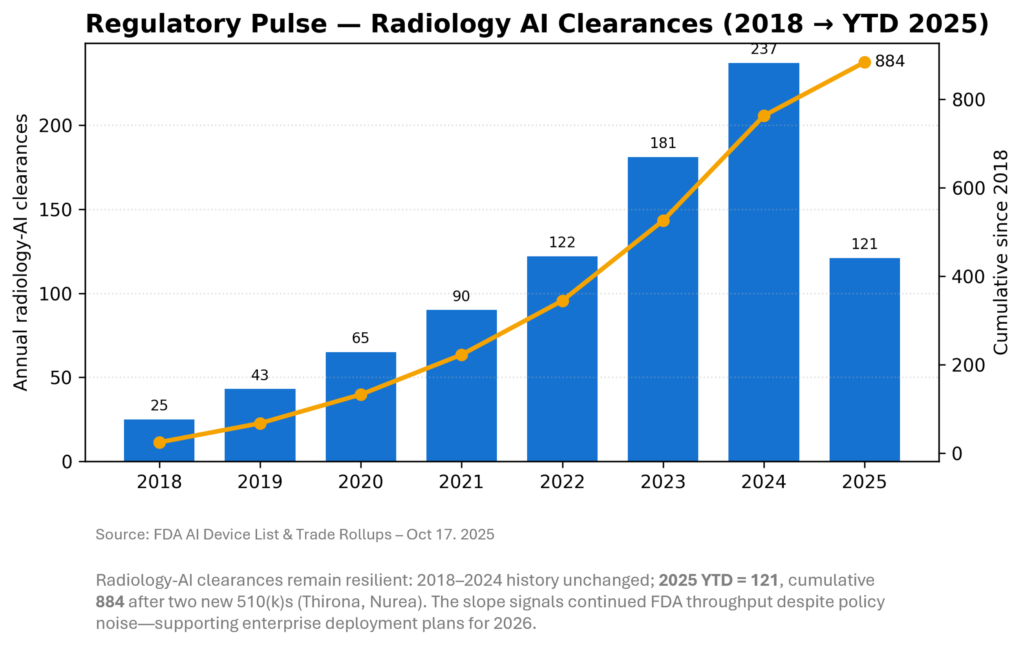

- Reg pulse flickers on shutdown headwinds: Despite a thin week overall, two imaging‑AI 510(k)s landed (Thirona LungQ 4; Nurea PRAEVAorta2). YTD radiology‑AI clearances now 121.

- Strategic repositioning: J&J moves to spin off DePuy Synthes, focusing capital on higher‑growth, tech‑centric medtech.

- Platform plays: RSNA Ventures × Rad AI embeds trusted knowledge into reporting workflows—AI shifts from point algorithm to co‑pilot.

- Long‑horizon alliances: GEHC–UCSD sign a 14‑year pact built on imaging + theranostics + AI—proof that risk‑sharing deals are the new enterprise model.

Quick-Glance Table

| Date | Headline | Our Take |

| Oct 14 | Clarity 64Cu‑PSMA Phase II shows superiority vs 68Ga‑PSMA‑11 in low‑PSA BCR | Clinical step‑function: better early localization supports salvage therapy planning; expect rapid protocol updates at cancer centers. |

| Oct 16 | RSNA Ventures partners with Rad AI to embed RSNA knowledge in reporting | Trust + workflow are the adoption unlocks; generative copilot moves from “nice‑to‑have” to standard. |

| Oct 14 | J&J to separate DePuy Synthes (Orthopedics) | Focused J&J MedTech doubles down on high‑margin cardio/robotics; Orthopedics becomes agile pure‑play. |

| Oct 16 | GE HealthCare–UCSD 14‑year “Care Alliance” | Long‑horizon risk‑share: theranostics + AI co‑development with guaranteed tech refresh. |

| Oct 16 | Nurea PRAEVAorta2 CT AI gets 510(k) | Earlier aneurysm detection/follow‑up; vascular AI expands beyond chest pathologies. |

| Oct 17 | Thirona LungQ® 4 AI (chest CT) wins 510(k) | Perfusion‑like CT analytics for COPD widens “everyday AI” in pulmonary imaging. |

| Oct 15 | Stereotaxis Synchrony “digital cockpit” EU launch; FDA filed | Cath‑lab consolidation platform sets the table for future AI guidance and tele‑proctoring. |

| Oct 16 | NUH/NUS launch total‑body PET/CT (Siemens) | Whole‑body kinetics + theranostics hub—watch for trial acceleration + dose/time benefits. |

| Oct 14 | Aidoc aiOS RSNA previews emphasize analytics layer | Vendor‑level analytics emerging as the “control plane” for enterprise AI orchestration. |

