From AI‑native MRI and CT to clinical AI foundation models and enterprise operations platforms, Day 1 at RSNA 2025 showed how fast imaging hardware, software and workflows are converging.

What Stood Out

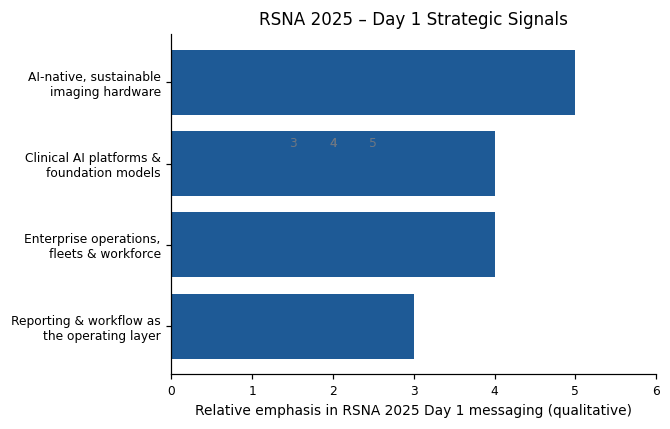

Across Philips, GE HealthCare, Siemens Healthineers, United Imaging, Aidoc, Coreline Soft and Rad AI, four cross‑cutting signals defined Day 1:

- AI‑native, sustainability‑aware imaging hardware

- Philips unveiled BlueSeal Horizon, the industry’s first helium‑free premium 3.0T MRI platform, and Verida, a detector‑based spectral CT fully powered by AI, combining resource security, dose efficiency and spectral imaging in one story.

- GE HealthCare highlighted next‑generation SIGNA MRI systems unveiled at RSNA 2025 and a broader wave of 40+ imaging innovations that merge advanced device technology with deep‑learning reconstruction and digital tools.

- United Imaging debuted its uSONIQUE® ultrasound family and uCT SiriuX CT platform, alongside its “Native AI” portfolio, signaling a pipeline of AI‑enabled hardware across modalities.

- Unified clinical AI platforms and foundation models

- Aidoc continued to position its CARE™ Clinical AI Reasoning Engine—a clinical‑grade foundation model trained on multimodal, real‑world data—and the aiOS™ platform as the backbone for multi‑condition triage and clinical decision support, supported by FDA Breakthrough Device designation and major system roll‑outs

- Coreline Soft previewed AVIEW 2.0, a unified chest AI platform that combines lung cancer screening, coronary artery calcium scoring and COPD quantification into a single workflow, with reported 89% faster throughput and ~60% reduction in interpretation time, drawing on national screening deployments in Europe and Australia.

- Enterprise operations, fleets and workforce as core AI use cases

- GE HealthCare’s RSNA 2025 messaging emphasized Imaging 360 and related AI‑powered operations tools designed to give a holistic view of imaging operations, streamline protocols across fleets and support remote collaboration—positioning operations as a primary AI use case.

- Siemens Healthineers, in its RSNA 2025 booth narrative, focused on how AI enhances patient experience across clinical pathways and how optimizing imaging fleets and workforce development prepares departments for tomorrow’s demand.

- Reporting and workflow as the new “operating layer”

- Rad AI, leveraging its collaboration with RSNA Ventures and its next‑generation speech‑recognition and reporting tools, is positioning reporting as a key enterprise layer for measurable ROI, scale and reduced cognitive load—embedding RSNA’s peer‑reviewed content directly into daily reporting workflows.

From Marketstrat’s perspective, Day 1 confirmed that RSNA 2025 is less about isolated products and more about how hardware, AI and operations interact to redefine radiology economics and practice.

Signal 1 – AI‑Native, Sustainability‑Aware Hardware

RSNA 2025 reinforced that “hardware” is very much alive as a strategic differentiator—but now in combination with AI and sustainability.

