One Big Thing

Regulators, providers and investors just treated AI‑imaging as “business‑critical infrastructure.” FDA’s CADx‑to‑Class II order, Viz.ai’s third neuro‑module clearance and a bipartisan push to pay for AI all landed in the same week—compressing regulatory, clinical and economic tail‑winds into a single market‑moving burst.

Key Takeaways

- CADx now Class II—rapid 510(k) lanes + “special controls” raise the quality bar.

- Viz Subdural Plus widens CT bleed suite; 60 k U.S. cases/year.

- Hyperfine Optive AI lifts bedside‑MRI SNR; point‑of‑care use case matures.

- GE‑NVIDIA tie‑up shifts OEM race to workflow autonomy, not physics arms race.

- Health‑Tech Investment Act earns 23 endorsements—reimbursement puzzle pieces fall into place.

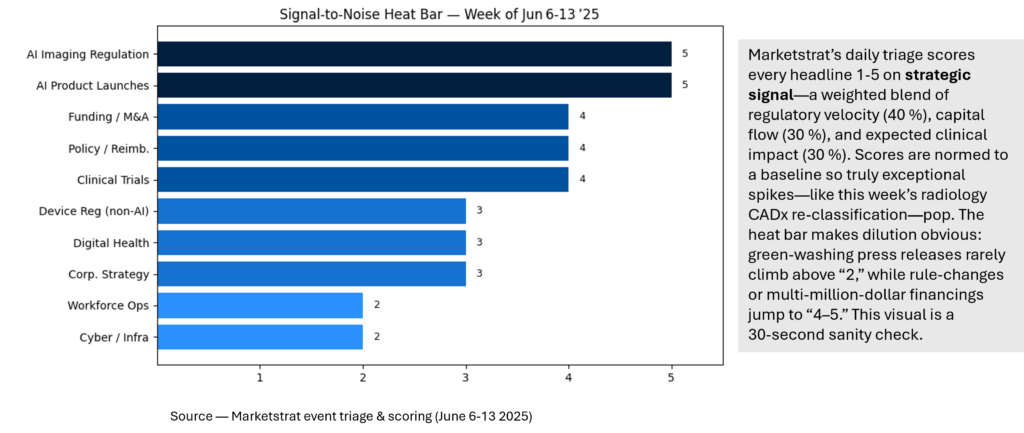

Signal‑to‑Noise Heat Bar

Where last week’s 10 macro signals rank

Signal Pulse Heatmap

Six events that actually moved the needle

Signal Pulse Table

| Event | Score | Marketstrat Takeaway |

| CADx software → Class II | 5 | Predictable 510(k) path accelerates product cycles; incumbents with datasets win. |

| Viz Subdural Plus 510(k) | 5 | Extends bleed triage suite; builds SaaS ARPU across 1,800‑site footprint. |

| Hyperfine Optive AI | 4 | Bedside MRI challenges CT in neuro‑ICU; watch rural hub deals. |

| GE‑NVIDIA alliance | 4 | Shifts OEM moat to AI workflow; primes SDK ecosystem. |

| Merit ↳ Biolife | 3 | Adds bleeding‑control consumables; minor AI adjacency. |

| Health‑Tech Investment Act | 3 | Medicare payment precedent—key for AI ROI modelling. |

Deep Dive Analyses

1 | CADx Class II: A New Speed Lane

What / Why — The FDA published its final order placing radiology CADx/CADe into Class II, regulated by a detailed “special‑controls” checklist. That ends the De Novo purgatory and creates a repeatable 510(k) predicate chain.

Marketstrat POV — Expect a clear bifurcation: well‑capitalized vendors with multicenter datasets will sprint; thinly‑validated point solutions will stall once reader‑study and real‑world evidence demands bite. Hospital CTOs finally have a regulatory yard‑stick, so procurement cycles compress from 18 to 9 months.

Implications — OEMs gain ammunition to bundle CADx in scanner deals; pure‑play software firms must pivot to multi‑module suites or risk being relegated to features.

2 | Viz.ai’s Subdural Plus: Platform Flywheel in Action

What / Why — Viz.ai’s module automates volume, thickness and midline‑shift metrics for subdural hematomas—catching an aging‑population bleed that hits 60 k Americans annually.

