One Big Thing

Software-first imaging hit an inflection: CT gets functional (CT:VQ), echo automates (ESC launches), and clearer FDA rules (PCCP) compress AI iteration cycles—together reshaping how hospitals buy, use, and get paid for imaging.

Key Takeaways

- Functional CT arrives. FDA cleared 4DMedical’s CT:VQ and CMS confirmed Category III payment—potentially shifting V/Q workups from nuclear medicine to existing CT suites and unlocking idle capacity across ~14.5k U.S. scanners.

- Cardiac pathway hardens: ESC data reaffirm CCTA-first parity vs. stress testing, while new systems (GE Vivid Pioneer, Philips Transcend Plus) push AI‑standardized echo workflows.

- Policy tailwind: FDA finalized PCCP guidance for AI devices (Aug 18) enabling pre‑agreed post‑market model updates—expect faster, safer iteration cycles.

- Oncology AI consolidates: Tempus→Paige and Lunit’s moves (Prognosia; Valencian Community) show data‑gravity plays and public‑system scale are redefining moat.

Quick‑Glance Table

| Date | Headline | Our Take |

| Sep 4 | FDA clears 4DMedical CT:VQ; CMS Cat III | Functional CT converts chest CT into quantitative V/Q—workflows shift from NM to CT; attractive add‑on economics. |

| Sep 2 | GEHC Revolution Vibe CT 510(k) | Spectral/AI stack supports 2026–28 CT upgrade cycle; backlog narrative intact. |

| Sep 2 | Hyperfine Optive AI CE/UKCA | EU/UK portability use‑cases (ICU, ED, pediatrics) expand MR access; AI workflow layer is the lever. |

| Aug 29 | GE Vivid Pioneer (ESC) | AI‑assisted echo standardizes acquisition/quantification; throughput win in echo labs. |

| Aug 27–28 | Philips Transcend Plus | FDA‑cleared cardio‑US automation strengthens Philips’ echo franchise; “smaller, smarter, connected.” |

| Sep 3 | Siemens↔Evident (digital pathology) | Interop + co‑selling accelerates digitized histopath; last‑mile integration matters more than model choice. |

| Aug 22–26 | Tempus→Paige ($81M) | Foundation‑model scale: slide datasets + oncology informatics consolidate under fewer platforms. |

| Sep 2 & 4 | Lunit win (Valencia) + Prognosia | Population screening moves from pilots to procurement; risk‑stratified screening economics improve. |

| Aug 27 | PROMISE 10‑yr follow‑up | No long‑term mortality difference: CCTA vs. stress testing—CCTA‑first pathways retain momentum. |

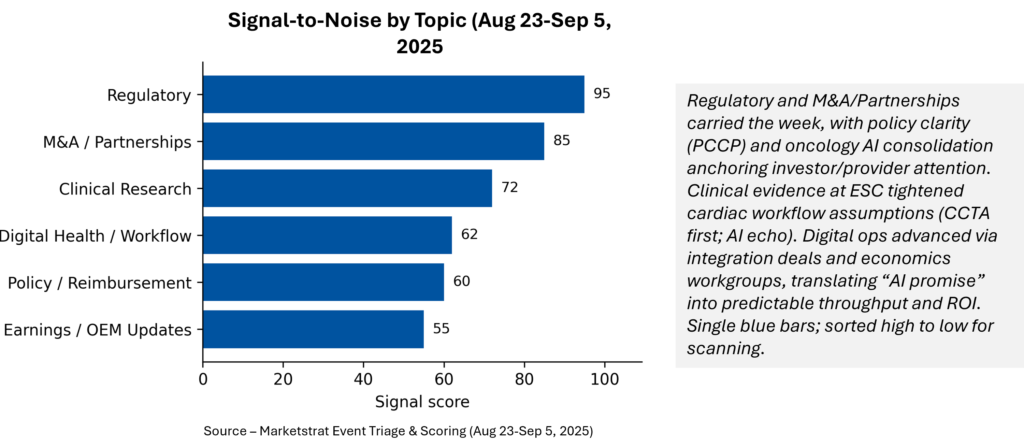

Signal-to-Noise by Topic – Aug 23-Sep 5, 2025

Regulatory and M&A/Partnerships dominate the signal—clearances plus policy clarity (PCCP) on one side, oncology AI consolidation on the other. Clinical evidence (ESC, PROMISE) substantiates CCTA‑first and AI‑echo standardization, while Digital Health/Workflow shows steady operationalization.

