One Big Thing

GE HealthCare doubled down on MRI—pairing an AI-enhanced low-field MRI collaboration (GEHC × University of Sheffield × UKRI) with a deal to acquire icometrix—turning neurologic safety monitoring and access-first MRI into a combined moat.

Key Takeaways

- Neuro-AI consolidation. GE HealthCare agreed to buy icometrix (icobrain/ARIA) to embed automated ARIA detection into MRI workflows as Alzheimer’s therapies scale. Expect software-led pull-through on MRI contracts.

- MRI access play. A GEHC–University of Sheffield–UKRI program targets AI-reconstructed low-field MRI, decoupling image quality from magnet cost and helium—and unlocking point-of-care lung/neuro use cases.

- Cardiac imaging upgrade. Tempus Pixel won FDA clearance for inline T1/T2 cardiac MRI mapping, shifting tissue characterization into the scan—faster reads, standardized metrics.

- Signals beyond MRI. Esaote US systems cleared (value US/POCUS), Masimo–Philips monitoring pact expanded, and iRhythm launched Zio in Japan—evidence of practical AI/connected care adoption.

Quick‑Glance Table

| Date | Headline | Our Take |

| Sep 11 | GE HealthCare to acquire icometrix (brain MRI AI) | ARIA monitoring is mandatory in anti-amyloid care; owning icobrain cements GE’s neurology stack and recurring software revenue. |

| Sep 11 | Tempus Pixel inline T1/T2 mapping cleared | Quant maps as part of the sequence = faster, standardized cardiac MRI; raises bar for MRI software value. |

| Sep 10 | Masimo × Philips expand monitoring alliance | “Best-of-breed” sensors + enterprise platforms; foreshadows AI-triaged monitoring at scale. |

| Sep 9 | GEHC–Sheffield–UKRI low-field MRI collaboration | AI recon + xenon lung MRI at low field can democratize MRI and cut helium/room costs. |

| Sep 8 | Esaote MyLab A50/A70 win FDA | Value/portable ultrasound with AI guidance pressures legacy mid-tier boxes. |

| Sep 2025 | iRhythm Zio launches in Japan | 14-day AI ECG in an aging market; reimbursement watch next. |

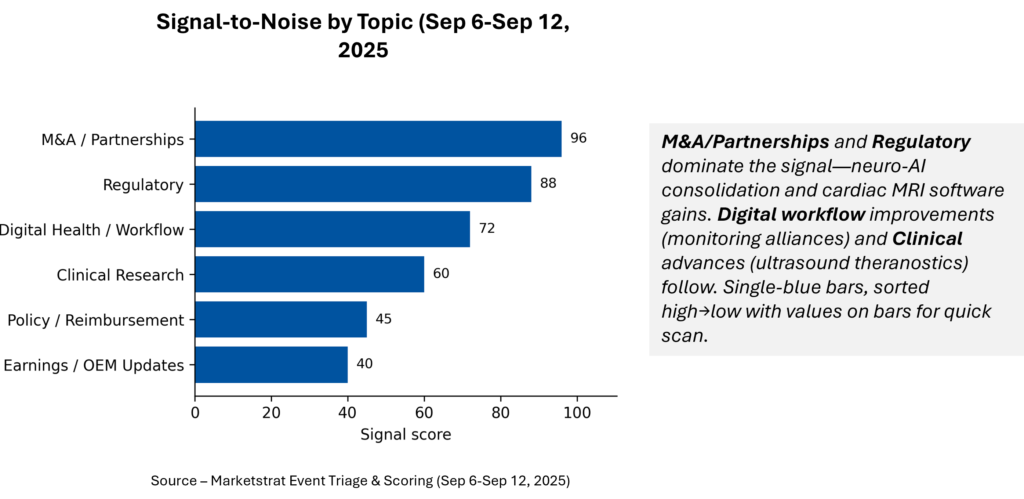

Signal-to-Noise by Topic – Sep 6-Sep 12, 2025

M&A/Partnerships lead—neuro-AI consolidation and monitoring alliances—followed by Regulatory momentum (cardiac MRI software, ultrasound). Digital workflow advances connect sensors to platforms; Clinical work hints at ultrasound-as-therapy enhancers. Sorted bars, single blue, values on bars.