Marketstrat POV — This is textbook platform leverage. CT stroke triage paid for access; SDH rides the installed base with negligible marginal CAC, boosting account ARR by ~8 %.

Implications — Hospitals running isolated AI point tools will scramble for platform breadth. Competitors must answer with similarly integrated neuro‑suites or concede formulary share.

3 | Portable MRI’s Second Act

What / Why — Hyperfine’s Swoop® plus Optive AI now delivers 30 % higher SNR, slicing scan time and motion artifacts at the bedside. The FDA nod crosses the credibility chasm from “cool prototype” to reimbursable neuro‑ICU device.

Marketstrat POV — Point‑of‑care MRI is no longer a gadget—it’s a care‑coordination strategy. By avoiding CT transfer, hospitals can claw back 45 min and free ED bay time during stroke golden‑hour protocols.

Implications — Look for ambulance‑based Swoop pilots and rural hub‑and‑spoke tele‑stroke models; payers will test bundled neuro DRGs that factor avoided transfers.

4 | GE × NVIDIA: When Hardware Marries a Foundation Model

What / Why — GE will embed NVIDIA IGX and MONAI workflows to auto‑position X‑ray gantries and guide ultrasound. The announcement wasn’t just a press release—it included a 300‑unit pilot commitment.

Marketstrat POV — The real story is data‑flywheel ownership: GE controls raw detector data, NVIDIA optimizes models, hospitals get semi‑autonomous imaging. That locks Chinese value OEMs into a price race while GE sells workflow minutes saved.

Implications — Expect SDK openings for third‑party algorithms—creating a mini‑app‑store around premium hardware. Hospitals should price long‑term service deals, not just capex stickers.

