ONE BIG THING

Imaging AI’s scaling constraint is shifting from model performance to “get paid + get distributed,” as Median’s end‑to‑end lung cancer screening clearance and Tempus Pixel distribution move collide with a fragile CMS OPPS payment construct that can swing AI software reimbursement by ~9× based on claims data.

KEY TAKEAWAYS

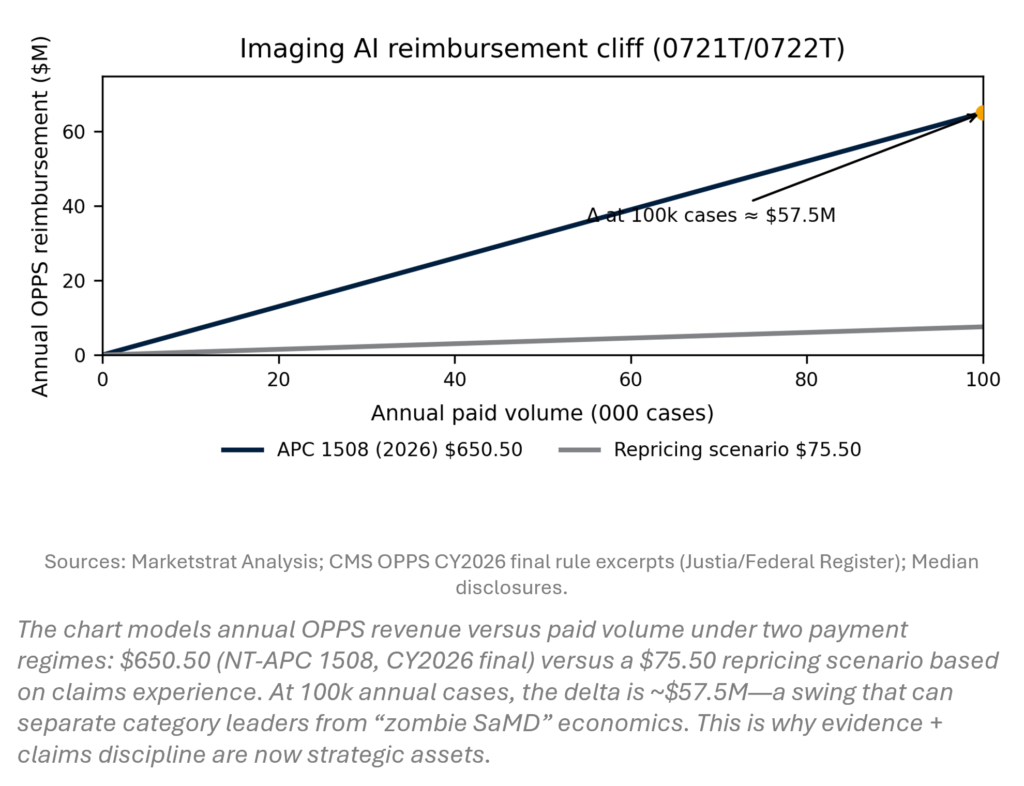

- Reimbursement is the real “killer feature.” CMS kept the AI CT CAD codes (0721T/0722T) in New Technology APC 1508 (≈ $650.50) versus a claims‑based reassignment scenario (≈ $75.50)—a ~$575/case swing that is existential at scale.

- Median just advanced lung cancer screening AI from “detection” to “pathway.” FDA cleared eyonis LCS for CADe/CADx in lung cancer screening with high reported performance metrics—positioning it closer to a workflow + reimbursement product than a point algorithm.

- Distribution platforms are becoming the go‑to‑market rails. Tempus will distribute eyonis LCS via Pixel, reframing “channel access” as a strategic moat—especially given persistently low LCS participation.

- AI safety + regulatory capacity are now procurement variables, not side notes. Reuters’ TruDi reporting and disclosures around FDA imaging‑software staffing strain reinforce the need for auditable claims, telemetry, and post‑market monitoring as table stakes.

- Platform economics are tightening competitive gravity. Pro Medicus’ results underscore that enterprise imaging platforms can throw off software‑like margins; AI vendors that can’t integrate cleanly into PACS/VNA ecosystems will face rising friction and CAC.

INNOVATION HOOK

The Reimbursement Cliff” for Imaging AI SaMD

The week’s most leverageable insight is that imaging AI is entering a reimbursement regime where claims data can abruptly re-rate software economics. CMS kept 0721T/0722T in New Technology APC 1508 (~$650.50), despite proposing a reassignment implied by limited claims (~$75.50). Median’s clearance turns that policy nuance into a business‑critical variable: scale too fast without evidence, and you risk triggering a payment collapse.

