One Big Thing

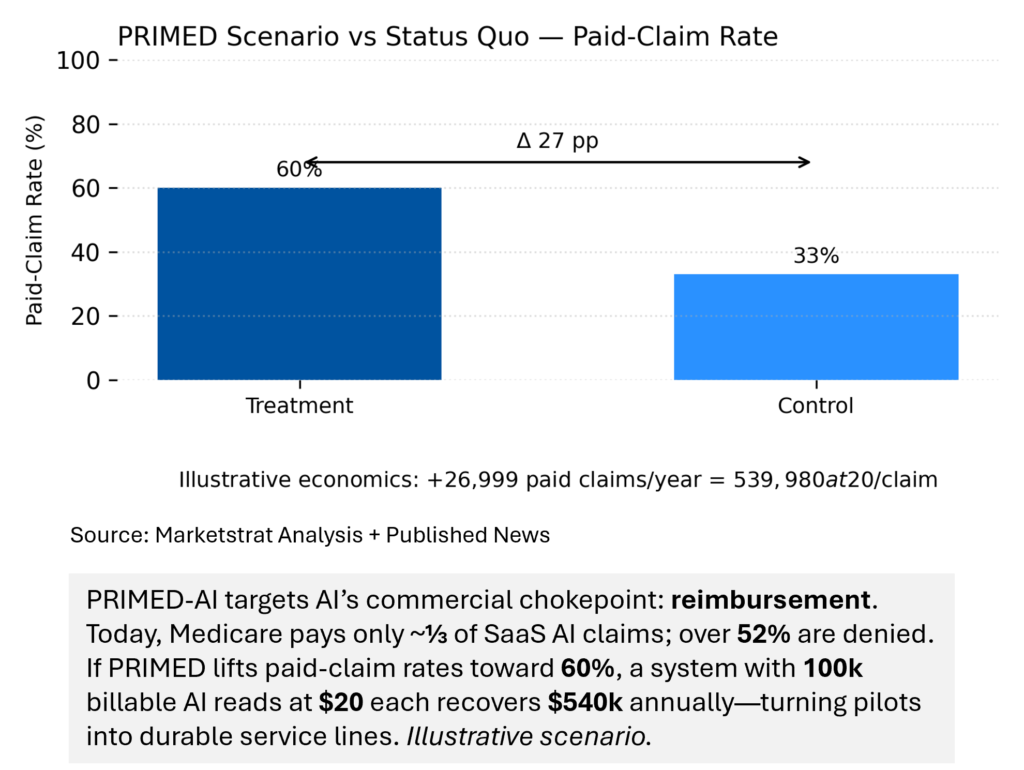

NIH’s PRIMED‑AI puts federal weight behind paying for imaging AI by standardizing validation and reimbursement—moving AI from pilots to paid workflows.

Key Takeaways

- Reimbursement clarity is the unlock. PRIMED‑AI targets AI’s biggest barrier—payment—via validation centers, playbooks, and benchmarks tied to outcomes. Expect faster payer coverage decisions and enterprise adoption.

- Platforms > point tools. Strategic tie‑ups (e.g., Cook–Siemens iMRI, Proscia–AWS) and surgical software upgrades (da Vinci 5) show incumbents deepening moats with integrated ecosystems.

- Regulatory momentum expands access. FDA green lights—from Intuitive (software), to Mevion (compact proton therapy), to J&J’s INLEXZO—open new care pathways and community‑site adoption.

- Capital concentrates in AI. Fewer deals, larger checks, and OEM buy‑versus‑build moves (e.g., B. Braun–TDS) underscore the market’s shift to defensible, data‑rich platforms.

