Edition: March 14, 2025

Focus: Medical Imaging Developments (Photon-Counting CT, AI-Driven Cardiac Imaging, Handheld Ultrasound, and M&A)

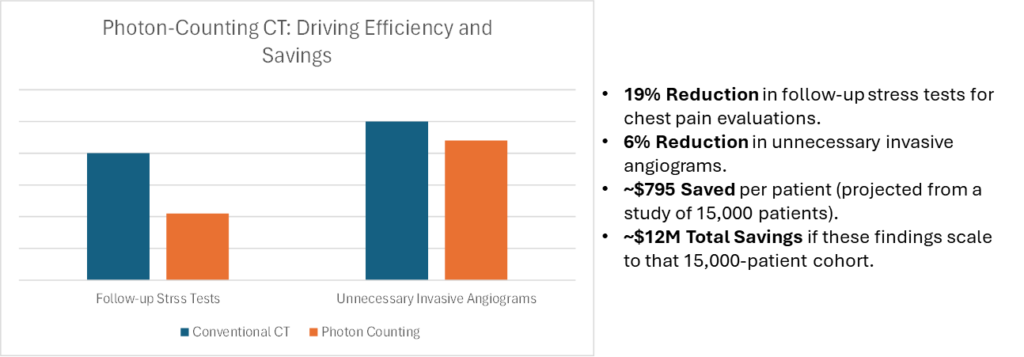

ONE BIG THING Siemens’ photon-counting CT technology is poised to save hospitals millions by reducing unnecessary cardiac tests, signaling a shift toward faster, more cost-effective imaging.

WHY IT MATTERS Industry leaders and payors increasingly prioritize innovations that improve outcomes and cut costs. The data show potential systemwide savings of ~$12 million for every 15,000 patients—a transformative leap for radiology departments.

CONTEXT ECR 2025 data indicated a 19% drop in follow-up stress tests when using photon-counting CT, demonstrating immediate value in real-world cardiac workups.

1. Key Takeaways

Photon-Counting CT: Siemens’ next-gen photon-counting CT clearance cements a leap forward in speed and diagnostic clarity, with early studies suggesting multimillion-dollar cost savings.

- AI in Cardiac Imaging: FDA cleared Caristo Diagnostics’ AI software for CCTA plaque analysis, demonstrating growing acceptance of AI in cardiology.

- Handheld Ultrasound Surge: Vave Health’s new wireless, single-probe device reflects rising demand for affordable, point-of-care imaging—potentially the “new stethoscope.”

- AI Sector Consolidation: Gleamer’s dual acquisitions in MRI AI illustrate how startups increasingly merge to offer broader, enterprise-grade solutions, especially as new reimbursement models emerge.

- Overall Market Implications: These developments underscore a global push toward earlier, faster, and more cost-effective diagnostics, with AI integration shaping imaging’s future.

2. Fast-Read Weekly Highlights

- Photon-Counting CT: FDA’s greenlight for Siemens’ Naeotom Alpha series triggers renewed hospital interest in upgrading CT fleets.

- AI for Coronary CT: Caristo’s CaRi-Plaque gains FDA clearance, allowing non-invasive, AI-driven plaque quantification for proactive CAD management.

- Handheld Ultrasound: Vave Health launches a subscription-free wireless probe—blurring lines between specialty and primary care imaging.

- M&A in Radiology AI: Gleamer acquires Pixyl and Caerus Medical, expanding into MRI solutions and signaling sustained AI consolidation.

3. Deep Dive Analysis

3.1 Photon-Counting CT Gains Momentum

What’s New

- FDA Clearance: Siemens Healthineers received 510(k) clearance for its latest Naeotom Alpha photon-counting CT family (including single-source and dual-source models).

- Clinical Data: At ECR 2025, an economic analysis showed photon-counting CT could reduce downstream cardiac testing by ~19%, saving ~$12 million per 15,000 patients.

Why It Matters

- Clinical Impact: Ultra-fast scanning (up to 737 mm/s) plus 0.2 mm slice resolution improves detection of small lesions (e.g., dense coronary plaques) and cuts radiation exposure.

- Cost & Value: Hospitals can lower follow-up stress tests and invasive procedures. Significant potential for ROI as payors increasingly back advanced imaging if it prevents costly interventions.

Market Dynamics

- Competition: Siemens’ clearance strengthens its first-mover advantage. GE HealthCare and other rivals are accelerating next-gen CT launches.

- Adoption Drivers: Radiology chiefs and CFOs weighing capital outlays against long-term savings could find photon-counting CT a compelling value proposition—particularly under value-based care models.

- Global Reach: Expect robust interest in developed markets initially, with emerging markets to follow once payors confirm tangible cost savings.