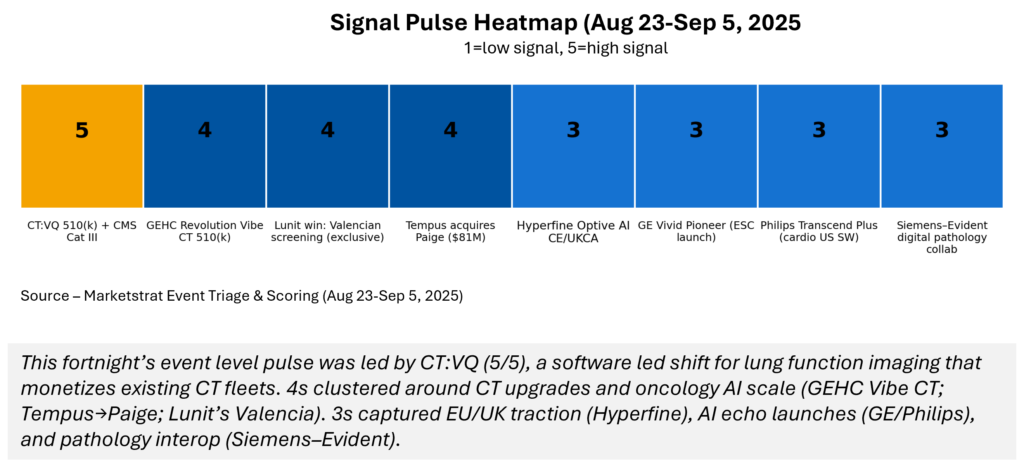

Signal Pulse Heatmap – Aug 23-Sep 5, 2025

The fortnight’s highest‑impact event is CT:VQ (score 5, orange), which reframes lung functional imaging. Strong 4s: GEHC Revolution Vibe CT, Lunit’s Valencian win, Tempus→Paige. 3s* fill out EU/UK momentum (Hyperfine), cardiology echo automation (GE/Philips), and Siemens‑Evident pathology alignment.

Regulatory Pulse

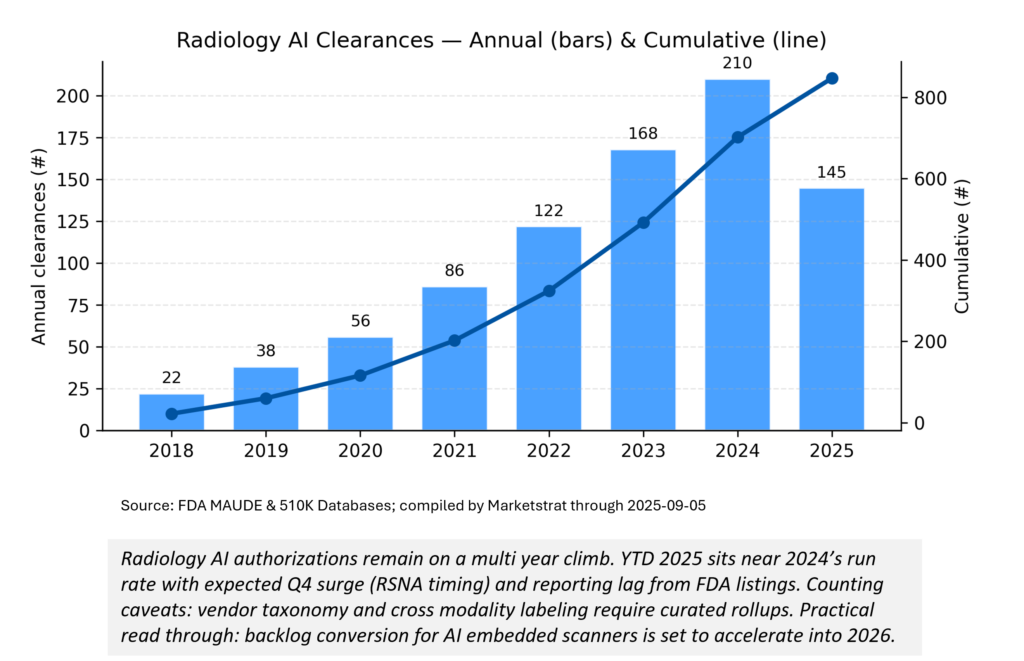

The cadence of radiology AI clearances keeps rising, with YTD 2025 tracking near 2024’s pace despite typical Q4lumpiness (RSNA‑timed submissions). Expect late‑year acceleration and post‑PCCP filings to show up with lag in FDA’s device list. Caveat: vendor “radiology” tagging is imperfect; we normalize across internal trackers.