MARKETSTRAT POV

- Payment policy remains the gating variable for imaging AI monetization. Near‑term OPPS stability for imaging AI codes improves visibility but does not remove the “reimbursement cliff” risk if/when CMS reprices off cost data or packages the service.

- Distribution is consolidating. Provider roll-ups and JV platforms increasingly behave like AI distribution rails—standardizing protocols, contracting, and workflow at scale. Examples seeded into the tracker include RadNet’s platform expansion via Radiology Regional and Northwest Radiology.

- Regulatory volume remains high, but governance expectations are rising. The practical differentiator is moving from “we have clearance” to “we can operate safely at scale” (monitoring, updates, claims discipline).

- Capacity economics are moving to the foreground. Workforce and infrastructure bottlenecks are becoming the ROI center of gravity—throughput, uptime, and fewer repeats will outsell incremental accuracy in many buying committees.

- Cloud imaging IT is a strategic choke point. The winners will be vendors that integrate tightly into cloud PACS/VNA + enterprise workflow, not bolt-on point tools.

Marketstrat take

Imaging AI is shifting into an “infrastructure-like” phase: buyers are increasingly optimizing for (1) what gets paid, (2) what increases capacity, and (3) what can be governed across multi‑site enterprises. Vendors relying on a single OPPS rate as a durable annuity risk getting hit by (a) repricing/packaging, and (b) consolidators that force standardized economics.

Winning playbook (next 2–4 quarters)

- Land enterprise rollout deals with consolidators and imaging IT platforms (distribution > point deployments).

- Productize governance (monitoring, drift management, update controls) as a first‑class feature.

- Pivot commercial contracting toward capacity + quality economics (time saved, uptime restored, fewer repeats) that survive payment resets.

