Individual License: $2,950 | Team and Enterprise License Options Available

Europe’s Oncology Imaging AI market is forecast to grow from US$143.4M in 2023 to US$1.72B by 2032 (31.8% CAGR)—a major global “second engine” where adoption is shaped by multi-country procurement realities, imaging replacement cycles, and oncology pathway standardization.

Europe Oncology Imaging AI Pulse 2025–2032 provides Marketstrat’s quantitative view of AI in cancer imaging across Europe, combining a regional outlook with dedicated country chapters for major markets including Germany, France, the United Kingdom, Italy, Spain, and Rest of Europe.

This Pulse helps teams answer:

Europe is a “multi-market execution” region

Success requires country sequencing (top markets drive the majority of dollars), local workflow integration, and channel strategy aligned to each system’s procurement and deployment norms.

Screening and diagnosis remain the adoption surface

High-volume breast and chest pathways anchor the near-term market, while downstream response/measurement layers expand as standardized oncology pathways mature.

Quantification becomes the growth multiplier

Across MRI and PET/Nuclear, measurement-grade quantification and analytics expand beyond detection—supporting higher-value offerings tied to staging, response, and longitudinal monitoring.

Software remains core; services and governance matter

Deployment, validation, and ongoing monitoring are increasingly commercialized as explicit line items, particularly in enterprise and multi-site rollouts.

This Pulse focuses on market structure and commercialization rails, including:

Use this Pulse to:

Q1) What is the Europe Oncology Imaging AI market forecast for 2023–2032?

A: Europe Oncology Imaging AI is forecast to grow from US$143.4M (2023) to ~US$1.72B (2032) at a 31.8% CAGR (nominal USD).

Q2) Which European countries account for the largest share of Oncology Imaging AI spending?

A: The largest 2032 country markets are Germany (~US$526M), France (~US$324M), and the UK (~US$310M), followed by Rest of Europe (~US$260M), Italy (~US$169M), and Spain (~US$128M).

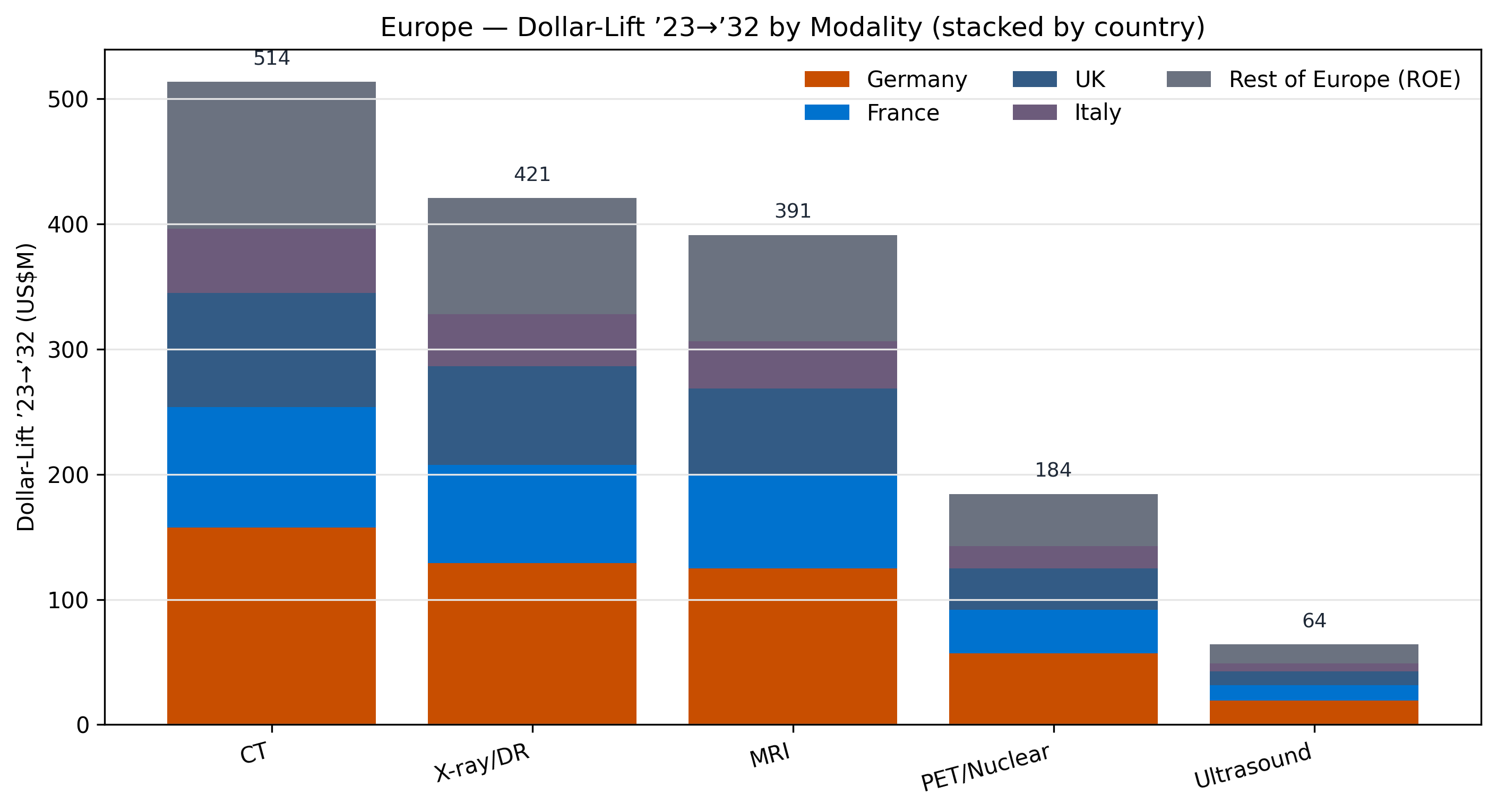

Q3) What modalities drive Oncology Imaging AI demand in Europe?

A: By 2032, Europe’s biggest modality pools are CT (~US$552M), X‑ray/DR incl. mammography/DBT (~US$466M), and MRI (~US$430M), with PET/Nuclear (~US$205M) as an important high-value niche.

Q4) Which tumor sites are most important in Europe’s Oncology Imaging AI market?

A: The largest 2032 tumor-site pools are Breast (~US$471M) and Lung/Chest (~US$366M), with Prostate (~US$201M) as a key premium growth lane.

Q5) What does “screening mandates and MDR rails” mean for the Europe Oncology Imaging AI market?

A: In Europe, adoption is heavily influenced by screening program throughput (especially breast and lung pathways) and regulatory/quality requirements that shape procurement, deployment, and vendor readiness across multi-country health systems.

Q6) What is included in the Europe Pulse report?

A: The Europe Pulse includes a regional outlook plus major country chapters (Germany, France, UK, Italy, Spain, and Rest of Europe) with forecasts by modality, tumor site, pathway stage, clinical application, end-use, and revenue stream.

Driving healthcare innovation through actionable intelligence, strategic execution, and transformative solutions for global impact and growth.