Deeper Dives

Regulatory

- CT:VQ (4DMedical) cleared with Category III CPT add‑on—CT‑based V/Q could reduce transfers and nuclear scheduling bottlenecks while monetizing idle CT time; watch guidelines and payer uptake.

- GEHC Revolution Vibe CT 510(k): spectral + AI features advance cardiothoracic/body imaging; reinforces the pending photon‑counting wave.

- Hyperfine Optive AI CE/UKCA: EU/UK adoption likely through ICU/ED pilots where portability and workflow are decisive.

Funding / M&A

- Tempus→Paige ($81M): accelerates foundation‑model training with multi‑modal datasets; moat widens with consented data at scale. Lunit adds Prognosia and secures Valencian Community exclusive screening—evidence of public‑system AI procurement.

Digital Health / AI Ops

- PCCP final guidance de‑risks post‑market updates and supports ARR expansion via continuous performance gains; procurement teams should require PCCP scope + telemetry.

- ACR economics workgroup + operational AI moves (e.g., RP Mosaic) signal ROI frameworks maturing for reading‑room automation.

Clinical Research

- PROMISE 10‑yr: Long‑term mortality parity sustains CCTA‑first pathways and payer openness for CT‑based functional AI layers (e.g., plaques, FFRct). (PubMed, JAMA)

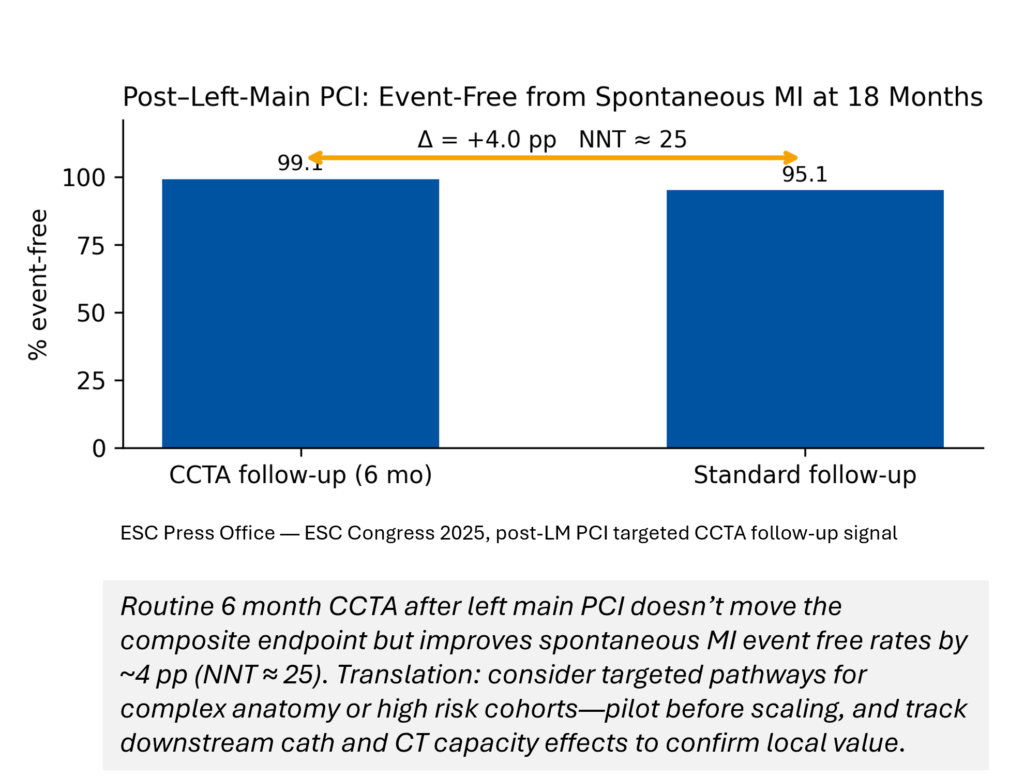

- PULSE (left‑main PCI): Routine 6‑month CCTA didn’t improve composites but reduced spontaneous MI—consider targeted use in complex anatomy; capacity and cath‑lab downstream effects merit local pilots. (Escardio, JACC)

- Opportunistic CAC from LDCT reinforces “find value in every scan” thesis for incidental AI.

Innovation Hook

“Is 6‑month CCTA worth it after left‑main PCI?”