- Philips – BlueSeal Horizon & Verida

- BlueSeal Horizon brings a helium‑free 3.0T magnet with a sealed, low‑helium design and AI‑driven features for accelerated scanning and simplified siting—addressing resource risk and energy costs while improving workflow.

- Verida spectral CT uses detector‑based spectral imaging and AI‑powered reconstruction to deliver high‑quality images at lower dose and with faster reconstruction, targeting oncology, cardiology and complex diagnostic pathways.

- GE HealthCare – Next‑gen SIGNA MRI and spectral CT

- GE’s Day 1 RSNA communication highlighted 510(k) submissions for new SIGNA MRI systems and a broader “wave of AI imaging launches,” including spectral CT (Photonova Spectra) and other devices that blend deep‑learning reconstruction with new system architectures.

- United Imaging – uSONIQUE, uCT SiriuX and Native AI

- United Imaging’s RSNA narrative combined the uSONIQUE ultrasound family and uCT SiriuX CT with a strong emphasis on uAI as “Native AI,” integrated directly into acquisition, reconstruction and workflow across its portfolio.

Implications

- Procurement conversations are evolving from “Which MRI/CT is faster or sharper?” to “Which platform best balances performance, sustainability, AI‑readiness and lifecycle economics?”

- For OEMs, the bar is now AI‑native + sustainability + operations story as table stakes, not add‑ons.

- For health systems, the TCO equation must factor helium risk, power and staffing, not just uptime and image quality.

Signal 2 – Clinical AI Platforms and Foundation Models

Day 1 made clear that AI conversations are shifting from single‑use algorithms to platforms and clinical foundation models.

- Aidoc – CARE™ + aiOS™

- Aidoc’s CARE™ Clinical AI Reasoning Engine is framed as a clinical‑grade foundation model trained on multimodal data (imaging, labs, vitals, notes), underpinning an expanding set of FDA‑cleared use cases and a multi‑condition triage system that has earned FDA Breakthrough Device designation.

- Combined with aiOS™, Aidoc positions itself as a platform for deploying both Aidoc and third‑party AI models across multiple service lines with performance monitoring and enterprise integration.

- Coreline Soft – AVIEW 2.0 unified chest AI platform

- AVIEW 2.0 consolidates lung cancer screening, coronary calcium scoring and COPD quantification into a single pipeline for thoracic CT, with clinical data showing 89% faster case throughput and a 60% reduction in interpretation time.

- Coreline’s RSNA positioning is strengthened by real‑world deployments in national lung screening programs in France, Germany and Australia, plus U.S. sites such as Temple Lung Center.

Implications

- Clinical AI is moving from “apps on top of PACS” to platforms that unify multiple diseases and workflows.

- Foundation models like CARE™ and unified platforms like AVIEW 2.0 are key examples of how AI vendors are racing to become core infrastructure, not point solutions.

- For OEMs, this raises a strategic choice: build, buy, or partner for foundation‑model and platform capabilities.

Signal 3 – Enterprise Operations, Fleets and Workforce

Operational efficiency and workforce sustainability were front‑and‑center in Day 1 messaging.

- GE HealthCare – Imaging 360 and operations

- Imaging 360, highlighted in GE’s RSNA AI and software portfolio, focuses on giving a holistic view of imaging operations—capacity, utilization, protocol standardization, remote collaboration and scan assist—to help departments manage fleets, staff and throughput with AI support.

- Siemens Healthineers – pathways, fleets and workforce

- Siemens’ RSNA booth communications emphasize AI across clinical pathways and the need to optimize imaging fleets and foster workforce development, underscoring that staffing and operations are inseparable from AI strategy.

Implications

- AI for operations (scheduling, protocol standardization, fleet utilization, remote scanning) is becoming as important as AI for interpretation.

- For imaging departments, the question is shifting from “Which AI app do we buy?” to “Which vendors help us run the entire department more intelligently?”

- For vendors, success will depend on demonstrating measurable operational ROI—not just improved AUC or sensitivity.