SIGNAL DASHBOARD

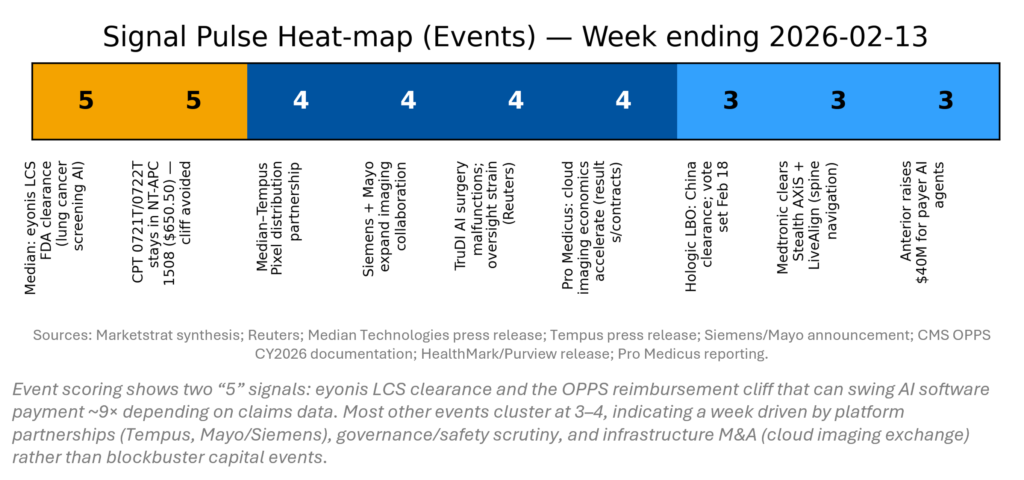

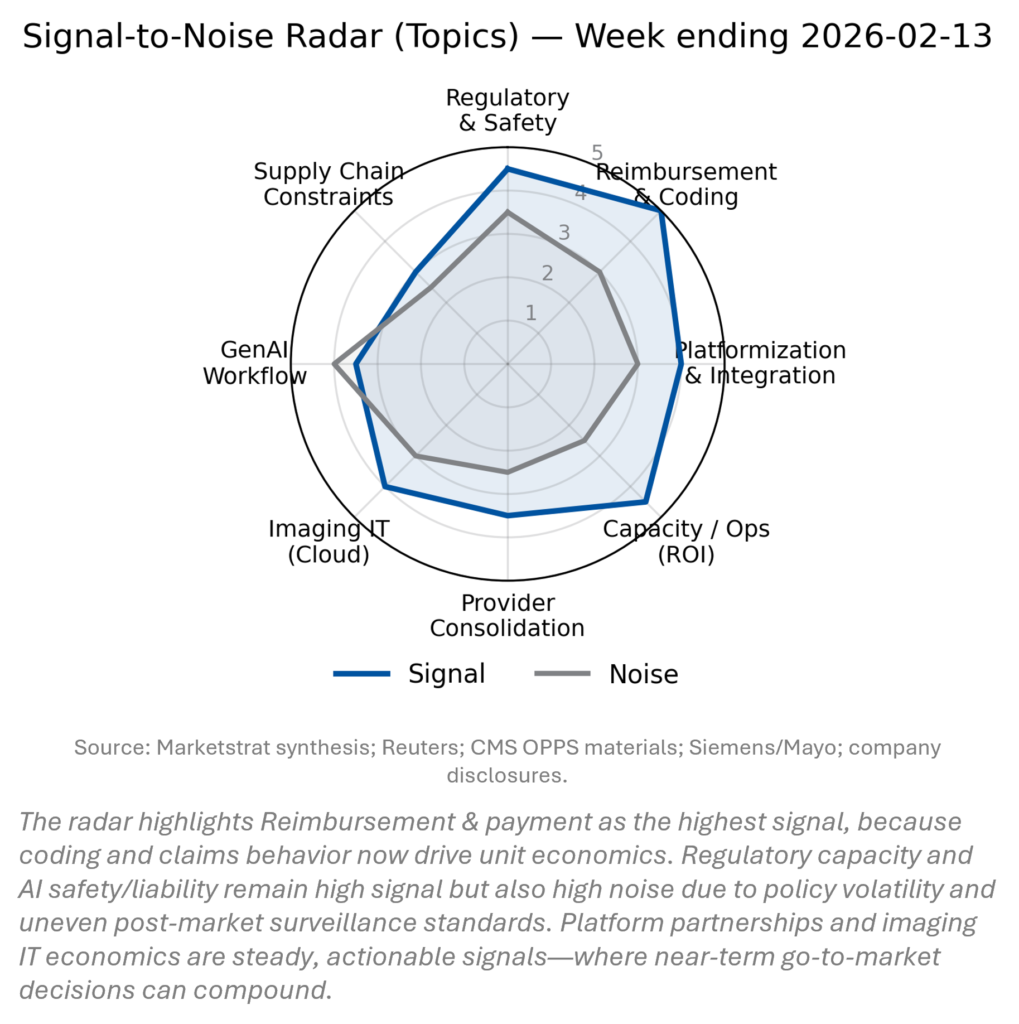

This week’s signal is unusually concentrated around commercialization mechanics: FDA clearance plus payment stability and distribution rails. The highest-consequence events are not mega‑M&A—they’re the “plumbing” decisions that determine whether imaging AI becomes a scalable business (coding, claims discipline, platform integration) while buyers simultaneously raise the bar on safety, auditability, and liability. The implication: product roadmaps must now be co-owned by clinical, revenue-cycle, and IT leaders.