Quick‑Glance Table

| Date | Headline | Our Take |

| Sep 13–19 | NIH PRIMED‑AI: multi‑track grants to unify imaging AI validation & tie payment to outcomes | Reimbursement playbook + validation centers = line of sight to coverage; expect hospital CFOs to green‑light platform rollouts where ROI is demonstrable. |

| Sep 17 | Cook Medical + Siemens Healthineers to co‑develop interventional MRI (iMRI) suite | Radiation‑free guidance could reset device requirements (MRI‑safe/visible), creating a semi‑closed hardware + consumables ecosystem. |

| Sep 15 | Intuitive da Vinci 5 gets FDA‑cleared software (force gauge, in‑console replay, remote enables) | Builds a data/UX moat around surgeons’ cognitive workflow—harder for challengers to displace. |

| Sep 16 | Mevion S250‑FIT compact proton therapy system 510(k) | Vault‑fit form factor democratizes proton therapy—expect community‑site adoption and volume lift. |

| Sep 16 | Proscia–AWS integrate Concentriq® with AWS HealthImaging (DICOM‑native pathology) | The “plumbing” for multimodal AI—pathology joins radiology in a unified, cloud‑scale data plane. |

| Sep 18 | House panel advances 4‑year Medicare coverage for Breakthrough Devices | Faster coverage narrows the FDA‑to‑payment gap; diagnostics inclusion remains a watch‑item. |

| Sep 15 | B. Braun acquires True Digital Surgery | Vertical control over digital microscopy accelerates OR platformization vs. Zeiss/Olympus. |

| Sep 19 | Medtronic Altaviva tibial nerve stim implant approved | Expands neuromodulation into urge incontinence with MRI‑safe, fast‑recharge profile. |

