Key Takeaways – RSNA 2025 Day 3

- Image-based AI is moving beyond detection to predictive biomarkers and risk stratification, with new RSNA data on chronic stress and breast cancer risk, plus aggressive vendor moves around risk-based screening platforms.

- The conversation around AI is shifting from “assistive tools” to governance, role separation and equity, with RSNA frameworks on AI–human roles, encoding equity in algorithms, and health-equity programming.

- Ultrasound and enterprise imaging are emerging as high-velocity testbeds for AI-native workflows, with Samsung’s R20 platform, GE HealthCare’s Genesis Radiology Workspace and DeepHealth’s OS positioning themselves as operating layers for AI-powered imaging.

- RSNA’s own AI Challenge and ATLAS infrastructure continue to expand the data and benchmarking rails that future commercial products will depend on, especially in high-risk areas like intracranial aneurysm detection.

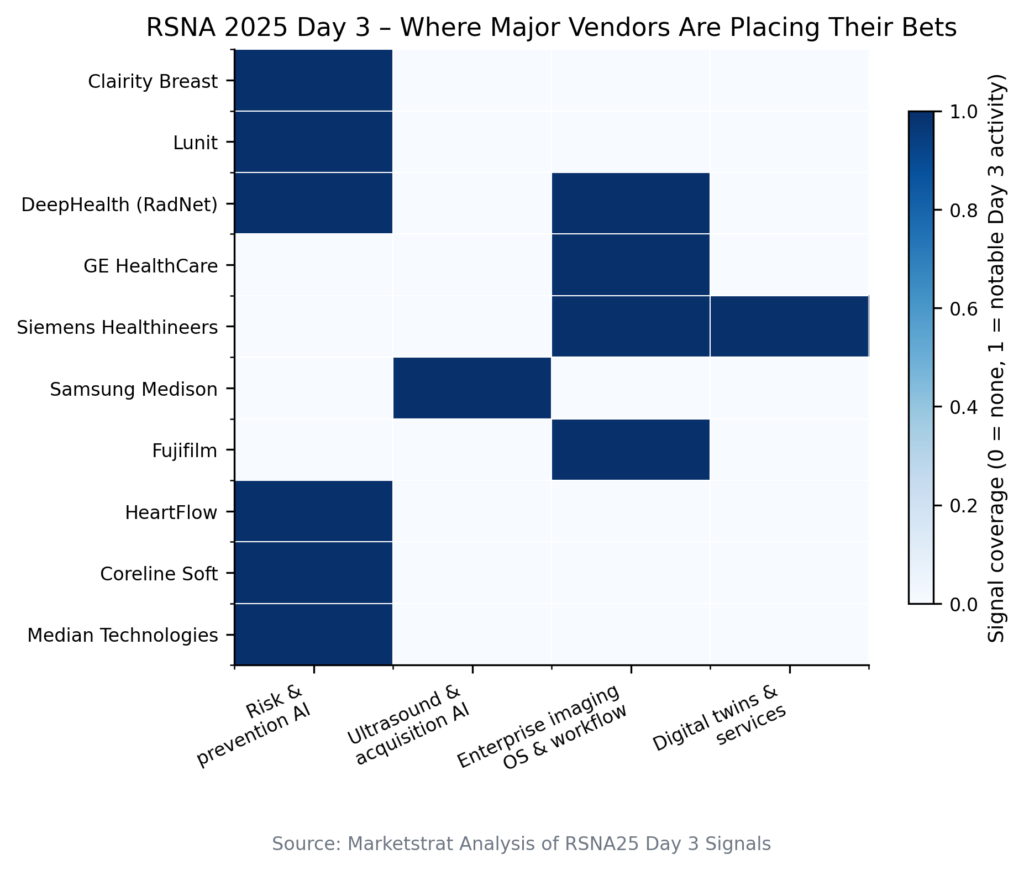

Major Vendor Bets

Innovation Hook – From Pixels to Prevention Programs

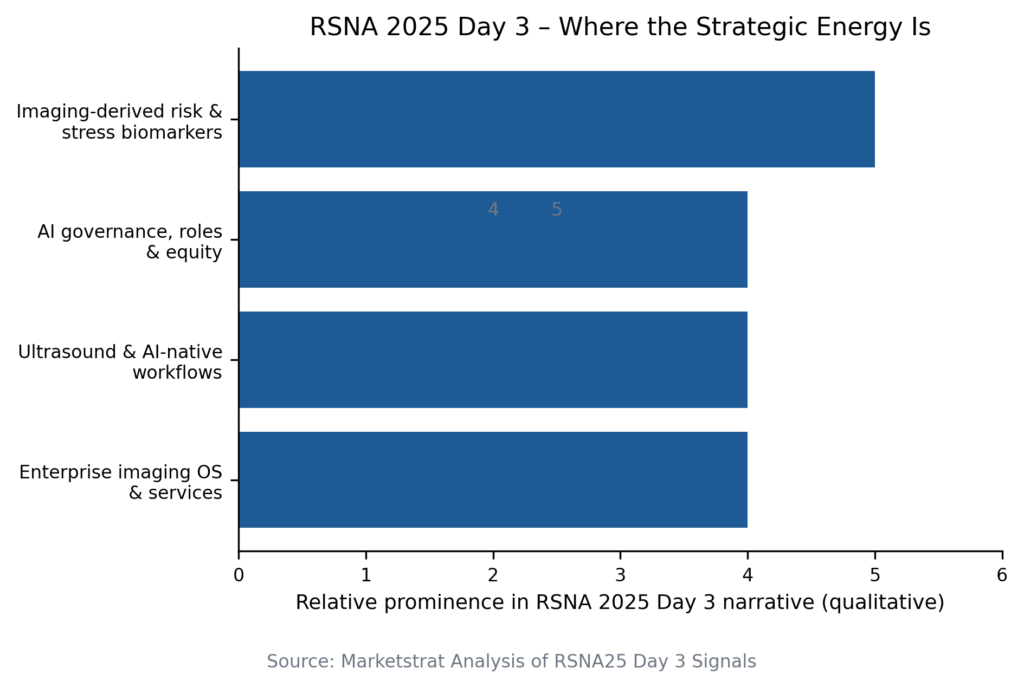

RSNA 2025’s Day 3 signal is not another gadget or one more AI algorithm. It’s the convergence of:

- Biomarkers that predict, not just detect (chronic stress AVI; image-only breast risk).

- Governance frameworks that clarify who does what and how systems are certified.

- AI-native workflows in ultrasound and enterprise imaging that can actually deliver these innovations to patients at scale.

For Marketstrat’s clients, the strategic question coming out of Day 3 is:

How quickly can you move from “demo‑ready algorithm” to risk‑based prevention programs that fit into evolving governance and platform landscapes?

