March 28, 2025

One Big Thing

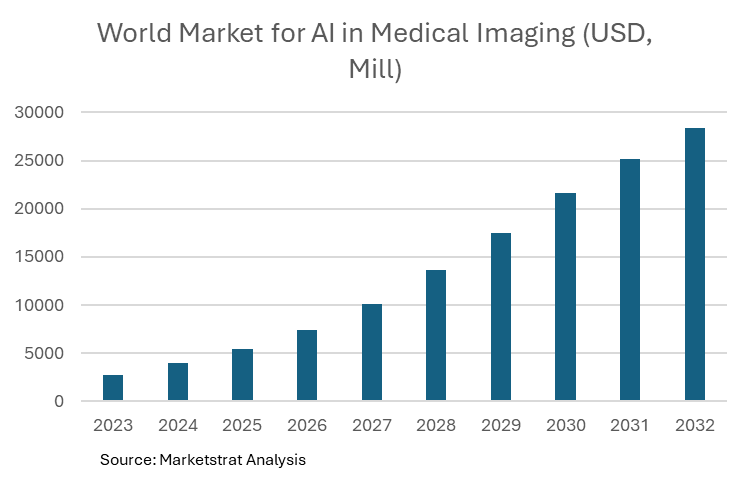

AI + Imaging Convergence Accelerates via Strategic Platforms

The industry is racing beyond single-solution AI tools: the new trend is platform “ecosystems” that combine multiple AI modules on imaging hardware to streamline everything from image acquisition to interpretation. Case in point: GE HealthCare’s expanded partnership with Nvidia and its growing Edison ecosystem (adding AI startups like Aidoc) indicates a move toward integrated “one-stop” AI marketplaces.

Why It Matters

- Hospitals can adopt multiple specialized AI algorithms—stroke detection, mammography triage, automated echo analysis—from a single vendor platform.

- Imaging OEMs like GE HealthCare gain recurring revenue and deeper customer lock-in, while forging alliances with smaller AI innovators.

- Radiologists benefit from consistent user interfaces and more robust clinical decision support, integrated right into existing workflows.

- Investors see synergy and scale: platform-based models can onboard new AI solutions faster, potentially leading to better returns and more M&A activity.

Deeper Dive

1. Regulatory & Policy

HHS Staff Cuts vs. “Frontline” Reviewers

- Big Picture: HHS Secretary Robert F. Kennedy Jr. says 10,000 employees (~25% of HHS) will be cut, yet the FDA’s core device-review staff is supposedly spared.

- Market Reaction: Device makers remain cautious—any broad staffing disruption could slow AI device clearances. On the upside, new FDA Commissioner Dr. Martin Makary is a physician-advocate who may champion streamlined AI approvals.

EU MDR/IVDR Early Reassessment

- Why It Matters: The European Commission’s decision to re-evaluate medical device regulations ahead of schedule signals that real-world challenges (especially for complex AI devices) might get addressed sooner—good news for AI-driven imaging companies needing clearer EU pathways.

2. M&A, Funding & Partnerships

23andMe Bankruptcy

- Key Note: Direct-to-consumer genomics giant now seeks asset sales after Chapter 11.

- Impact: Shows vulnerability of purely consumer-focused healthcare plays; robust B2B or clinical channels may be necessary for sustainability.

AI Funding Continues Despite Headwinds

- Sibel Health: $30M Series C for wireless vitals monitoring, plus an FDA clearance.

- Evident Vascular: Series B (undisclosed) for an AI-based intravascular ultrasound platform.

- Takeaway: Investors are still betting on AI solutions that can demonstrate clinical workflow improvements or strong outcomes.

Mid- to Late-2025 M&A Surge Projected

- Reasoning: Normalized valuations and easier financing could spur “mega deals.”

- Likely Acquirers: Boston Scientific, J&J, Stryker, Zimmer Biomet.

3. Product Launches & Market Entries

Abbott’s Volt PFA in Europe

- Early CE Mark: Abbott’s pulsed field ablation system for AFib launched ahead of schedule, vying with Boston Sci, Medtronic, J&J in the race to dominate PFA.

- Significance: PFA is poised to become a safer, faster ablation method, potentially reshaping electrophysiology labs.

Monogram Orthopedics’ mBóS Knee Robot

- FDA Clearance: Focus on personalized cutting guides for total knee replacement.

- Launch Strategy: Targeting key opinion leaders first, then broader rollout.

