Date: January 16, 2026 | Topic: Medical Imaging & MRI | Company: Vista AI

Vista AI closed a $29.5M Series B with a notable twist: multiple strategic health systems participated—an unusually strong market signal that MRI automation is becoming operational infrastructure, not just “AI at the reading workstation.”

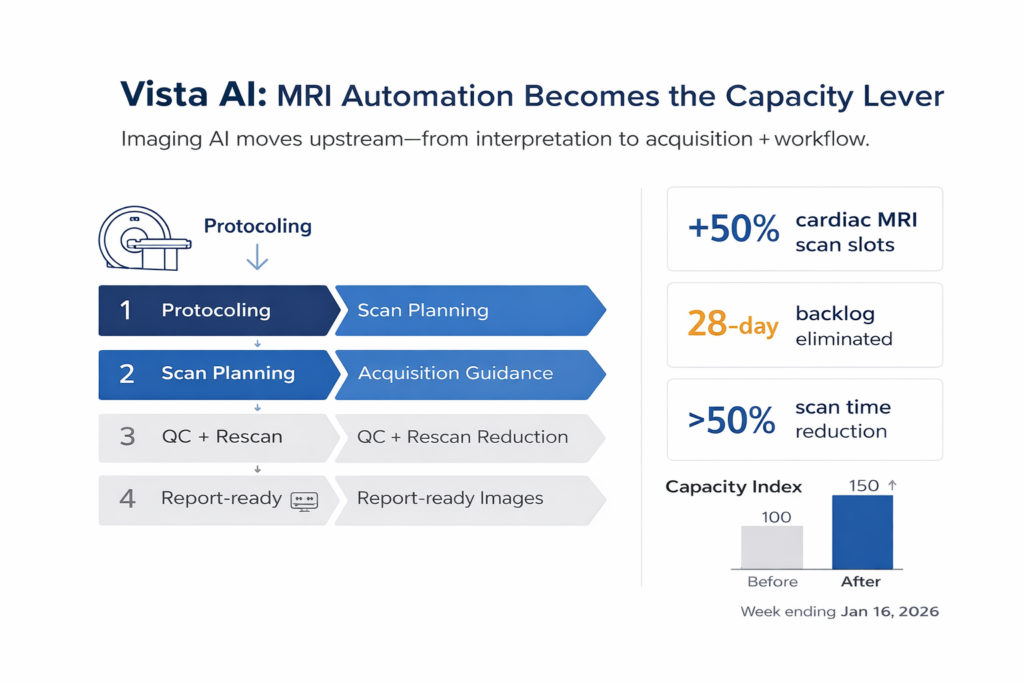

Vista AI is leveraging an FDA-cleared platform that can operate alongside MRI consoles to automate acquisition workflows (initially cardiac MRI) and is explicitly investing proceeds into multi-anatomy expansion and remote scanning services, targeting the core constraint: capacity and technologist scarcity.

Key Takeaways

- Strategic investor mix is the story. Provider-backed financing suggests Vista’s value proposition is being validated as a system-level access and throughput lever, not merely a departmental tool.

- Imaging AI’s “center of value” is shifting upstream. Vista is automating protocoling/planning/acquisition/QC—where variability, scan time, and staffing constrain volume—rather than interpretation alone.

- Evidence is operationally compelling but still largely company-reported. Vista highlights throughput and backlog reductions at early sites (e.g., +50% scan slots, backlog compression) and a study indicating 31% shorter AI-assisted scans and improved consistency.

- Regulatory posture reduces some governance friction. FDA documentation describes outputs as acquisition settings and preliminary analyses, with technologists retaining the ability to modify/reject—positioning Vista as “assistive automation” rather than autonomous decision-making.

- Watch the remote scanning vector. Vista’s remote scanning services ambition aligns with a broader momentum toward remote operations—but this will face operational, supervision, and risk-management scrutiny as it scales.

Why this raise matters beyond dollars

Vista’s Series B is a category validation event: health systems investing directly implies internal stakeholders have pressure-tested the solution against operational KPIs (backlog, access, staffing burden) and see enterprise-scale relevance.

Two strategic implications follow:

- Budget authority shifts from “innovation” to “operations.” If automation demonstrably creates new exam capacity without incremental scanner capex, it competes for the same dollars as scheduling, staffing optimization, and service-line growth initiatives.

- AI becomes embedded in the modality value chain. In MRI, the most stubborn constraint is not interpretation time—it’s acquisition complexity, exam variance, and staffing. Vista is playing precisely at that choke point.

Deal Snapshot

Round: Series B

Amount / Date: $29.5M / Jan 14, 2026

New strategic investors (named): Cedars-Sinai Health System, Intermountain Health, University of Utah Hospital System, Temple University / Fox Chase Cancer Center, Tampa General Hospital

Other investors mentioned: Khosla Ventures, Bold Brain Capital (plus other existing investors)

Stated use of proceeds: Expand beyond FDA-cleared cardiac MRI into brain, prostate, spine (once cleared) and develop remote scanning services

Valuation / terms: Not disclosed in referenced public sources.

Marketstrat POV

- We view acquisition automation as the next durable layer in imaging AI because it attacks the binding constraint (time variance + technologist scarcity), not just read efficiency.

- Strategic health system investors are signaling “scale-out intent.” The next proof point is multi-site replication and standardized QA governance, especially as remote scanning enters the mix.

- OEM dynamics will shape the ceiling. Vista’s parallel-console approach is powerful, but long-term scale will depend on maintaining compatibility through scanner upgrades and (potentially) partnering with OEM channels.

About Marketstrat

Marketstrat® is a market intelligence and GTM enablement firm focused on medtech, healthcare, and life sciences. Under the Markintel™ brand, Marketstrat delivers robust market intelligence and proprietary frameworks; through GrowthEngine advisory and tools, it helps clients turn insights into execution. Together, these capabilities support clients in converting evidence‑weighted insight into practical action across strategy, product, and commercial execution.

Marketstrat® and Markintel™ are trademarks of Marketstrat Inc. All other trademarks are the property of their respective owners.

Check out free Research and Insights and Analysis of Industry Events

Check out our collection of Markintel Horizon and Markintel Pulse research.

Check out details on our reports, World Market for AI in Medical Imaging and World Market for Oncology Imaging AI and other Pulse Reports in the Imaging space.