One Big Thing

Payer alignment + fresh FDA wins moved coronary plaque AI from “interesting add‑on” to reimbursable workflow, while OEMs doubled down on platform plays—shifting imaging AI from single models to end‑to‑end pathways.

Key Takeaways

- Cardiac AI crosses the chasm. HeartFlow’s next‑gen plaque analysis cleared 510(k) as Cigna added coverage; Cleerly also secured nationwide Cigna coverage—cementing CCTA‑first pathways and accelerating adoption ahead of 2026 Category I CPT.

- Platform > point solution. GE’s icometrix deal, Philips’ RT simulators (with AI auto‑seg options) and RamSoft‑Koios cloud embedding underline a workflow‑native GTM.

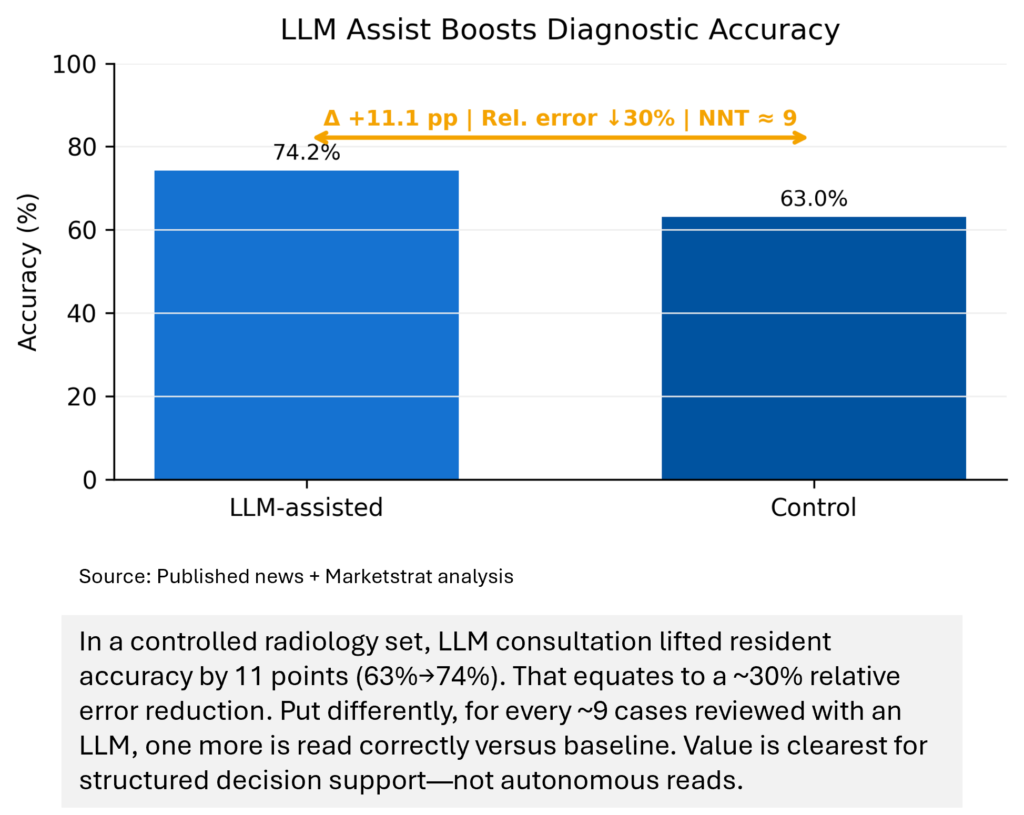

- Evidence engine revs. A PCORI‑funded PRISM mammography RCT launches; real‑world workflow data show ~25% faster CXR reading with AI; LLMs lifted resident accuracy by 11 p.p. in a radiology set.

- Policy watch. UK stood up a national AI health commission (rulebook due 2026); U.S. 232 import probe adds supply‑chain risk to imaging hardware into 2026.