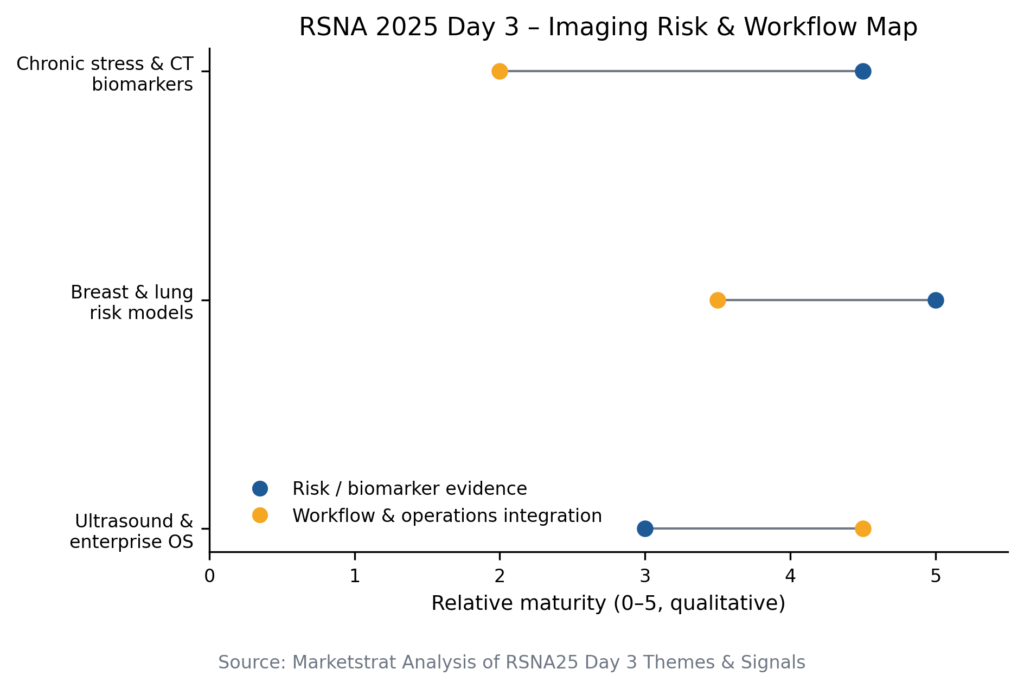

Day 3 Themes <> Imaging Risk & Workflow Map

RSNA25 – Day 3 Signals

Signal 1 – Imaging becomes a risk- and stress‑biomarker engine

What happened

- Chronic stress on CT, quantified by AI

- RSNA highlighted a Johns Hopkins study that uses a deep learning model to segment adrenal glands on routine chest CT and compute an Adrenal Volume Index (AVI) as a biomarker of chronic stress. Higher AVI correlated with cortisol levels, validated stress questionnaires, allostatic load and future adverse cardiovascular outcomes, including heart failure and mortality.

- Crucially, this is all derived from existing CT scans—no new imaging or radiation exposure—opening a path to opportunistic stress risk profiling at scale.

- Image-only breast cancer risk models step into the spotlight

- RSNA press and oncology media amplified data showing an image-only AI risk model (Clairity Breast) that outperforms breast density for five‑year risk stratification, applied to >245,000 screening mammograms from multiple US and European sites. Women in the AI “high risk” group had >4x the cancer incidence of the average‑risk group, while density alone offered only modest separation.

- Clairity Breast is positioned as the first FDA‑authorized, image‑only breast cancer risk model, commercialized as a platform that turns routine mammograms into longitudinal risk scores rather than just detection events.

- Vendors line up to own the “risk layer”

- Lunit is using RSNA 2025 to showcase a comprehensive AI breast ecosystem – DBT detection, density analytics and a coming image-based risk model (Lunit INSIGHT Image-Based Risk) – plus new evidence data across 14 studies.

- DeepHealth is positioning its Breast Suite as a modular, cloud-native stack spanning detection, density, risk and quality analytics, integrated into the broader DeepHealth OS platform already deployed across large screening programs.

Why it matters (adoption, evidence, economics)

- Evidence is now running ahead of guidelines. RSNA data suggests image-based AI risk models and CT-derived biomarkers can stratify risk with far greater precision than current rules-of-thumb (density, family history, cortisol spot checks), but screening guidelines and reimbursement frameworks remain age-based and fragmented.

- Opportunistic imaging becomes a revenue and outcomes play. Every chest CT or mammogram becomes a potential node for longitudinal risk management—stress, cardiovascular risk, cancer risk—without new hardware. That favors:

- CT and mammography OEMs that can bundle biomarkers and risk scores into their installed base.

- AI platforms that can aggregate, normalize and score multimodal data across health systems.

- Payer and health‑system GTM: Risk models with validated five‑year outcomes (breast) and long‑term cardiovascular endpoints (stress) are exactly the type of tools payers and IDNs need for tiered screening, targeted follow‑up imaging and preventive interventions. Expect:

- Pilot contracts around risk‑based screening programs.

- Pressure for new CPT codes or bundled payment models for image‑based risk assessment.

What to watch

- How quickly Clairity, Lunit, DeepHealth and others can convert RSNA‑level evidence into reimbursed services vs. “nice-to-have” insights.

- Whether CT vendors move to pre‑install stress and cardiometabolic biomarkers on scanners as standard options, turning risk analytics into a feature of every chest CT.

Signal 2 – Trust, role separation and equity move to the center

What happened

- A formal framework for AI–human role separation

- RSNA highlighted an editorial by Eric Topol and Pranav Rajpurkar calling for clear separation of roles between AI systems and radiologists, arguing that current assistive models create “distrust and dependence” without clear responsibility.

- They propose three archetypes:

- AI‑first sequential workflows (AI pre‑reads or assembles clinical context).

- Doctor‑first sequential workflows (radiologist leads, AI supports report generation/follow‑up).

- Case‑allocation models, where some cases are managed by AI alone, some by clinicians alone, and others jointly.

- The piece also calls for new clinical certification pathways for AI beyond traditional FDA device approval, potentially via multi‑stakeholder bodies.

