Teleradiology has evolved from a niche overnight-reading service to a critical pillar in modern medical imaging. By enabling remote interpretation of scans—whether X-ray, CT, MRI, or ultrasound—teleradiology addresses global radiologist shortages and extends advanced diagnostics to underserved or rural regions. In parallel, rapid improvements in broadband connectivity, AI-driven analytics, and cloud-based PACS have made it easier for healthcare systems to adopt teleradiology as part of a 24/7, cost-effective imaging workflow.

Beyond on-call radiologists reading from a distance, the teleradiology ecosystem encompasses both equipment and services. Imaging OEMs (original equipment manufacturers) provide the vital hardware (e.g., MRI machines, digital radiography, specialized monitors) and the secure data solutions, while service providers offer reading and reporting. This blended approach fosters faster turnaround times, reduces wait periods for specialized reads, and can lower overall healthcare expenditures—making teleradiology relevant to providers, patients, and investors alike.

Target Release Date: Q4 2025

Marketstrat’s best current estimates place the global teleradiology market at around $8.0 billion in 2023, with a compound annual growth rate (CAGR) of approximately 16% forecast from 2023 to 2028. This market size encompasses both the equipment (imaging modalities, workstations, secure data transmission systems) and services (remote reads, consultations, second opinions).

(These are in-progress estimates, subject to final validation.)

Emerging hybrid players—combining hardware, software, and reading services—are gaining traction, especially in rapidly growing markets like Southeast Asia. Meanwhile, AI vendors (e.g., Aidoc, Qure.ai) collaborate with both OEMs and teleradiology groups to streamline triage and reporting workflows.

This Markintel Horizon report from Marketstrat on World Market for Teleradiology will include:

Our data and best current estimates arise from:

All information is subject to validation as we finalize the report in the coming months.

| Title | World Market for Teleradiology — Pre-Release Overview |

| Type | Markintel Horizon (Flagship, In-Depth) |

| Estimated Publication | Q4 2025 (Data Collection and Analysis In-Progress) |

| Number of Pages | ~175 (final count subject to validation) |

| Format | PDF (digital download, direct purchase) |

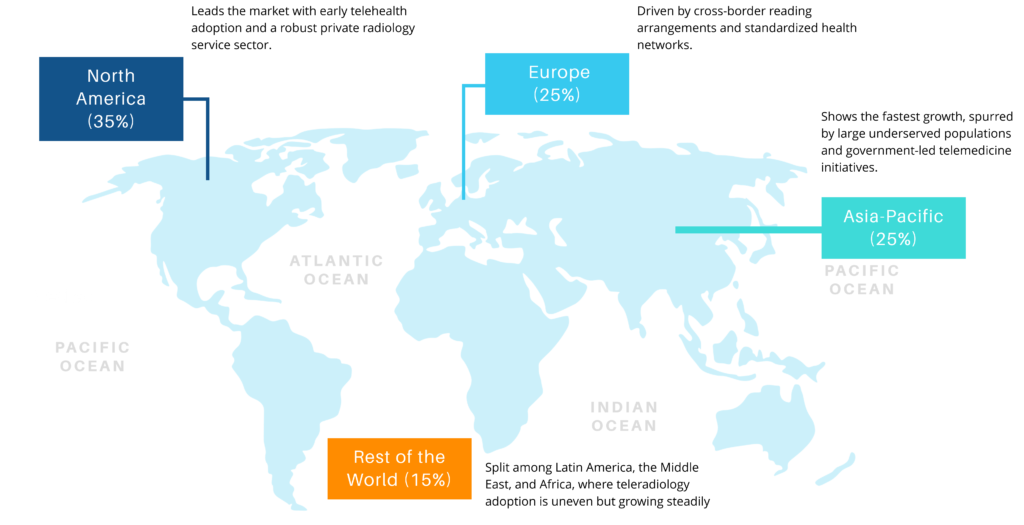

| Geographical Coverage | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Segmentation | – By Modality: X-ray, CT, MRI, Ultrasound

– By Level of Service (Emergency/STAT, Daytime Overflow, Subpecialty) – By End-Use: Hospital vs. Outpatient – By Region: NA, EU, APAC, etc. |

| Key Topics | – Teleradiology Adoption Rates & Growth

– OEM vs. Service Integration – AI & Workflow Optimization – M&A & Partnerships |

| Methodology | Primary Interviews + Secondary Data Markintel M³ & TDIT frameworks and more |

| Price & Licensing | Individual, Team, Enterprise licensing |

This is a pre-release document, showcasing our best current estimates based on in-progress interviews, preliminary data analysis, and proprietary frameworks. Final numbers, segment definitions, and market breakouts may be subject to additional validation before publication.

By illuminating equipment-service integration, regional expansions, and innovative AI solutions, this Markintel Horizon report from Marktstrat is designed to guide informed decision-making for all stakeholders aiming to capitalize on the accelerating global demand for teleradiology.

Driving healthcare innovation through actionable intelligence, strategic execution, and transformative solutions for global impact and growth.