Quick‑Glance Table

| Date | Headline | Our Take |

| Sep 22 | HeartFlow wins 510(k) for next‑gen Plaque Analysis | Product step‑up + payer coverage → rapid scale in CCTA workflows. |

| Sep 24 | Cigna adds nationwide coverage for Cleerly AI‑QCT/AI‑CPA | Coverage now broad across major payers—de‑risks hospital uptake. |

| Sep 24 | Cigna covers HeartFlow Plaque Analysis (Oct 1 start) | Puts plaque quant on rails ahead of 2026 CAT‑I codes. |

| Sep 22 | Tempus Pixel 510(k): inline T1/T2 CMR mapping | Quant CMR on installed base—standardizes myocarditis/cardiomyopathy assessment. |

| Sep 24–25 | Lantheus ↔ GE: exclusive PYLARIFY license (Japan) | Strengthens end‑to‑end prostate imaging; radiopharma distribution leverage. |

| Sep 23–25 | RamSoft + Koios: ultrasound CADx native in cloud RIS/PACS | Evidence + reimbursement + zero‑friction delivery = community‑site flywheel. |

| Sep 23 | PRISM RCT (mammography) launches (PCORI) | Pragmatic evidence for payers on recall, cancer detection, trust. |

| Sep 26 | UK launches national AI Health Commission | Signals streamlined rulebook & at‑scale RWE; watch 2026. |

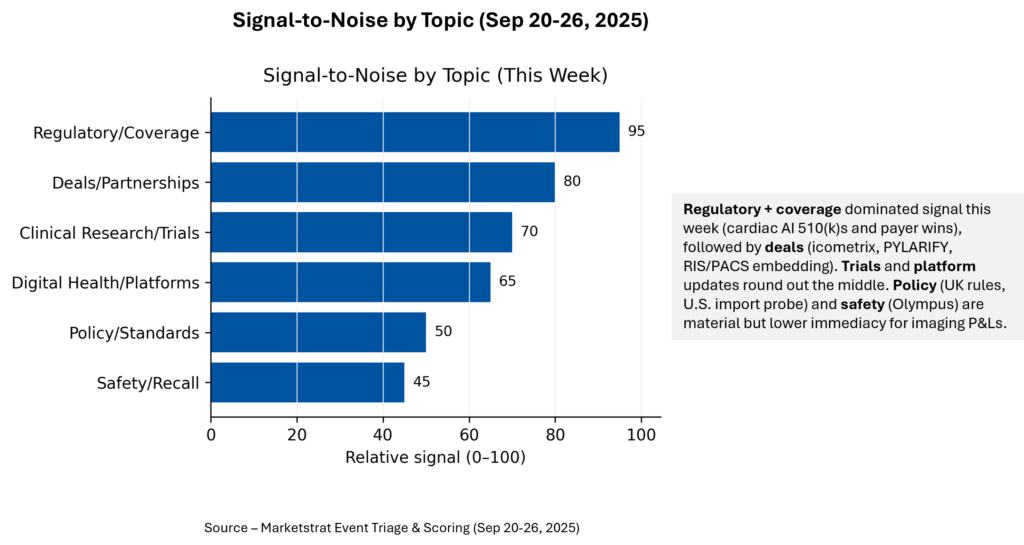

Signal-to-Noise by Topic – Sep 20-26, 2025

We score topic‑level signal by expected near‑term adoption and revenue impact. Payer alignment and new clearances directly change utilization and billing—hence the top rank. Deal flow matters where it controls the pathway (neuro‑MRI, prostate PET, ultrasound CADx delivery). Policy and safety color risk and operations but show slower revenue translation for imaging service lines absent immediate code or access changes.