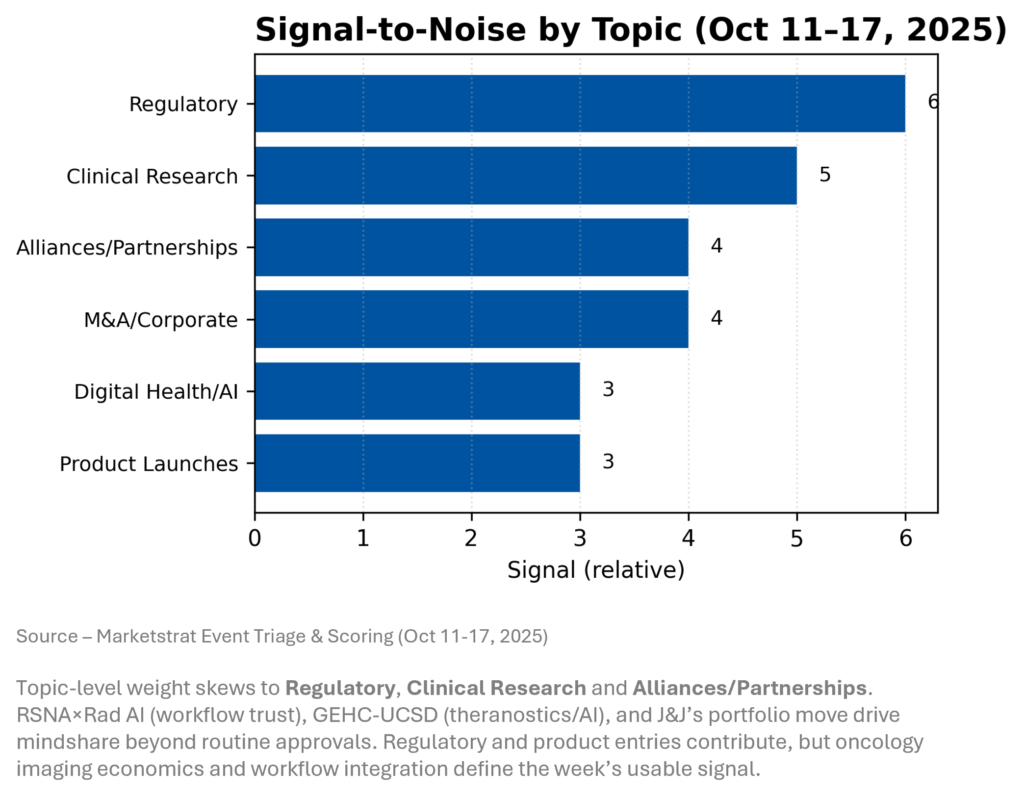

Signal-to-Noise by Topic – Oct 11-17, 2025

When we normalize mentions by impact, three vectors dominate: (1) clinical signal translating to near‑term pathway changes (64Cu‑PSMA), (2) workflow/platform integration (RSNA×Rad AI), and (3) long‑term commercial positioning (J&J separation; GEHC‑UCSD alliance). Regulatory clearances matter, but the organizational and clinical levers will shape 2026 budgets more than incremental features.