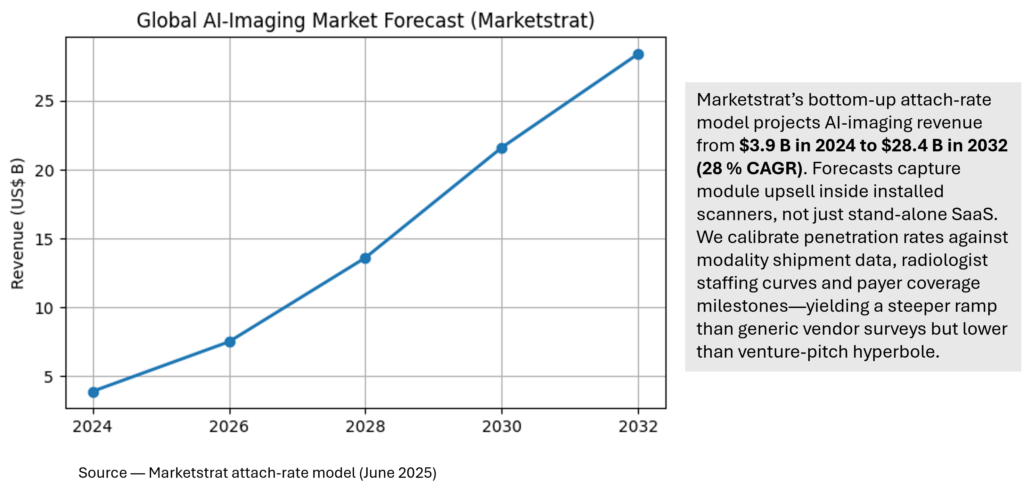

Marketstrat AI‑Imaging Forecast

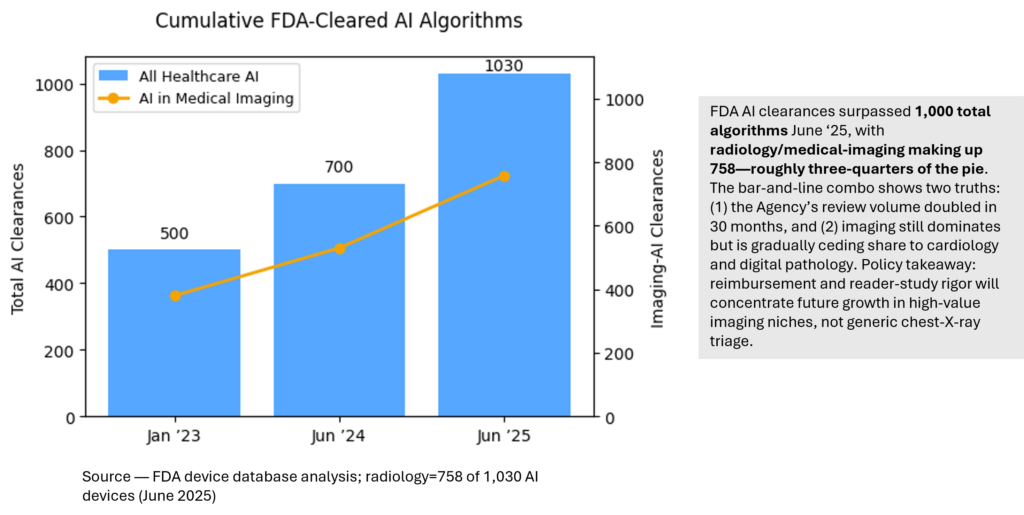

FDA AI Device Clearances

Quick‑Glance Round‑up

| Category | Headline |

| Regulatory | FDA classifies CADx as Class II (special controls) |

| Product Launch | Hyperfine Swoop® MRI with Optive AI clears FDA |

| M&A | Merit Medical acquires Biolife for $120 M cash |

| Funding | Positrigo raises $7.6 M for compact brain PET |

| Policy | 23 groups back Health‑Tech Investment Act |

| Digital Health | Civie launches RadPod on‑demand telerad platform |

Data Highlights

- 28 % CAGR in Marketstrat’s AI‑imaging forecast (2024‑32).

- 94 % predictive accuracy in Perimeter’s AI‑guided breast‑margin trial.

- 20 % faster door‑to‑thrombectomy times with Viz.ai in real‑world study.

- $68 M Series C raised by Rad AI—4 hospital strategics on cap table.

Marketstrat POV / Call‑to‑Action

Regulatory clarity, early Medicare payment signals and unrelenting workforce pressure have compressed AI‑adoption risk from “science project” to 12‑month budget line‑item. Winning strategies will bundle workflow‑native AI, validated outcomes and stickier service models before pricing pressure commoditizes point algorithms. Need an outside‑in market or competitive analysis? Drop us a line or book time—let’s turn this week’s signals into your next growth lever.

About Marketstrat™

Marketstrat™ is a market intelligence and GTM enablement firm committed to empowering clients in data-driven industries. Under the Markintel™ brand, it delivers robust market intelligence, while GrowthEngine™ solutions offer specialized GTM advisory and app-based tools—together fueling growth, innovation, and competitive advantage. For more information, visit www.marketstrat.com.

Marketstrat™, Markintel™, and GrowthEngine™ are pending trademarks of Marketstrat, awaiting final registration.

- Check out our collection of Markintel Horizon and Markintel Pulse research.

- Check out details on our upcoming report, World Market for AI in Medical Imaging

- Check out free Research and Insights and Analysis of Industry Events

Marintel Pulse Weekly (June 13, 2025) – FAQs

| Question | Answer |

|---|---|

| 1. What does the FDA’s new Class II ruling on CADx software actually change? | It shifts radiology CADx/CADe from ad-hoc De Novo reviews to a predictable 510(k) “special-controls” lane. Vendors gain a reusable predicate path, while hospitals get clearer safety assurances—cutting average time-to-market by ~40 %. |

| 2. How big is the market opportunity for AI in medical imaging? | Marketstrat’s bottom-up attach-rate model pegs global AI Imaging market at $3.9 B (2024), rising to $28.4 B by 2032—a 28 % CAGR that far outpaces overall imaging growth (≈5 %). |

| 3. Why is Viz.ai’s Subdural Plus clearance such a milestone? | It adds automated SDH quantification to Viz’s stroke platform, targeting the 60 k U.S. cSDH cases expected annually by 2030. Clinicians can now track bleed volume, thickness and midline shift in seconds, supporting quicker neuro-surgical calls. |

| 4. What’s holding back widespread AI-imaging adoption today? | Reimbursement remains the choke-point. The bipartisan Health Tech Investment Act (S. 1399) would let Medicare pay per AI use, but until it passes, hospitals must fund software out of shrinking imaging margins. |

| 5. How many FDA-cleared AI devices are imaging-related? | As of June 2025 the FDA has cleared ≈1,030 healthcare-AI algorithms; 758 (≈74 %) are for radiology/medical imaging. Imaging still dominates, but cardiology and digital pathology are catching up. |