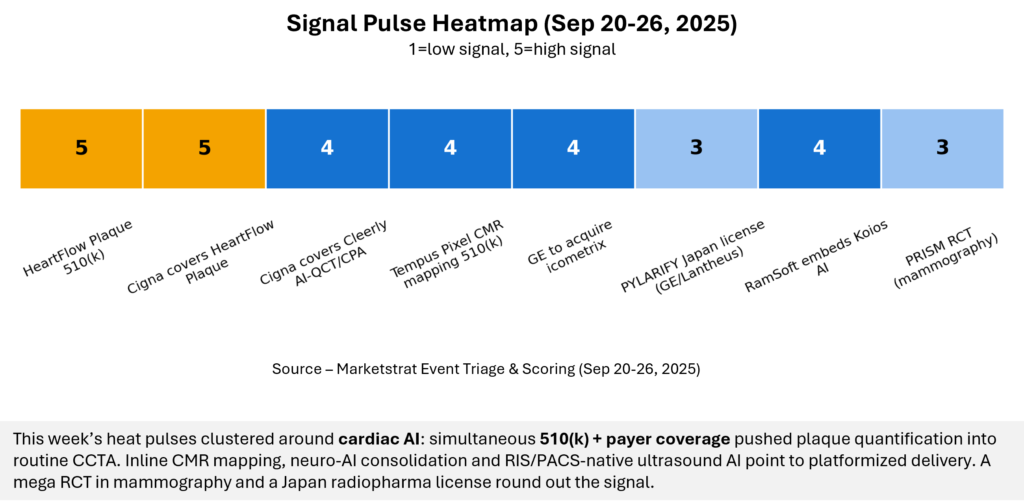

Signal Pulse Heatmap – Sep 20-26, 2025

When regulatory + reimbursement hit in the same week, adoption curves bend. The strongest signals came from CCTA plaque quant and inline CMR mapping—both lower friction and raise standardization. Platform integration (cloud RIS/PACS, OEM RT suites) continues to win over standalone deployments. Expect near‑term buys to favor embedded, reimbursable modules that compress time‑to‑value and clear credentialing/compliance hurdles.

Regulatory Pulse

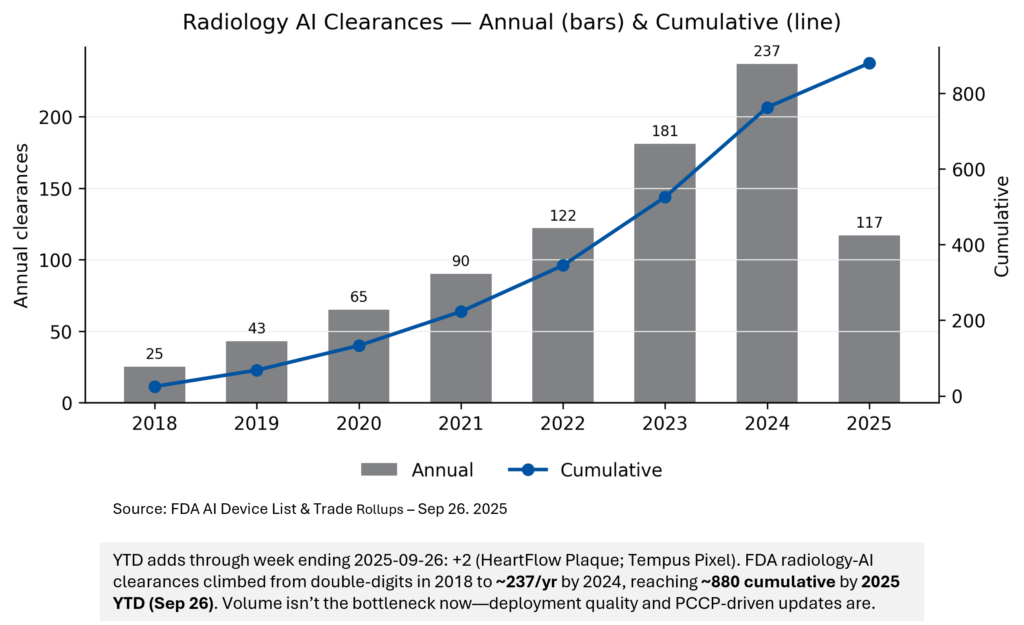

Volume is no longer the constraint; deployment quality is. Hospitals that standardize provenance, monitoring, and rollback (aligned to PCCPs) can treat model updates like routine releases. Pair device UDIs with ADT/chargemaster data to create regulatory‑grade RWE for renewals and payer HEOR. That’s how clearances convert into durable, reimbursable service lines.

