One Big Thing

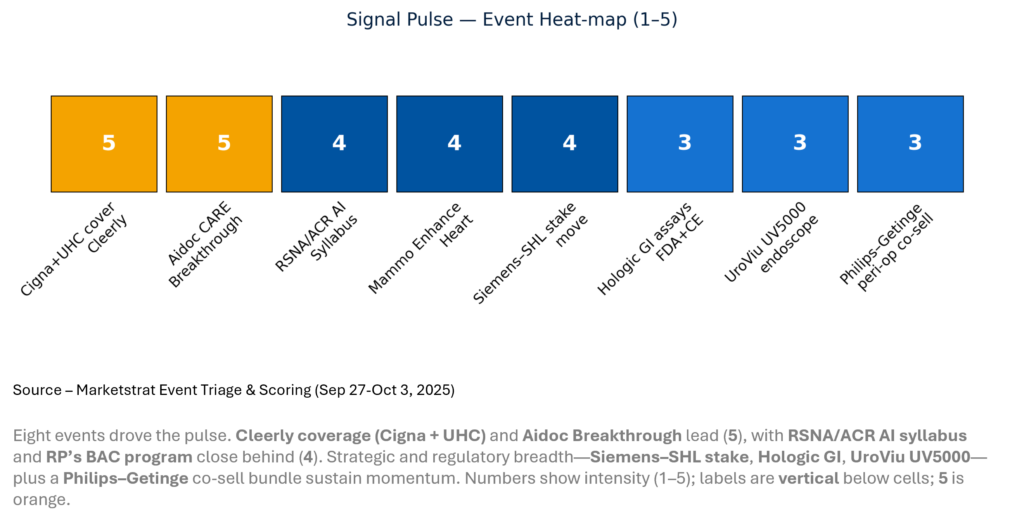

Coverage met platform: national coverage for AI‑QCT plaque analysis (Cigna + UHC) and Aidoc’s multi‑triage ER CT Breakthrough pushed imaging AI from pilots to paid, pathway‑level adoption—and onto enterprise shortlists.

Key Takeaways

- Coverage creates moats. Cigna joined UHC to cover Cleerly’s AI‑QCT (effective Oct 1), catalyzing CCTA‑first chest‑pain pathways.

- Platform proof. Aidoc CARE Breakthrough validates foundation‑model multi‑indication triage over point tools.

- Throughput sells AI. Subtle Medical disclosed 2.5× US revenue with 600+ US installs—ROI via faster scans, not capex.

- Channels consolidate. Philips–Getinge formed a peri‑op co‑sell bundle; strategy is shifting to platform route‑to‑market.

- Refocus at the top. Siemens AG is weighing a partial Healthineers spin‑off—more float, more independence.

Quick‑Glance Table

| Date | Headline | Our take |

| Oct 1 | Cigna + UHC cover Cleerly AI‑QCT | Coverage clarity pulls chest‑pain toward CCTA‑first; near‑term revenue for cardiac AI and CT capacity planning. |

| Sep 30/Oct 1 | Aidoc CARE multi‑triage ER CT gets FDA Breakthrough | Foundation‑model triage → unified ER alerts; aiOS strengthens as the enterprise AI backbone. |

| Oct 1 | RSNA/ACR/SIIM/AAPM issue role‑based AI syllabus | Sets the minimum “AI literacy” bar—expect explicit RFP language and faster rollouts. |

| Oct 3 | Radiology Partners launches Mammo Enhance Heart™ (BAC) | “One exam, two conditions” prevention with closed‑loop cardiology handoffs—new revenue, same scan. |

| Oct 3 | Philips–Getinge peri‑op co‑sell bundle | Platform channeling shortens peri‑op sales cycles; signals integrated routes to enterprise deals. |

| Oct 2 | Hologic Panther Fusion GI multiplex assays (FDA + CE) | Menu expansion + stewardship; labs gain time‑to‑answer on installed platforms. |

| Sep 30 | UroViu UV5000 cordless single‑use endoscope 510(k) | Single‑use/hybrid base for future CADx; faster setup and no reprocessing. |

| Oct 2 | Siemens AG explores stake spin‑off of Healthineers | More float and strategic flexibility; watch software M&A & R&D velocity. |