3.2 AI-Driven Cardiac Imaging Breakthrough

What’s New

- FDA Greenlight: Caristo Diagnostics’ CaRi-Plaque AI software for coronary CT angiography (CCTA) obtains approval. It automatically detects and quantifies plaque burden, stenosis severity, and plaque composition.

Why It Matters

- AI Expansion: Regulatory clearance of AI devices has exceeded 1,000 in the U.S., reflecting a sea change in radiology.

- Clinical Advantage: Earlier detection of subclinical CAD could reduce heart attacks and shift care toward prevention.

- Workflow Impact: Radiologists and cardiologists get advanced plaque insights without extra scans, saving time and potentially improving outcomes.

Ecosystem Effects

- Hospitals: Competitive advantage for cardiac centers integrating AI-based plaque detection into standard workflows.

- Payors: Insurers watching real-world evidence on cost avoidance; supportive evidence could lead to dedicated reimbursement pathways.

- Vendors: AI developers like HeartFlow and Cleerly face intensifying competition. Platform integration (PACS, EMR) remains crucial for broad adoption.

3.3 Portable Ultrasound on the Rise

What’s New

- Product Launch: Vave Health introduced a Universal Wireless Probe, combining linear and phased-array capabilities in a pocket-sized device, with no recurring subscription fees.

Why It Matters

- “New Stethoscope”: Handheld ultrasound devices are increasingly standard in the ER, primary care, and even remote telemedicine.

- Cost & Access: Priced around $4,000–$5,000, POCUS devices are lowering the barrier to immediate diagnostic imaging for smaller clinics and rural health settings.

Market Trends

Care Delivery: Rapid triage, faster diagnoses, and potentially fewer hospital transfers. For patients, it means more convenient, on-the-spot imaging.

POCUS Growth: Portable ultrasound market is projected to exceed $6 billion by the early 2030s at double-digit CAGR.

Competitive Landscape: Established players (Philips, GE, Butterfly Network) face emerging challengers emphasizing affordability, connectivity, and AI-driven workflow.

3.4 AI Imaging Sector Consolidation (M&A)

What’s New

- Gleamer’s Dual Acquisition: The French radiology AI firm acquired Pixyl and Caerus Medical to expand its portfolio into MRI solutions, complementing its existing X-ray and CT offerings.

Why It Matters

- Platform Strategy: Hospitals prefer enterprise AI solutions over patchwork point products. Gleamer now covers X-ray, CT, mammography, and MRI under one umbrella.

- Industry Trend: Ongoing consolidation among AI players—scalability, broader product suites, and synergy with large imaging OEMs are key survival strategies.

- Reimbursement Outlook: U.S. healthcare payors are gradually introducing AI-specific CPT codes; this access to reimbursement accelerates AI adoption and M&A activity.

Implications for Stakeholders

- Hospitals: Fewer vendor relationships, streamlined IT integration, single licensing model.

- Radiologists: Comprehensive AI support (fracture detection, neuro imaging, spine issues) can reduce burnout and missed findings.

- Patients: Faster and more standardized diagnoses—potentially earlier intervention for chronic and neurologic conditions.

4. Strategic Outlook

Convergence of Tech and Care

- Trend: Precision diagnostics is central to value-based care, with advanced imaging hardware paired to AI software.

- Global Perspective: Regulatory bodies in the U.S. and EU are advancing clearances, while emerging markets rapidly adopt portable solutions. However, concerns over data integrity—especially in outsourced clinical trials—underscore the need for robust validation.

Market Demand & Investment

- Dual Speed Growth: High-end modalities (like photon-counting CT, advanced MRI) see continued demand in major hospitals; simultaneous growth in low-cost, high-volume portable devices.

- Funding: Venture capital and strategic partnerships remain strong, especially for AI tools that demonstrate cost-effectiveness.

- Reimbursement Hurdles: While AI and next-gen imaging attract interest, coverage and payment lag behind. Advocacy remains crucial to reduce the 5+ year gap between FDA approval and Medicare reimbursement.

Ecosystem Impact

- Hospitals & Health Systems: Must budget for capital expenditures (hardware) and IT integration (software/AI) amid a push for reduced operational costs.

- Clinicians: Require continuous training on AI and advanced imaging, with guidelines evolving to prevent over-reliance.

- Patients: More timely diagnoses, personalized treatments, and improved outcomes if the technology is deployed equitably.

Final Thought

Imaging innovation, from cutting-edge CT to AI-driven analysis and handheld devices, continues to reshape global healthcare. The winners will be those who integrate these technologies thoughtfully—balancing capital costs, training, reimbursement, and real-world patient impact. Marketstrat’s ongoing research will delve deeper into these trends, offering guidance on implementation strategies, ROI, and long-term forecasts to help stakeholders stay ahead in this evolving ecosystem.

For inquiries or custom research on emerging MedTech, AI validation, or market adoption strategies, please contact Marketstrat at research@marketstrat.com.