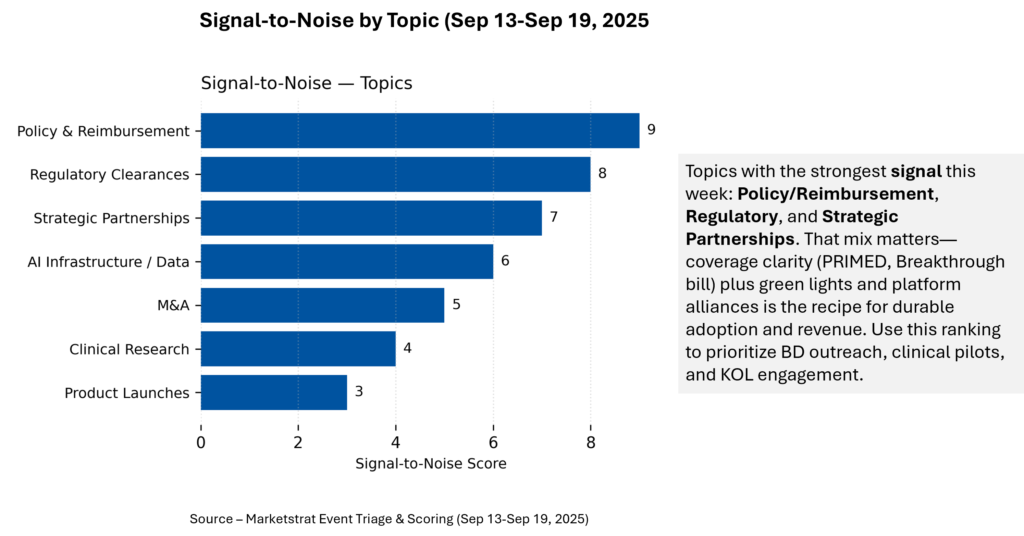

Signal-to-Noise by Topic – Sep 13-Sep 19, 2025

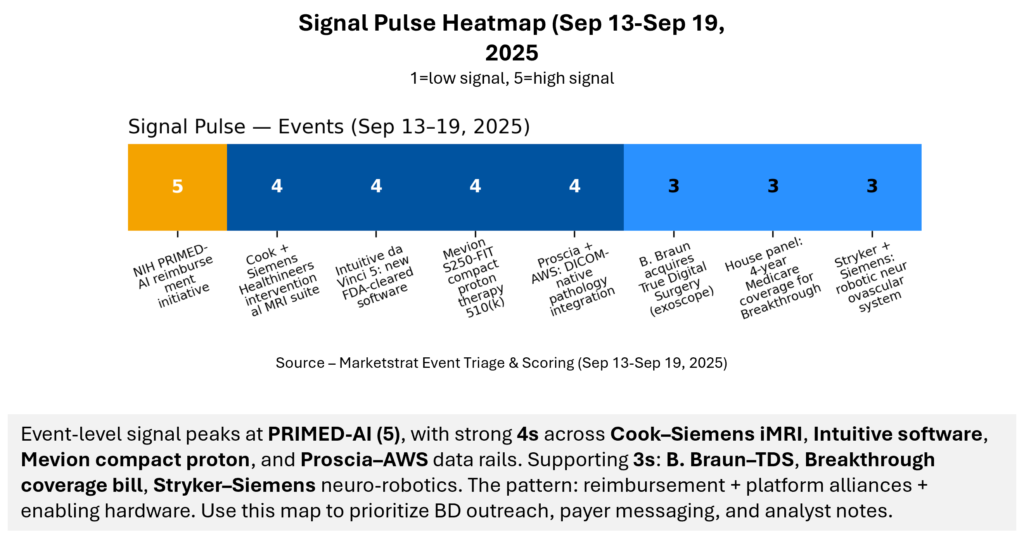

Signal Pulse Heatmap – Sep 13-Sep 19, 2025

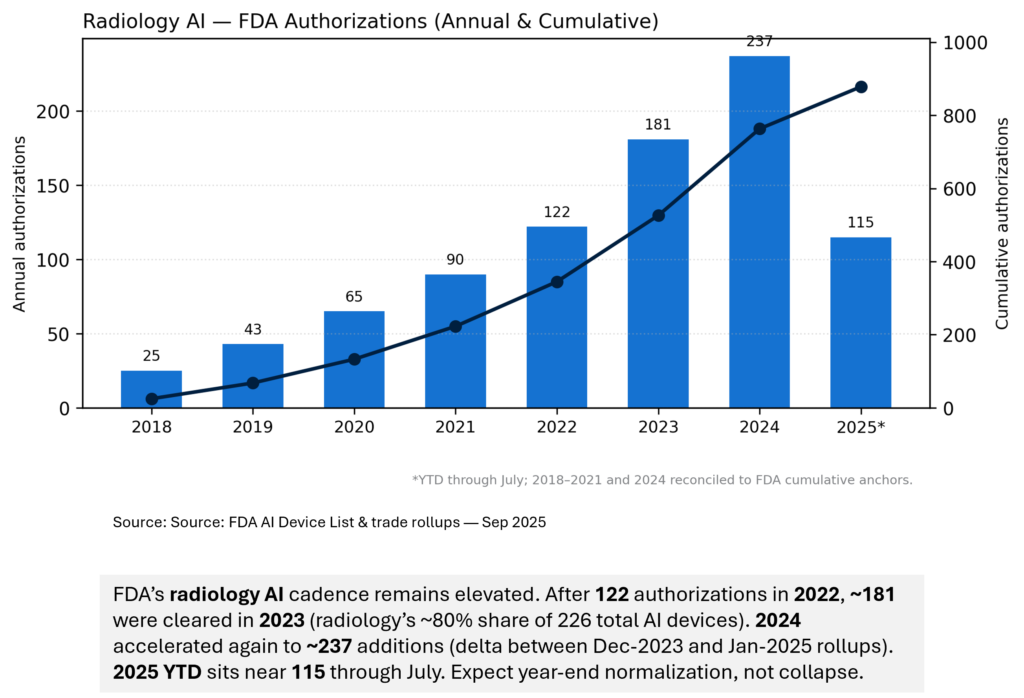

Regulatory Pulse

Signals remain constructive. Radiology still commands the majority of AI device authorizations. 2024’s step‑up looks like a batch‑update effect and maturing pipelines more than a one‑off spike. 2025 is tracking softer than 2024’s peak but comfortably above pre‑2022 levels. The more important story: reimbursement clarity (PRIMED‑AI) is arriving just as productization and platform consolidation improve deployment economics.