Deeper Dives

Regulatory

What happened: The FDA cleared HeartFlow Plaque Analysis (next gen) and Tempus Pixel for inline cardiac MR mapping; TechsoMed expanded its ablation platform to the kidney; simultaneously, Cigna granted national coverage for HeartFlow and Cleerly plaque AI starting Oct 1. The UK established a National Commission to shape a 2026 AI rulebook with large‑scale NHS RWE.

Why it matters: Cardiac imaging AI is becoming standard‑of‑care in CCTA, with coverage + coding momentum lowering hospital friction; Pixel lifts quant CMR access across the installed base; UK reforms may compress approval‑to‑deployment timelines by leaning into shared evidence.

Funding / M&A / Partnerships

Key moves: GE HealthCare → icometrix (neuro‑MRI AI), GE↔Lantheus exclusive PYLARIFY rights in Japan, RamSoft + Koios ultrasound CADx embedded in cloud RIS/PACS; Philips explored bundling MVision AI in new RT simulators; Microsoft unified its marketplace—important channel shift for ISVs.

So what: OEMs are consolidating pathways (neuro, prostate, RT); cloud marketplaces shorten procurement by tapping pre‑committed cloud spend; embedding CADx at the RIS/PACS layer wins in community settings that lack IT lift.

Digital Health / AI

Themes: Vendor‑neutral RT orchestration (analytics, auto‑seg, theranostics), AI reconstruction improving throughput without new hardware, network‑scale triage, and foundation/LLM tools for broader task coverage; governance anchors include PCCPs and ISO 42001 signaling mature QMS for AI.

Operator playbook: Favor platforms with EMR/OIS/FHIR hooks and VNA‑based AI indexing; treat ROI levers—planning time cuts, faster MR/PET, ultrasound throughput, stroke triage—as budget‑line items, not pilots.

Clinical Research

Signals: PRISM RCT (hundreds of thousands of mammograms) will test AI’s real‑world value; CXR preliminary reports cut reading time from 25.8s → 19.3s with acceptability rising; LLM assist boosted trainee accuracy; ACL MRI meta‑analysis showed strong pooled performance with heterogeneity; LMIC external‑validity gaps persisted (Nigeria CXR AUC drop).

Bottom line: Expect payers to demand operational and outcome KPIs (recalls avoided, time saved) alongside ROC curves; site‑level governance and monitoring are as decisive as model AUC.

Innovation Hook — LLM assist reduces diagnostic errors in radiology trainees

What we quantify: In a 129‑case reader study, residents allowed to consult an LLM (ChatGPT‑4o) improved accuracy from 63.0% → 74.2% (Δ +11.1 p.p.), cutting error rate ~30% (relative). NNT ≈ 9 cases to gain one additional correct diagnosis.

The near‑term LLM play is augmented decision support. Trainee accuracy gains and error reductions translate into measurable QA and training benefits while keeping humans firmly in the loop. Hospitals should pilot LLM‑assisted reads in defined scenarios (e.g., differential narrowing, checklist prompts) with audit trails and bias monitoring. Pair with governance (policy disclosure, data use) to de‑risk while harvesting the productivity dividend.