SIGNAL PULSE HEATMAP – Feb 7 – 13, 2026

SIGNAL-TO-NOISE RADAR BY TOPIC – Feb 7 – 13, 2026

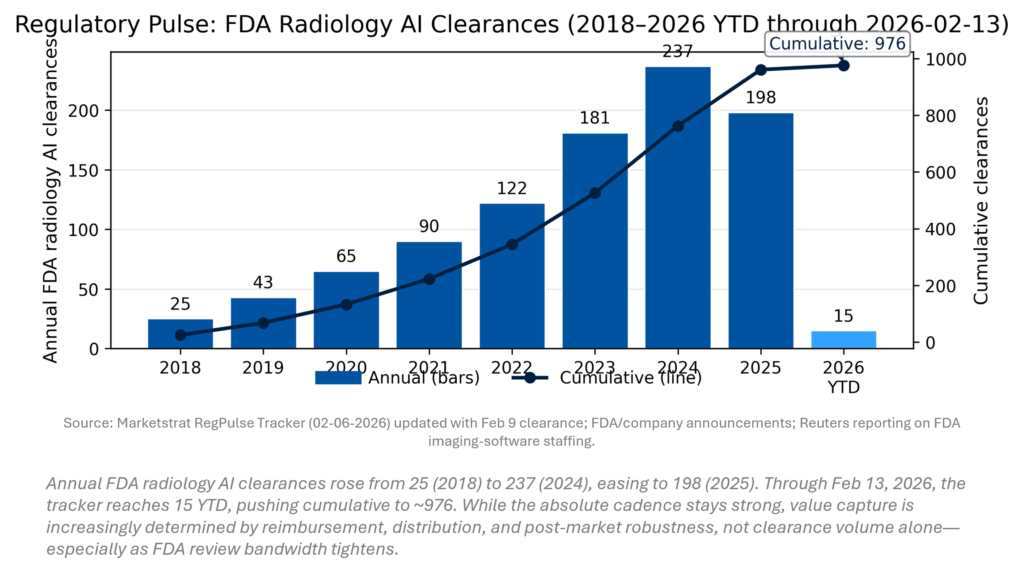

REGULATORY PULSE

FDA radiology AI clearances remain structurally high, but the market is shifting from “how many clearances?” to “how much deployable ROI per clearance?” Counts peaked in 2024, cooled in 2025, and 2026 has started steadily (now 15 YTD through Feb 13, +1 vs last week). The bigger risk is throughput at the regulator: staffing constraints in imaging software review functions could slow time‑to‑market and raise uncertainty premiums.

QUICK-GLANCE TABLE

| Date | Headline | Our Take | Source |

| 2026-02-09 | FDA clears Median’s eyonis LCS for lung cancer screening | First-order win is regulatory; second-order win is positioning AI as a reimbursable pathway asset (CADe/CADx + workflow). | Median PR (Median Technologies) |

| 2026-02-12 | Tempus to distribute eyonis LCS on Pixel | Pixel is emerging as a commercialization rail; distribution + workflow integration may matter more than incremental AUC. | Tempus PR (Tempus) |

| 2026 (policy context) | CMS keeps 0721T/0722T in NT‑APC 1508 (≈$650.50) vs claims-based repricing (≈$75.50) | This is the “reimbursement cliff” problem: real‑world claims can re-rate AI software economics dramatically. | Federal Register/Justia (Justia) |

| 2026-02-12 | Siemens Healthineers + Mayo expand strategic collaboration | OEM‑provider co‑design (AI MRI protocols, digital twins, UHF MRI) strengthens ecosystem moats; signals where evidence will be created. | Siemens/Mayo (Siemens Healthineers) |

| 2026-02 (reporting) | Reuters highlights TruDi malfunctions + AI oversight strain | Expect tighter buyer scrutiny: audit trails, human‑in‑the‑loop design, and liability clarity become core sales artifacts. | Reuters (Reuters) |

| 2026-02-12 | HealthMark acquires Purview (cloud imaging exchange) | Imaging “data liquidity” is moving from CDs to cloud exchange networks—strategic for AI training/deployment and referral capture. | PRWeb (PRWeb) |

| 2026-02-12 | Pro Medicus posts strong 1H FY26 results | Confirms enterprise imaging IT as a high‑margin platform layer; AI vendors must align with platform roadmaps and integration standards. | Capital Brief (Capital Brief) |

| 2026-02-10 | Hologic LBO gets China clearance; vote set Feb 18 | De-risks deal mechanics; watch downstream impact on R&D prioritization and portfolio pruning. | Reuters (Reuters) |

| 2026-02-13 | FDA clears Medtronic Stealth AXiS with LiveAlign | Imaging‑guided surgery continues to integrate alignment intelligence; interoperability + governance will matter as autonomy rises. | MDDI (RTTNews) |

| 2026-02-11/12 | Anterior raises $40M to build payer AI agents | “Administrative AI” is scaling fast; near-term ROI is in prior auth/claims friction, but regulatory scrutiny is likely. | TechCrunch (Investing.com) |

| 2026-02 (study/advocacy) | Only ~18.7% of eligible adults are up-to-date on LCS; full uptake could prevent ~62,110 deaths over 5 years | The screening funnel—not the algorithm—is the TAM unlock; distribution + capacity is the wedge. | ACS (American Cancer Society MediaRoom) |

Sources & Methodology

- Proprietary Data: Marketstrat Frameworks, Data Models, and Regulatory Pulse Tracker (Data through Feb 6, 2026).

- Market Intelligence: Broker Research, Expert Transcripts, and Filings via AlphaSense.

- Trade Reporting

- Analysis: Marketstrat Research & Synthesis.

About Marketstrat

Marketstrat® is a market intelligence and GTM enablement firm committed to empowering clients in data-driven industries. Under the Markintel™ brand, it delivers robust market intelligence, while GrowthEngine solutions offer specialized GTM advisory and app-based tools—together fueling growth, innovation, and competitive advantage. For more information, visit www.marketstrat.com.

Marketstrat® is a registered trademark and Markintel™ is a pending trademark of Marketstrat.

Check out free Research and Insights and Analysis of Industry Events

Check out our collection of Markintel Horizon and Markintel Pulse research.

Check out details on our reports, World Market for AI in Medical Imaging World Market for Oncology Imaging AI and other Pulse Reports in the Imaging space.