Deeper Dives

Regulatory

- Intuitive: FDA‑cleared da Vinci 5 software (force gauge, replay, remote enablement) deepens the cognitive/UX moat.

- Mevion: compact proton system vault‑fits—lowers capex/time to service line; watch community hospital uptake.

- J&J INLEXZO: first intravesical drug‑releasing system with 82% CR in SunRISe‑1; oncology care pathway expands.

Clearances this week tilt toward platform leverage—software that compounds installed‑base value (Intuitive) and hardware that unlocks new sites of care (Mevion). Oncology pathway updates (INLEXZO) reinforce the shift from episodic imaging to longitudinal programs. For imaging AI, these moves increase total scan volumes and create mandatory read workflows (e.g., therapy monitoring), strengthening attach rates for reimbursable AI.

Funding / M&A / Partnerships

- Cook–Siemens iMRI: radiation‑free guidance could force MRI‑compatible device portfolios; razors+blades ecosystem.

- B. Braun–TDS: vertical integration to secure visualization IP for digital surgery platforms.

- Stryker–Siemens (neurovascular robotics): standardization and speed for stroke/aneurysm interventions.

Partnerships now re‑architect care venues. iMRI threatens X‑ray‑centric interventional suites; neurovascular robotics standardizes high‑skill procedures. The strategic pattern: own the operating system (imaging + navigation + instruments) and monetize consumables + data. Expect near‑term M&A in MRI‑safe devices and navigation software as OEMs race to fill capability gaps.

Digital Health / AI Infrastructure

- Proscia–AWS: DICOM‑native, petabyte‑scale pathology unifies data for multimodal AI with radiology. Sub‑second retrieval unlocks real‑time workflows.

- Foundation models: OEMs and pure‑plays pivot from single‑task to platform economics; hospitals want fewer vendors, deeper integration.

Data plumbing is strategy. Standardized, cloud‑scale imaging (radiology + pathology) creates an AI‑ready substrate for validation and deployment—exactly the fabric PRIMED will reward. Vendors that are DICOM‑first, cloud‑native, and enterprise‑integrated will out‑execute point tools. Hospitals should rationalize AI portfolios into platform marketplaces with centralized governance.

Clinical Research

- Lung screening AI: 40% false‑positive reduction with no missed cancers in external validation—a meaningful patient and cost win.

- Who reads matters: Non‑radiologist reads linked to 2–3× higher 90‑day repeat imaging—evidence for expert interpretation and AI decision support.

Two signals converge: AI improves specificity in population screening, and specialist reads reduce waste. Expect PRIMED to prioritize such measurable deltas (avoided follow‑ups, reduced repeats) as billable value. Pair radiologist‑led reading models with triage/risk AI to compress unnecessary imaging and accelerate definitive care.

Innovation Hook — AI-Low-Field MRI vs 1.5T: 5-Year TCO Delta

NIH’s design—validation centers, logistics hub, and reproducibility playbooks—creates payer‑grade evidence and a consistent path from performance to payment. Expect early waves in stroke triage, oncology pathways, and workflow automation where outcomes (time‑to‑treatment, avoided repeats) are quantifiable. For vendors, “reimbursement‑ready by design” becomes table stakes; for providers, enterprise adoption shifts from grants to cash‑flow positive operations. The winners will price against outcomes and plug into PRIMED’s evidence rails.