Portable Imaging Gains Steam

- Hyperfine: CE Mark enhancements on the Swoop portable MRI, incorporating new AI-driven software for faster brain scans.

4. Clinical Highlights

Burn Assessment AI Scores

- Spectral AI (DeepView): Achieved 87% sensitivity vs. 41% by burn specialists in identifying non-healing tissue.

- Ramifications: Potential for earlier, more accurate graft decisions, lowering complications and cost.

Breast Imaging AI Continues to Impress

- MASAI Trial: 28% higher detection with AI second reader for mammograms.

- AI-Initiated Recalls: Showed 85% higher positive predictive value vs. radiologist-initiated.

- Message: Large-scale data cements AI’s role in screening—particularly valuable as radiologist shortages persist.

Adaptive DBS for Parkinson’s

- Medtronic’s Percept™ RC: FDA-cleared device adjusts stimulation in real time—an example of “closed-loop” therapy that uses onboard AI to fine-tune treatment.

5. AI & Digital Health Innovations

Deep Dive: GE HealthCare’s Expanding AI Platform

- GE–Nvidia Partnership

- Goal: Develop “autonomous imaging” solutions, starting with X-ray and ultrasound. Nvidia’s Isaac™ for Healthcare provides simulation environments to train AI for real-world scanning tasks.

- Implications:

- Patient Positioning: AI could auto-align patients for optimal imaging angles, reducing retakes and tech workload.

- Workflow Gains: Faster throughput in busy radiology departments, bridging staff shortages.

- Global Access: Autonomous or semi-autonomous portable units might help remote or rural areas lacking skilled radiology staff.

- Edison Marketplace Expansion

- Marketplace Model: GE’s Edison platform allows hospitals to “shop” for AI algorithms (e.g., stroke detection, triaging chest CT) from multiple vendors (Aidoc, Subtle Medical, etc.) in a single integrated environment.

- Why This Matters:

- Plug-and-Play AI: Radiology sites avoid disjointed software installations—one platform ties everything together.

- Monetization: GE can charge licensing/subscription fees while offering smaller AI startups immediate scale.

- Flexibility: Radiology directors can quickly adopt new AI tools as they’re published, rather than undergoing lengthy IT integrations each time.

- Aidoc Collaboration

- Background: Aidoc is known for multi-condition AI solutions (PE detection, intracranial hemorrhage triage, stroke, etc.).

- On Edison: Aidoc’s suite can integrate seamlessly with GE scanners and PACS systems, speeding up triage workflows.

- Future Outlook: With more validated algorithms, one platform (Edison) becomes a “control tower” for imaging AI across different modalities.

Takeaway for Imaging Executives

- Unified Ecosystem: Instead of juggling separate AI point solutions, you can adopt a curated library within GE’s environment, receiving consistent updates/support.

- Competitive Differentiator: If your organization invests in this ecosystem early, you may attract top talent and referral networks by offering advanced AI-based reading.

- Long-Term ROI: Potential for improved turnaround times, fewer retakes, and better outcomes could justify subscription costs.

Other AI Tidbits

- Quest + Google Cloud: Focus on generative AI for lab data queries. Potential blueprint for how imaging labs might soon employ large-language-model tools to interpret or summarize data in real-time.

- Synchron’s BCI: Brain-computer interface controlling Apple Vision Pro with AI bridging signals. While still niche, it showcases the broader scope of AI in transforming “human–machine” interactions, not just scanning.

6. Company & Earnings Updates

Dexcom vs. FDA

- Warning Letter: Dexcom counters that sensor supplier changes were minor, with no safety impact.

- Outlook: Investors likely watch for resolution or any potential recall (which Dexcom says is unlikely).

TriSalus Life Sciences

- Positive Path: Foresees profitability by late 2025, fueled by strong uptake of liver oncology infusion systems.

- Significance: Smaller medtech players can reach viability with a focused strategy—particularly in specialized markets like interventional oncology.

Marketstrat Angle

- Platform Ecosystems: With GE’s Edison as a template, expect more imaging OEMs (Philips, Siemens) to double down on integrated marketplaces—hastening AI adoption.

- Value-Based Care: High-quality data on improved patient outcomes from AI (like the breast screening trials) will be pivotal to winning over payors.

- Consolidation Looms: As M&A picks up, smaller AI startups with validated solutions—especially those proven in large-scale studies—are prime acquisition targets.