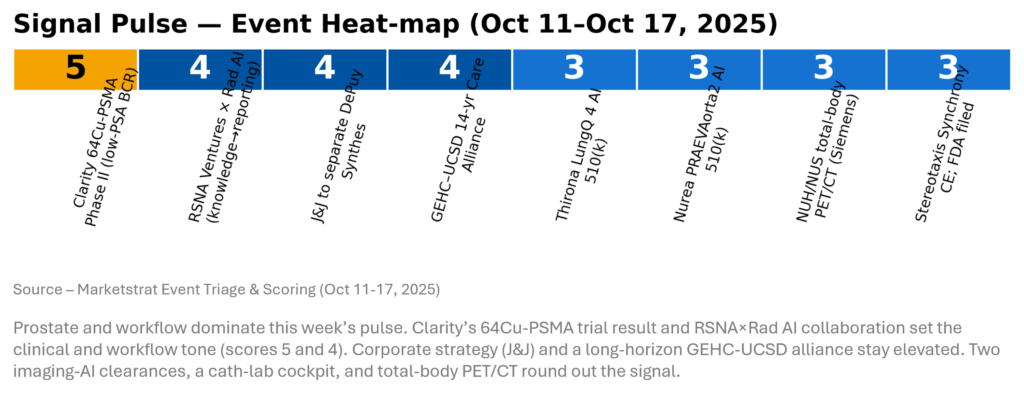

Signal Pulse Heatmap – Oct 11-17, 2025

Event‑level momentum clusters in oncology imaging and workflow integration. 64Cu‑PSMA’s edge in low‑PSA recurrence is a meaningful clinical unlock; RSNA’s knowledge infusion into reporting tackles the trust barrier. J&J’s separation sharpens competitive focus while GEHC‑UCSD institutionalizes co‑innovation. Regulatory cadence (Thirona, Nurea) is steady despite macro noise. Together, these points foreshadow oncology AI budgets shifting to quantification, structured reporting, and theranostic readiness.

Regulatory Pulse

YTD additions reinforce a steady cadence, with pulmonary and vascular CT analytics broadening beyond stroke and trauma. With RSNA ahead, expect a December/January clearance bulge as the backlog clears. For buyers, 2025’s mix tilts toward quantification and longitudinal follow‑up rather than single‑finding detectors—fitting post‑market performance scrutiny and workflow ROI thresholds.

Deeper Dives

Regulatory

- What’s new: Thirona LungQ 4 and Nurea PRAEVAorta2 both received 510(k) clearance (AI on CT). Despite shutdown constraints, imaging‑AI stayed on the board. Regulatory Pulse updated below.

- Radiology‑AI continues to clear practical hurdles—lung function mapping and automated aortic measurements are “get‑done” tasks for overworked services. The week’s trickle of approvals underscores a broader pivot: safety‑net AI for routine quantification and follow‑up is what crosses finish lines during lean regulatory weeks. It’s also what budgets will fund first.

Funding / IPO

- OneImaging raised $38M to sell radiology “as a benefit,” compressing access friction (scheduling, auth, price). This could push more volume to cost‑efficient centers and pressure hospital outpatient pricing.

- The benefit‑bundling model for imaging is gaining validation. Employer‑sponsored diagnostics remove access bottlenecks and redirect volume to high‑throughput sites. For imaging groups, the play is network participation and SLAs; for hospitals, protect share with scheduling speed and transparency—or lose lower‑acuity studies.

Digital Health / AI

- RSNA Ventures × Rad AI puts peer‑reviewed knowledge into the reporting pane—reducing variation in recommendations and nudging appropriateness upstream.

- Gen‑AI in radiology is moving from “second reader” to practice platform. Embedding society‑vetted guidance addresses the trust gap and shortens the path from finding → action. Expect copycat alliances and procurement language that asks vendors to prove knowledge governance, not just pixel accuracy.

Clinical Research

- 64Cu‑PSMA superiority in low‑PSA BCR reframes prostate pathways; total‑body PET/CT expansion at NUH/NUS signals mainstreaming of whole‑body kinetics for oncology.

- Oncology imaging is now about precision + logistics. Better detection at low signal plus platform‑ready hardware (total‑body PET/CT) means earlier, more confident interventions—and datasets suited to adaptive therapy. The near‑term impact: prostate and theranostics budgets get prioritized in capital committees.

Innovation Hook — 64Cu‑PSMA: sensitivity lift at low PSA

This is more than a tracer swap. Longer half‑life supports hub‑and‑spoke supply, flexible scheduling, and next‑day reads that uncover otherwise missed lesions—precisely when salvage planning is time‑critical. On economics, earlier localization can avert metastatic cascades and long systemic therapy. The data bolsters the platform thesis: image with 64Cu, treat with 67Cu.