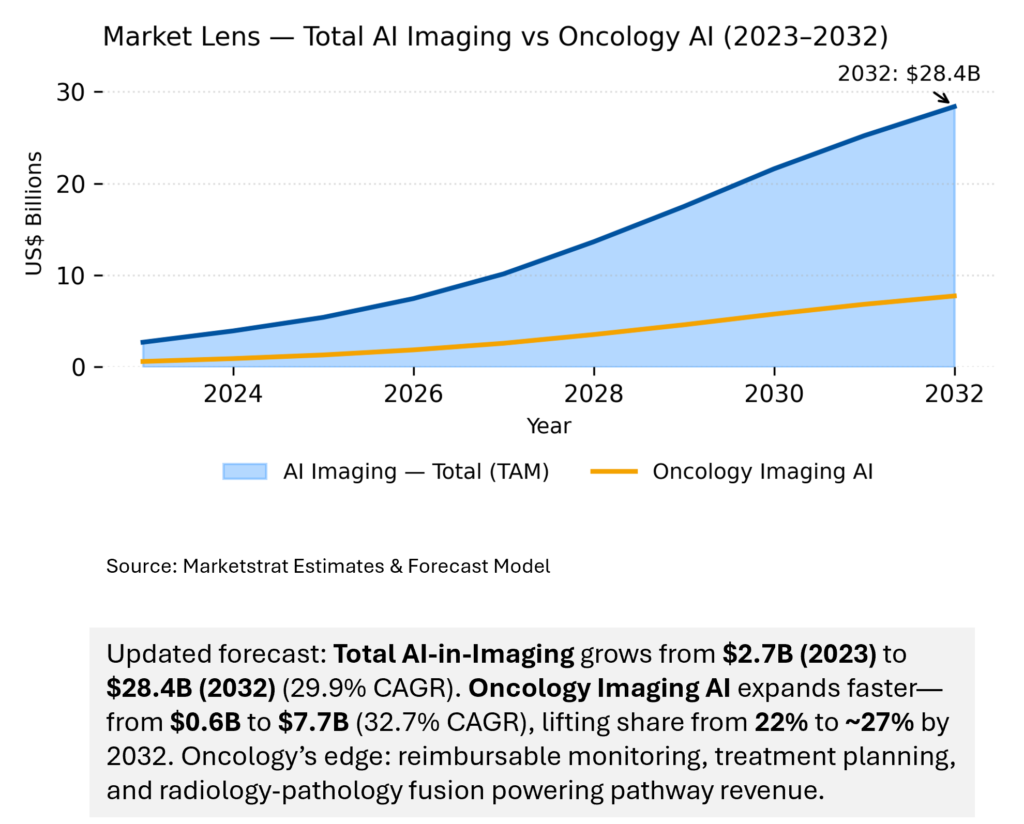

Market Lens – AI Imaging and MRI Segment

Oncology outpaces the total market with 32.7% CAGR, raising its share +4.9 pp (22.4% → 27.3%, 2023–2032). The driver is pathway monetization: mandatory therapy monitoring (e.g., ARIA MRI), longitudinal treatment planning, and multimodal fusion with pathology. As PRIMED‑AI standardizes payer‑grade evidence and accelerates reimbursement decisions, oncology modules become the first scaled winners. Expect oncology service lines to anchor enterprise AI contracts and command premium attach rates.

Marketstrat POV — Strategy

- Design for payment, not pilots. Align trials to PRIMED endpoints; package pricing to outcomes (turnaround time, avoided repeats, NNT‑like proxies).

- Own the rails. Standardize on DICOM‑native, cloud‑ready infrastructure (radiology + pathology) to speed validation and deployment across sites.

- Build pathway moats. Prioritize oncology and interventional suites where workflows are recurring and reimbursable (ARIA monitoring, iMRI‑guided procedures).

About Marketstrat

Marketstrat™ is a market intelligence and GTM enablement firm committed to empowering clients in data-driven industries. Under the Markintel™ brand, it delivers robust market intelligence, while GrowthEngine™ solutions offer specialized GTM advisory and app-based tools—together fueling growth, innovation, and competitive advantage. For more information, visit www.marketstrat.com.

Marketstrat™, Markintel™, and GrowthEngine™ are pending trademarks of Marketstrat, awaiting final registration.

Check out free Research and Insights and Analysis of Industry Events

Check out our collection of Markintel Horizon and Markintel Pulse research.

Check out details on our reports, World Market for AI in Medical Imaging and other Pulse Reports in the Imaging space.