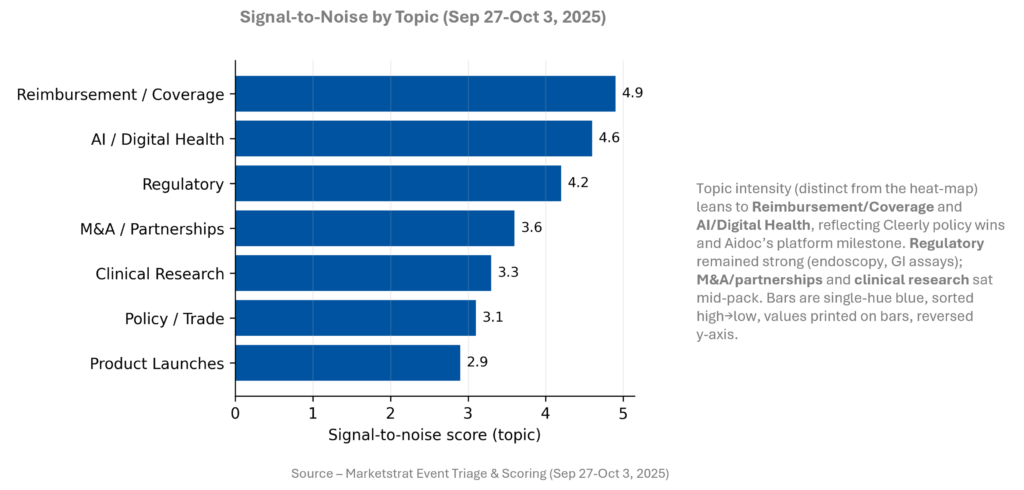

Signal-to-Noise by Topic – Sep 27-Oct 3, 2025

Signal Pulse Heatmap – Sep 20-26, 2025

This week’s signal concentrated in reimbursement, platform AI, and workflow ROI. Commercial coverage for AI‑QCT makes CCTA‑first chest‑pain pathways funded. Aidoc’s Breakthrough validates multi‑triage CT as an ER‑wide operating layer. Provider action (RP’s BAC program) shows how opportunistic prevention monetizes “free signals.” Regulatory breadth (Hologic, UroViu) and a Philips–Getinge channel bundle round out adoption enablers, while Siemens’ stake move reframes capital strategy. Net: pilots are becoming paid, integrated deployments.

Regulatory Pulse

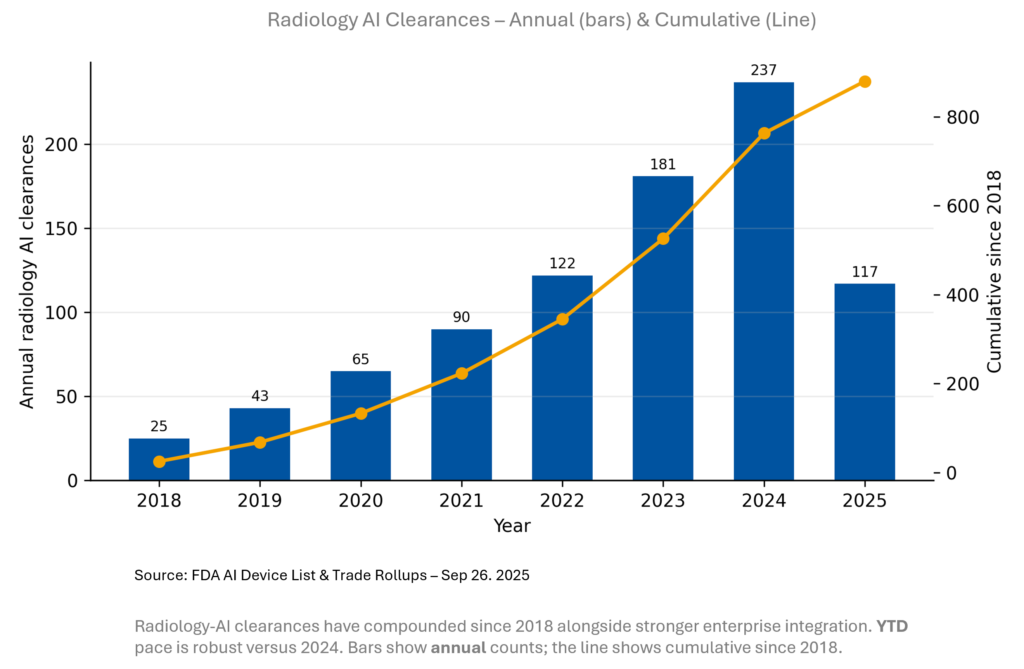

Clearances are migrating from single‑finding point tools to bundled platforms (multi‑triage, QA, reporting). Expect more PCCP‑enabled updates and pragmatic‑trial‑linked indications in 2026. Programs aligned to staffing bottlenecks (ER, breast, chest) retain priority. Keep docs ready for QMSR (Feb 2026) and EU AI Act to avoid 2026–27 access cliffs—treat them as MDR‑redux in your risk plan.