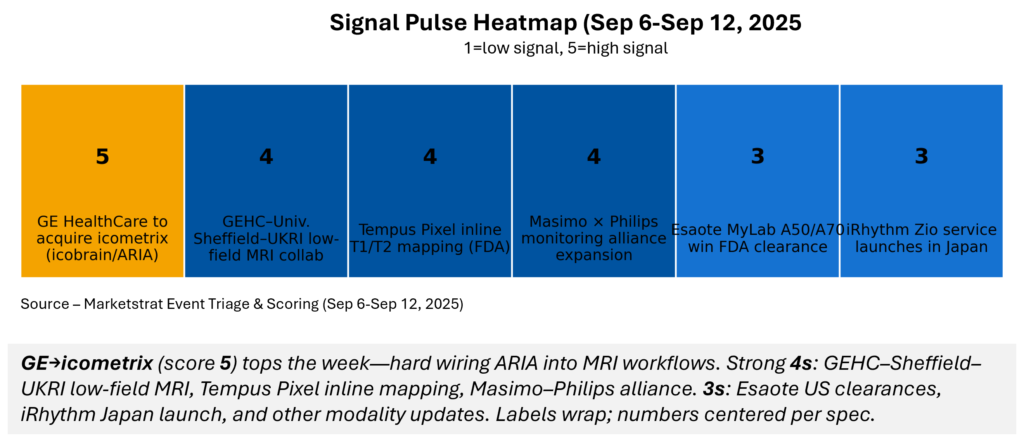

Signal Pulse Heatmap – Sep 6-Sep 12, 2025

GE→icometrix (5/5) reframes neuro MRI as ARIA-ready in the Alzheimer’s era. 4s (low-field access, Tempus inline mapping, Masimo–Philips) push software-led throughput and safety. 3s reflect value devices and new geographies (Esaote U.S.; iRhythm Japan).

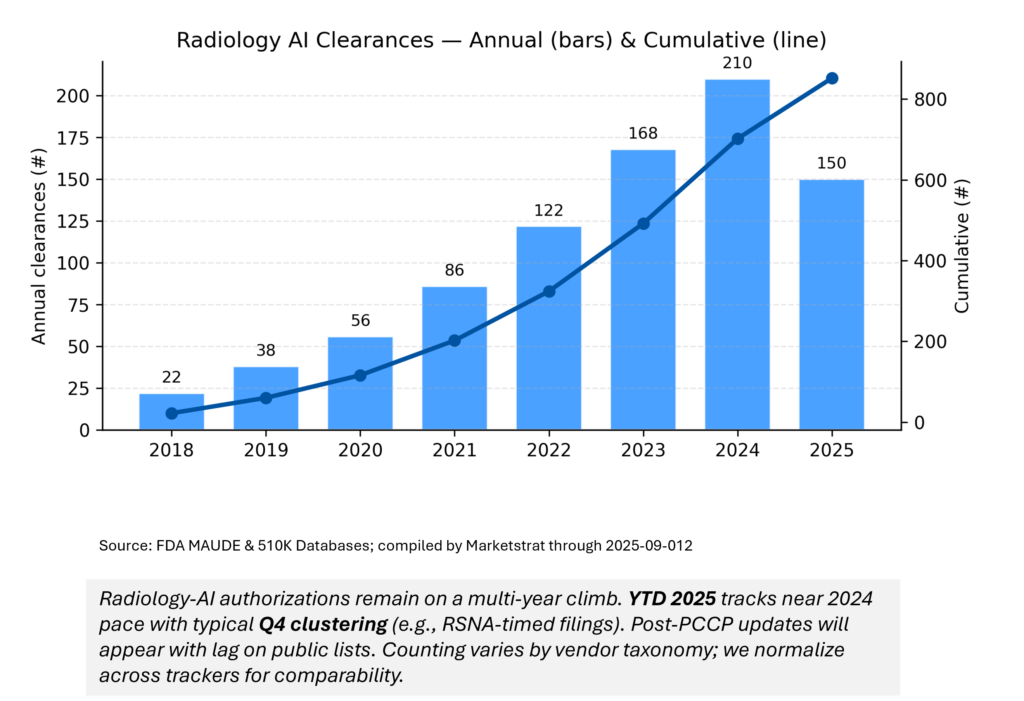

Regulatory Pulse

YTD trajectories remain strong with Q4 surges typical around RSNA. Expect a lag between submission and public listing—especially for PCCP-scoped updates—and variability in vendor taxonomy we normalize in our trackers.

Deeper Dives

Regulatory

- Tempus Pixel (cardiac MRI) clearance pushes tissue characterization inline—expect copycat moves from MRI software stacks; hospitals gain time and standardization.