- Equity and fairness embedded in the RSNA program

- RSNA’s Health Equity Committee has built a focused track addressing imaging disparities, AI equity and inclusive workforce development.

- Sessions include “Encoding Equity in AI Algorithms” and “Addressing Imaging Disparities in American Indian and Alaska Native Communities,” as well as a Discovery Theater presentation on health‑equity resources and community‑facing events in Chicago.

- Benchmarks and challenges as trust infrastructure

- RSNA’s 2025 Intracranial Aneurysm Detection AI Challenge tasks global teams with detecting and localizing aneurysms across CT angiography, MR angiography and MRI, building large, annotated datasets and open benchmarks.

- The Challenge sits alongside RSNA ATLAS and the Imaging AI Certificate Program, signaling RSNA’s role as a neutral arbiter and data convenor as AI matures.

Why it matters (regulatory & GTM)

- The “operating model” for AI is now strategic. Vendors that can clearly articulate where AI leads, where humans lead and how liability is managed will have an edge in RFPs and institutional pilots.

- Certification becomes a moat. If RSNA‑aligned or multi‑stakeholder certification pathways emerge on top of FDA clearance, vendors with early participation will gain credibility and potentially pricing power.

- Equity isn’t just optics. Encoding equity in algorithms and showcasing real‑world outcomes is becoming table stakes for large U.S. health systems and global NGOs. For screening AI in particular (breast, lung, TB), evidence of performance across diverse populations is now an explicit buying criterion.

What to watch

- Which vendors move first to align their products to role‑separation models (e.g., explicit AI‑first triage vs. doctor‑first reporting support).

- Whether RSNA’s health‑equity content translates into procurement language (e.g., RFP requirements for equity analyses, bias monitoring, or health‑equity impact reporting).

Signal 3 – Ultrasound and enterprise imaging become AI workhorses

What happened

- Samsung’s R20 ultrasound pushes AI‑native acquisition

- Samsung Medison launched the R20 ultrasound system at RSNA 2025, combining an advanced imaging engine with more than a dozen AI tools for real‑time guidance, diagnostic assistance, workflow automation and automated measurements.

- The system is explicitly designed to reduce user variability, standardize acquisition across experience levels and address sonographer pain and workforce shortages with ergonomic design.

- Enterprise platforms and services as the new operating layer

- GE HealthCare is showcasing over 40 innovations with heavy emphasis on Genesis Radiology Workspace, a cloud‑first platform with a zero‑footprint Genesis Viewer and a portfolio of ~100 FDA‑authorized AI solutions, aimed at unifying workflows and reducing cognitive load.

- Siemens Healthineers is promoting new AI‑enabled radiology services and simulations, including a Radiology Services Suite spanning scheduling through reporting and the ActExcell Operational Twin to model departmental scenarios and recommend operational improvements.

- DeepHealth OS is framed as a cloud-native operating system that unifies clinical and operational data, with population‑oriented suites (Breast, Chest, Prostate, Neuro, Thyroid) and documented impact on workflow (e.g., remote scanning programs and reduced slot times).

- Imaging IT and mobile radiography reinforce the trend

- Fujifilm and others continue to use RSNA to highlight enterprise viewers, remote reading, and portable DR systems designed to bring hospital‑grade images to the bedside while maintaining secure remote access – reinforcing the shift from point solutions to platform-centric GTM.

Why it matters (workflow & economics)

- Ultrasound may be the fastest near‑term AI ROI story. It is operator‑dependent, faces serious workforce shortages, and sits early in many care pathways. AI‑guided acquisition and automated measurements go straight to:

- Reduced repeat scans and no‑show losses.

- Higher throughput and consistent quality (critical for enterprise deals).

- Platforms > point solutions. GE, Siemens, DeepHealth and others are clearly competing to be the “operating system” for radiology, integrating viewing, orchestration, AI routing, and population workflows:

- That shifts GTM from single‑department PACS deals to multi‑year, multi‑modality platform contracts with embedded AI.

- It also reinforces a services and subscription revenue mix (radiology services, remote scanning, operational twins).

- Strategic implication for AI startups: Surviving as a standalone app will be difficult. The more compelling path is:

- Embed into these platforms as white‑label or co‑branded modules, or

- Own a tightly defined, high‑value niche (e.g., specific disease program) with demonstrable economic impact.