What’s new: ESC’s PULSE trial found no composite endpoint benefit for routine CCTA vs. symptom‑driven follow‑up—but spontaneous MI fell from 4.9% to 0.9% at 18 months. That’s a +4.0 pp absolute improvement (event‑free), implying an NNT ≈ 25 to avert one spontaneous MI—hypothesis‑generating for high‑risk subsets. (Escardio, JACC, tctmd.com)

Market Lens

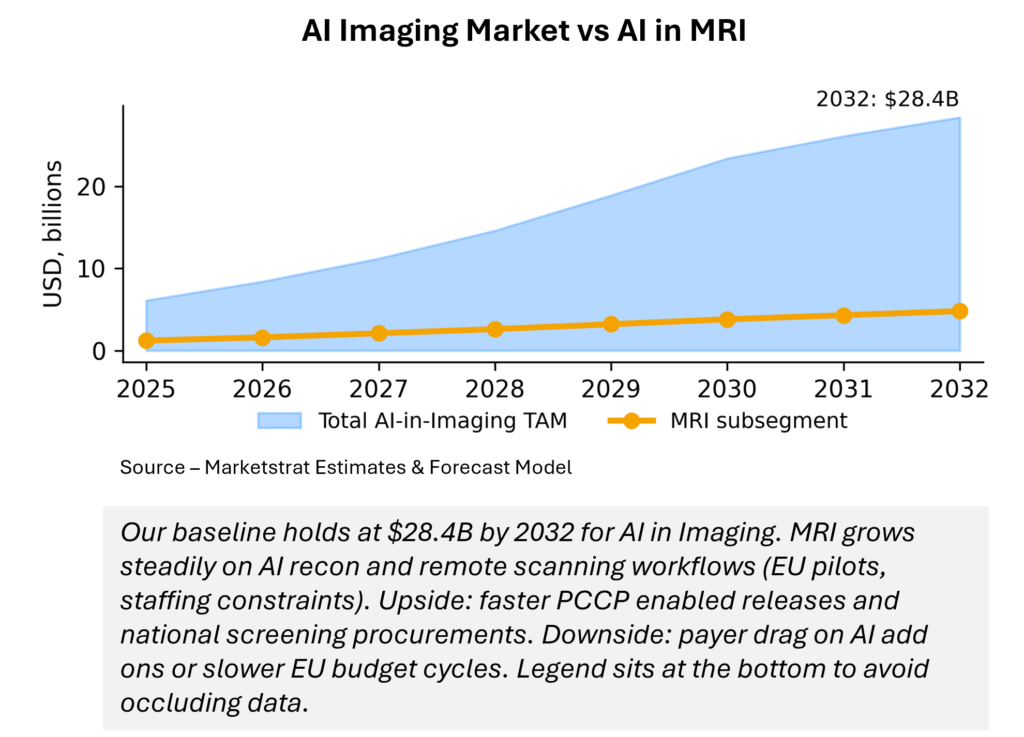

Baseline TAM reaches $28.4B by 2032, driven by CT functional add‑ons, AI‑standardized echo, and oncology/pathology data platforms. MRI grows on productivity (AI recon, remote ops) plus photon‑counting spillovers. Sensitivities: payer rules for AI add‑ons, EU procurement velocity, and foundation‑model consolidation. Legend sits at bottom to avoid data occlusion.

MARKETSTRAT POV — Strategy

- Bet on platform leverage, not point tools. Hospitals will reward vendors that bundle hardware + AI + ops telemetry under PCCP governance.

- Exploit “found capacity.” CT:VQ‑like software that monetizes existing fleets beats capex‑heavy plays in 2025–26 budgets.

- Target edge cohorts. Post‑LM PCI CCTA follow‑up may justify selective protocols (NNT≈25 for spontaneous MI); run local pilots before scaling.

About Marketstrat

Marketstrat™ is a market intelligence and GTM enablement firm committed to empowering clients in data-driven industries. Under the Markintel™ brand, it delivers robust market intelligence, while GrowthEngine™ solutions offer specialized GTM advisory and app-based tools—together fueling growth, innovation, and competitive advantage. For more information, visit www.marketstrat.com.

Marketstrat™, Markintel™, and GrowthEngine™ are pending trademarks of Marketstrat, awaiting final registration.

Check out free Research and Insights and Analysis of Industry Events

Check out our collection of Markintel Horizon and Markintel Pulse research.

Check out details on our reports, World Market for AI in Medical Imaging and other Pulse Reports in the Imaging space.