Bottom Line: For imaging executives, the shift from standalone AI apps to curated, OEM-backed ecosystems is the single most important trend this year. Ensuring your facility is “platform-ready” could be critical to staying competitive.

Fast-Read: Top Developments at a Glance

| Headline | Key Points |

|---|---|

| GE–Nvidia Partnership | Autonomous imaging R&D; training “self-driving” ultrasound/X-ray in virtual simulations. |

| GE Edison Marketplace Growth | New AI modules from startups (Aidoc, Subtle Medical) unify on one platform for easy integration. |

| Abbott Volt PFA CE Mark | Early entry into Europe’s AF ablation market, competing with Medtronic, Boston Sci, J&J. |

| Spectral AI’s Burn Tool | 87% sensitivity in picking non-healing burns; big potential for burn centers, lowers guesswork. |

| MASAI Trial (Mammo AI) | +28% cancer detection, 85% higher PPV on AI-initiated recalls, reinforcing AI’s screening power. |

| Monogram Knee Robot | FDA-cleared for personalized bone prep; limited KOL release in 2025. |

| Sibel Health $30M Round | Wearable wireless vital-sign monitoring sees continued investor interest in digital health. |

| Dexcom & FDA | Dispute over whether sensor component changes were “significant”; no recalls anticipated. |

| TriSalus Sees Profit by 2025 | Interventional oncology device maker, >50% revenue growth forecast. |

More on AI & Imaging

From Single Solutions to Integrated Platforms

- OEM Platforms

- GE’s Edison, Philips’ IntelliSpace AI Workflow Suite, and Siemens’ AI-Rad Companion are vying to host multiple AI applications.

- Hospitals can reduce complexity by working with one main vendor “store” or integration engine.

- Focus on Workflow

- Many AI solutions (e.g., stroke triage, mammography, lung nodule detection) require quick access to PACS data and automatic routing to the right specialist.

- A single “hub” ensures consistent user experiences and QA processes.

- Evolving Reimbursement

- With large trials (like MASAI) showing improved outcomes, payors could start reimbursing AI reading services or awarding quality-based incentives.

- This drives further adoption in imaging exec circles, who weigh cost-of-license vs. improved efficiency and lower callback rates.

- Nvidia Partnerships

- Beyond GE, Nvidia is working with multiple OEMs (including Siemens, Philips, and upstart robotics players) to embed HPC/AI modules directly into imaging consoles.

- Real-time processing at the scanner level: scanning decisions, auto-annotation of suspicious lesions, fewer manual tasks.

Final POV for Imaging Executives

- Platform Commitment: Evaluate if an integrated OEM solution suits your enterprise vs. best-of-breed AI from smaller vendors.

- Data & ROI: Look for real-world evidence on detection improvements, reading-time reductions, or fewer recalls. That’s your justification for budget approvals.

- Pilot & Scale: Start with a high-impact use case (e.g., breast screening, stroke triage) to gather internal data and user acceptance, then expand.

- Stay Alert on M&A: The AI vendor you choose could get acquired soon. Factor in potential transitions for service, pricing, or integration.

Quick-Glance Summary

| Item | Takeaway |

|---|---|

| GE + Nvidia | Aiming for autonomous imaging; training X-ray/ultrasound to self-position & analyze |

| Edison Marketplace | Aggregates AI startups (Aidoc, etc.) for easy add-ons to GE imaging systems |

| Abbott Volt PFA | Grabs early EU lead in AF ablation with pulsed field technology |

| MASAI Trial | AI outperforms double reading, 28% higher cancer detection, 85% better PPV |

| Sibel Series C | $30M raised for wearable sensors + new FDA clearance |

| 23andMe | Bankruptcy underscores pitfalls of purely consumer-driven health biz models |

Final Word

AI in medical imaging is moving beyond individual tools to integrated platforms. With major OEMs (like GE) forging alliances (with Nvidia, Aidoc, etc.), the next wave of AI solutions will be easier to adopt and more deeply embedded in the imaging workflow. Imaging executives who get ahead of this trend—aligning with robust marketplace platforms and using real-world evidence to justify budgets—can significantly enhance diagnostic performance, reduce staff burden, and deliver top-tier patient care.

Click here to participate in our research in AI for Medical Imaging or AI-Assisted Mammography

For previous weeks’ Markintel Pulse newsletters, click here

For the latest in Marketstrat’s research, click here