- Esaote MyLab A50/A70 clearance broadens AI-enabled ultrasound at lower TCO; POCUS and cardiology/liver features target throughput and access.

Funding / M&A / Partnerships

- GEHC → icometrix (icobrain/ARIA): a pick-and-shovel play on Alzheimer’s therapies; bakes ARIA surveillance into MRI. Expect OEMs to race for neuro-AI assets.

- Masimo × Philips: deeper sensor-to-platform integration points to AI-triaged alarms and fewer monitoring gaps—pressure on rivals to match ecosystem breadth.

Digital Health / AI Ops

- Low-field MRI access thesis (GEHC–Sheffield–UKRI): AI recon + helium-light hardware lowers TCO and expands lung/ED/community MRI. A field-strength arms race gives way to software quality.

- iRhythm Zio in Japan: regulatory entry precedes reimbursement; aligns with aging population and AF detection yield.

Clinical Research

- Microbubble ultrasound in liver oncology showed large response gains as a radiotherapy adjunct—early but promising “theranostic” crossover for ultrasound.

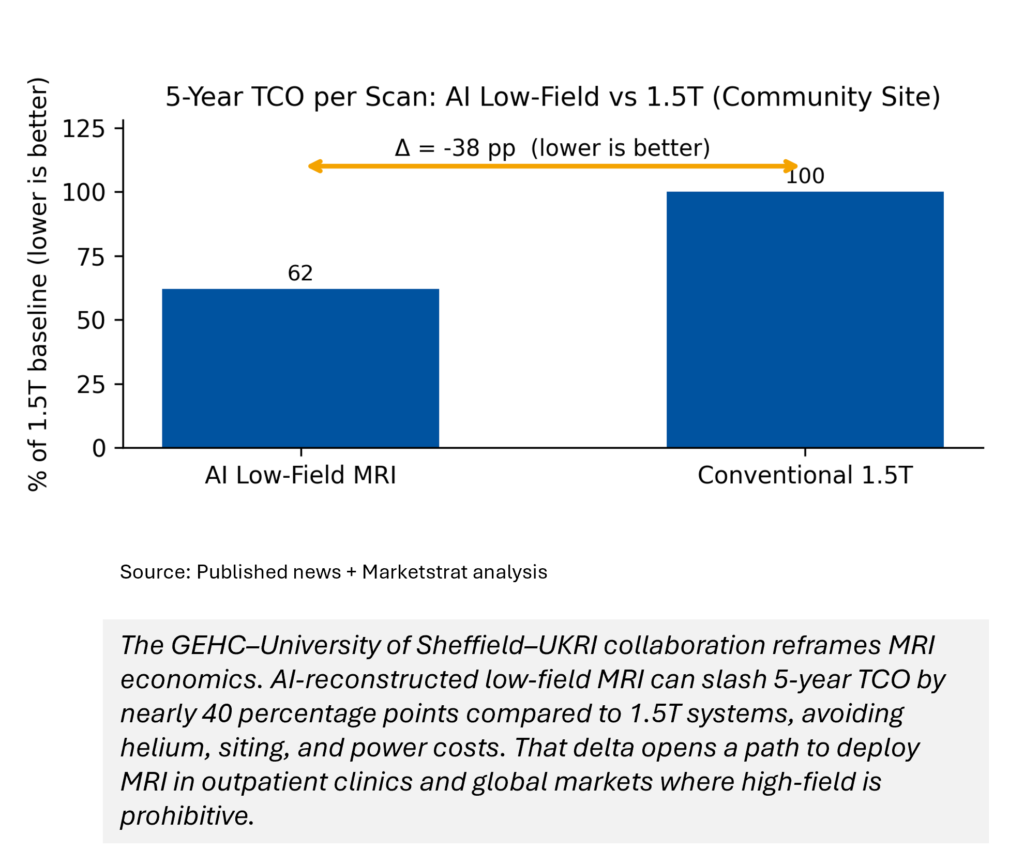

Innovation Hook — AI-Low-Field MRI vs 1.5T: 5-Year TCO Delta

The GEHC–University of Sheffield–UKRI collaboration reframes MRI economics: AI-reconstructed low-field systems can cut 5-year total cost of ownership by avoiding helium, easing siting, and lowering power/maintenance—expanding access points. Modeled head-to-head vs. a community 1.5T suite, our base case shows a –38 pp TCO reduction per scan; scale drives further gains.