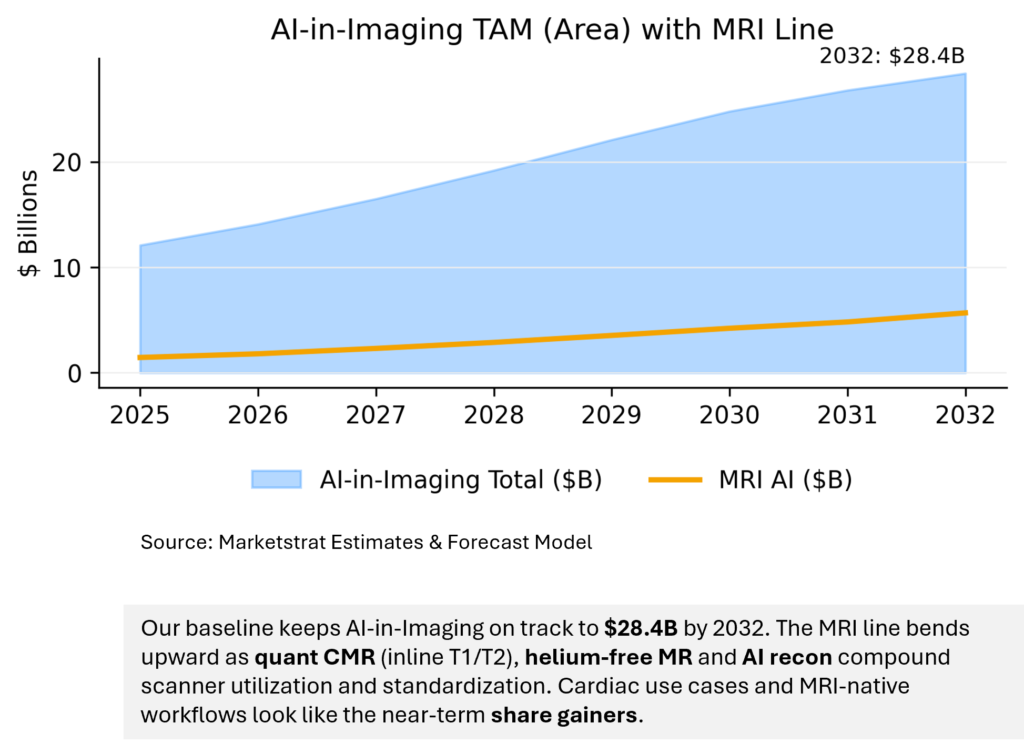

Market Lens – Baseline TAM to $28.4B by 2032 + topical angle (MRI line)

MRI’s share expands as vendors unlock installed‑base capabilities (Pixel mapping; SmartSpeed‑style acceleration) without new hardware. That raises practical TAM: more quant outputs per scan and higher throughput per magnet. Cardiac, neuro and RT simulation anchor the upswing; the rest of the pie grows via marketplace delivery and reimbursable analytics inside core workflows. (See pack’s product and platform sections.

Marketstrat POV — Strategy

- Make coverage your wedge. For CAD service lines, design pathways around CCTA + plaque quant (policy‑aligned order sets, lipid clinics, shared‑savings pilots). The billing friction is falling; capture the throughput and downstream therapy yields now.

- Sell workflows, not widgets. Bias to embedded AI (RIS/PACS, RT suites, EMR/OIS) and measure time‑to‑plan and reads/day, not just AUC. Procure through cloud marketplaces where possible.

- Operationalize governance. Treat PCCPs, ISO 42001, and RWE pipelines as core capabilities; they’re now adoption accelerants as much as performance.

About Marketstrat

Marketstrat™ is a market intelligence and GTM enablement firm committed to empowering clients in data-driven industries. Under the Markintel™ brand, it delivers robust market intelligence, while GrowthEngine™ solutions offer specialized GTM advisory and app-based tools—together fueling growth, innovation, and competitive advantage. For more information, visit www.marketstrat.com.

Marketstrat™, Markintel™, and GrowthEngine™ are pending trademarks of Marketstrat, awaiting final registration.

Check out free Research and Insights and Analysis of Industry Events

Check out our collection of Markintel Horizon and Markintel Pulse research.

Check out details on our reports, World Market for AI in Medical Imaging and other Pulse Reports in the Imaging space.