What to watch

- Early data on R20 deployment: does real‑time guidance materially reduce variability, exam times and repeat rates in real-world cohorts?

- Whether Genesis, DeepHealth OS, or other platforms start to publish system‑level impact metrics (radiologist productivity, turnaround times, revenue lifts) that go beyond single‑algorithm ROC curves.

Selected Initiatives – Day 3

Selected RSNA 2025 Day 3 initiatives mapped to Marketstrat’s core signals and strategic implications

| Theme / Signal | Organization(s) | Highlighted announcement / study | Primary lens (Evidence / Workflow / Economics / Policy) | Strategic signal for industry |

| Imaging as chronic stress biomarker | Johns Hopkins / RSNA | Deep learning model uses chest CT to derive Adrenal Volume Index, correlating with cortisol, stress scores & heart failure. | Evidence, Prevention | Routine CT becomes a platform for stress and cardiometabolic risk programs without incremental scanning. |

| Image-only breast cancer risk stratification | RSNA / Clairity | Clairity Breast AI model outperforms breast density for 5‑year risk; first FDA‑authorized image-only risk model. | Evidence, Policy, Reimbursement | Risk‑based screening will require new guidelines, coding and payer strategies; vendors that own risk scores gain strong moats. |

| Image-based risk ecosystems | Lunit | RSNA 2025 portfolio with eight oral presentations, six posters, and new image‑based risk and DBT performance data. | Evidence, GTM | Full-stack breast ecosystems (detection + risk + QA) are becoming standard expectations for screening programs. |

| AI-powered screening suites & OS | DeepHealth / RadNet | DeepHealth OS and population suites (Breast, Chest, Prostate, Neuro, Thyroid) showcased as cloud-native operating system for imaging. | Workflow, Economics | OS-level platforms that unify data, AI and remote scanning will increasingly control access to end users. |

| AI-native ultrasound | Samsung Medison | R20 ultrasound system with advanced imaging engine, >12 AI tools and ergonomic design to reduce variability and sonographer strain. | Workflow, Workforce, Economics | Ultrasound is emerging as a high-impact proving ground for AI-guided acquisition and operational ROI. |

| Cloud-first radiology workspaces | GE HealthCare | Genesis Radiology Workspace and Genesis Viewer highlighted alongside ~100 FDA-authorized AI solutions. | Workflow, Platform, GTM | Battle for the radiology “operating layer” is intensifying; AI becomes a feature of the platform, not a standalone sale. |

| AI-enabled radiology services & twins | Siemens Healthineers | New radiology services suite and ActExcell Operational Twin to simulate and optimize departmental operations. | Services, Economics | Service-led and twin-based offerings create recurring revenue and shift conversations from devices to performance guarantees. |

| Governance & role separation framework | RSNA / Topol & Rajpurkar | Editorial advocates clear AI–human role separation and new clinical certification models beyond FDA clearance. | Policy, Governance | Buyers will increasingly ask vendors which workflow model they support and what external certification they pursue. |

| Health equity & AI fairness | RSNA Health Equity Comm. | Sessions on encoding equity in AI algorithms and addressing disparities in underserved communities. | Equity, Policy, Reputation | Equity metrics and evidence will be part of RFPs and publications, not just conference talking points. |

| RSNA AI Challenge – aneurysm detection | RSNA | 2025 Intracranial Aneurysm Detection AI Challenge across CTA, MRA and MRI; expands multi-modal annotated datasets. | Evidence, Benchmarking | Shared benchmarks and datasets raise the bar for performance claims and ease regulatory and payer evaluation of competing tools. |

About Marketstrat

Marketstrat® is a market intelligence and GTM enablement firm committed to empowering clients in data-driven industries. Under the Markintel™ brand, it delivers robust market intelligence, while GrowthEngine solutions offer specialized GTM advisory and app-based tools—together fueling growth, innovation, and competitive advantage. For more information, visit www.marketstrat.com.

Marketstrat® is a registered trademark and Markintel™ is a pending trademark of Marketstrat.

Check out free Research and Insights and Analysis of Industry Events

Check out our collection of Markintel Horizon and Markintel Pulse research.

Check out details on our report, World Market for Oncology Imaging AI

Check out details on our other reports, World Market for AI in Medical Imaging and other Pulse Reports in the Imaging space.