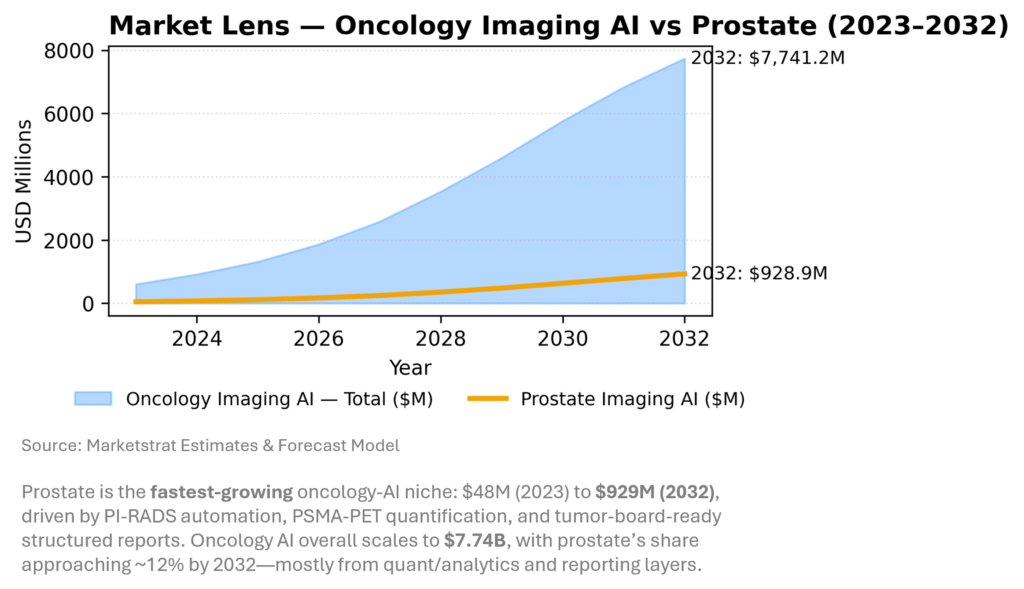

Market Lens – Oncology Imaging AI vs Prostate Imaging AI

What we’re showing (new this week): Total Oncology Imaging AI vs Prostate Imaging AI (sub‑segment) from 2023–2032. Prostate grows from $48.4M→$928.9M (38.9% CAGR) inside a total oncology AI market rising $604.7M→$7.74B (32.7% CAGR). Baseline reminder: overall AI‑in‑Imaging TAM = $28.4B by 2032.

The spend pivot is clear: oncology programs are prioritizing quantitative analytics, response tracking, and structured outputs over point detectors. In prostate pathways, MRI PI‑RADS + PSMA‑PET quant plus longitudinal response unlocks enterprise software + validation services, integrated to oncology IT. Land first where tumor boards live; co‑develop protocols with KOLs; de‑risk via cross‑site validation against protocol variability.

Marketstrat POV — Strategy to-dos

- Land where tumor boards decide. Bundle PI‑RADS automation + PSMA‑PET quant + longitudinal response with structured, tumor‑board‑ready outputs; sell enterprise software with validation services.

- Defend share with platforms, not point apps. Emulate RSNA×Rad AI: trust + workflow + evidence. Make analytics the control plane (aiOS‑style) and standardize post‑market performance monitoring.

- Hedge tariff risk. Package multi‑year AI/QC/service roadmaps as capex substitutes; show CFOs how $200–$500K tariff deltas convert to 3–5 year software ROI.

About Marketstrat

Marketstrat® is a market intelligence and GTM enablement firm committed to empowering clients in data-driven industries. Under the Markintel™ brand, it delivers robust market intelligence, while GrowthEngine solutions offer specialized GTM advisory and app-based tools—together fueling growth, innovation, and competitive advantage. For more information, visit www.marketstrat.com.

Marketstrat® is a registered trademark and Markintel™ is a pending trademark of Marketstrat.

Check out free Research and Insights and Analysis of Industry Events

Check out our collection of Markintel Horizon and Markintel Pulse research.

Check out details on our reports, World Market for AI in Medical Imaging and other Pulse Reports in the Imaging space.