Deeper Dives

Regulatory

Endoscopy and diagnostics led. UroViu’s cordless single‑use platform (UV5000) advanced 510(k); Hologic added GI multiplex assays (FDA + CE). Olympus detailed GI CAD/AI with cloud‑delivered OLYSENSE under MDR. These widen the single‑use/hybrid base on which CADx can layer, lowering activation energy for AI in GI/urology without big‑ticket capital.

Funding / M&A / Alliances

QT Imaging raised $18M (PIPE) to extend cloud roll‑out; Full‑Life secured $77M for radiopharm capacity; Mirion issued $375M 0.00% converts. On channels, Philips–Getinge formed a peri‑op bundle; DMS and Positron expanded distribution via US partners—routes that compress sales cycles vs. greenfield.

Digital Health / AI

Aidoc’s Breakthrough cements the platform thesis; Subtle’s 600+ US installs and 2.5× US growth show throughput economics; RSNA/ACR/SIIM/AAPM issued a role‑based AI syllabus; RSNA Ventures adds society‑backed validation. Governance baselines (security, privacy) are increasingly must‑pass gates for enterprise buys.

Clinical Research

At ASTRO, TORPEdO found no QoL edge for proton vs. modern IMRT in oropharyngeal cancer—tempering indiscriminate proton build‑outs. Early FIH devices (e.g., Relief Cardiovascular “smart” mitral valve) illustrate sensorized therapy. Meta‑analyses on stroke AI remain mixed, underscoring that workflow fit, not AUC alone, drives outcomes.

Innovation Hook

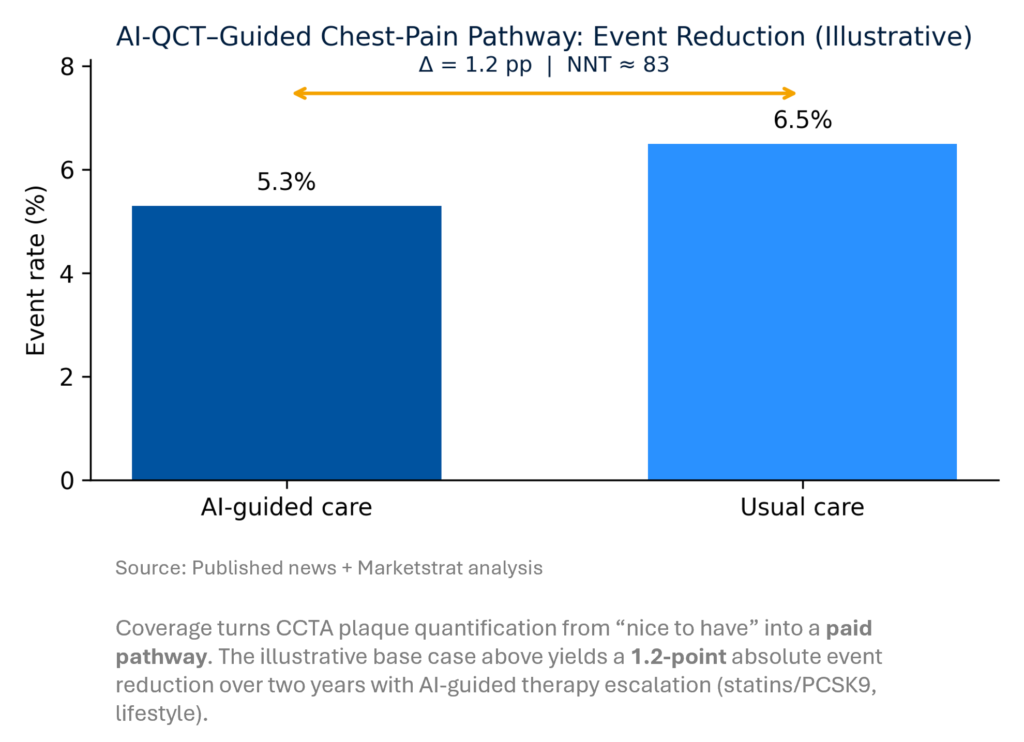

Hook: AI‑QCT (AI‑CPA) in CCTA‑first chest‑pain pathways. With Cigna+UHC national coverage in force, a conservative base case shows 2‑year MACE 6.5% → 5.3% (ARR 1.2pp, NNT ≈ 83) when AI‑guided therapy escalation is applied in intermediate‑risk patients. Tune to local prevalence and therapy mix.