Why it matters: MRI access is constrained by capital, helium, and footprint requirements. The Sheffield–GEHC program shows how AI software can decouple image quality from magnet strength, lowering ownership costs and enabling new respiratory and neuro applications at the point of care. This could expand MRI penetration into settings historically limited to CT or ultrasound.

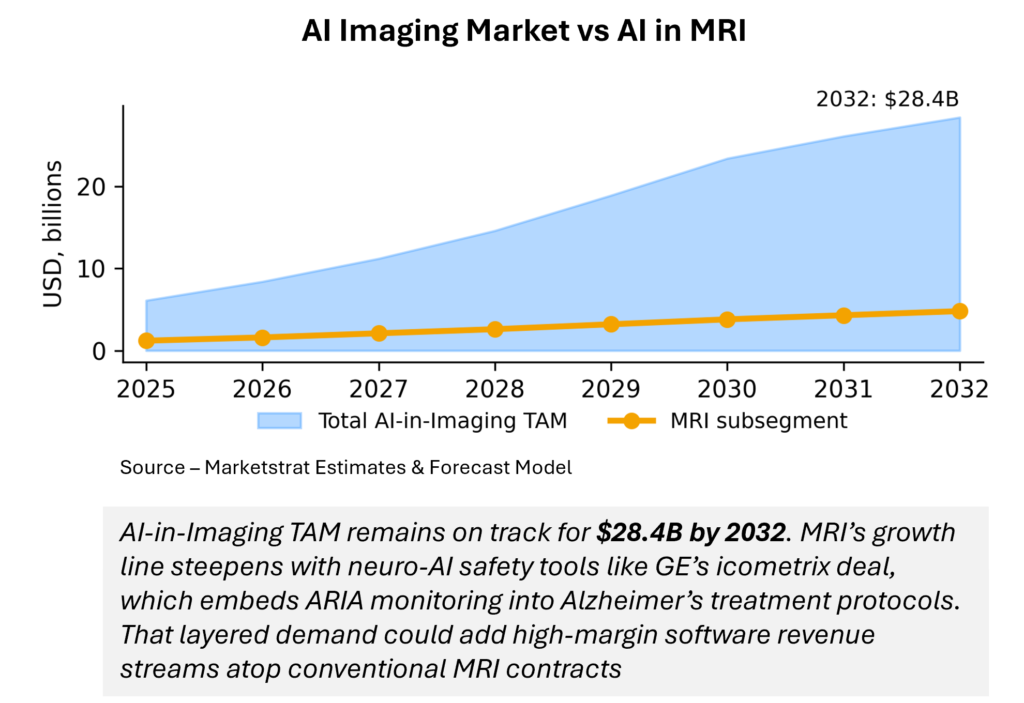

Market Lens – AI Imaging and MRI Segment

This week’s market angle: the Alzheimer’s drug wave is creating an “ARIA monitoring market” that sits squarely in MRI’s domain. By bundling icometrix into its MRI stack, GE captures recurring revenues tied to therapy protocols, not just capital sales. TAM projections stay intact, but neurology AI monitoring could be an upside lever if payer coverage follows

Special Callout (MRI focus)

- Collab: GEHC–Sheffield–UKRI targets AI-low-field MRI + xenon lung imaging to expand access and slash helium/site constraints.

- M&A: icometrix adds ARIA surveillance to GE’s MRI stack, aligning with Alzheimer’s therapy monitoring protocols.

Marketstrat POV — Strategy

- Own the workflow, not just the magnet. Low-field MRI + AI recon shifts value to software and service SLAs; evaluate total-cost playbooks, not field-strength one-ups.

- Bundle neurology for Alzheimer’s era. MRI + ARIA AI + reporting pipelines will win memory-clinic RFPs; GE→icometrix sets the bar.

- Operationalize evidence. Inline cardiac maps (Tempus) reduce friction; negotiate telemetry + PCCP terms to keep updates flowing.

About Marketstrat

Marketstrat™ is a market intelligence and GTM enablement firm committed to empowering clients in data-driven industries. Under the Markintel™ brand, it delivers robust market intelligence, while GrowthEngine™ solutions offer specialized GTM advisory and app-based tools—together fueling growth, innovation, and competitive advantage. For more information, visit www.marketstrat.com.

Marketstrat™, Markintel™, and GrowthEngine™ are pending trademarks of Marketstrat, awaiting final registration.

Check out free Research and Insights and Analysis of Industry Events

Check out our collection of Markintel Horizon and Markintel Pulse research.

Check out details on our reports, World Market for AI in Medical Imaging and other Pulse Reports in the Imaging space.