Signal 4 – Reporting and Workflow as the Operating Layer

Finally, Day 1 reinforced that the “operating layer” of radiology may be reporting + workflow orchestration.

- Rad AI – RSNA Ventures collaboration and next‑gen reporting

- Rad AI is using RSNA 2025 to highlight AI‑driven reporting and speech recognition, positioned to reduce cognitive load, accelerate turnaround times and embed RSNA’s peer‑reviewed knowledge directly into report generation via RSNA Ventures.

This sits alongside enterprise workspaces such as GE’s Genesis Radiology Workspace and emerging workflow engines from vendors in the RSNA exhibitor news feed, which frame routing, prioritization and analytics as strategic levers.

Implications

- The battle for control of radiology’s “operating layer” is intensifying:

- Modality OEMs (hardware + software),

- AI platform vendors (clinical and operational AI),

- Reporting and workflow players.

- Whoever orchestrates reporting, decision support and case flow at scale will have disproportionate influence over which AI, which devices and which pathways are adopted.

Vendor × Signal Snapshot

| Vendor | AI‑native hardware & sustainability | Clinical AI platform / foundation model | Enterprise ops & fleet / workforce | Reporting / operating layer |

| Philips | BlueSeal Horizon 3.0T helium‑free MRI; Verida AI‑powered spectral CT | – | Workflow & efficiency features tied to new systems | – |

| GE HealthCare | Next‑gen SIGNA MRI, Photonova Spectra CT, PET/CT and other devices combining hardware with deep‑learning reconstruction | – | Imaging 360 operations platform; digital and AI solutions to manage fleets and throughput | Genesis Radiology Workspace, broader enterprise imaging stack |

| Siemens Healthineers | New systems and AI‑enhanced imaging showcased at RSNA | – | Focus on AI across pathways, fleets and workforce in booth story | – |

| United Imaging | uSONIQUE ultrasound family; uCT SiriuX CT; multi‑modality portfolio | “Native AI” (uAI) across modalities | – | – |

| Aidoc | – | CARE™ foundation model + aiOS™ platform; multi‑condition triage with Breakthrough designation | Enterprise‑wide deployments and performance monitoring across service lines | Roadmap includes CARE‑powered report drafting and extended clinical support |

| Coreline Soft | – | AVIEW 2.0 unified chest AI platform; multi‑disease pipeline with strong real‑world validation | Efficiency and throughput gains (89% faster; ~60% less interpretation time) | – |

| Rad AI | – | – | Enterprise‑level AI for reporting ROI and burnout reduction | Reporting and speech‑recognition platform integrated with RSNA Ventures content |

What This Means for Imaging & AI Leaders

Day 1 at RSNA 2025 suggests three near‑term imperatives:

- Re‑position portfolios around AI‑native hardware and platforms, not isolated products.

- Anchor AI roadmaps in operations and workforce realities—fleet, staffing, turnaround times, burnout.

- Clarify your role in the emerging operating layer of radiology—modality innovator, AI platform, workflow orchestrator, or a hybrid.

This is exactly where Marketstrat will continue to focus as we track RSNA 2025 through daily signals and a post‑meeting strategic recap.

About Marketstrat

Marketstrat® is a market intelligence and GTM enablement firm committed to empowering clients in data-driven industries. Under the Markintel™ brand, it delivers robust market intelligence, while GrowthEngine solutions offer specialized GTM advisory and app-based tools—together fueling growth, innovation, and competitive advantage. For more information, visit www.marketstrat.com.

Marketstrat® is a registered trademark and Markintel™ is a pending trademark of Marketstrat.

Check out free Research and Insights and Analysis of Industry Events

Check out our collection of Markintel Horizon and Markintel Pulse research.

Check out details on our report, World Market for Oncology Imaging AI

Check out details on our other reports, World Market for AI in Medical Imaging and other Pulse Reports in the Imaging space.