Why now: payers accepted a specific slot (no known CAD; intermediate risk) for AI‑QCT—not blanket “AI on CCTA.” That precision funds the highest‑yield use and protects utilization discipline. Expect CT capacity planning, cardiology‑radiology handoffs, and HEOR that tracks avoided invasive angiography and event reduction. Vendors without coverage‑grade evidence face a widening commercial gap as buyers standardize on reimbursed pathways.

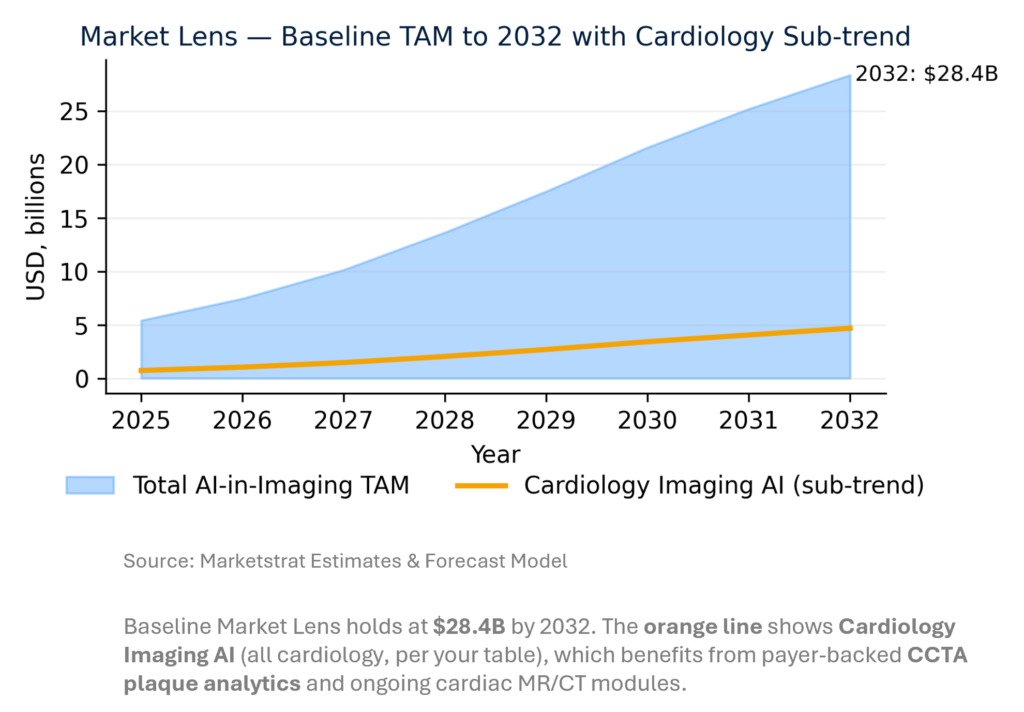

Market Lens – Baseline TAM to $28.4B by 2032 + topical angle (MRI line)

Topical angle (this week): Cardiology Imaging AI is rising as payers fund plaque‑based risk (CCTA) and cardiac modules spread across MR/CT workflows. We plot the baseline TAM with a Cardiology sub‑trend line to show the shift.

Budgets are migrating from departmental pilots to enterprise buys. Coverage for AI‑QCT tilts chest‑pain pathways toward CCTA‑first, while cardiac MR mapping and workflow accelerators expand cardiology AI usage. OEM/platform bundles (workflow + models) are shifting spend from ad‑hoc licenses to systems contracts. Expect Cardiology Imaging AI’s share to climb as HEOR ties event avoidance and throughput gains to service‑line growth.

Marketstrat POV — Strategy to-dos

- Own the covered pathway. Bundle CCTA workflow (AI‑QCT + orchestration + referral templates), then publish HEOR within 90 days; coverage is a moat only if you exploit it.

- Platform + literacy = scale. Pair multi‑triage/QA platforms with role‑based AI training to reduce change‑management drag and hit RFP criteria.

- Pre‑empt the clocks. Treat QMSR (Feb 2026) and EU AI Act like MDR‑redux; start documentation and Notified Body queueing now to avoid 2026–27 access cliffs.

About Marketstrat

Marketstrat™ is a market intelligence and GTM enablement firm committed to empowering clients in data-driven industries. Under the Markintel™ brand, it delivers robust market intelligence, while GrowthEngine™ solutions offer specialized GTM advisory and app-based tools—together fueling growth, innovation, and competitive advantage. For more information, visit www.marketstrat.com.

Marketstrat® is a registered trademark and Markintel™ is a pending trademark of Marketstrat.

Check out free Research and Insights and Analysis of Industry Events

Check out our collection of Markintel Horizon and Markintel Pulse research.

Check out details on our reports, World Market for AI in Medical Imaging and other Pulse Reports in the Imaging space.